Send Currency Update 11th December 2023

Send Payments -In The News Today - Update on AUD/USD Pair – Market Analysis

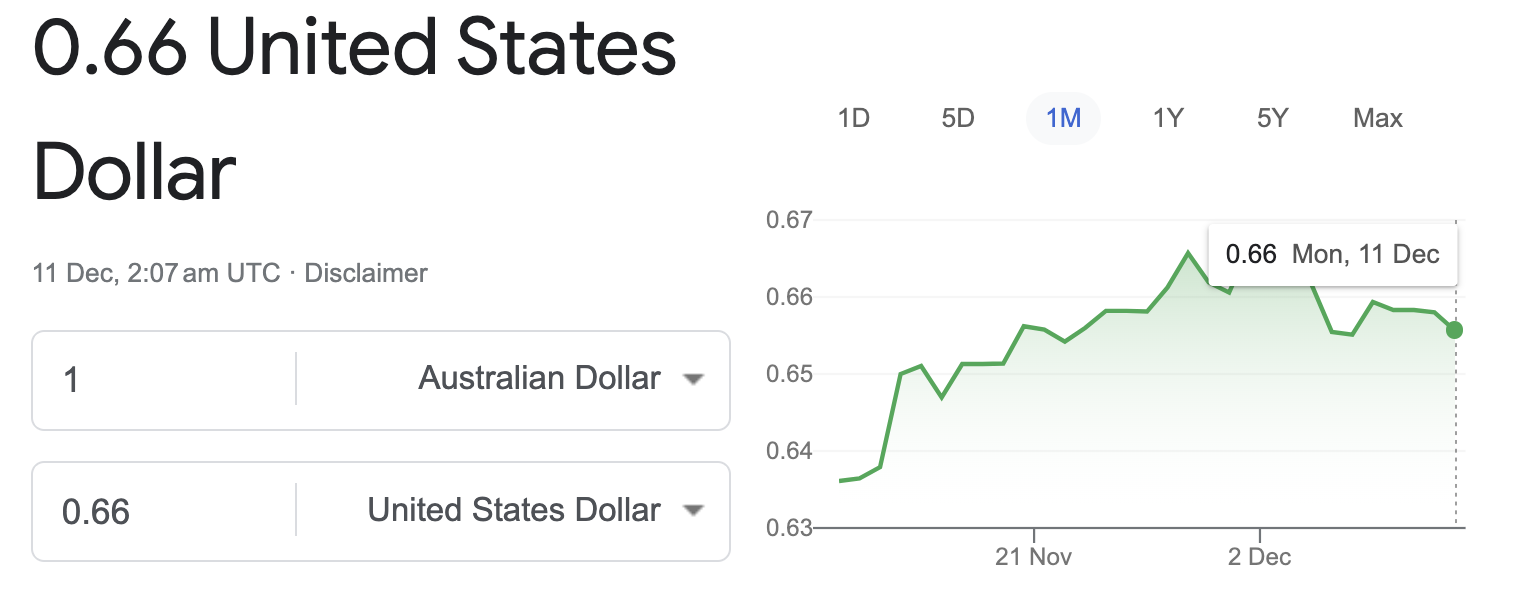

AUD/USD rates hit 4-month highs last Monday prior to the RBA interest rate. The increase was mainly due to an increase in gold pricing and risk-on market sentiment, though this was short-lived after the RBA announced interest rates would hold at 4.35%.

The AUD/USD pair has since dipped below the 0.6600 barrier, down 1.6% from last week’s high. Positive US Nonfarm Payrolls data released over the weekend lifted the US Treasury bond yields and the US Dollar.

At the time of writing, the market is trading around the key support level of 0.6580. If maintained, the next target for the pair is 0.6655, December’s peak so far. On the downside, below 0.6580, the pair might find support at 0.6525 ahead of 0.6511.

Recent data from the US indicated an increase in jobless claims, suggesting a potential loosening in the US labour market. This has fuelled speculation that the Federal Reserve might consider rate cuts starting in March.

Things to look out for this week;

Tuesday 12th December - Reserve Bank of Australia Speaks

Tuesday 12th December - GBP; Claimant Count Charge

Wednesday 13th Dec - USD Change in Price of goods and services (CPI y/y)

Thursday 14th Dec - Unemployment rate (AUD)

Thursday 14th Dec - Federal Reserve Bank Funds Rate (USD)

Thursday 14th Dec - Bank of England - Official Bank Rate

Friday 15th Dec - European Central Bank - Main Refinancing Rate

AUD-USD 🇺🇸

Fx rates have currently dropped compared to 4 Dec for the AUD. 0.6580 (1:00PM AEST)

AUD-GBP 🇬🇧

Rates for AUD TO GBP steady at 0.5243 (1:00PM AEST)

AUD-NZD 🇳🇿

AUD to NZD has risen back up to the current rate of 1.0745 compared to the weekend.

(1:00PM AEST)

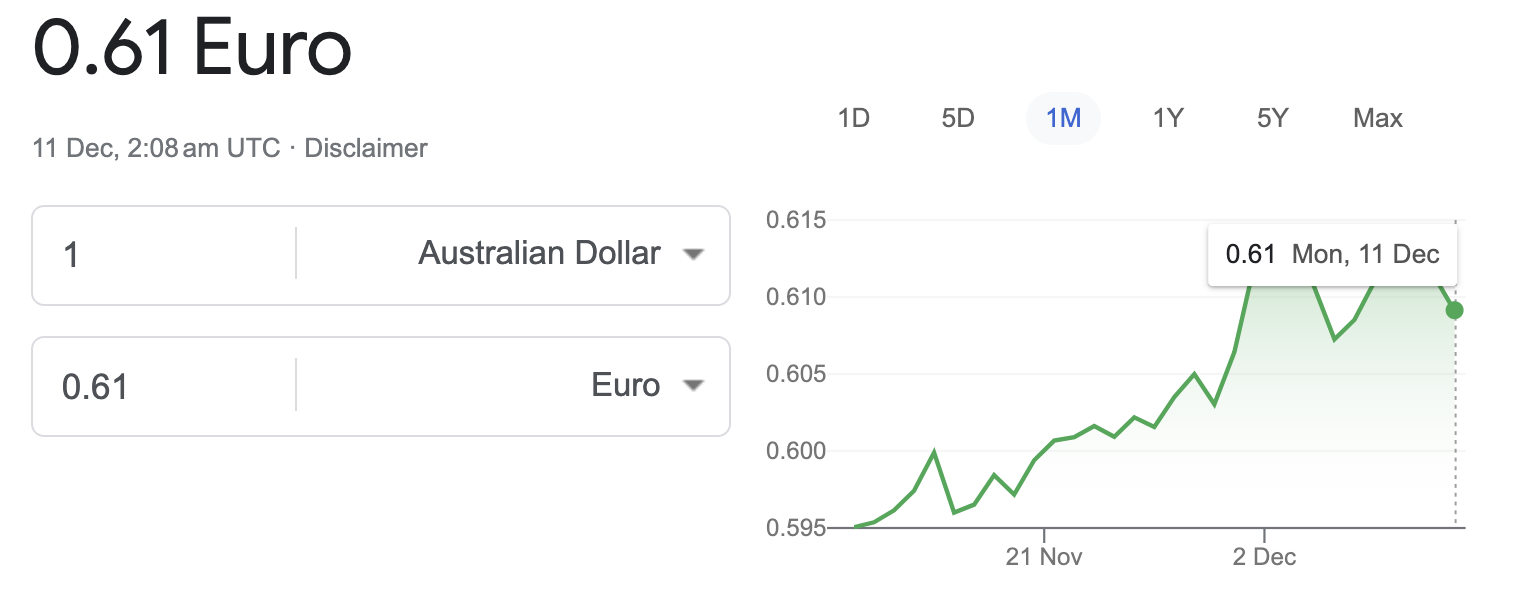

AUD-EUR 🇪🇺

AUD to the EUR is still sitting at a rate 0.6120, as compared to last week.

(1:00PM AEST)

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.