Australian Bureau of Statistics reported that the monthly CPI indicator rose by 2.7% from the 12 months to August.

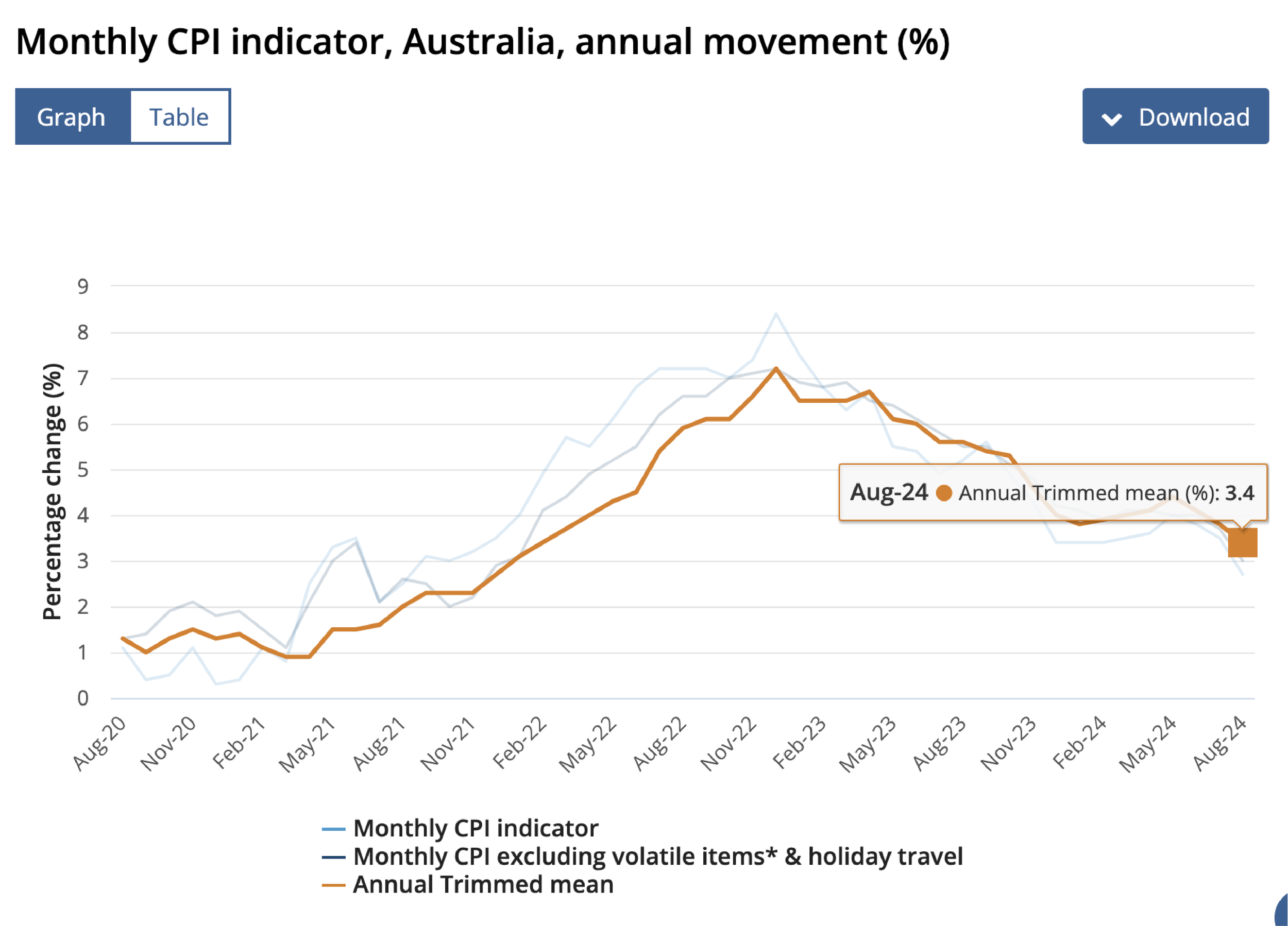

On September 25th, the Australian Bureau of Statistics (ABS) reported that the monthly CPI indicator rose by 2.7% from the previous 12 months to August, down from 3.5% in July. The Trimmed mean inflation, excluding fluctuations in automotive fuel and electricity, was 3.4% in August, down from 3.8% in July.

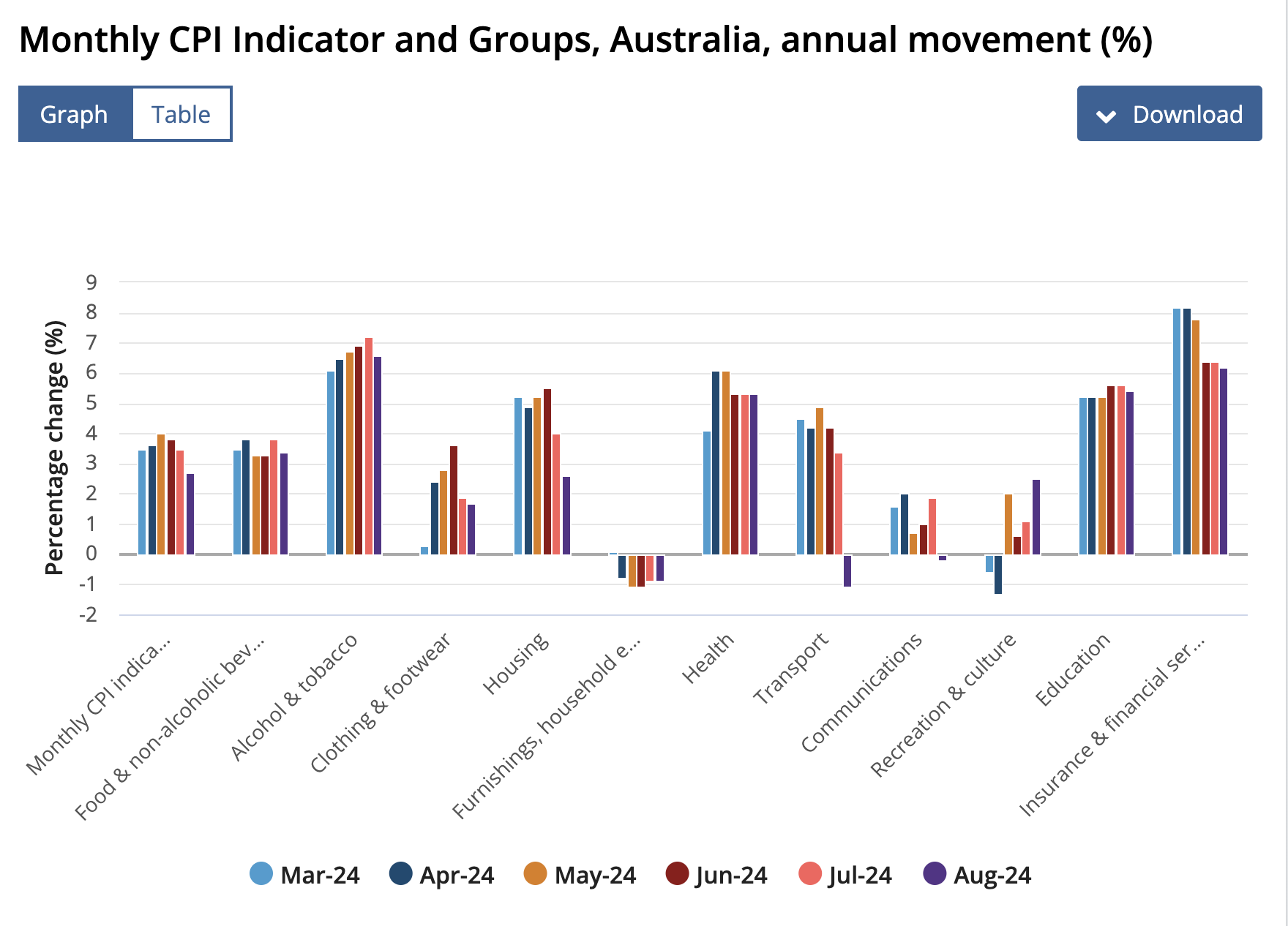

The most significant price increases were in Housing (+2.6%), Food and non-alcoholic drinks (+3.4%), and Alcohol and tobacco (+6.6%). Prices for electricity, fuel, household items and services, communications, dairy products, and transport fell, helping lower the overall increase in August.

Let’s take a closer look at the negative movers.

Dairy and related products - 0.2%

Electricity -17.9%

Furnishings, household equipment and services -0.9%

Transport -1.1%

Fuel - 7.6%

Communications -0.2%

ABS Key monthly takeaways.

The Commonwealth Energy Bill Relief Fund rebates began in July 2024 for select States and expanded to all States and Territories in August, reducing household electricity costs by 17.9%.

The annual CPI, excluding volatile items and holiday travel, was 3.0% in August, down from 3.7% in July.

The Trimmed mean inflation, excluding fluctuations in automotive fuel and electricity, was 3.4% in August, down from 3.8% in July.

New home prices, including new constructions and major renovations, increased by a consistent 5.1% over the past year until August.

Rental prices rose 6.8% in the year up to August, slightly lower than the 6.9% increase in July due to low vacancy rates in many major cities.

Insurance prices increased by 14.0% in the year leading up to August, matching the growth rate from July. Over the past year, rising costs for reinsurance, natural disasters, and claims have driven up premiums for vehicle, home, and contents insurance.

Holiday travel and accommodation prices rose 2.8% in the 12 months to August, following a rise of 0.2% in the 12 months to July.

In monthly terms, holiday travel and accommodation prices fell 1.4% in August. The main contributor to the fall was domestic holiday travel and accommodation (-2.6%), as demand was softer due to the lack of school holidays.

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.