SJP WeekWatch 16th September 2024

WeekWatch

Thank you, David Gardner and St James’s Place Asia and Middle East, for sharing your valuable market insights with our community in the SJP 16th September Weekwatch.

In this week’s WeekWatch, the SJP Team tackles the Stock Take, Wealth Check, In the Picture and the Last Word. In particular, the fallout from US Job Data, US, UK and European rate cuts, the Chinese slowdown, the Trump/Harris Debate, Nivida talks with Saudi Arabia, and which stocks performed well. Here are our key takeaways below;

US job numbers and their impact on the Chinese economy

Weather impacted the increase in food process and increase in China

Weakening of the Chinese Economy, yet found some relief by the fastest growth in 17th months ahead of tariffs being raised in the US, Canada, India and the EU.

Figures showed China’s industrial output slowing to a five-month low in August, while retail sales and new home prices weakened further.

US and Euro stocks staged a comeback, and buyers snapped up bargains.

The tech-heavy Nasdaq index had registered its most significant Friday-to-Friday fall since January 2022, but investors chose to look ahead to key data and actions from central banks.

Markets remained indifferent to Tuesday's US presidential debate between Trump and Harris, with stocks performing well under both Trump and Biden. A Harris victory is unlikely to change current policies.

Markets were unsettled by the latest US inflation data, which showed consumer prices rose 2.5% in the 12 months to August, the lowest level in over three years.

The inflation data appeared to dash any hopes of a half-point interest cut by the Federal Reserve at its meeting this week; markets indicated the data had clinched a smaller 25 basis point reduction.

There was news that the US government was considering allowing Nvidia to export advanced chips to Saudi Arabia, following its steps to limit its involvement with Chinese firms.

Official figures released on Wednesday revealed that the UK economy unexpectedly stagnated for the second month of July. The news left unchanged expectations that the Bank of England will cut interest rates again this year, probably in November.

The UK now exports more services—such as finance, accountancy, legal advice, and advertising—than goods. It is the first of the G7 advanced economies to do so.

On Thursday, the European Central Bank confirmed its well-telegraphed rate cut, lowering its deposit rate by 0.25% to 3.5%, but ECB sources suggested another interest rate cut in October was unlikely unless there was a major deterioration in the growth outlook.

Some investors and ECB policymakers, particularly those in southern eurozone countries, are concerned that the central bank could be too slow to ease policy, further hampering the bloc’s anaemic recovery.

As equity markets continue to trade near all-time highs, investors were also cheered by news that global dividends hit record levels in the second quarter of 2024, propelled by banks’ profits which have been boosted by higher interest rates. HSBC made the largest single payout of $4 billion, while US payouts were also boosted by new dividend payers such as Google-owner, Alphabet.

Wealth Check

People are living longer. Therefore, it is crucial to plan for your retirement future.

The amount you need to retire in Australia depends on your desired lifestyle, age, and other factors. According to the Association of Superannuation Funds of Australia (ASFA), the amount you need to retire is:

Comfortable retirement

A single person needs $595,000 in retirement savings, and a couple needs $690,000. This assumes that the retiree(s) own their home and receive the age pension.

To determine how much you need to retire, you can:

Work out your budget

Consider your current living expenses and adjust them for retirement. You can remove expenses like children's school fees and rent or mortgage repayments, and add in expenses like medical bills and home maintenance.

Start saving early

Start saving and planning for retirement as early as possible to benefit from compound interest.

The moderate lifestyle provides more financial security and increased flexibility, in addition to the minimum lifestyle. For example, you could take a two-week holiday in Europe or Asia, eat out a few times a month, and afford to drive a small car.

At the comfort level, you could enjoy some luxuries like regular beauty treatments, theatre trips and at least two weeks in Europe a year.

A concrete goal based on things you enjoy, such as holidaying or eating out with friends, is a powerful psychological motivator to keep saving.

Whatever stage you’re at on your saving journey, having a specific income in mind can help you focus on the end goal – and look forward to it.

The value of an investment with St. James's Place will be directly linked to the performance of the funds selected, and the value may, therefore, fall and rise. You may get back less than you invested.

Source

Association of Superannuation Funds of Australia (ASFA)

In The Picture

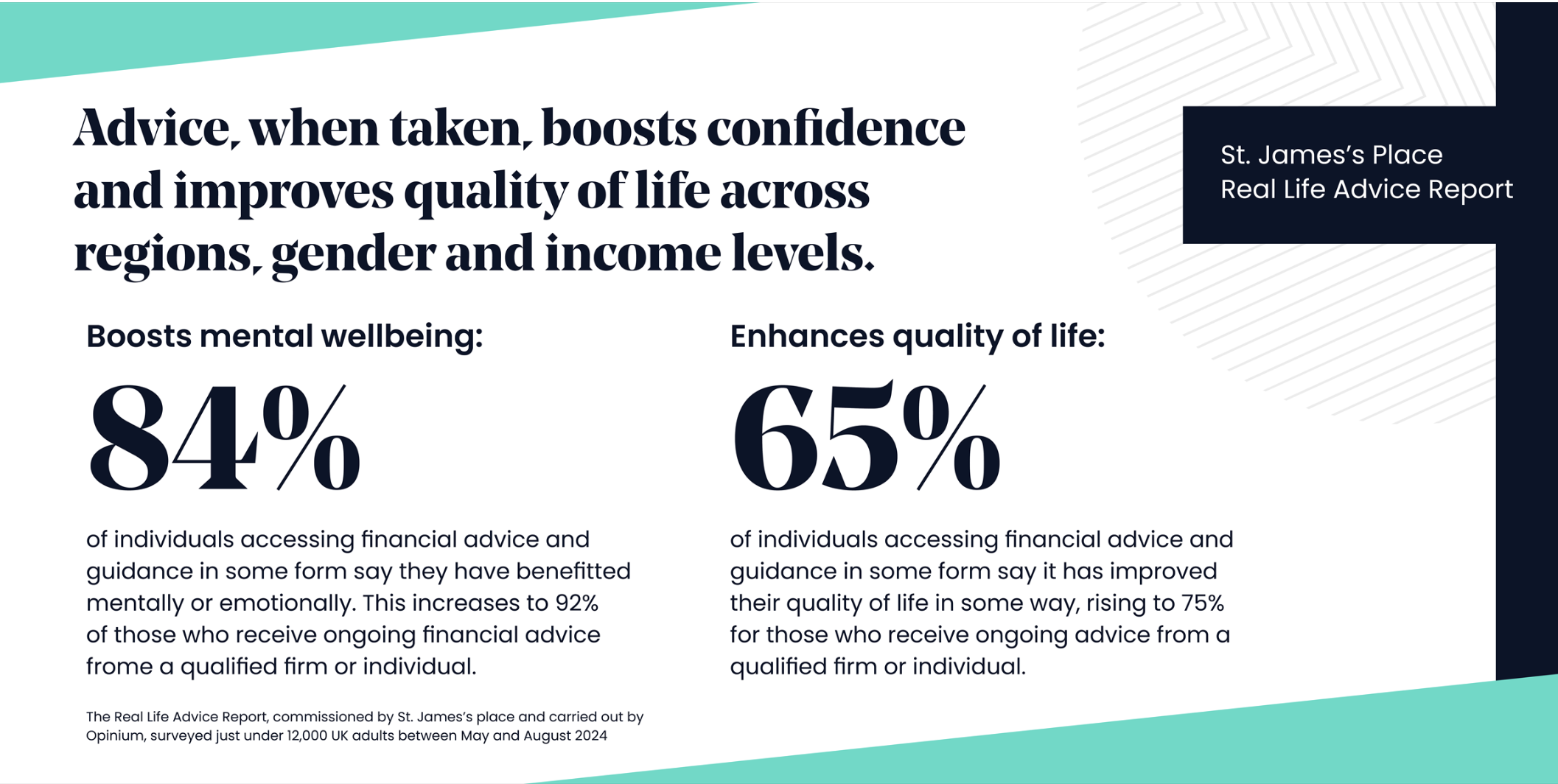

The Real Life Advice Report is St. James's Place's largest survey on how financial advice impacts lives and attitudes. Conducted from May to August 2024, it features real stories and interviews with over 12,000 UK consumers.

The Last Word

"The Dragon is now three times higher than the Space Station, the furthest that humans have been from Earth in over half a century!"

Elon Musk on SpaceX’s Polaris Dawn mission, where a four-person crew aboard The Dragon spacecraft completed the first commercial spacewalk.

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.