Stanford Brown Market Report November 2022

Thank You, Ashely Owen, Chief Financial Officer from Stanford Brown, for sharing their Monthly Investment Markets Report for November 2022.

This month StanfordBrown tackle some of the most pressing questions for longer-term investors:

Inflation and interest rates – Where are we now? - and how high will they go?

Share markets – Are they cheap yet, or still expensive? – and where to from here?

Spending is slowing, but we still sitting on a huge mountain of cash to spend – where did it all come from?

The FTX collapse – is this the end for crypto? Or just a bump in the road?

Inflation and interest rates – Where are we now? - and how high will they go?

“November was a very good month for both share and bond markets, with inflation slowing and with hints that the central banks may soon to “pivot” towards slowing the pace of interest rate hikes.”

Share markets – Are they cheap yet, or still expensive? – and where to from here?

“Aside from the big US Online/Tech Stocks, the rest of the US market, and the rest of the world share markets, are now reasonably priced after this year’s falls. The main problem is still with the very expensive tech/online stocks, which are mainly in the US. The chart below show the heavy falls in the US Tech/Online Giants, as well as other selected Tech Stocks in other markets”

Shares - Where are we now? Where from here?

“Market prices oscillate around the long-term central “fair value” path over time (based on long term growth in population, productivity, incomes etc) through booms and busts. The post-GFC/post covid/post-tech online boom that was filed by ultra-cheap money, peaked in 2021 before rate hikes began.”

“There are three main paths for the stock market ahead. 1. “Soft landing Scenario” 2. This is a mythical world where share prices calmy and neatly settle on their underlying fundamental fair values and drift along quietly on their long path, ignoring any and all short-term economic or political or military crises that may come along. 3. This is where rate hikes (and/or other shocks to spending) trigger deep cuts to corporate profits. Whether or not it is defined by economists as a “recession”, it is not important to investors. What is important is aggregate corporate profitability. ”

Spending is slowing, but we still sitting on a huge mountain of cash to spend – where did it all come from?

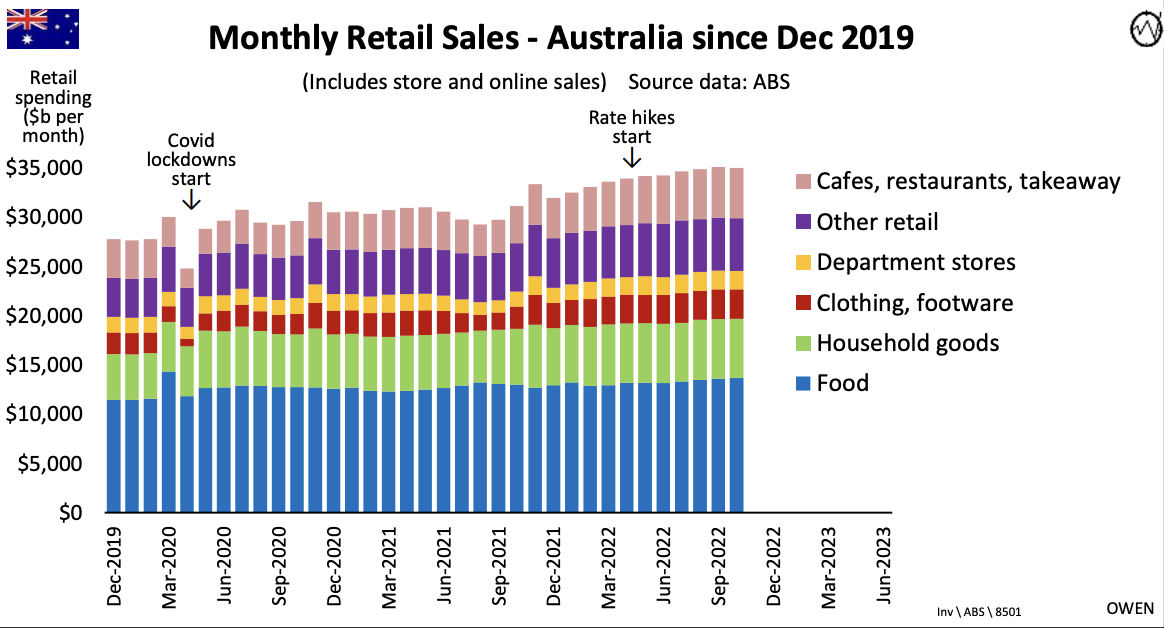

“After seven RBA interest rate hikes this year Australians are finally showing signs of slowing their collective spending spree. Over the past three months spending on food/groceries ( blue) and cafe, restaurants and takeaways (pink) are still rising strongly, but other categories have flattened off. Retail (purple) is falling the fastest in the wake of the interest rate hikes”

“The problem is Aussies have too much money to spend. The next chart shows retail sales since 2016 (maroon line). Sales volumes are now running at 25% above pre-covid levels. Australians are now spending an average of $3,500 per household per month, compared with $2,800 per household per month pre-covid.

One reason for additional spending is that mortgage repayments are still much lower than they were pre-covid even with the recent interest rate hikes. Lower prepayment means more money for spending.

The big hit from the rate hikes will be over the next 12 months when a tidal wave of low fix-rate loans ( at around 2%) will need to be refinanced to much higher interest rates (around 5% or higher) .That is sure to put a big break in spending next year. ”

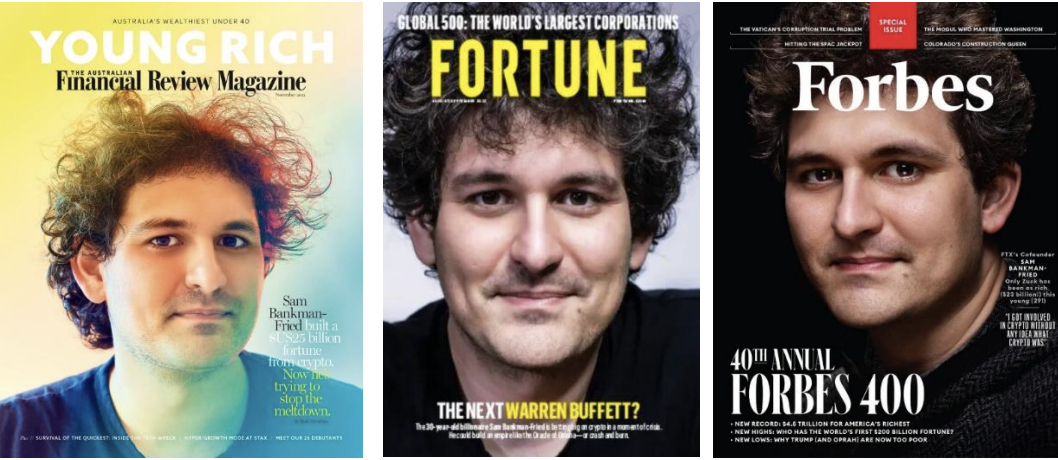

The FTX collapse – is this the end for crypto? Or just a bump in the road?

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.