Meet Michael Purvis: A Trusted Financial Expert for Australian Expats

We are thrilled to introduce Michael Purvis, a highly experienced financial advisor who has dedicated over 20 years of his professional career to helping individuals and businesses effectively secure their financial future and achieve their various financial goals. Purvis has an extensive and impressive career throughout Australia, where he has worked across both the private and business banking sectors, providing valuable insights and personalized financial strategies to his diverse clientele.

St. James’s Place Weekwatch - US Election and Wall Street.

Thank you, David Gardner and St James’s Place Asia and Middle East, for sharing your valuable market insights with our community in the SJP 11th November Weekwatch. This week, the focus is on the US Election 2024, Interest rates in US and UK, Tarrifs and how they are already impacting production levels in China. The posibility of a snap election in Germany , plus Wealthwatch and In the Picture.

US election: What does Trump's victory mean for markets?

US election: What does Trump's victory mean for markets?

At a glance:

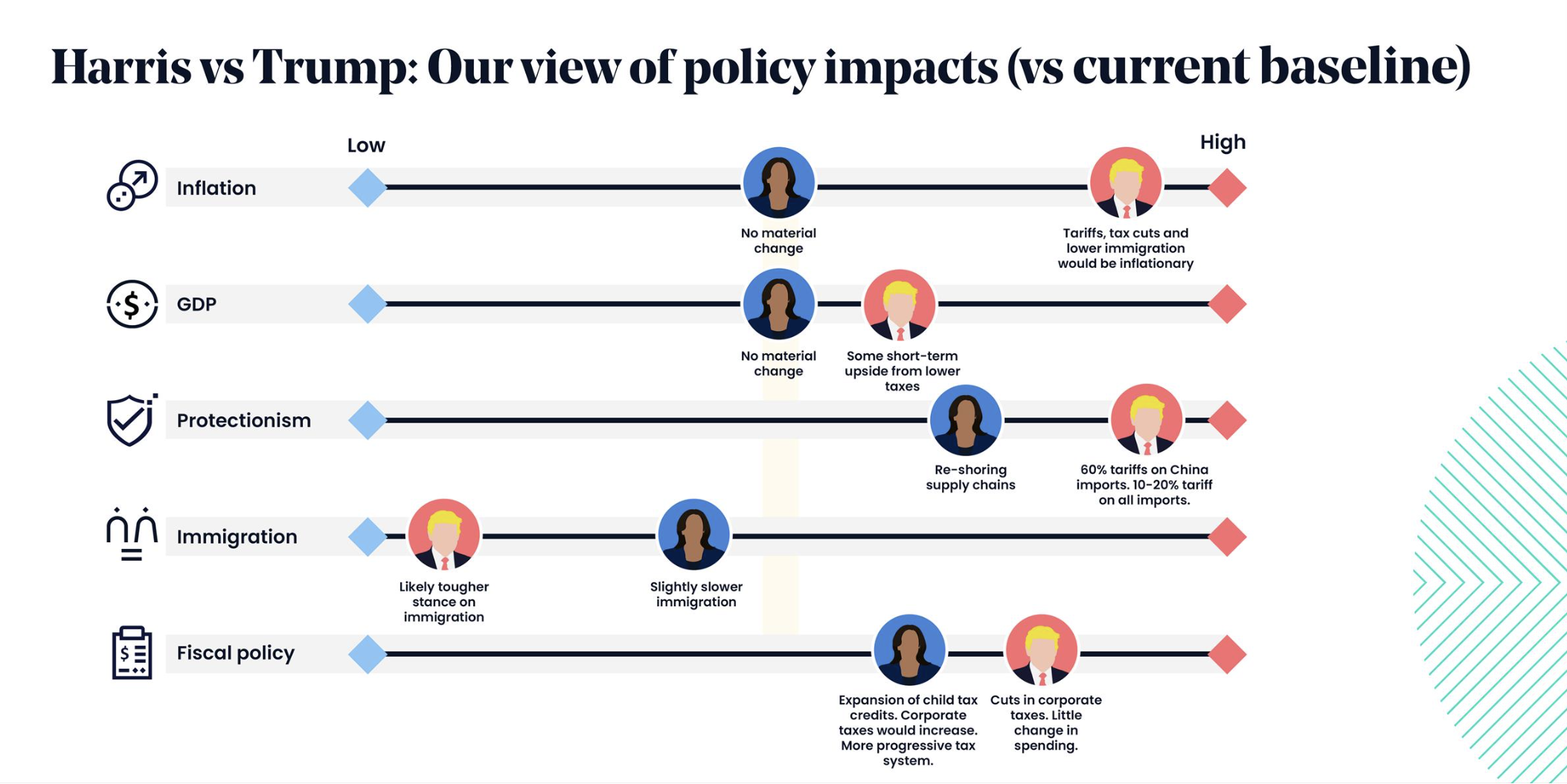

Donald Trump’s policy promises, such as increased tariffs, could raise inflation in the US, while the longer-term impact on China may be more nuanced.

We expect to see short-term market volatility, both up and down, but we do not act on speculation. We remain anchored to our long-term investment views.

Avoiding a knee-jerk or emotional response after such a divisive election is essential.

SJP Weekwatch - Beyond the Ballot: the US Election 2024

Thank you, David Gardner and St James’s Place Asia and Middle East, for sharing your valuable market insights with our community in the SJP 15th October Weekwatch. This week, the focus is on the US Election 2024 after a short global financial markets quarter recap.

St. James’s Place Week Watch 30th September 2024

St. James’s Place Week Watch 30th September 2024

In this week’s WeekWatch, the SJP Team tackles the Stock Take, Wealth Check and In the Picture. In particular, the SJP team focuses on the Chinese, US, EU, and UK economic updates and more. We’ve taken the time to put together the takeaways from the update.

Stock Take

China

Since it was opened up and reformed in the late 1970s, China’s economy has grown at an average rate of 9% annually.

China risks missing its annual growth target of around 5%. Therefore, markets reacted enthusiastically to the People’s Bank of China unveiling a major package of aggressive measures designed to stimulate the economy.

Plans to cut the amount of cash banks must hold in reserve are estimated to free up around one trillion yuan ($142 billion) for new lending.

Efforts to boost the property market by cutting borrowing costs for existing mortgages and lowering the minimum down payments on all homes to 15%.

Global stocks rose to a record high on Tuesday, while major US indices also hit closing highs as investors cheered the news.

SJP Financial Education Workshops” in your workplace.

SJP Financial Education Workshops” in your workplace.The St. James’s Place team has created Financial Education “Workshops”, a fantastic platform to increase financial literacy within your workplace community. This holistic approach supports your employees through financial well-being and recognizes the significant correlation between financial well-being and mental health.

So, who is the BIGGEST Wealth Management Company in the UK?

So, who is the BIGGEST financial planning firm in the UK? David Gardner takes some time to share some fast facts with us about St. James’s Place.

In conversation with Wasatch Global Investors, Emerging Markets Fund Manager | SJP

SJP's Senior Investment Consultant, Darren Johnson, met with Ajay Krishnan, a Portfolio Manager at Wasatch Global Investors, to discuss economic conditions and provide reassurance that long-term investment strategies remain strong. Find out how our fund managers add value to our portfolios and listen to Darren and Ajay as they respond to questions from our live audience.

Australia Repatriation Checklist.

Australia Repatriation Checklist by Senior Financial Adviser, Partner St. James’s Place Asia and Middle East, David Gardner.

The key to a successful and financially efficient repatriation is the planning process. We recommend that the repatriation planning process take place well before you return to Australia.

Here is a checklist to ensure your move back to Australia goes as smoothly as possible.