Interest rates, interesting times…

Earlier in the year we wrote about the effect that interest rates has on the ability to borrow funds.

Effectively, as interest rates rise, the amount you can borrow reduces. Broadly, a 1% interest rate rise reduces your ability to borrow by 10% (of total debt), eg if you could borrow $1mil and rates rise 1%, then you can now only borrow $900,000.

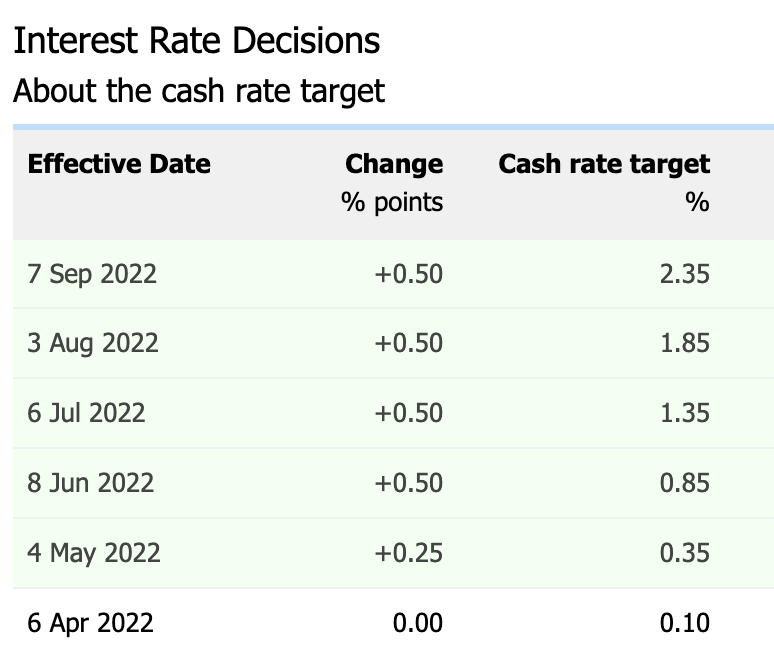

As we now have the Reserve Bank of Australia (RBA) increase rates by 2.25%, then the effect of this can be quite significant on the ability to borrow.

We have been in a period of record low rates; the increases have in reality, brought us back to where we would have normally expected rates to be. However, this does not take away the pain of a rate rise nor a potential reduction in borrowing capacity.

The most common questions I’m being asked currently is where I believe the interest rate increases will end up, eg

“How many more rate increases can I expect?”

and

“Should I consider fixing all or at least part of my loan?”

Let’s look at the first part of that, what additional rate rises are we expecting? The RBA has indicated that the increases have started to show signs of a slowing economy and tightening of the household budget, so this would indicate that we may be nearing a position where rate rises may then no longer be necessary.

It is worth noting that we are not there, and we do expect one or two more 0.25% rises before the end of the year.

What is interesting though is where fixed rates are currently. This morning I looked at the rates of one lender (which is a good representation of where most are at) and noticed something quite unusual, something that I don’t recall ever seeing before.

The rates I on offer from a lender (fixed rates for an Investment loan) are:

1yr = 5.54%

2yr = 5.44%

3yr = 5.29%

It's not often you see a 1 yr higher than a 2 yr that is higher than a 3yr rate!

I think it’s the first time I’ve ever seen that!

My interpretation of this is that it indicates the lender believes we are getting close to the top of the cycle and that there may be potential for rate reductions over the 2 to 3yr period.

So, should you fix or not?

Ultimately, fixing a loan is about comfort initially and affordability as a secondary. If you are concerned about the rising cost of debt, then yes, fix part of the loan, but be aware that the cost will increase in the short term as the fixed rates are higher than the variable rates.

Lastly, as an alternative,

When did you last review the lender?

All lenders reward new business more than they reward loyalty. So, if you have been with a lender for a few years, as a starting point, we encourage you to ask the lender for a better discount (this is something we do for our clients), then review the new rate to what is available in the broader market. The only issue with potentially moving the debt is whether you can move the debt, eg

Does the maths still work with the level of debt you have if we applied your debt to a new lender?

If you have held a property for the past few years, then you would have hopefully seen a notable increase in value. This may have taken you from needing an 80% loan to only needing a 70% loan or even less. This reduction in the Loan to Value Ratio (LVR) this often opens up new lenders that previously were not an option.

If you need assistance reviewing your position, please reach out; we’re always happy to assist. Connect with Adam Kingston THE EXPATRIATE Mortgage Specialist.

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.