Core Logic February Report

Core Logic Home Value Index Report

THE EXPATRIATE was lucky enough to catch Core Logic Tim Lawless Executive, Research Director, Asia-Pacific. We have put together key points from the Core Logic Home Value Index February Housing Sale figures.

“Growth in Australian housing values continues to lose steam as Sydney records first decline in 17 months.”

Tim Lawless - Core Logic.

Home Value Index HVI - 06% - Lowest Growth since March 2020.

Home Value Index (HVI) posted a national gain of 0.6% in February, which is the 17th Connective Monthly Increased; however, there is a sign of slower growth, as the HVI is down for the first time since March 2020 from 1.1 to 0.6%. A n increase of 0.6% is the lowest growth we have seen since the pandemic and well below the high of 2.8% in March 2021.

Core Logic February Home Index Value Report

The sharpest declines in growth were in Sydney (-0.1%) with its first decline, and Melbourne (0.0) housing values remained unchanged now with three months of no growth, -0.1 December, and (+0.2) in January.

Brisbane, Adelaide, and Hobart all saw growth of over 1%, with regional markets seeing more robust gains of 1.2% for February and 7.2%, 6.4%, and 3.5%, respectively, for the quarter.

Nationally annual growth is up 20%, with total return leaders in the capital cities being Brisbane 34.2%, Adelaide 30.3%, Hobart all above 30% increase. Then came Canberra 28.2%, Sydney 25.0%, Darwin 19.4%, Melbourne with 15.4%, and Perth 13.3%.

Regional Areas Remain Strong

Regional Australia continues to record a substantially higher rate of growth. Over the past three months, housing values across the combined rest-of–state regions increased at more than three times the speed of housing values across the combined capital cities; 5.7% and 1.8%, respectively.

Although the rolling quarterly value growth rate remains rapid across regional Australia, conditions have eased from a recent peak of 6.4% over the December quarter. They are down from a cyclical peak of 6.6% recorded in April last year.

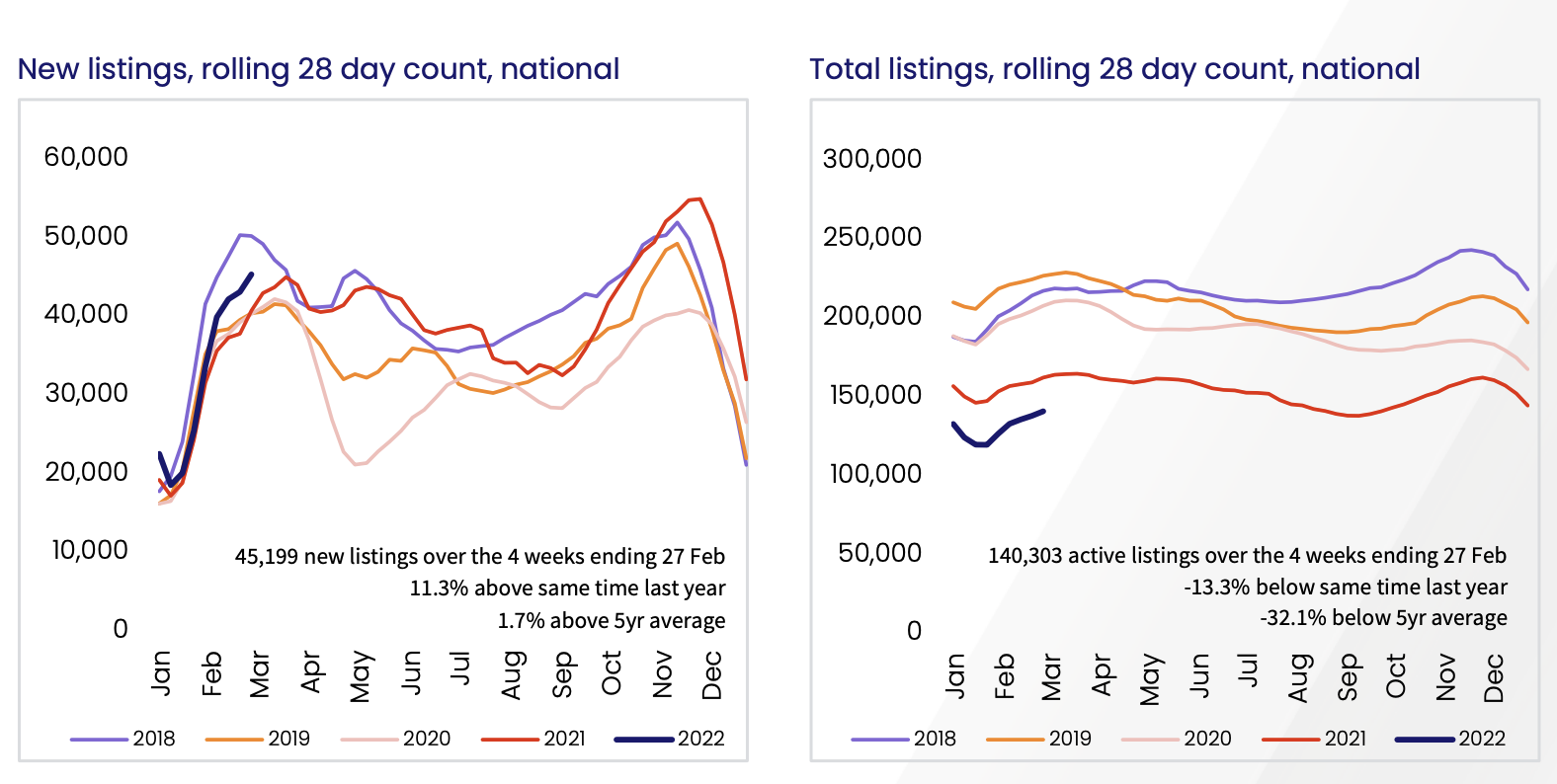

Core Logic Advertised New Listings

Core Logic Report - Advertised Supply.

Reserve Bank of Australia Cash Interest Rates remained Unchanged at 0.10% this Week. There is a slow down in the market, but where? Sydney and Melbourne yes, however, lack of supply to the market will mean that Brisbane, Adelaide, and Combined Regional Area will remain strong. There seems to be a genuine desire to change lifestyle and to move to improve quality of life to either a sea or tree change.

The unprovoked Russian Invasion of Ukraine will be on our minds and we move forward. We will do our best to keep you up to date on any information that may affect THE EXPATRIATE Community. The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.