CoreLogic Australian Property Market Report: March HVI 2025

CoreLogic Home Value Index: HVI Report March 2025: Housing downturn reverses in February, with Melbourne & Hobart leading the way

CoreLogic Home Value Index: HVI Report March 2025: Housing downturn reverses in February, with Melbourne & Hobart leading the way

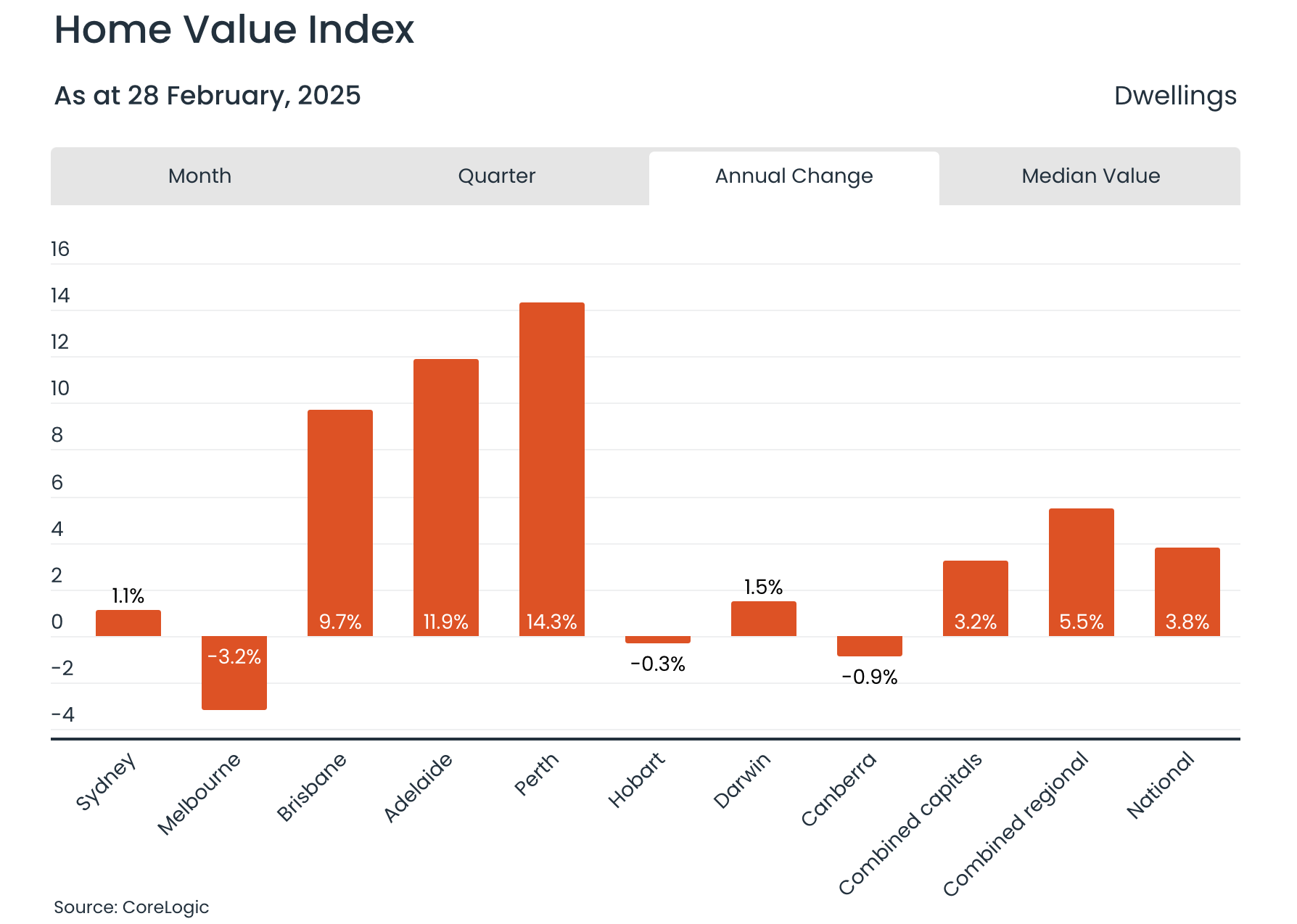

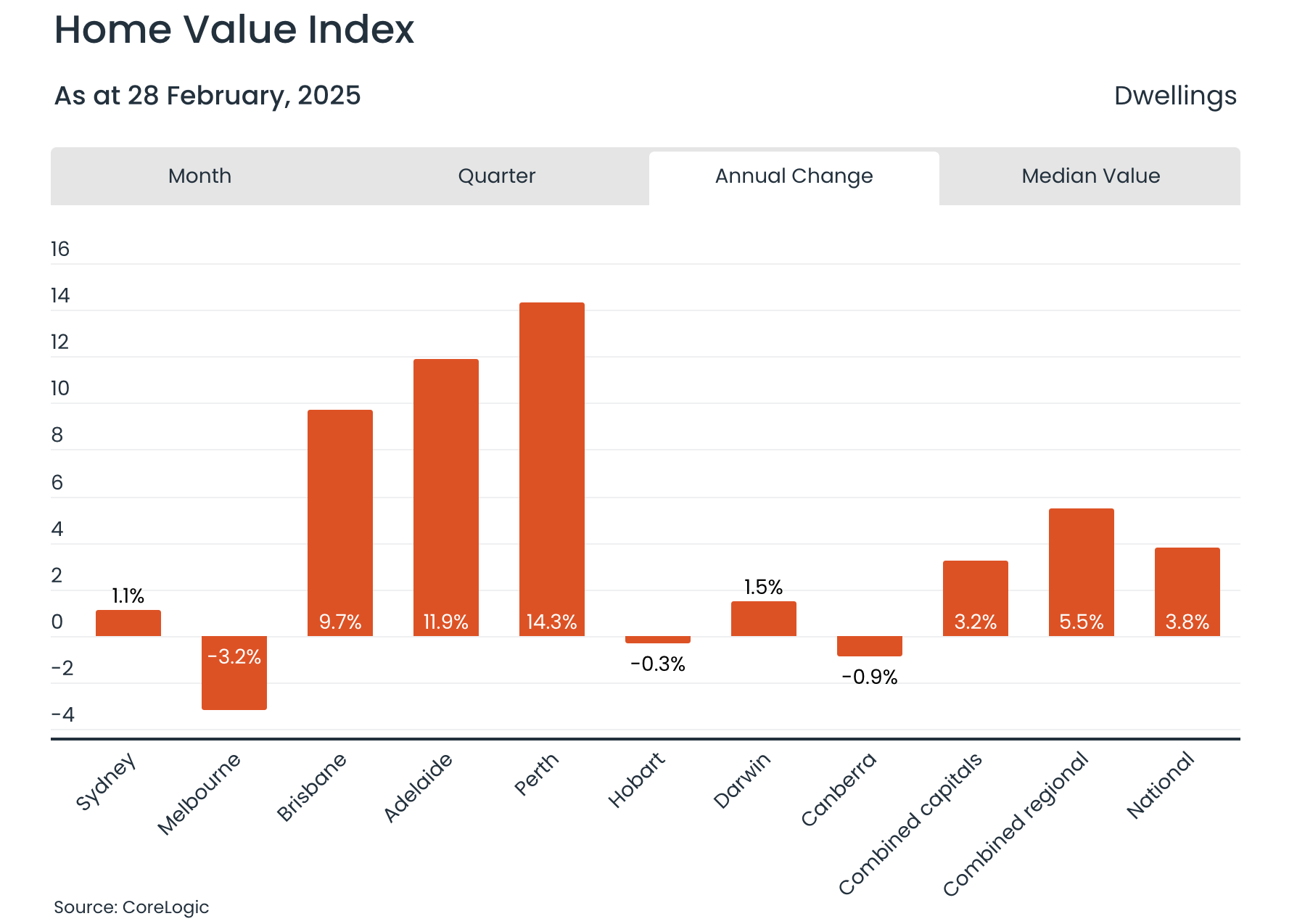

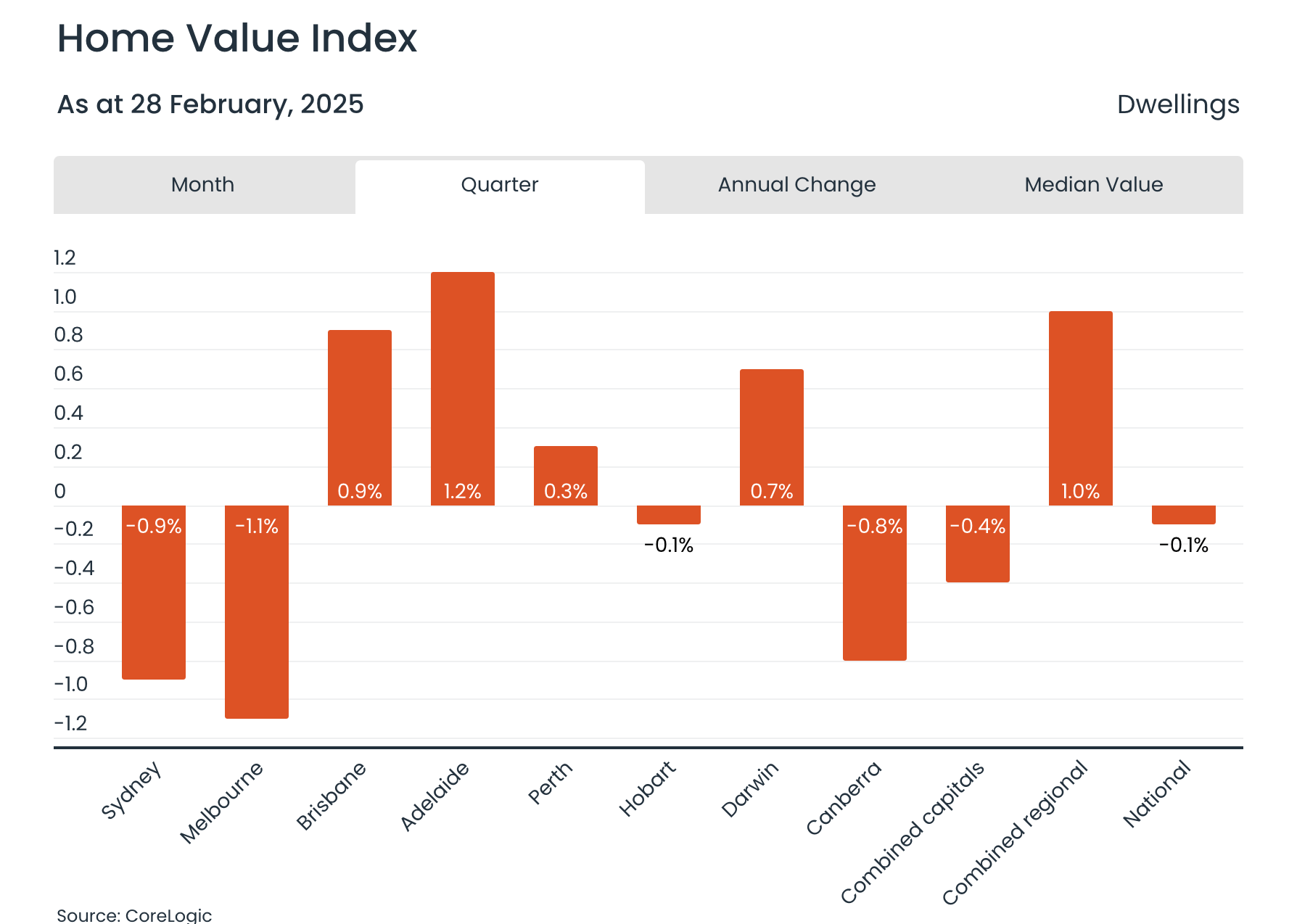

The latest CoreLogic Home Value Index (HVI) for March 2025 reveals a subtle yet broad-based re-acceleration in housing values across Australia. Following a brief three-month downturn, national home values rose by 0.3% in February, signaling improved market sentiment and optimism among buyers.

Melbourne and Hobart Lead the Recovery

While most markets saw an uplift, Melbourne and Hobart experienced the highest month-on-month growth at +0.4%, marking a notable shift for these cities, which had been among the weakest performers in recent months. For Melbourne, this marks the end of a ten-month streak of falling values.

Shifts in Market Strength

Interestingly, the mid-sized capitals—Brisbane, Perth, and Adelaide—have lost their momentum as the strongest growth markets. While these cities still recorded positive monthly gains (ranging from 0.2% to 0.3%), their pace has slowed compared to previous months. Adelaide and Brisbane continue to lead quarterly growth trends, with increases of 1.2% and 0.9%, respectively. However, Perth has seen a sharper deceleration, with its quarterly change slipping to just 0.3%.

Premium Markets Driving Growth

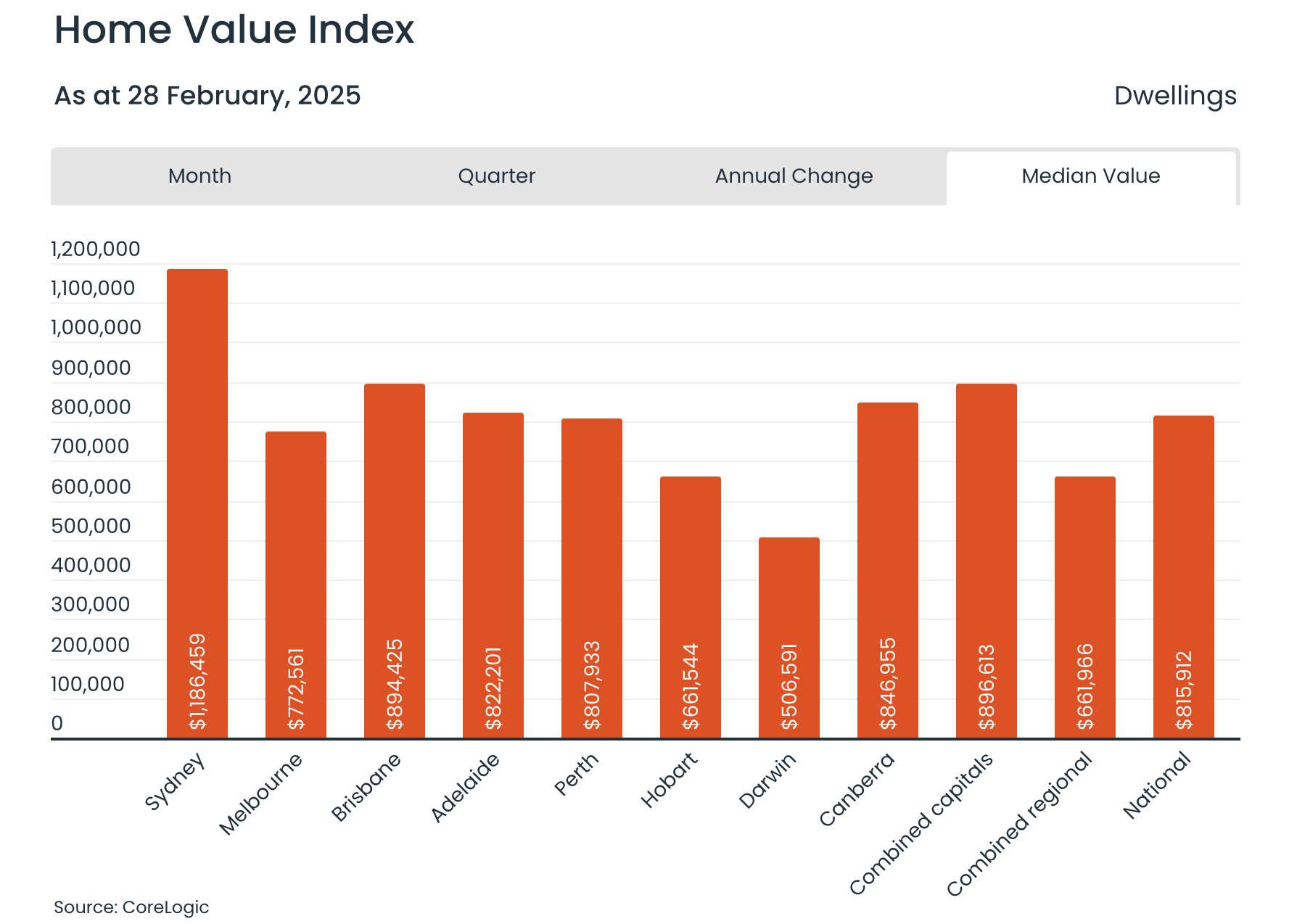

A key trend emerging from the data is the outperformance of high-value properties. The upper quartile of house values in Sydney and Melbourne led the gains, reversing some of the steep declines seen in previous months. This aligns with historical patterns, where premium markets tend to react more swiftly to changes in interest rate expectations.

Auction Clearance Rates and Supply Dynamics

Alongside rising values, auction clearance rates have returned to long-term averages, indicating stronger buyer demand. Additionally, new property listings remain constrained, with the combined capitals seeing a -4.7% year-on-year decline in new listings. This tightening in supply, combined with improved sentiment, is likely contributing to the modest price increases.

Regional Markets Show Continued Strength

Regional housing markets continued outperforming their capital city counterparts, with a combined regional index rise of 0.4% for the month and 1.0% over the rolling quarter. However, growth remains uneven, with stronger performance in select areas than others.

Rental Market Trends

National rental values increased by 0.6% in February, their strongest monthly gain since May 2024. However, annual rental growth has slowed to 4.1%, marking the slowest since early 2021. Factors such as normalizing overseas migration and changing household dynamics appear to be tempering rental demand.

Looking Ahead

While the market appears to be stabilizing, the trajectory remains uncertain. Future growth may hinge on further improvements in affordability, interest rate movements, and broader economic conditions. Cities like Melbourne and Hobart, which have experienced steeper downturns, could be poised for a more substantial recovery due to their renewed affordability advantage.

As we move through 2025, monitoring shifts in sentiment, supply trends, and macroeconomic factors will be crucial in understanding how the housing market evolves in the months ahead.

The information contained is general information only and does not consider your personal objectives, financial situation and needs. We strongly recommend that you do not act on any information provided in this website without individual advice from your trusted advisor. You should also obtain a copy of and consider the Product Disclosure Statement for all financial products before making any decision.

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.