CoreLogic Home Value Index (HVI) released October 1st 2024.

“Home values inch higher nationally as growth loses momentum.” CoreLogic Australia HVI Report Released October 1st 2024.

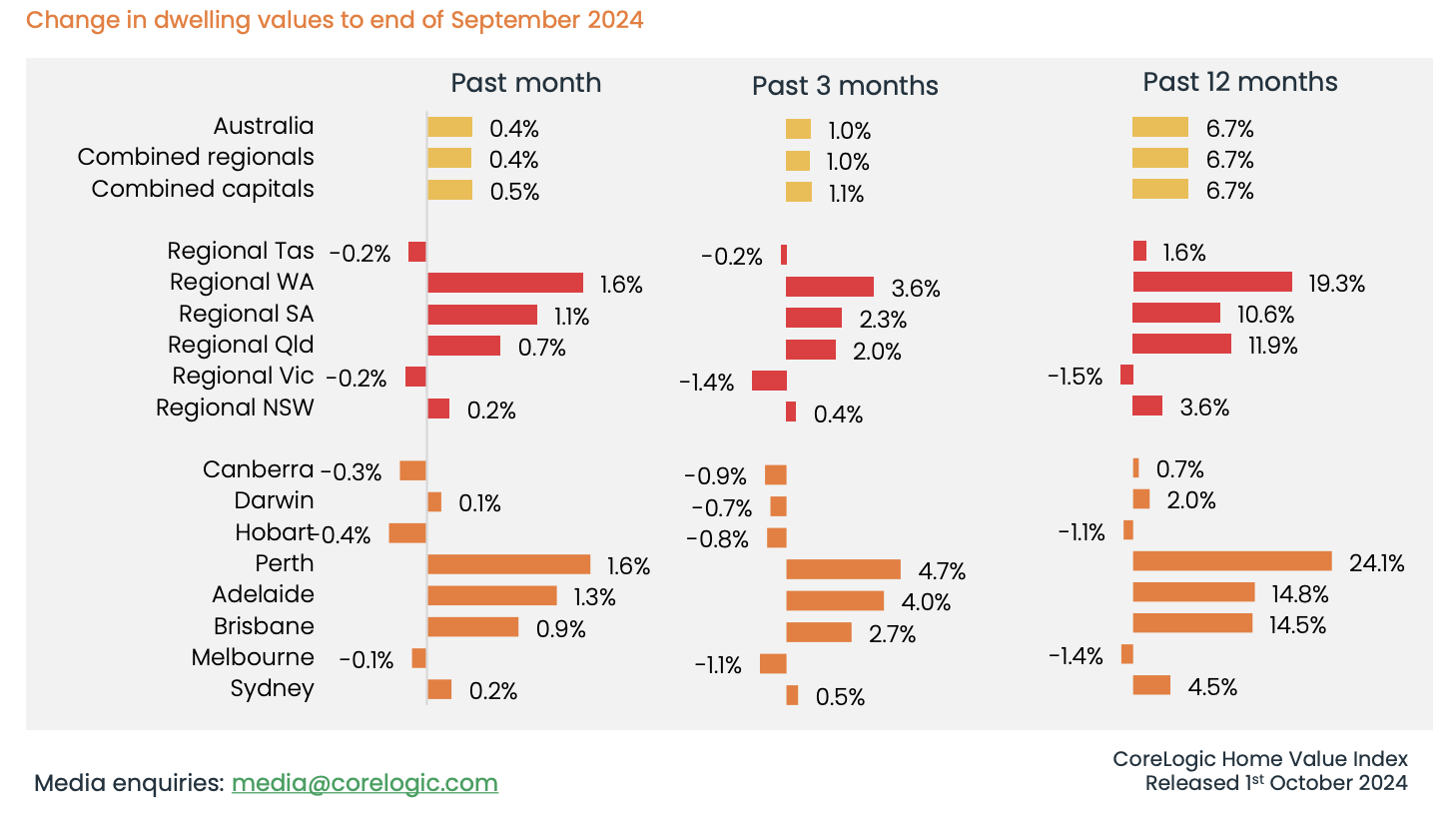

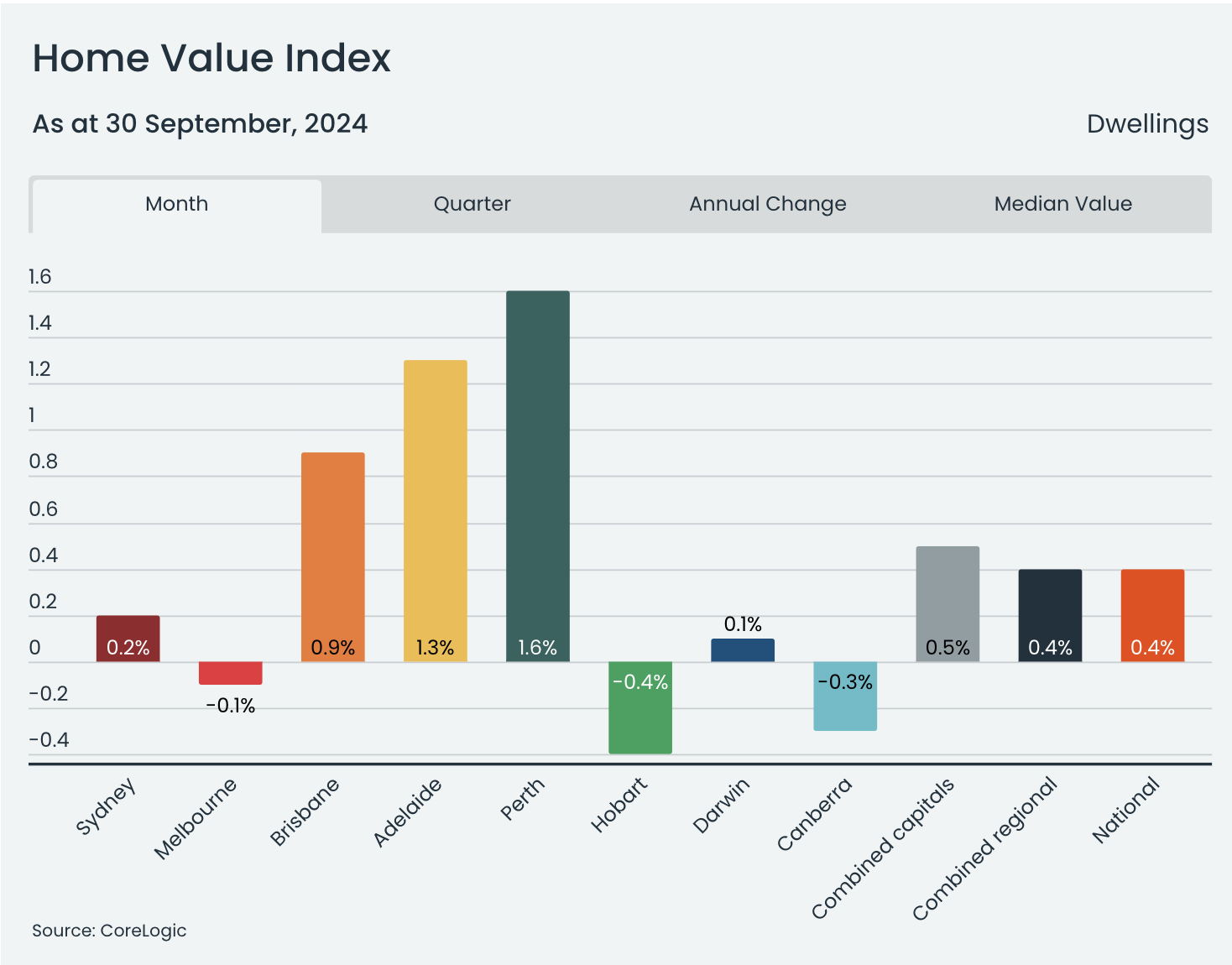

Thank you, CoreLogic Australia, for sharing the Home Value Index September housing market results with the expatriate community. The HVI reported that Australian home values increased by 0.4% in the first month of spring, similar to the changes of 0.3% in July and August as the market slows down.

Perth +1.6% Regional WA +1.8%

Adelaide +1.3% Regional SA +1.1%

Brisbane +0.9% Regional QLD +0.7%

Sydney + 0.2% and Regional NSW +0.2%

Melbourne -0.1% Regional VIC -0.2%

Darwin -0.1%

Canberra -0.3%

Hobart -0.4% Regional TAS -0.2

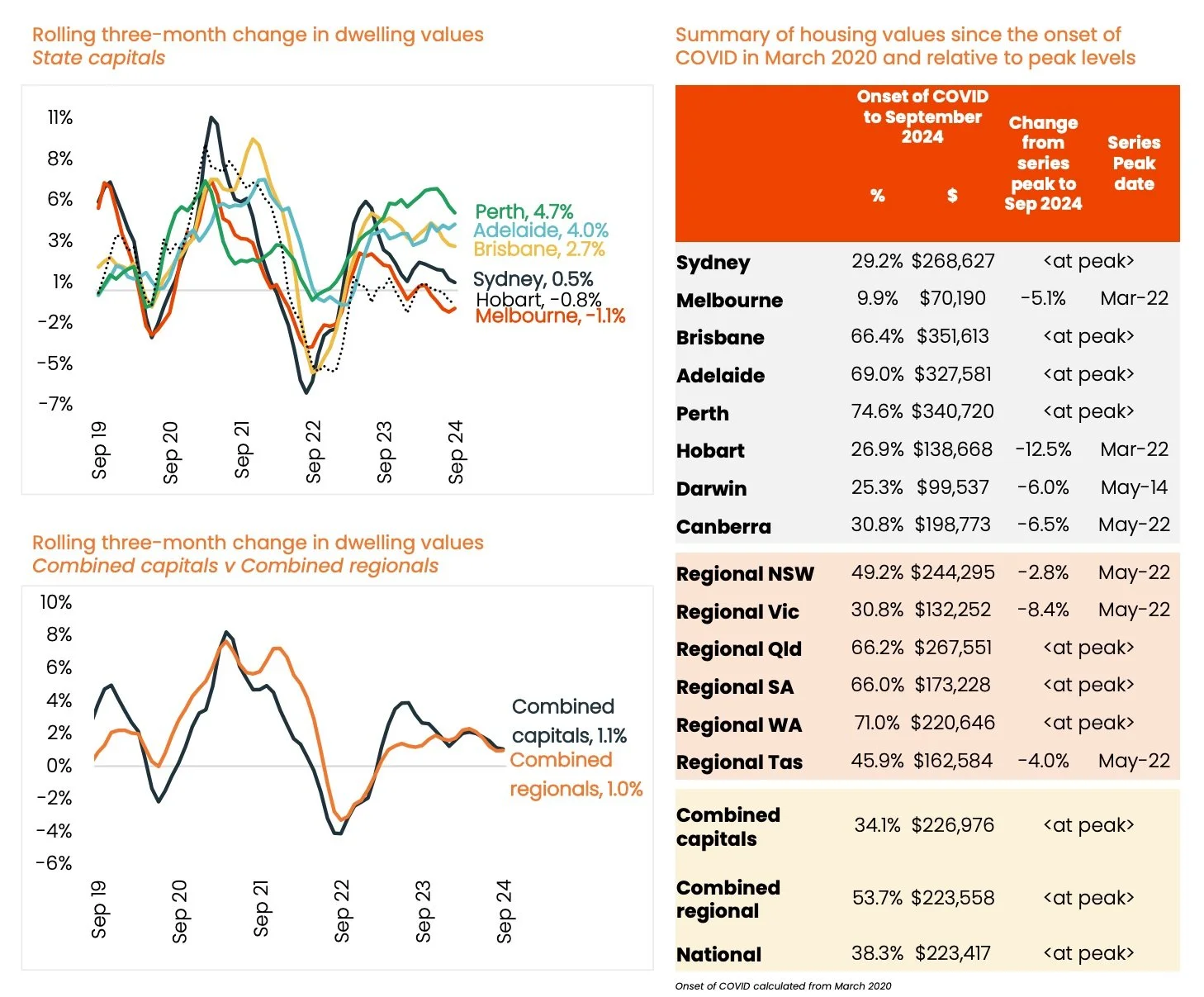

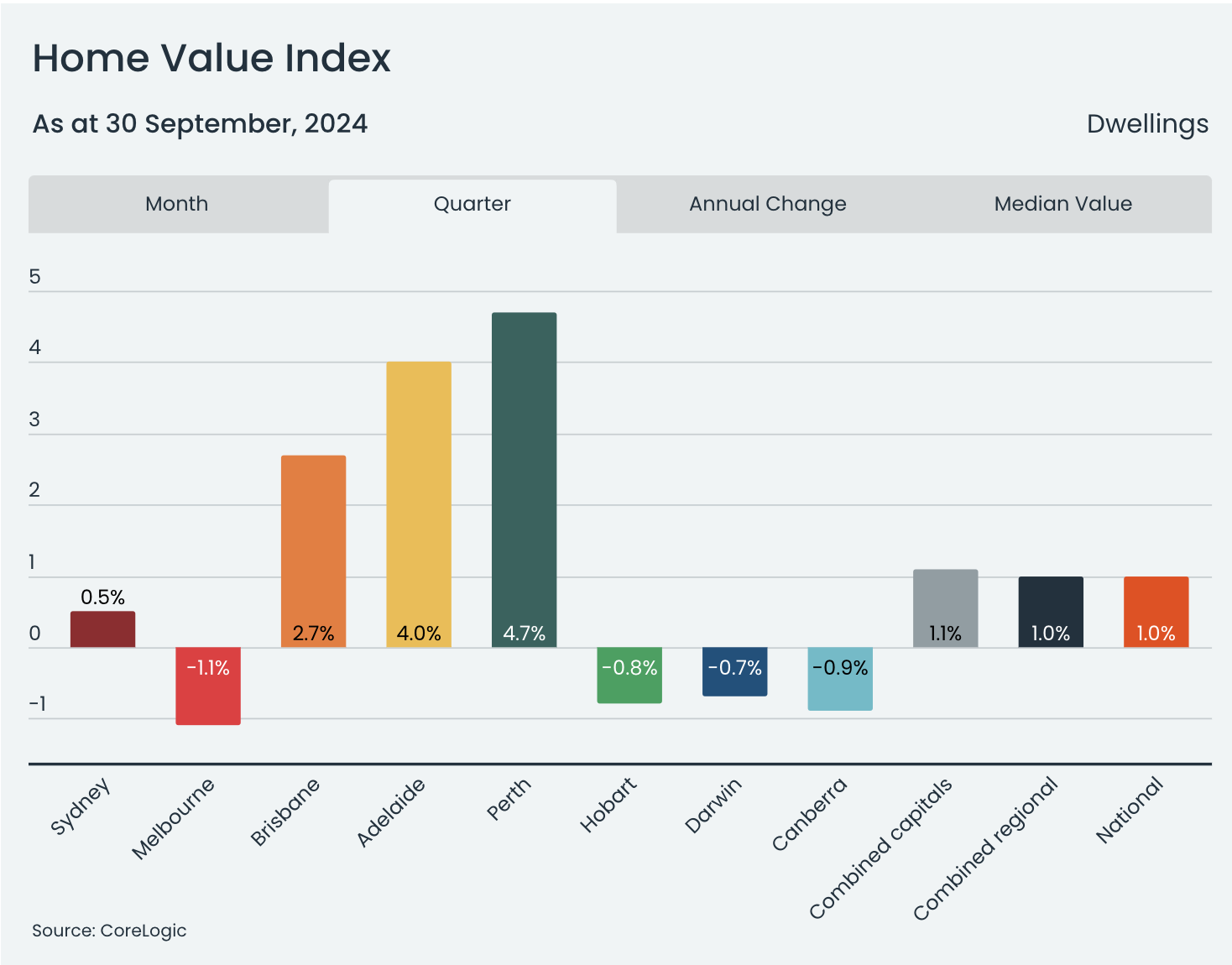

Housing values increased by 1.0% nationally in the September quarter, the smallest rise in the Home Value Index since March 2023, when the market began recovering.

Four capital cities showed different housing conditions, with decreased property values during the September quarter. Melbourne saw the most significant drop, at -1.1%, followed by declines in Canberra, Hobart, and Darwin.

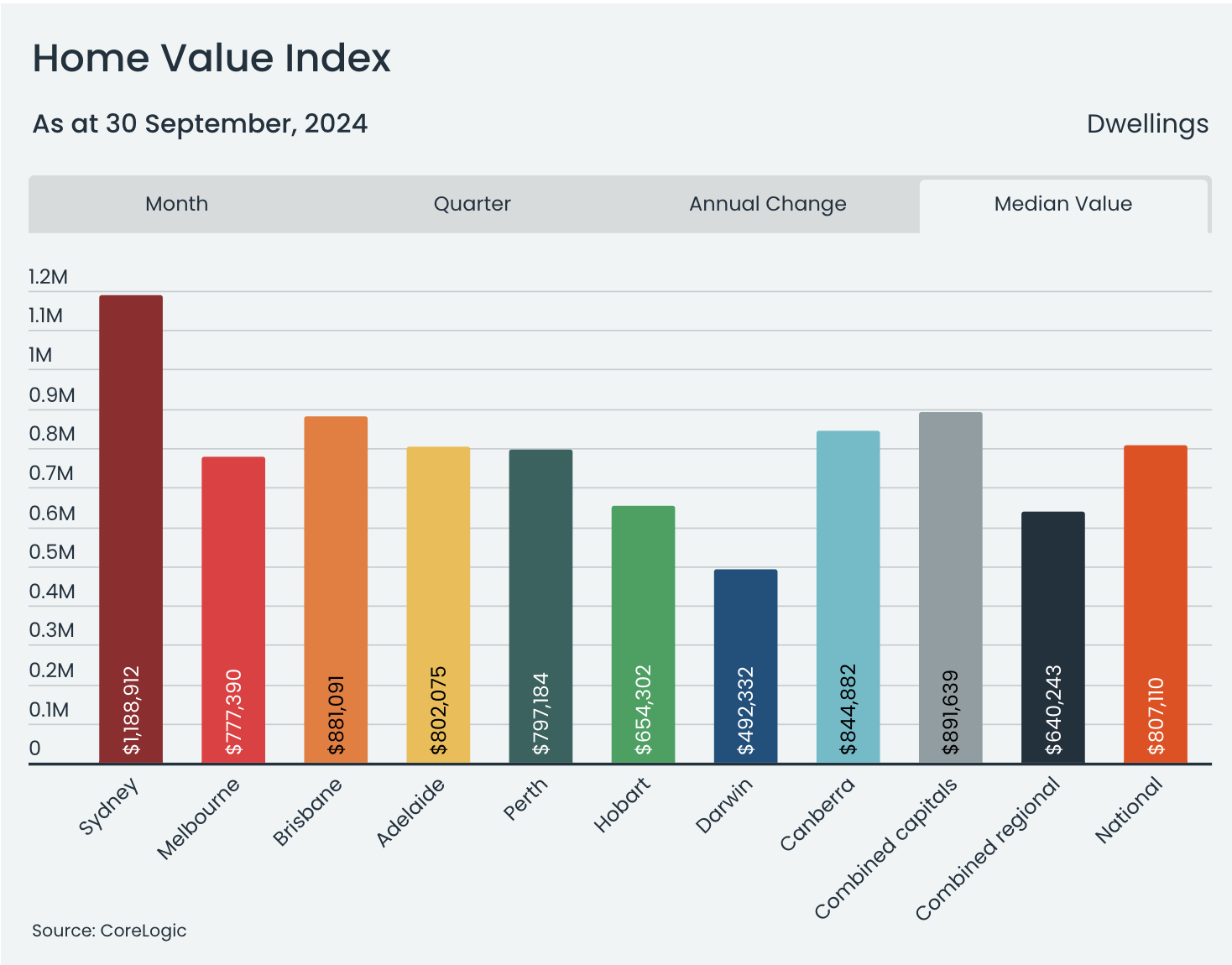

Sydney home values are still rising, but the 0.5% increase in the September quarter is the lowest growth since February 2023, when values dropped by 0.3%.

Mid-sized capitals, which drove capital gains for much of the upturn Nationally, are slowing down, although they still grow faster than other capitals. Perth's values rose by 4.7% in Q3, down from 6.2% in June. Adelaide's growth appears to be levelling off with a 4.0% increase this quarter, while Brisbane's growth has dropped to 2.7%, the lowest since April last year.

Growth is slowing as more homeowners want to sell. New listings are 3.2% higher than last year and 8.8% above the average for this time over the past five years.

“The rise in real estate inventory is a seasonal trend, with spring and early summer one of the busiest periods of theyear for selling,” said Tim Lawless, CoreLogic’s research director. “However, the flow of freshly advertised housing stock hasn’t been this high at this time of the year since 2021.”

Tim Lawless Research Director CoreLogic Australia

Real estate listings are increasing, but vendor metrics are declining, indicating weaker selling conditions. Auction clearance rates have dropped to the low 60% range across major cities, about 4 percentage points lower than the decade average. Homes sold privately take longer to sell, with a national median of 32 days in the September quarter, compared to 29 days in June and 27 days a year ago.

Affordability issues and less borrowing power have strengthened conditions in lower-priced housing markets. In major capitals, the lowest-priced homes have risen by 12.4% in the past year, while the highest-priced ones increased by just 3.8%. This trend is seen in most capital cities, except for the ACT and Darwin, which remain the most affordable when considering local income levels.

Six of the eight capitals have seen unit values increase more than house values, or in Melbourne's case, have experienced a smaller drop during the September quarter.

Housing market growth in regional areas has decreased. The regional index rose 2.3% in the three months ending April, then dropped to 1.7% in June and 1.0% in September. In Western Australia, South Australia, and Queensland, growth rates of 3.6%, 2.3%, and 2.0% respectively drive the trends.

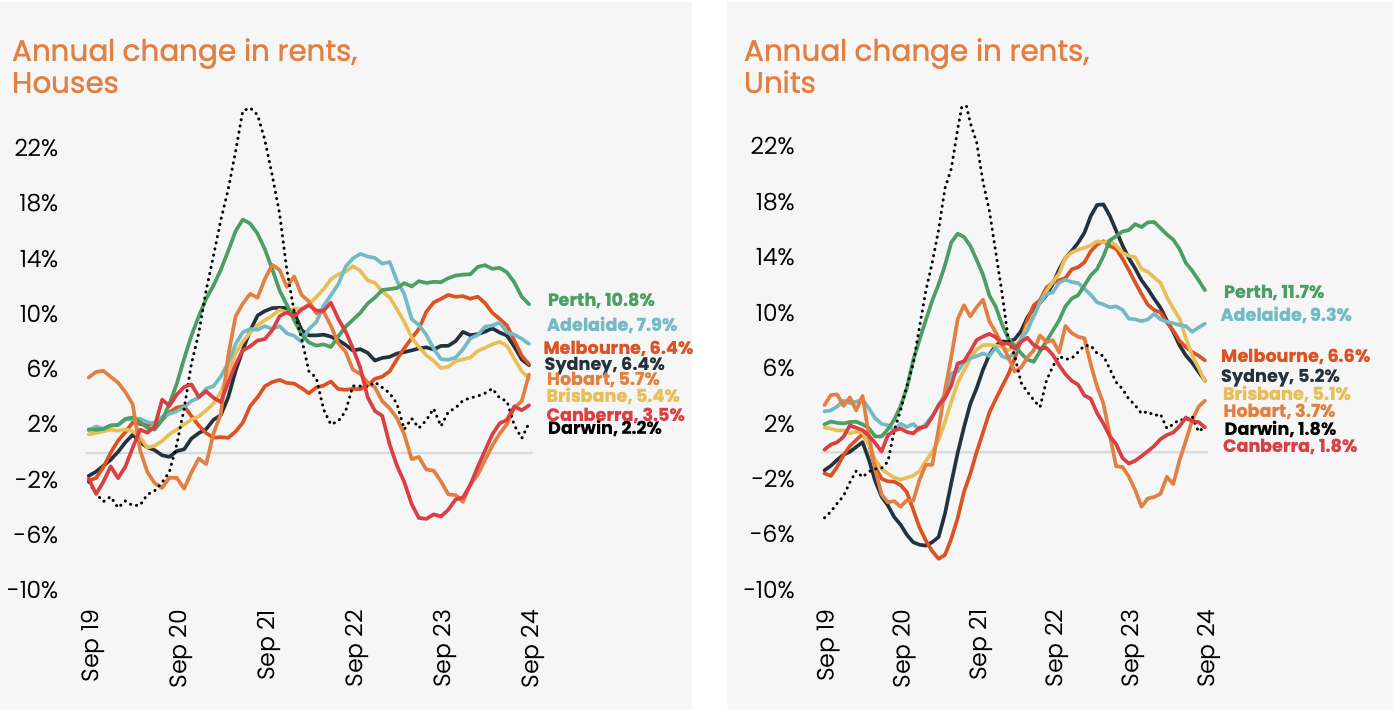

The national rental index rose by only 0.1% in the September quarter, the most minor change in four years.

Sydney (-0.5%), Brisbane (-0.2%), and Canberra (-0.8%) all saw rent decreases this quarter, and many other capitals are experiencing slower rental growth. Melbourne and Perth each had a 0.3% increase in rents this quarter, a significant drop from a year ago when rents rose by 2.2% and 2.3%, respectively.

The slowdown in rental growth is likely due to fewer people moving from abroad and the need for affordable housing changing demand.

“The latest demographic trends from the ABS showed net overseas migration reduced by 19% from the record highs in the first quarter of 2023. The March quarter of 2024 saw 133,800 net overseas migrants arrive in Australia, 31,700 fewer than a year prior, helping to take some pressure off rental demand.

Our affordability metrics indicated that the median income household would require around a third of their income to service the median rent value across Australia in June. It wouldn’t be surprising if the average household size has continued to increase as group households and multigenerational households become more common in the face of high rental costs.”

Tim Lawless Research Director CoreLogic Australia

With rental growth slowing more than home value growth, the national home value index has increased every month for five months, putting some pressure on rental yields.

Nationally, the gross rental yield has reduced to 3.68%, the lowest since December last year.

“With variable mortgage rates for new investors averaging around 6.6% against a backdrop of below average yields, most recent investors are likely to be incurring a cash flow loss on their investment properties unless they have relatively low levels of leverage,”

Mr Lawless said.

CoreLogic Key Takeaways Tips

The national housing market is expected to rise gradually and keep growing in value overall, but the pace may slow, and there will be more differences between cities and regions.

Positive signs for housing include improved sentiment with slowing inflation, a strong job market, and expected interest rate cuts. Tax cuts and energy rebates benefit households, boosting confidence and borrowing, while ongoing inflation declines may improve real income growth.

Housing supply constraints, such as low builder profits, labour shortages, and competition with public infrastructure, will maintain high housing prices and rents.

Interest rates may drop by late this year or early next year, boosting borrowing and household confidence in major purchases like homes.

Housing remains expensive. In the June quarter, households spent 50.3% of their income on new mortgages, the highest ever. The dwelling value to income ratio is 7.9. A median-income household would take about 10.6 years to save a 20% deposit for a median-value home, assuming 15% yearly savings.

Potential lower interest rates ease mortgage payments, but homes will only be affordable if mortgage rates or values drop significantly or incomes rise.

A reduction in credit may hurt the housing market. The September Financial Stability Review reveals that the RBA sees residential property as a critical area where households could face risks from excessive debt. As interest rates fall, lending standards will be monitored closely.

More listings give buyers greater negotiating power. Increased available homes make sales more challenging, with listings expected to rise into spring and early summer.

Rental growth seems to have peaked as demand and supply balance. Slowing overseas migration and a shift to larger households may lower demand. Construction delays have prolonged some buyers' time in the rental market. As HomeBuilder grant-funded homes are completed, rental demand is expected to decline further.

Rental supply remains limited, but investor activity has risen to 38% of new loans, potentially enhancing rental supply.

“If the first month of spring is anything to go by, purchasing activity isn’t keeping pace with the flow of new listings,” Mr Lawless said. “Markets where stock levels have lifted the most are unsurprisingly the weakest from a values perspective. A further rise in advertised supply is good news for buyers, but for vendors, it means more competition and the potential for a softening in selling conditions.”

Mr Lawless said.

To download the PDF click on the button below.

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.