CoreLogic HVI July 2024

Thank you, CoreLogic, for sharing your Home Value Index, Pain and Gain report, and Property Pules with our community. The key points are below.

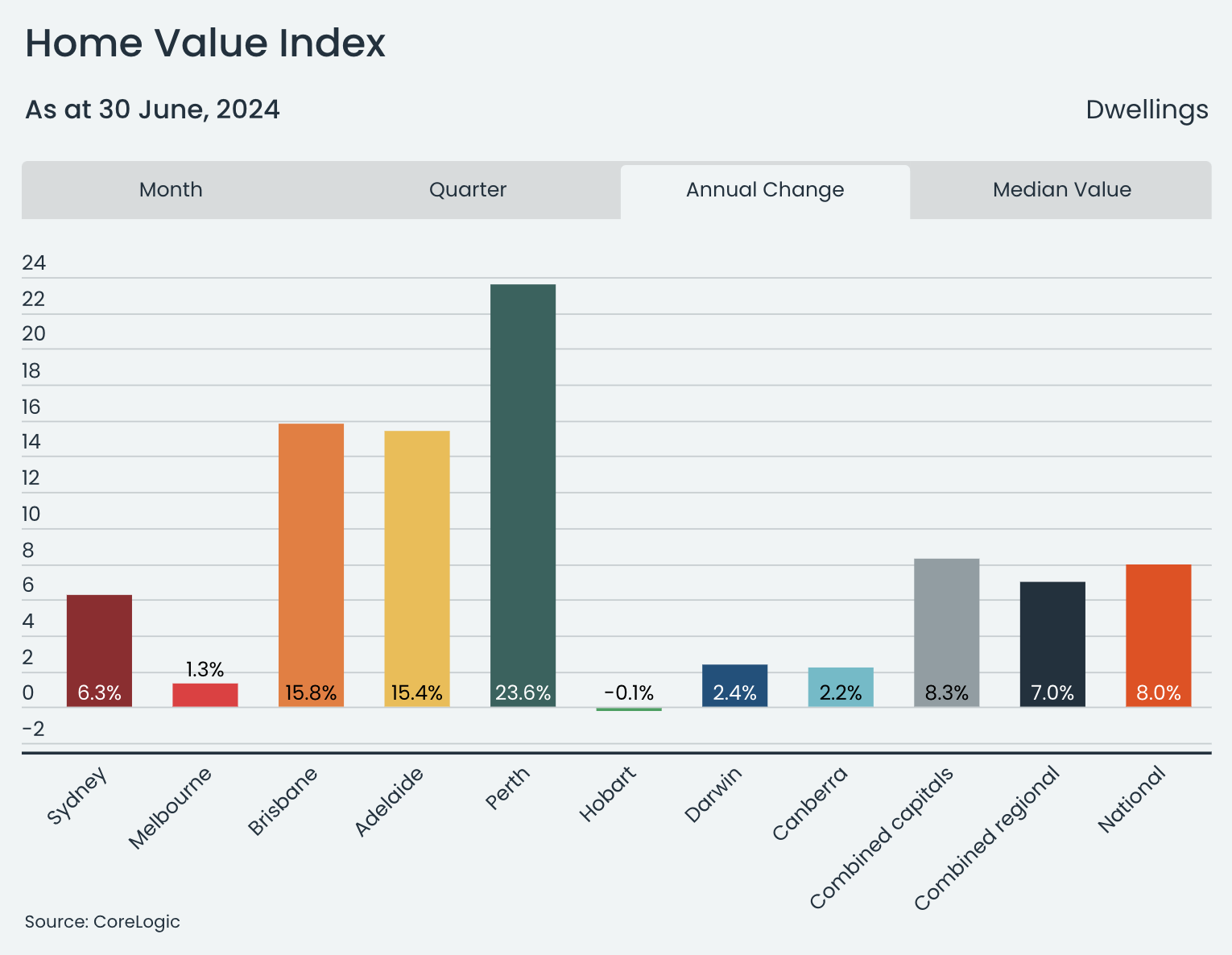

Australian house prices rose by 0.7% in June, totalling an 8% increase for FY2023-24. This equals a $59,000 rise to a typical house price of $794,000. The yearly increase sharply differs from the -2% fall in FY2022-23. In that period, values dropped by 7.5% nine months after May 2022 due to higher cash rates. Despite the yearly increase, growth rates have slowed since mid-2023, with the recent June quarter seeing a 1.8% increase, similar to last year's March and December quarters. Here is the monthly change for each capital city and regional area;

Sydney +0.5% and REG NSW +0.3%

Melbourne -0.2% and REG VIC -0.3%

Brisbane +1.2% and REG QLD +1.0%

Adelaide +1.7% and REG SA +1.3%

Perth +2.0% and REG WA +1.5%

Hobart +0.1% and REG TAS +0.7%

Darwin 0.0% NA

Canberra +0.3%

“The persistent growth comes despite an array of downside risks including high rates, cost of living pressures, affordability challenges and tight credit policy. The housing market resilience comes back to tight supply levels which are keeping upwards pressure on values.”

Property market values are increasing in different areas, except in Melbourne, regional Victoria, and Hobart. Melbourne's values decreased by -0.2%, regional Victoria's by -0.3%, and Hobart experienced a slight increase of +0.1% in June. Over the June quarter, Hobart, Melbourne, and regional Victoria saw a slight value decrease of -0.3%. Regional Victoria also had a 0.5% drop in values over the year.

Mid-sized capital cities like Perth, Adelaide, and Brisbane have seen significant increases in property values recently. Perth's values went up by +2.0% in June and are now +23.6% higher compared to last year. Adelaide experienced a +1.7% increase in June, leading to a +15.4% rise over the financial year. In Brisbane, values rose by +1.2% in the month and +15.8% over the year.

Regional areas like Regional WA, Regional SA, and Regional Qld are seeing growth similar to capital cities. Regional WA had the highest increase at +1.5% in June and +16.6% over the year. Regional SA and Regional Qld also show good growth.

Growth trends in stock levels show a severe shortage of homes for sale. Perth, Adelaide, and Brisbane have fewer listings than last year and the past five years.

Melbourne property listings have been +14% higher than usual over five years, while Hobart listings have been elevated for years and are currently +46% above average.

Demand-side factors have also played a significant role, particularly as migration between states has been high in Western Australia, Queensland, and formerly South Australia.

High demand for housing persists despite challenges, shown by increased home sales. Across the country, annual home sales rose by +8.6% compared to last year and +4.8% above the average of the past five years. Perth experienced the biggest surge, with sales +29% higher than the five-year average.

Rental Change

Rent prices are rising more slowly but are still high overall. The cost of renting went up by 0.4% in a month and 8.2% in a year, which are lower increases compared to the previous months. Sydney, Melbourne, and Brisbane are the cities where rent increases are slowing down the most, especially for apartments. This is because fewer people from overseas are moving in, affecting the demand for rentals. The high cost of renting compared to people's incomes is also a factor. Even though rent prices are not going up as fast as before in some places, they are still higher than usual in most areas. Overall, rent prices usually increased by 2.0% each year before the pandemic. Gross rental yields are stable at around 3.5% for cities and 4.4% for regional areas.

CoreLogic’s Key Takeaways;

An undersupply of housing remains the primary factor keeping upwards pressure on home values despite a growing element of downside risk.

Most cities are now seeing more new listings coming to market as vendors become more active.

Despite what is likely to be an increased level of financial hardship among households, the latest data from APRA for the March quarter shows mortgage arrears are rising but contained.

With inflation remaining high and the risk of another rate hike or a longer period before interest rates come down, it's likely that mortgage stress and arrears will rise further.

Although the risks facing the housing sector are growing, we are still expecting home values to rise, at least into the near term.

Pain and Gain Report Key Findings

Key Findings for Pain & Gain, March Quarter 2024

CoreLogic analysed approximately 85,000 dwelling resales in Q1 2024.

The incidence of profit-making sales nationally increased to 94.3%.

The median nominal loss was -$40,000, and the total nominal resale loss was $278 million.

Melbourne became the second-least profitable market of the capital cities behind Darwin.

Source, Q1 2024 Pain & Gain report.

Property Pulse Link: What could another rate rise do to the Australian housing market??

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.