CoreLogic Market Update - October Home Value Index (HVI) Report 1st November 2023

Thank you, CoreLogic, for sharing your national Home Value Index (HVI) report and key insights on the Australian Housing market with our community.

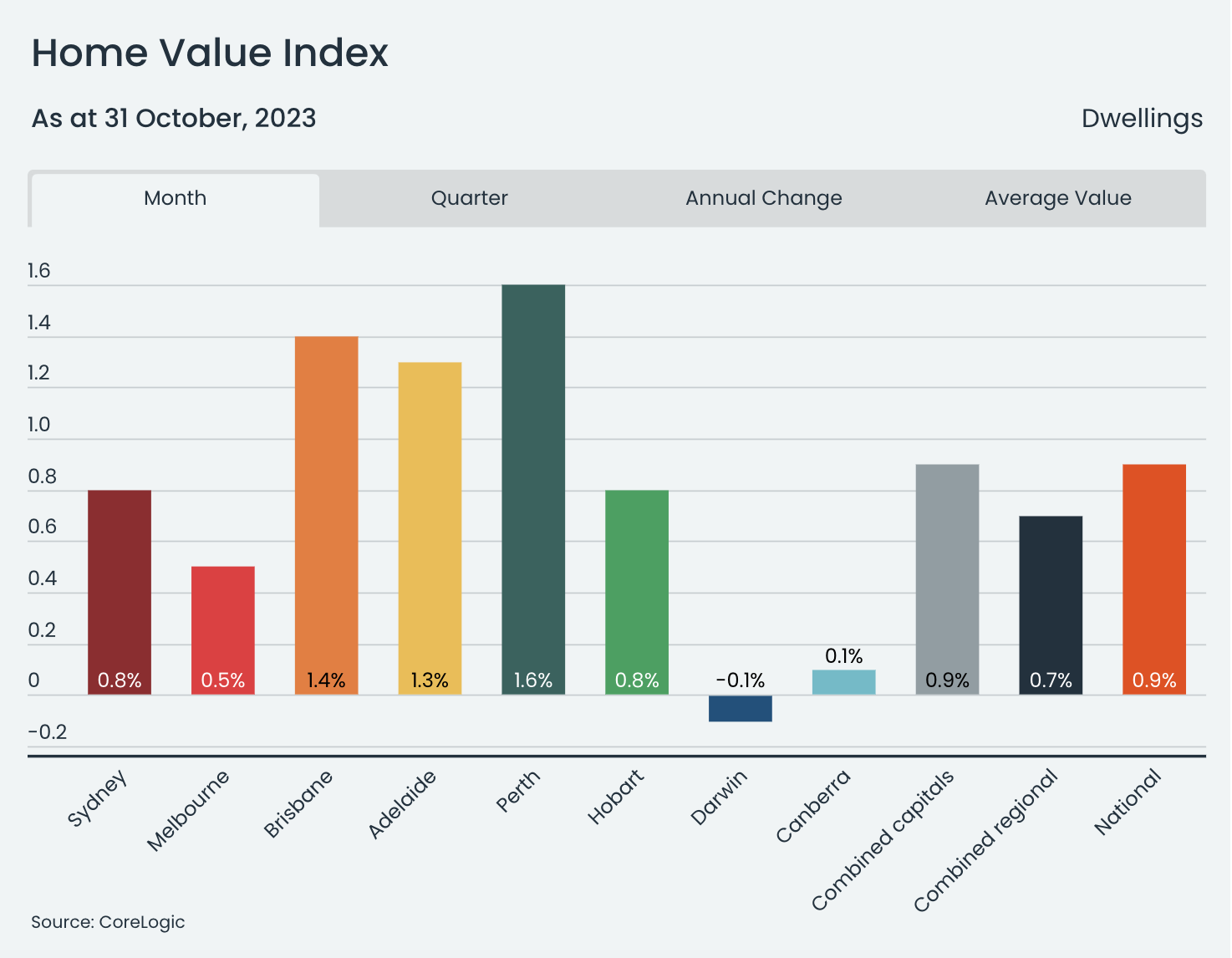

The 1st November report recorded that the national HVI rose a further 0.9% in October, accelerating from a 0.7% rise in September (revised down from 0.8%).

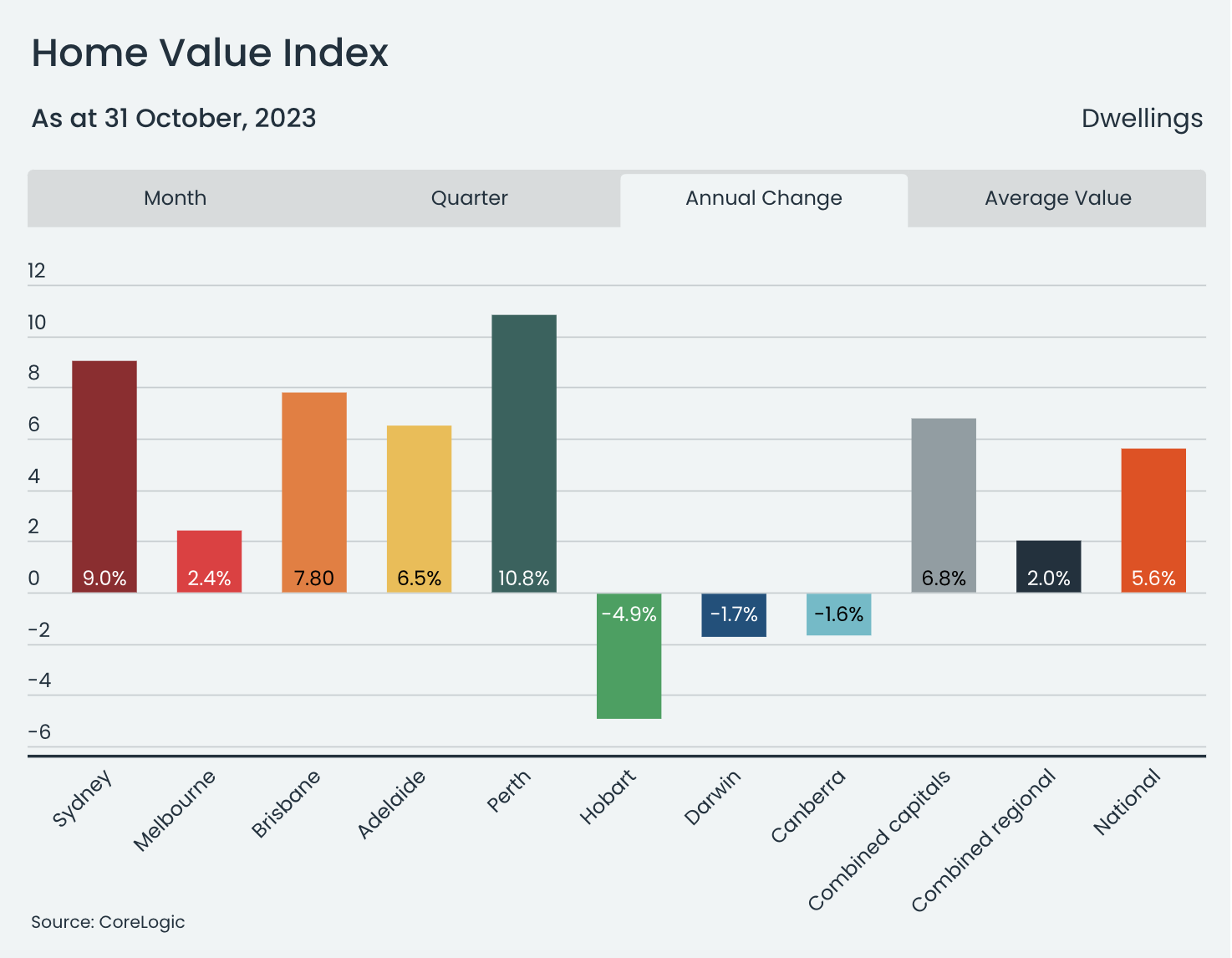

Does this mean the Australian housing market has fully rebounded from its recent losses in January? The report found the national HVI has increased 7.6%, leaving the index only half a per cent below the historic high recorded in April last year.

CoreLogic’s research director, Tim Lawless, noted a nominal recovery in the national index is likely to be just around the corner.

“At this rate of growth, we will see the national HVI reach a new record high mid-way through November, recovering from the -7.5% drop in values recorded over the recent downturn between May 2022 and January 2023.”

CoreLogic’s research director, Tim Lawless

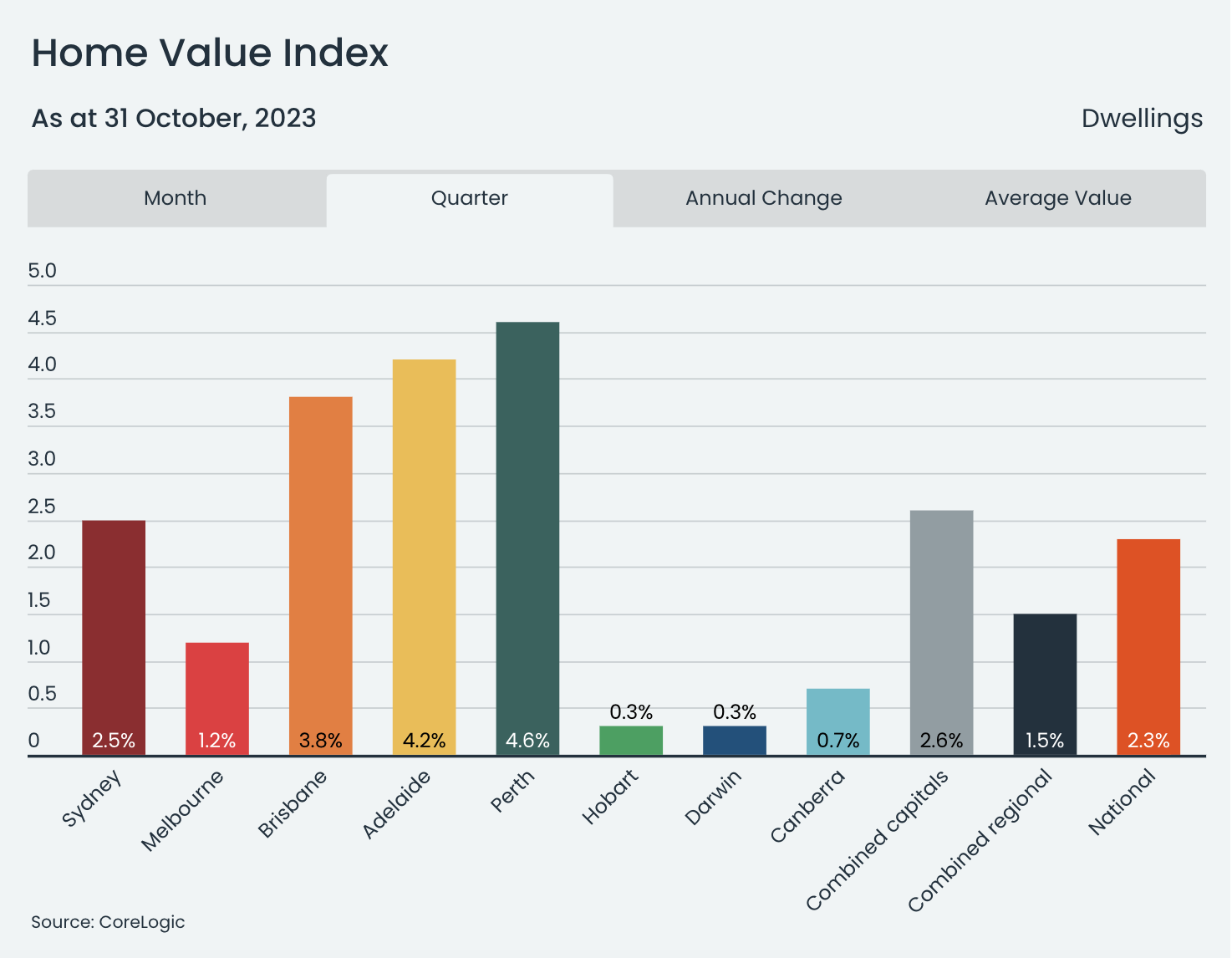

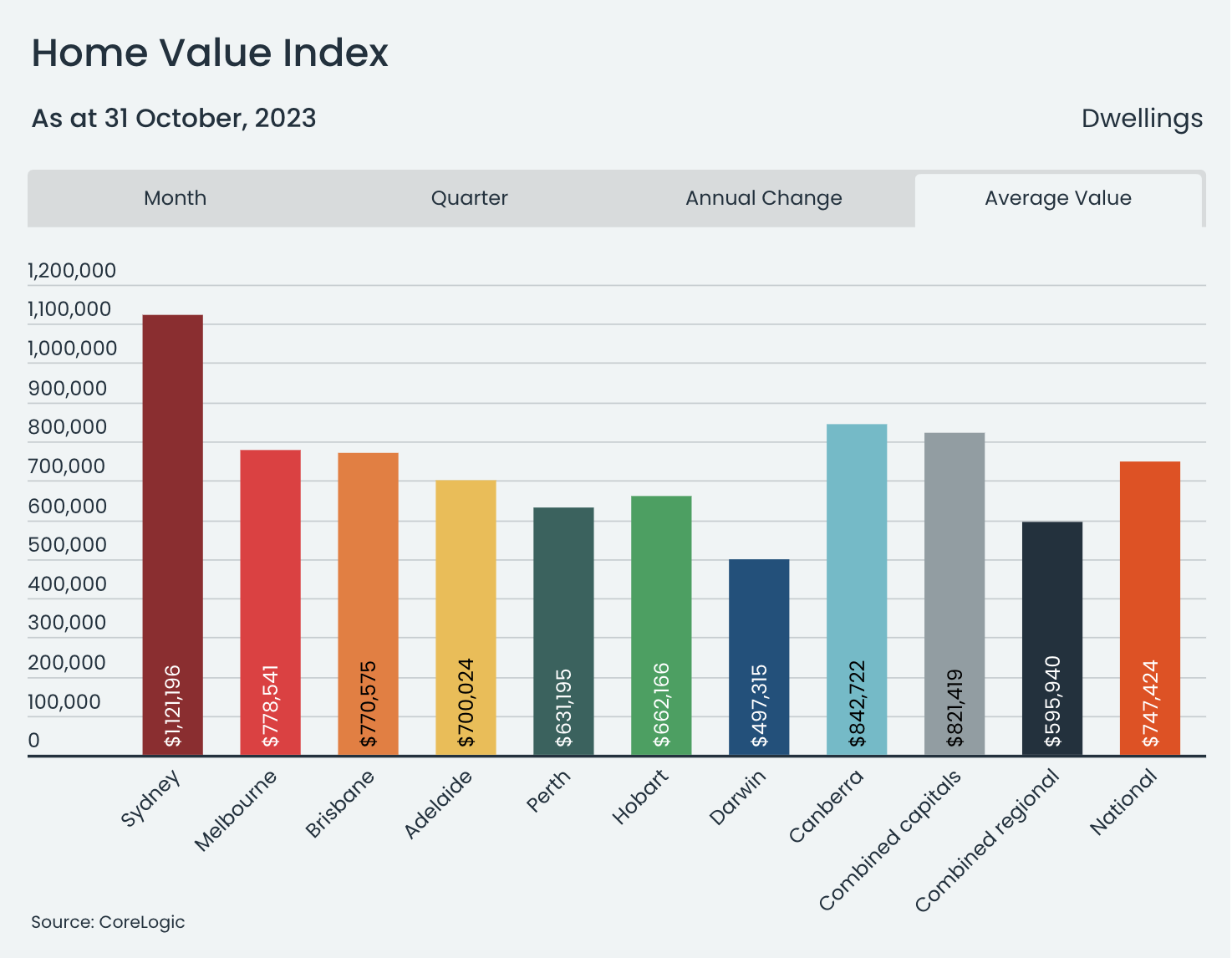

The Cities are striving ahead, with dwelling prices increasing in value in all capital cities except Darwin (-0.1%) last month. Perth (1.6%), Brisbane (1.4%), and Adelaide (1.3%) performed better than the other cities. Sydney (10.9%), Perth (10.8%), and Brisbane (10.2%) saw the highest increases in dwelling values in the first ten months of the year. Brisbane's housing values recovered in October, reaching a new record high after a drop of -8.9%, returning to 12.5%. Perth and Adelaide also reached new record highs after a mild decline earlier this year.

However, Sydney values are still -2.2% below the peak in January 2022, and Melbourne values are -3.7% below the peak in March 2022. Hobart values have decreased since their recent high, remaining -11.6% below peak levels.

Stock levels impacting housing trends; new city listings up 12% YoY. Total listings are lower than last year but rising. Buyer demand not keeping pace. Inventory is diverse across regions. At one end of the spectrum is Perth; stock levels have fallen through spring to be -2.1% below levels recorded at the end of winter in Brisbane (+0.5%) or Adelaide (+1.6%). Compared with ACT, listings increased by 21.3%. Melbourne +10.7% across Melbourne and +9.3% across Sydney and Hobart remained above average for over a year.

So, are we approaching a buyer’s market conditions, or is it still a seller’s market?

“With vendor activity gathering some momentum while buyer activity slows, it’s likely selling conditions will continue to rebalance towards buyers, especially in those cities where advertised supply levels are high.

In markets where demand and advertised supply are more evenly balanced, it's logical to expect price growth to slow down. In other markets such as Perth, where listings are almost -45% below the five-year average while sales activity is almost 25% above average, prices are rising at the fastest pace since March 2021.”

CoreLogic’s research director, Tim Lawless

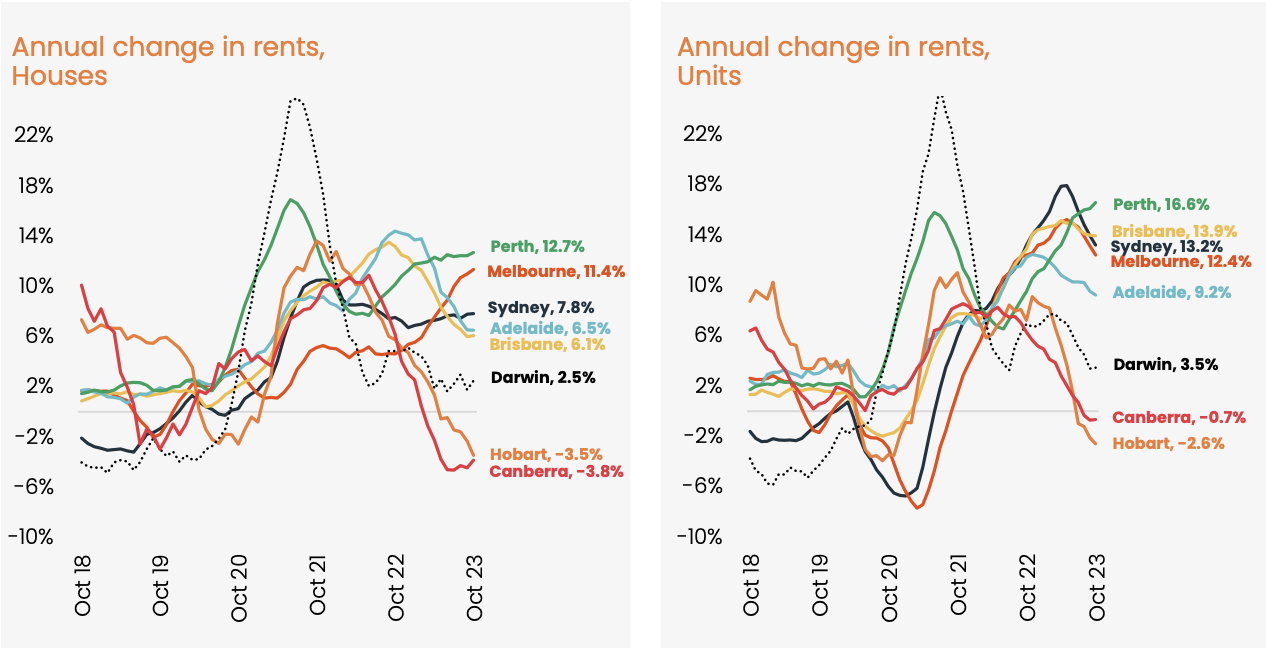

In October, there were very few rental vacancies, reaching a record low of 0.9% in the capital cities and 1.2% in regional markets. Rental listings were significantly below the average, decreasing by 35.5% compared to the previous five years and 16.1% compared to last year. Despite a shortage of rental properties, rent prices have been steadily increasing for the past 39 months. However, the rate of rent growth has slowed down and become more varied, especially in the unit sector. House rents are rising faster than unit rents in Sydney and Melbourne, possibly due to university semesters and foreign student arrivals. Perth has seen the highest annual rental growth, with a 12.7% increase in house rents and a 16.6% increase in unit rents. On the other hand, Hobart and Canberra have average vacancy rates and falling rents on an annual basis. Gross rental yields peaked between February and April at 3.73% nationally but have since decreased to 3.69% in October. Despite rising rents, it is challenging to find an investment property with positive cash flow due to high debt, maintenance costs, and holding expenses.

Tim Lawless Key Points

Low levels of available supply have been a central feature of the housing upswing to-date

While advertised supply is likely to rise further through spring and into early summer, the prospects for buyer demand aren’t as optimistic.

Higher-than-expected inflation through the September quarter and a lift in retail spending have increased the chances of a further rise in the cash rate on Melbourne Cup Day.

The wash-up is that we are likely to see a further reduction in the rate of growth in housing values over the months ahead, alongside increased diversity in capital growth performance.

While downside factors have become more prominent over recent months, other factors may support demand and values.

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.