Key Points from CoreLogic April Home Value Index (HVI) Report

CoreLogic Australia has shared its April Home Value Index (HVI) Report with THE EXPATRIATE Team.

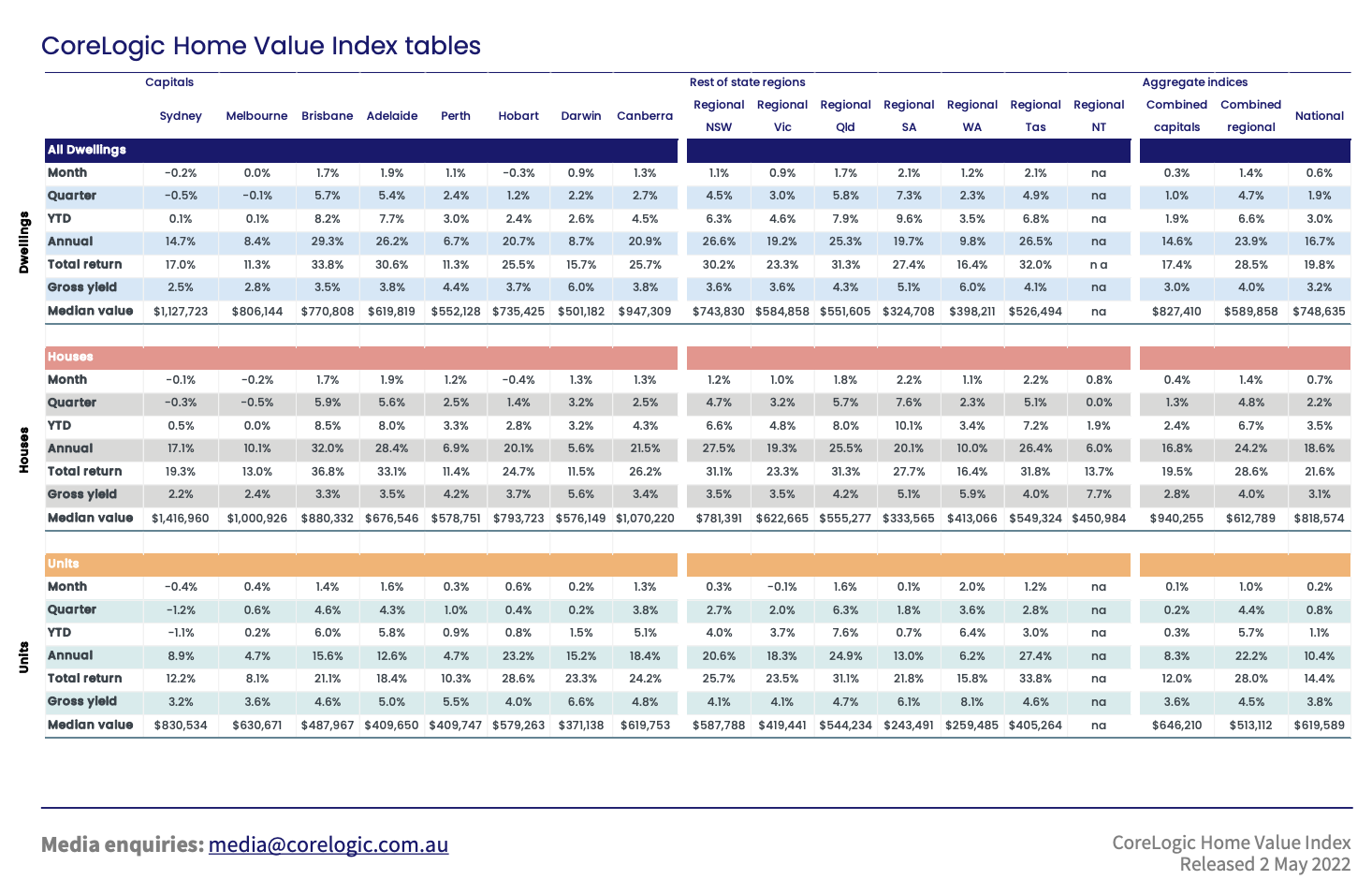

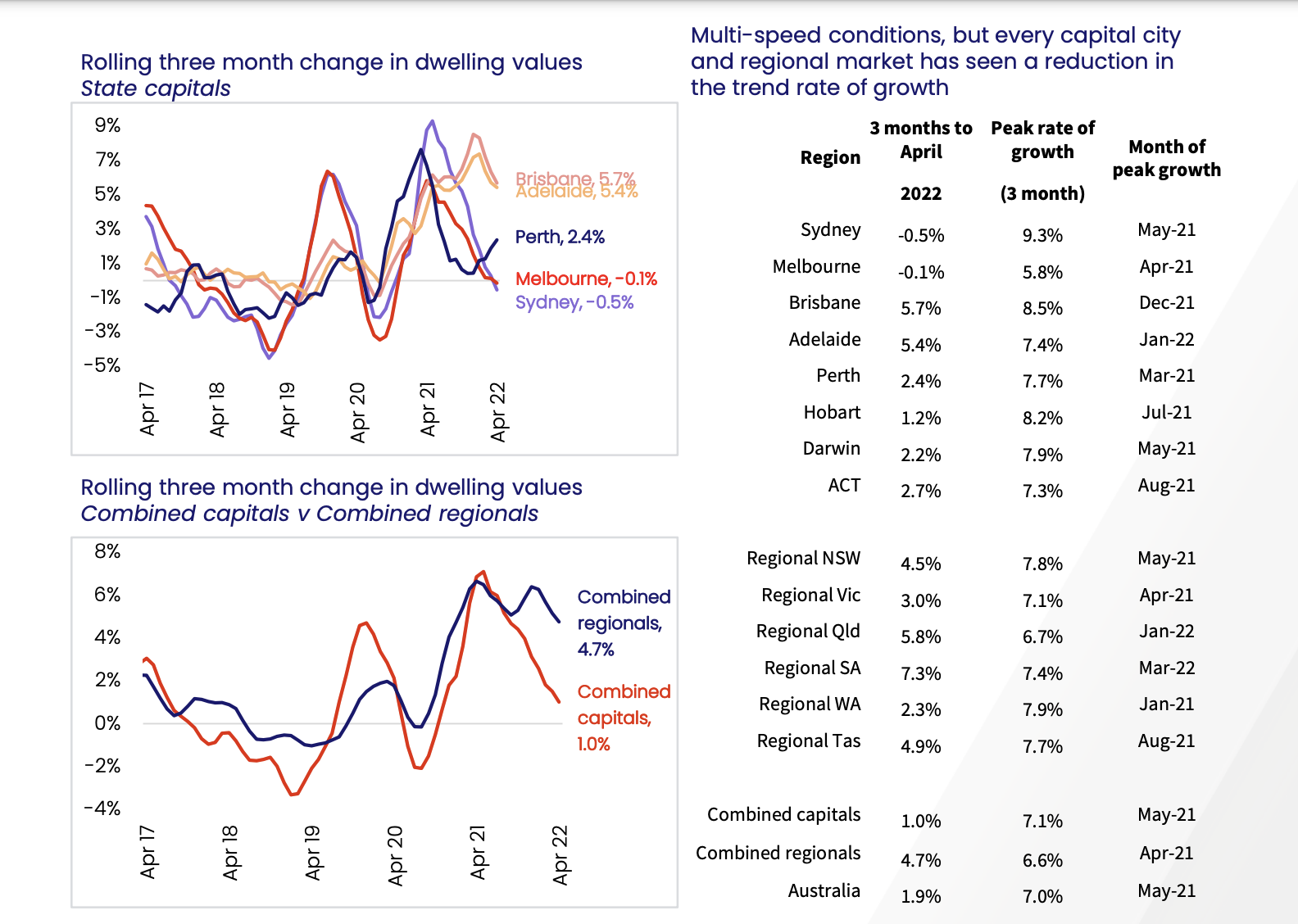

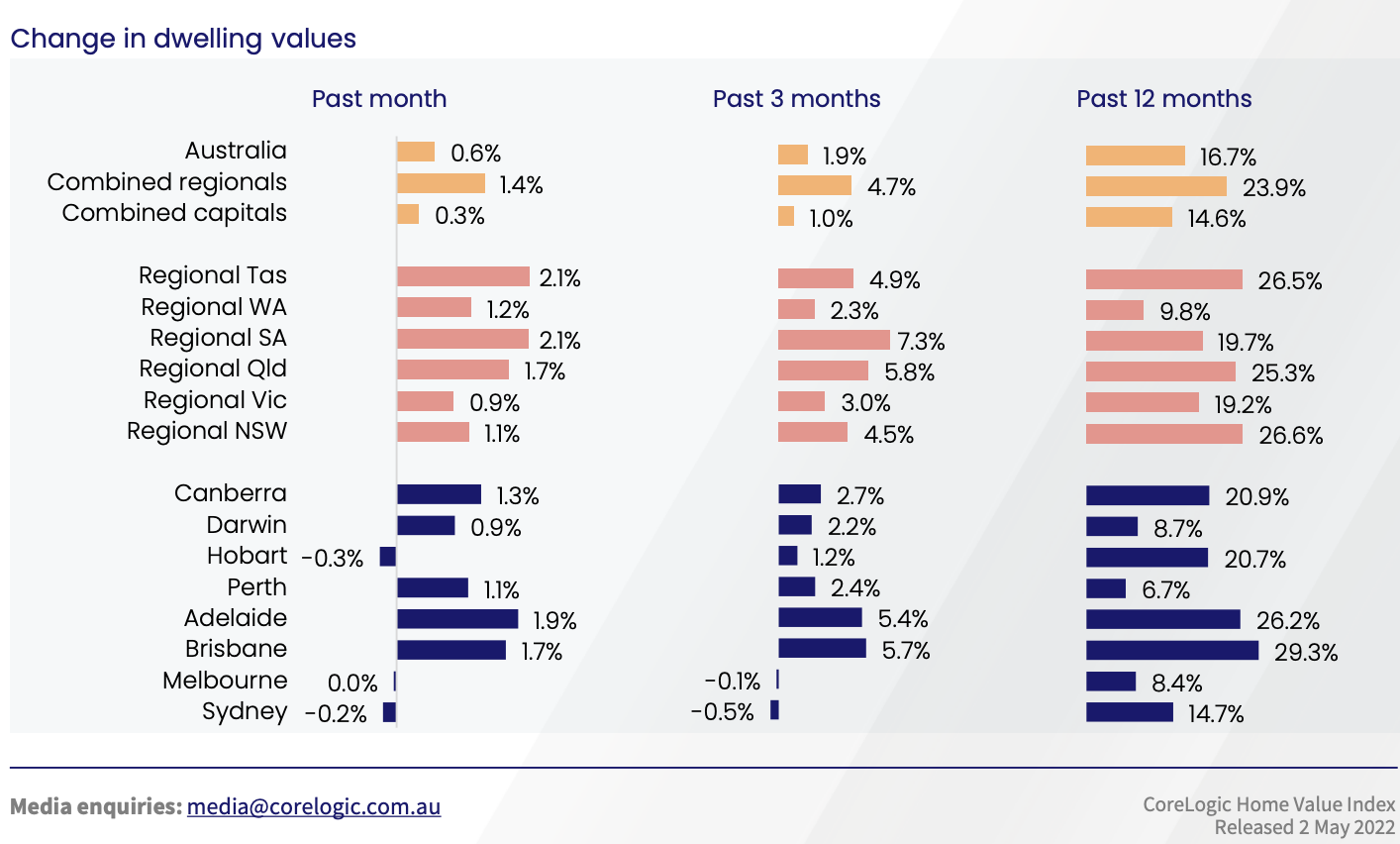

The data from the April HVI Report highlights Sydney -0.5%, Melbourne - 0.1% Australia's largest capital cities recorded their 1st negative Home Value for the 1st Quarter since the height of the COVID19 lockdowns in October 2020. Hobart has also recorded its first monthly negative Home Value of -0.3%. Nationally for the Quarter, Australia's Home Value grew by +1.9%, and +0.6% for the month.

Brisbane, Adelaide, and Regional Areas lead the way with increasing values; however, we have witnessed the peak and now seeing a slowdown in the property market and a stabilising of Home Values.

For the Quarter Brisbane is +5.7%, Adelaide +5.4%, Regional QLD + 5.8%, Regional NSW +4.5%, Regional TAS +4.9%.

Regional SA was the most robust in the regional group, with a remarkable 7.3% increase in dwelling value for the 1st Quarter.

Brisbane leads the way for the annual HVI growth with an impressive 29.3% Growth in dwelling value. Other leaders were, Regional NSW +26.6%, Regional TAS 26.5% +Adelaide 26.2%, Regional QLD 25.3%. It shows that housing affordability, combined with lifestyle choice and the Covid19 pandemic, with the acceleration of home office technologies, has contributed to the demand in the historically less expensive capital cities of Brisbane and Adelaide and Regional Areas.

Why is the demand so strong in Adelaide, Brisbane, and Regional Areas?

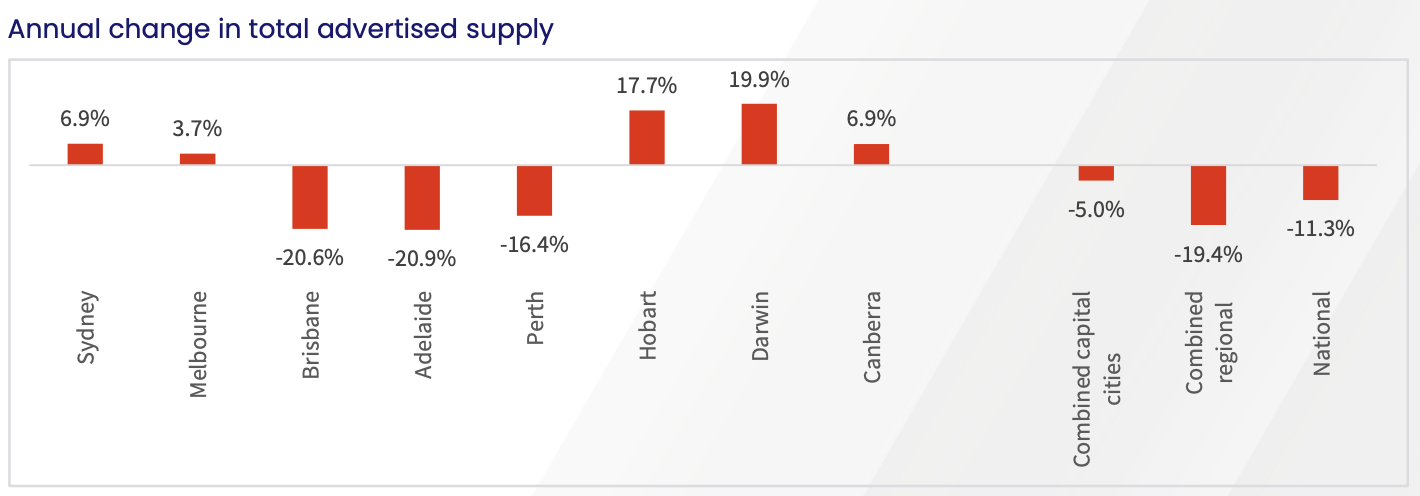

“Persistently low levels of property listings help to explain the strength across the smaller capitals and regional markets. Advertised inventory, at a national level, is tracking almost 30% below the previous five-year average over the four weeks ending April 24 at the national level. However, a more detailed analysis of each capital city highlights significant differences in the total number of homes available to purchase.

Total advertised inventory is more than 20% below levels from a year ago in Brisbane and Adelaide, and around 40% lower than the previous five-year average in both cities. The flow of new listings has generally been higher than normal in these markets; the shortage of available housing inventory in these markets is more due to a rapid rate of absorption as homes sell quickly amidst high demand.” - CoreLogic Australia

“In weaker markets like Melbourne and Sydney, advertised supply levels have normalised. Sydney advertised stock levels are roughly in line with the previous five-year average, while listings in Melbourne were 8.2% higher. Higher stock levels across these markets can be explained by an above-average flow of new listings coming on the market in combination with a drop in buyer demand.

In Hobart, where April’s -0.3% decline follows 22 consecutive months of growth, stock levels started to increase in the middle of March. The new listing count is now 46% higher over the four weeks to April 24 compared to the same period in 2021. “With higher inventory levels and less competition, buyers are gradually moving back into the driver’s seat. That means more time to deliberate on their purchase decisions and negotiate on price,” Mr Lawless says.

“Softening buyer demand can be seen in fewer home sales. The trend in housing turnover peaked at a record high through the December quarter last year. Estimated sale settlements since have fallen, with the quarterly number of home sales nationally estimated to be 14.0% lower relative to the same time a year ago”. - Tim Lawless CoreLogic Australia

Australia has just recorded its first interest rate increase in 11 years of 0.25%, and we've been warned that there could be another one in June. Reserve Bank of Australia's interest rate rise, combined with a looming Federal Election, and the inflation rate of 5.1%, has reduced consumer confidence. Our eyes will be watching out for CoreLogic Australia May HVI Report to see a further downturn trend in the Sydney and Melbourne property market and if Brisbane, Adelaide, and regional markets cool. A downturned Property Market can be viewed as a positive opportunity for buyers to pick and choose and pick up a potentially great deal.

"Be Fearful When Others Are Greedy and Greedy When Others Are Fearful"

― Warren Buffett

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.