Catch up and get the latest; Adam will be in Singapore and Hong Kong. CoreLogic Property updates and looking after your parents as an expat.

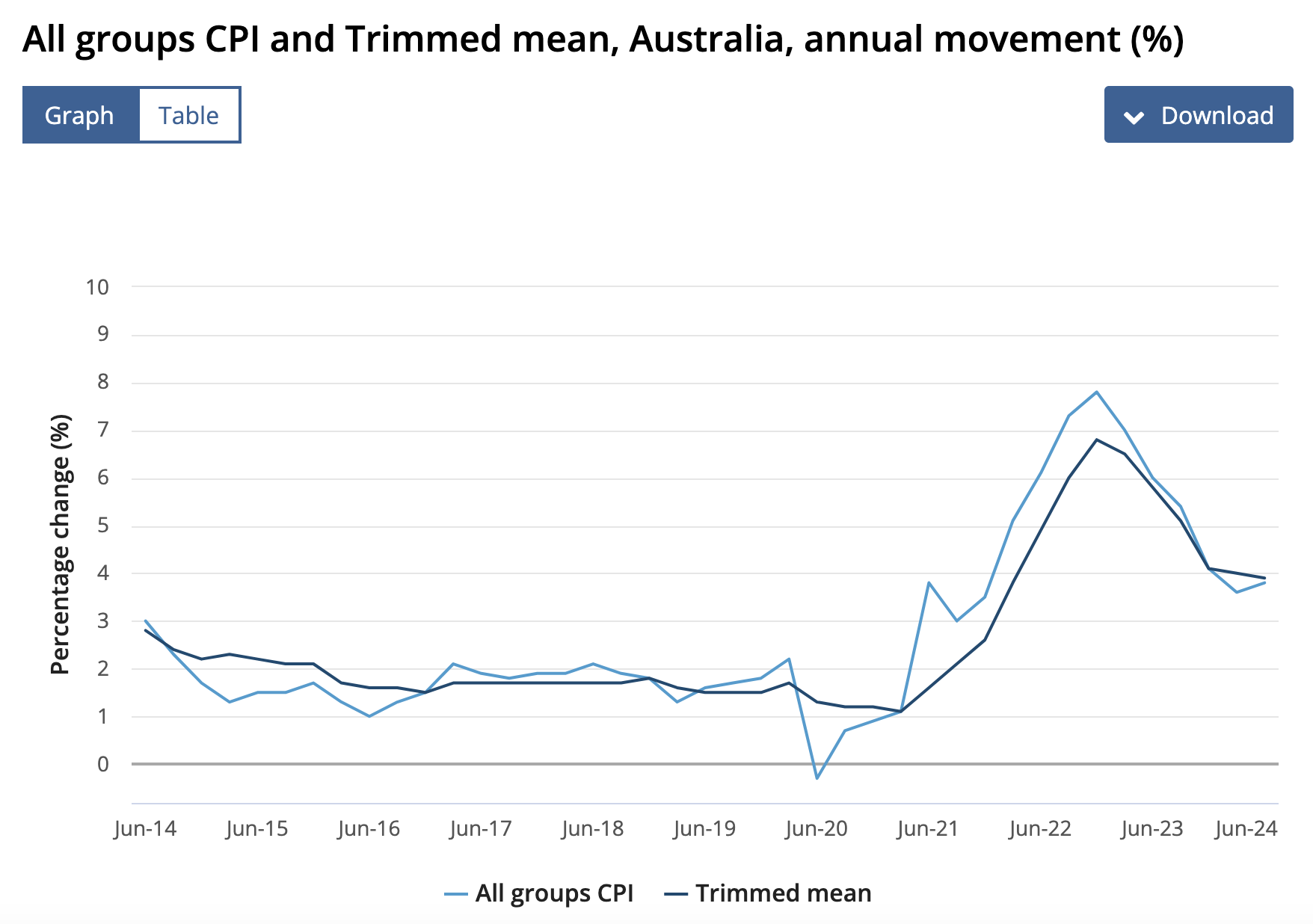

It’s a busy time of the year! You’ve just returned from your Midyear holidays and are back into the push to the end of the year; the Aussies are still in 4th place at the Paris Olympics. Most importantly, we just received the latest update from the Australian Bureau of Statistics. Although there was a slight rise in inflation, 3.8, up from 3.6, the trimmed mean annual inflation fell slightly to 3.9 per cent, down from 4.0 per cent in the March quarter. This is the sixth quarter in a row of lower annual trimmed mean inflation, down from the peak of 6.8 per cent in the December 2022 quarter.

Watch for tomorrow’s Reserve Bank of Australia Monetary Policy Media release; most are tipping the RBA to hold interest rates at 4.35%. The big four Banks predicting the following;

CBA: Peak of 4.35% in November 2023, then dropping to 3.10% by December 2025

Westpac: Peak of 4.35% in November 2023, then dropping to 3.10% by December 2025

NAB: Peak of 4.35% in November 2023, then dropping to 3.10% by June 2026

ANZ: Peak of 4.35% in November 2023, then dropping to 3.60% by December 2025

It is time to get organised for the Spring Selling Season or to discuss how you can refinance to a better bank and interest rate and discuss your debt options for 2024-2025 and into the future. Adam Kingston, Director of Australian Expatriate Finance, is available for face-to-face meetings in Singapore and Hong Kong on the following dates.

Singapore 25th - 27th of August

Hong Kong 28th - 31st of August.

In the meetings, Adam will be able to discuss your options on the following topics

how to present yourself to a bank to achieve a successful mortgage application

refinancing

preapprovals

bridging loans

Australian Property Market update, from CoreLogic Data.

To connect with Adam, please email him and book your appointment.

Property Market Report

Lauren Staley from Infolio Property Advisors in Melbourne, Chris Gray from Your Empire Sydney, and Zoran Solano from Hot Property Buyers Agency Brisbane share their valuable key insights on the Australian Property Market Update for July 2024 and share their opinion on the latest CoreLogic HVI July 2024 Data. They delve deep into various crucial topics, providing a comprehensive overview for those seeking to stay informed about the current trends and developments in the real estate landscape. In the YouTube Video they cover the following topics

The best way to present yourself for a home loan is by working with your mortgage broker.

How to hold onto your investment property through the cost of living crisis

Southern state buyers are moving to South East Queensland (SEQ), Gold Coast, Brisbane, and Sunshine Coast, where there is fantastic value for like-to-like property.

Growth plateauing in SEQ

Beware of inexperienced buyer agents. If you are looking for a buyer’s agent, ask the following questions;

What is your experience, and how long have you been in the industry?

Who are your contacts?

What is your feed process like?

Can I see your referrals?

Vendors dealing directly with a buyers agent? What do the experts think?

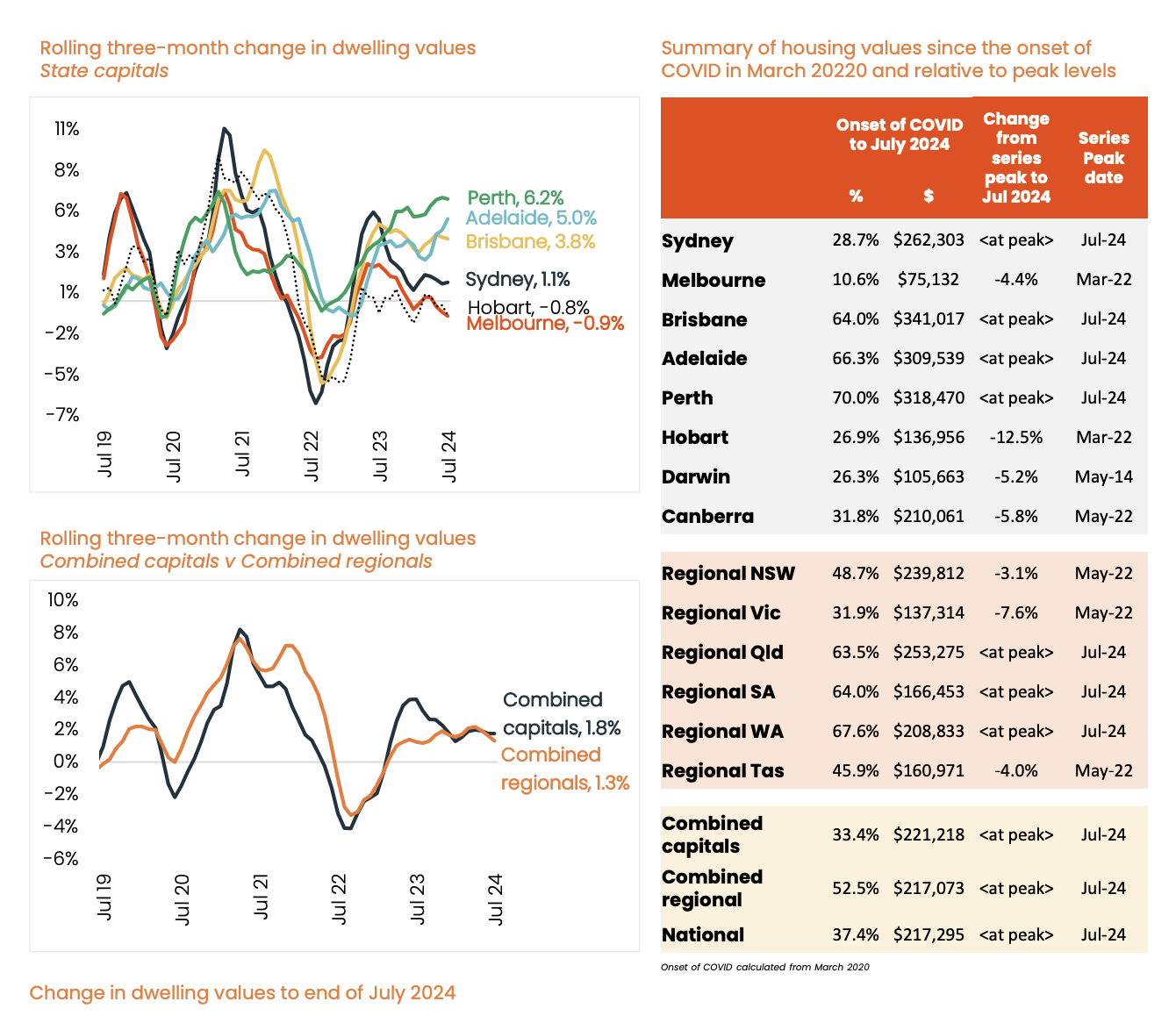

CoreLogic HVI Report, be mindful that it is the area average and not reflective of the blue-chip areas.

Relocating Your Parents as an Expat.

Our relocation specialist, Leona Lees, from Claymore Thistle, recently presented an inspiring case study detailing effective strategies for supporting your parents in their retirement planning and downsizing while living overseas. Her insightful guidance resonated with many seeking ways to navigate similar situations with care and consideration.

Leona’s team of relocation consultants coordinates every aspect of the move. Starting with a home visit, they organise decluttering and rehoming some items, packing and shipping items to family in London, and then moving and unpacking locally. They handle it all with care and compassion.

If you’d like to learn more and see how you can help your loved ones, or even yourself, click on the button below.

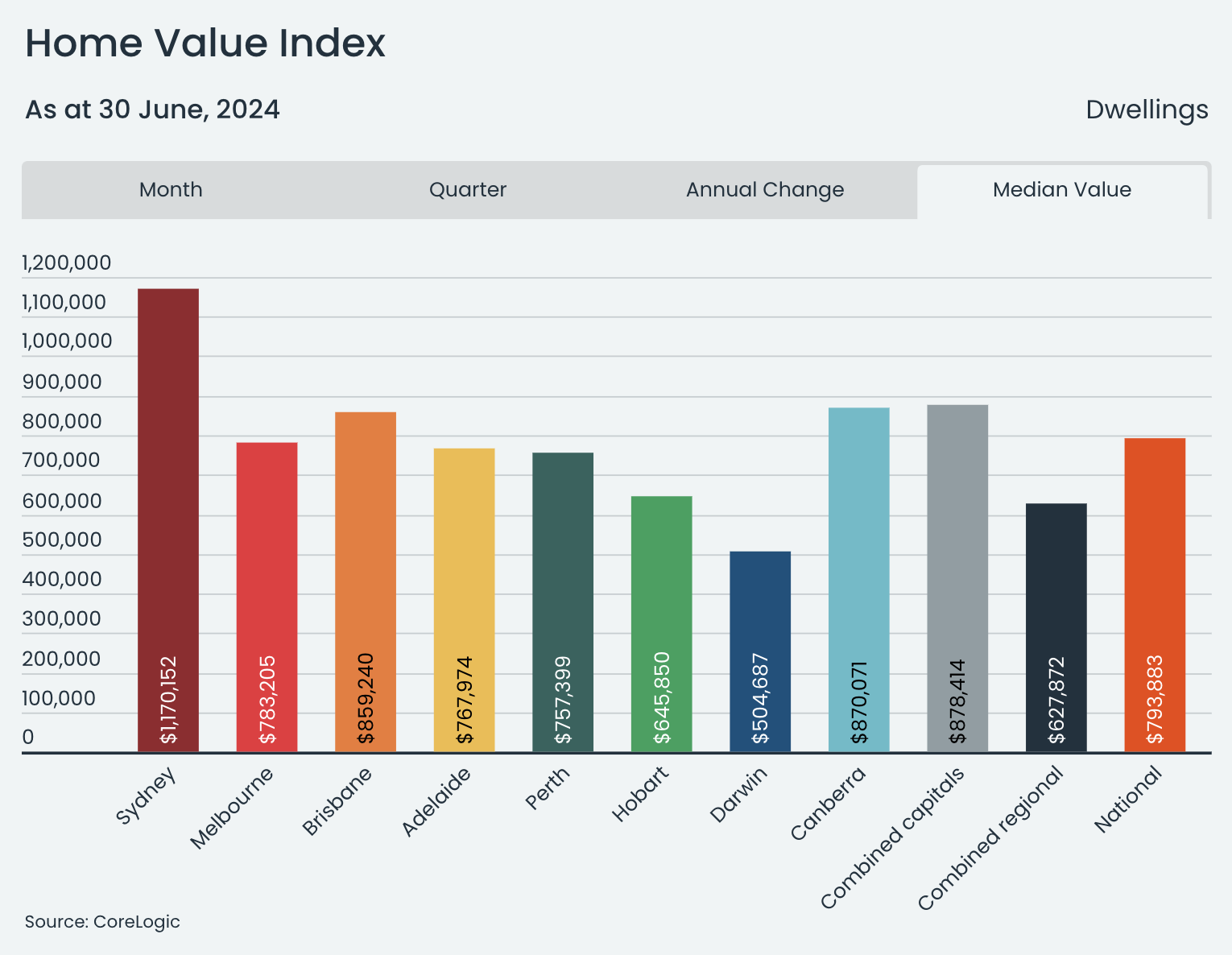

August 1st HVI Report from CoreLogic Australia.

Thank you, Tim Lawless and CoreLogic Australia, for sharing the 1st of August Home Value Index with our community.

National home values increased by 0.5% in July, marking the 18th month of growth and matching June's figure. After a 7.5% decline from May 2022 to January 2023, national home values have risen by 13.5% and reached new highs since November last year. However, the growth is slowing, with three capitals seeing drops in values: Melbourne fell by 0.9%, and Hobart and Darwin saw declines of 0.8% and 0.3%, respectively. Sydney's growth rate slowed to 1.1%, down from 5.0% last year. Overall, national home values rose by 1.7% in the past three months, a decrease from last year's 3.2% increase. Mid-sized capitals are performing better, with Perth growing by 6.2%, Adelaide at 5.0% (the fastest since May 2022), and Brisbane increasing by 3.8%, down from 4.7% last year.

If you missed our blogs from last week, here are some helpful links.

Stanford Brown YouTube Videos and SB Talks and Quarterly Financial Market Updates.

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.