Newsletter 11, St James’s Place Repatriation Info Package, Cris Gray’s 1st Blog, Currency and more.

It was a busy short week for THE EXPATRIATE Team. St James’s Place has put together a repatriation information package for Australians who want to return to Australia. It’s a great read covering everything from Tax - Traps for Expats, Superannuation, Taxation on Australian Property, income, assets, insurance.

We introduced you to property Guru and our Property Portfolio Specialist, Chris Gray from Your Empire. He’s already produced an insightful blog on Buyers’ Agents, with some tips and tricks for you to utilise. Here is Chris Grays’ Blog Link below;

We are in the middle of an election campaign, and we are also heading into Tax Time, so loads of information are coming our way, so we’d like to introduce you to the newest member of THE EXPATRIATE Team, Bradly Beer, our Tax Depreciation Specialist.

Bradley is the Chief Executive Officer of BMT Tax Depreciation, a company specialising in depreciation schedules for income-producing properties. BMT completes tens of thousands of depreciation schedules each year, helping property owners to maximise deductions and improve their cash flow.

BMT was founded in 1997; the company initially offered traditional quantity surveying and tax depreciation services. BMT now focuses solely on depreciation schedules and is ready and able to help THE EXPATRIATE community. If you’d like to know more about Bradley and BMT, jump on his Bio page by clicking on the button below;

The Australian Government has also announced that Vaccine Free International Travel was on the cards. The minute the details are announced for this change in our borders, we will let you know.

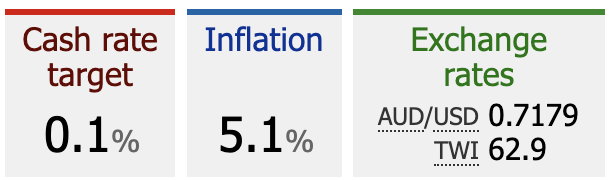

An announcement from the Reserve Bank Australia on inflation to change from 3.5% to 5.1%. We are still well behind Canada 6.9%, New Zealand 7% and the UK 7%, US7.9%. Connect to our socials to be alerted to the RBA Inflation Announcement. Next up, Send Payments and their Australian Currency Update.

“AUD has been under a lot of pressure this week against major currencies due to several reasons, at the top of which is the growing economic uncertainty. The AUD started the week on a high note but soon lost steam as investor mood switched in favour of safe-haven currencies.

The AUD tried to break the bearish trend it has been following since April started but failed to do so. Let us take a closer look at AUD against major currencies to find out what is the reason behind this week's performance.

AUD - USD

The AUD-USD pairing is currently trading between the 0.7331 - 0.7376 range. It rose to almost 0.7658 at the starting of the week, registering an increase of 3.72% compared to last week but soon lost all of this gain as the greenback strengthened. The AUD - USD pairing is at its lowest since March 17 and this trend is expected to continue in the short term. Yesterday it finished at a low of 0.71314

The USD strengthened on the back of rising bond yield, as FED hints at a further interest rate hike in May to counter the rising inflationary pressure. For the first time in a decade, the US bond rates are higher than Chinese bond rates, this theoretically makes US bonds more attractive to investors. However, at this point, it is too early to say whether this is sustainable or not.

The lockdowns in Shanghai are also negatively impacting the Chinese growth forecast, which is casting a negative effect on the AUD as the Australian economy is highly leveraged on trade with China.

Combine this with the possibility of another RBA rate hike in June as revealed in the minutes of the last meeting and the reasons for the pressure on AUD begin to unravel.

Based on high bond yields and the uncertain situation in Ukraine, investor sentiment is still in risk-on mode, which is why there is a rush to buy the greenback in the international market. This out of all the reasons is the biggest factor that has exerted sustained downward pressure on AUD, as it is a risk-sensitive currency.

The investor sentiment is neutral for the AUD-USD for the next week”

Ian Cragg Send Payments

AUD - USD 0.72

AUD - GBP 0.57

AUD - HKD 5.59

AUD - SPD 0.98

AUD - CNY 4.67

AUD - NZD 1.09

AUD - USD 0.72 AUD - GBP 0.57 AUD - HKD 5.59 AUD - SPD 0.98 AUD - CNY 4.67 AUD - NZD 1.09

Now we take a quick look at the Property Market with CoreLogic Australia.

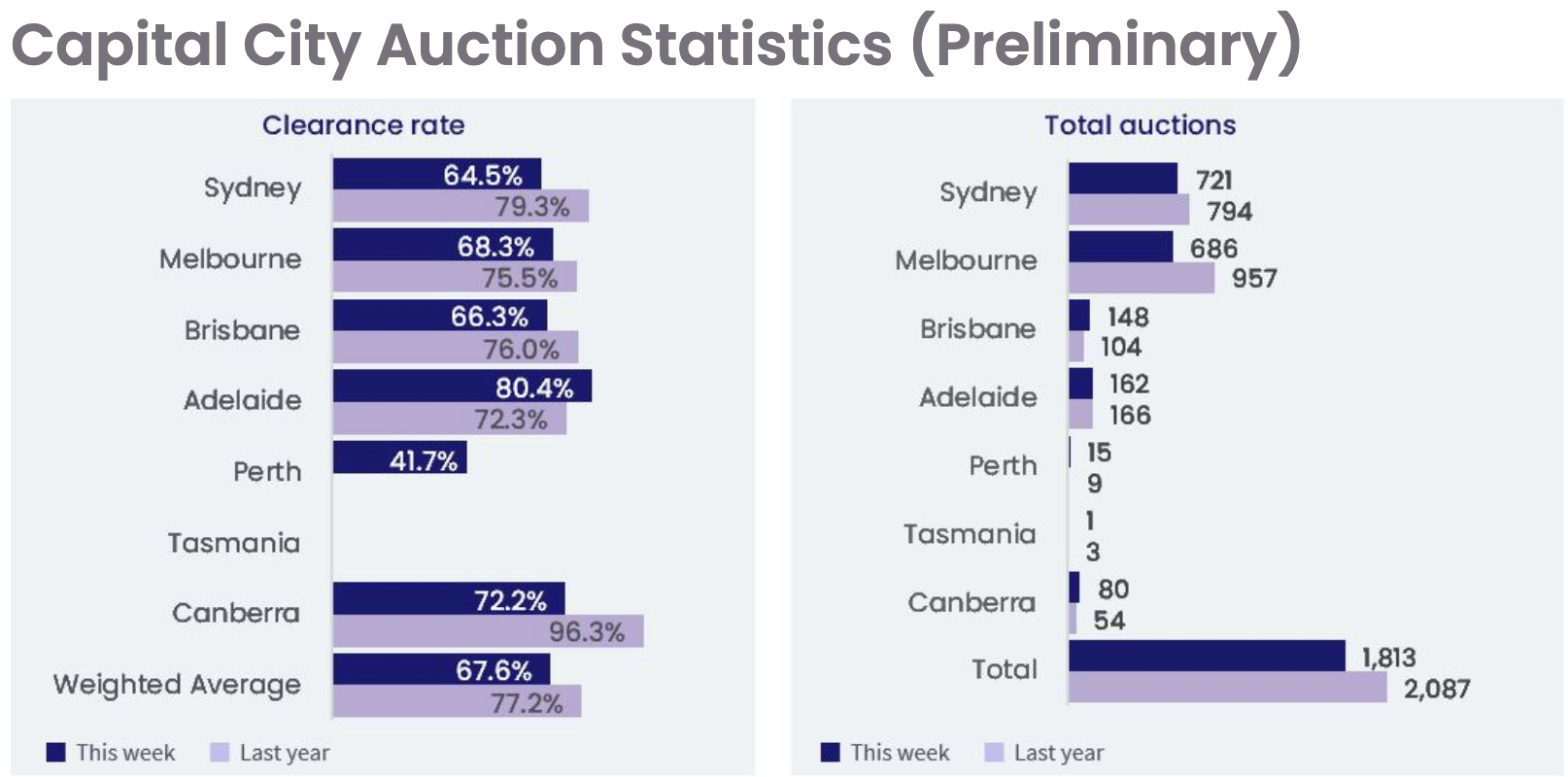

Annual Auction Clearance Rates 2021-2022 difference

SYD - 14.8%

MEL - 6.7%

BNE + 12.7%

ADE + 8.1%

ACT - 21.1%

AUS AVG - 4.6%

SYD - 14.8% MEL - 6.7% BNE + 12.7% ADE + 8.1% ACT - 21.1% AUS AVG - 4.6%

Of the 1,414 capital city results collected so far, 67.6 per cent were successful which is the lowest preliminary clearance rate recorded so far this year. The previous week returned a preliminary clearance rate of 73.3 per cent, slipping to 62.4 per cent at final figures, the lowest final clearance rate recorded all year, continuing the downwards trend we have been observing over the past couple of months. This time last year, the clearance rate was substantially higher across the combined capital cities (77.2 per cent).

-Core Logic Australia

We watch Brisbane +12.7% and Adelaide 8.1% defy the national trend, with migration rates in both those areas still strong. Queensland, in particular, has the highest rate of immigration in Australia, driving the strength in its property market.

CoreLogic Australia Graph

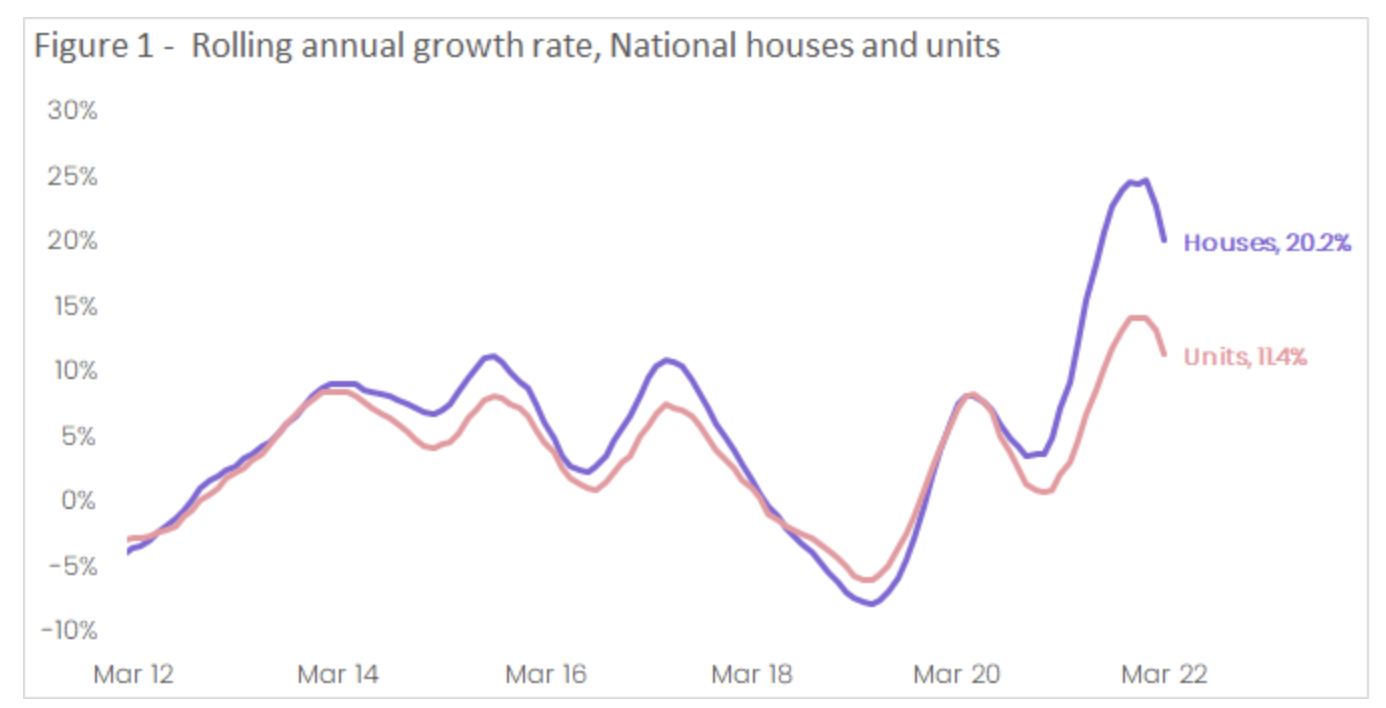

CoreLogic's monthly Unit Market Update shows the annual performance gap between houses and units fell to 8.7% in March as both markets slipped further from their peak rate of growth recorded in January.

CoreLogic Australia Graph

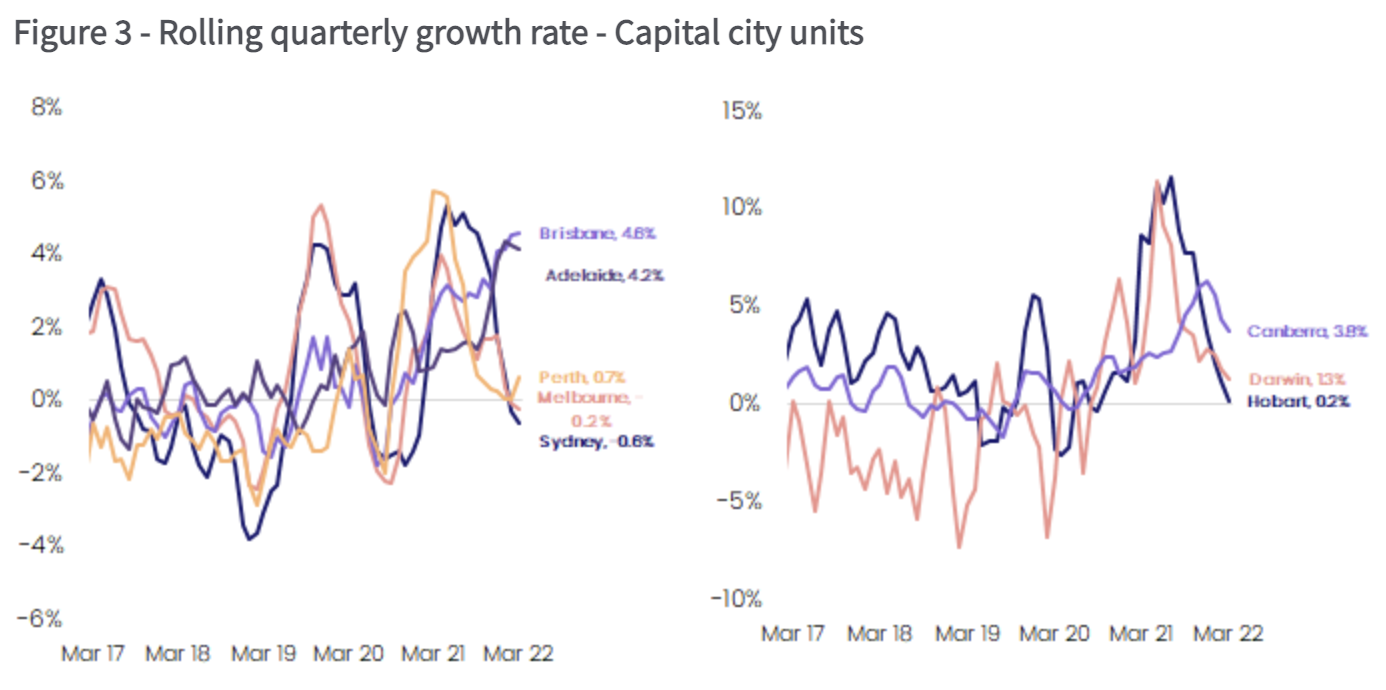

Again, the Quarterly Growth Rate in Unit Values, Brisbane, and Adelaide lead the way; however, the heat is coming out of the market with the boom slowing as the solid annual growth has put pressure on affordability and continues to be a key factor affecting market conditions. Higher inflation and the rising cost of living, prospective buyers find it harder to save for a deposit, while the amount required for a deposit has also increased, which is why we are seeing the gap between Units and Houses reduce as houses have become out of reach for many buyers in some markets.

Keep an eye out on your socials for updates and the latest blog information for you. Remember to let you friends know about THE EXPATRIATE and as them to SIGN UP to our mailing list by clicking on the “ JOIN THE CLUB” Button Below.