Newsletter 13, Stanford Brown May Market Report, Interest Rate Outlook 22-23, Chris Gray’s thoughts on the Property Market, and More.

First Up, Happy Mother’s Day to all the Aussie Expat Mums from everyone at THE EXPATRIATE (TE) team. We also hope that our TE Mothers, Shona and Leona were spoilt over the weekend.

The Australian Election heats up today as Pre-polling Booths are now open. There are two weeks to go in the Federal Election, and we all can’t wait until the uncertainty of who will lead the Australian Government is over. This uncertainty can be a time when people are cautious about making big decisions like purchasing a property. Uncertainty can also be viewed as an opportunity to take advantage of the softening of the housing market in Sydney and Melbourne. Chris Gray, our Property Portfolio, has written an excellent blog for us on making the most of times of uncertainty. Here is a link to his blog below;

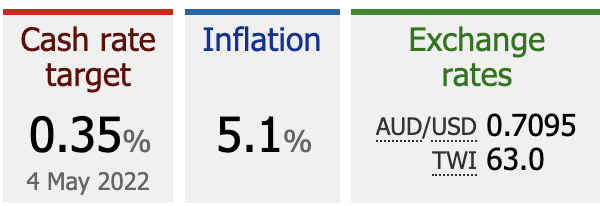

Reserve Bank of Australia raised interest rates for the first time in eleven years to a cash rate of 0.35%. The announcement followed the previous week’s inflation figures of 5.1%. The Aussie dollar again has slipped further to 0.7095.

In uncertain times, clarity is essential to making clear and informed decisions. It is crucial to be informed about the movements in the local economy. Stanford Brown has your questions answered about Interest Rates, Australian Share Markets, Election Parties, and the positive outlook for the Australian Markets in the coming years. Here is the Stanford Brown May Market Report.

Stanford Brown May Monthly Market Report Topics;

How high will interest rates go?

Which side of politics has been better for Australian share markets?

Which side has been better on government deficits and debts?

What are the impacts and implications of rising inflation and interest rates on investments?

Why the Australian share market is set to shine in the coming years?

It has been a rollercoaster ride of information over the past two weeks, with the news of Sydney and Melbourne recording negative Home Value Index (HVI) figures for the 1st Quarter. It is the 1st negative HVI since October 2020 at the height of the Pandemic Lockdowns in Sydney and Melbourne. It wasn’t all doom and gloom. Brisbane, Adelaide, and Regional Areas remain strong with robust increases in value for the first Quarter.

To read the full report, click on the link below.

Adam Kingston, THE EXPATRIATE Mortgage Specialist, from Australian Expatriate Finance has written a great blog on interest rates, the potential for more rises in 2022-2023, how much you will be paying, and what to expect from your banks. Here is a snippet from his blog below;

The 3rd May 2022 will it go down as a momentous day in the financial history of Australia. The weekend news was littered with the opinion of doom and gloom (relating to interest rate rises) and the effect of what interest rate rises will have on the economy.

- Adam Kingston THE EXPATRIATE Mortgage Specialist

THE EXPATRIATE Team is off to vote early. Click on the link to find your Pre-Polling Booths. We hope you enjoy having your say.

THE EXPATRIATE Team

Join the Club, Stay Informed, Grow Your Wealth, Buy Property, Return Home, Enjoy Life, Expat Life.

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.