Newsletter 9, Currency Up-Date, Tax Time, 21st May Election Day, CoreLogic HVI March, Blog Recap

It's election time in Australia, 21st May, correctly predicted by THE EXPATRIATE Team last week. Suppose you've been reading our blogs and our social media updates. In that case, you'd be able to answer the two questions that Opposition Leader Anthony Albanese couldn't answer on day one of the six-week election campaign.

Question 1, Anthony Albanese: What is the Reserve Bank of Australia Cash Rate?

Answer - 0.10 percent, record low levels since November 2020.

Question 2, Anthony Albanese: What is the unemployment rate?

Answer - According to the Australian Bureau of Statistics, the seasonally adjusted unemployment rate fell to 4% in February 2022, the lowest unemployment rate since August 2008.

Now we will move on to the

Little Aussie Battler

Australian Dollar and Send Payments have given us their weekly Currency Update.

The AUD continued its mighty run off the back of the RBA’s rate announcement earlier last week, keeping rates at 0.10% and touting robust unemployment data and commodity pricing behind most of the RBA’s confidence. The real question is how long the AUD can hold this high price. Heavy resistance at this new peak could see a further pullback. - Send Payments

AUD - USD 0.74

AUD - 0.57 GBP

AUD - 0.68 EUR

AUD - 5.85 HKD

AUD - 1.02 SGD

AUD - 1.09 NZ

AUD - USD 0.74 AUD - 0.57 GBP AUD - 0.68 EUR AUD - 5.85 HKD AUD - 1.02 SGD AUD - 1.09 NZ

AUD - USD 0.74

AUD - 0.57 GBP

AUD - 0.68 EUR

AUD - 5. 85 HKD

AUD - 1.02 SGD

It’s Tax Time - Time to

Meet our Taxation Specialist

Dean Crossingham

Head of Accounting at Stanford Brown

Dean has written a wealth of blogs for THE EXPATRIATE ;

Relocation News - Shop V Ship

Claymore Thistle Relocation Specialist Leona Lees let us know that we could enjoy some guilt-free shopping when relocating to Australia in her blog about weighing up the pros and cons of Shipping or Shopping. I know what I’d choose!

Thanks, Leona!

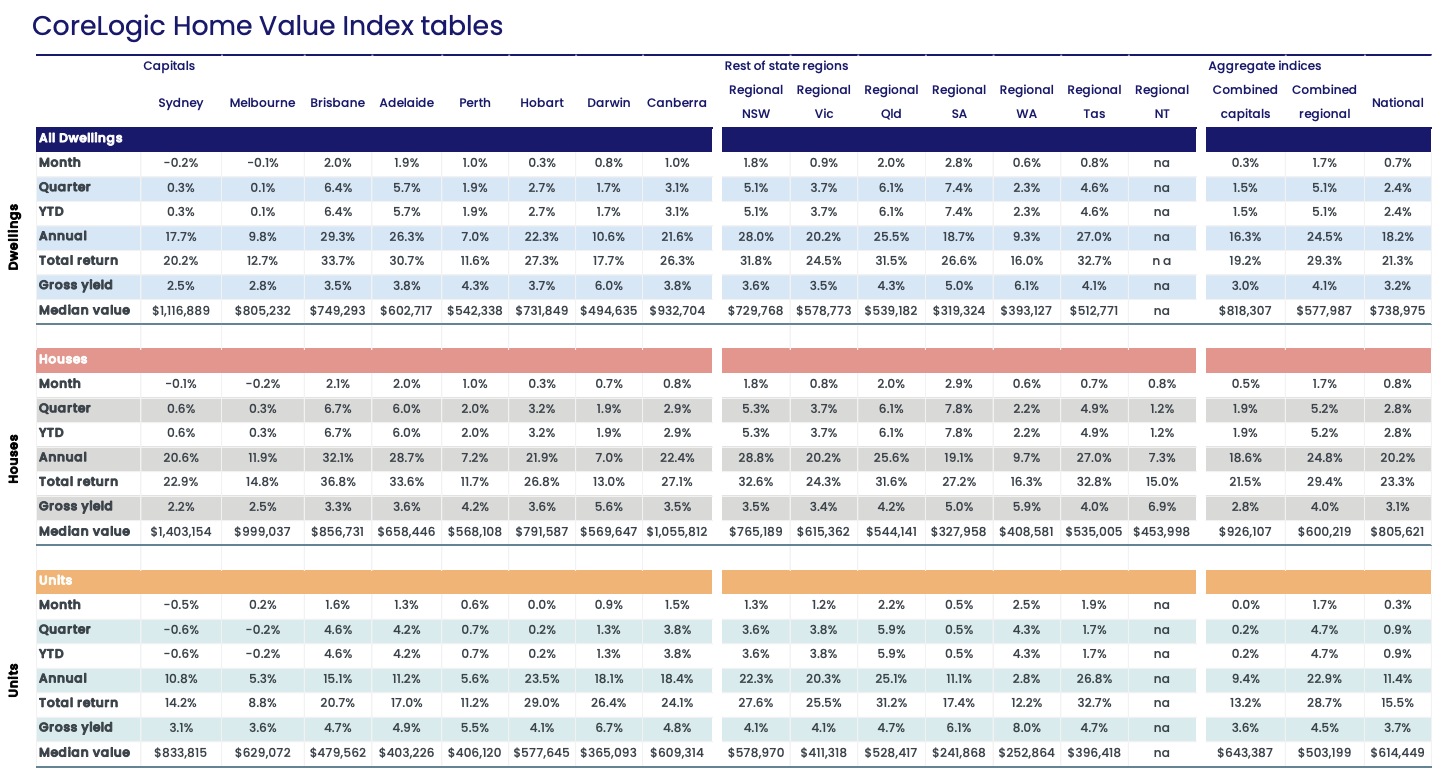

CoreLogic Housing Value Index March Report also came out last week.

CoreLogic HVI for March is up 0.1%, up from 0.6% to 0.7%, driven by Brisbane, Adelaide, Perth, and the ACT. Regional areas had impressive growth, which offset the drop in housing values in Sydney and Melbourne.

MARCH MONTH FIGURES

SYD -0.2

MEL -0.1

BNE +2.0

ADE + 1.9%

PER +1.0%

HBA +0.3%

DRW +0.8%

ACT +1.0%

REG-NSW +1.8%

REG-VIC +0.9%

REG-QLD +2.0%

REG-SA +2.8%

REG-WA+0.6%

REG-TAS+0.8%

REG-TAS+0.8%

REG-NT - NA

COM - CAP - 0.3%

COM - REG - 1.7%

NAT - 0.7%

MARCH MONTH FIGURES SYD -0.2 MEL -0.1 BNE +2.0 ADE + 1.9% PER +1.0% HBA +0.3% DRW +0.8% ACT +1.0% REG-NSW +1.8% REG-VIC +0.9% REG-QLD +2.0% REG-SA +2.8% REG-WA+0.6% REG-TAS+0.8% REG-TAS+0.8% REG-NT - NA COM - CAP - 0.3% COM - REG - 1.7% NAT - 0.7%

1st Quarter Figures

SYD +0.3%

MEL +0.1%

BNE +6.4%

ADE +5.7%

PER +1.9%

HBA +2.7%

DRW +1.7%

ACT +3.1%

REG-NSW +5.1%

REG-VIC +3.7%

REG-QLD +6.1%

REG-SA +7.4%

REG-WA +2.3%

REG-TAS +4.6%

REG-NT + NA

COM-CAP -1.5%

COM-REG +5.1%

NAT +2.4%

1st Quarter Figures SYD +0.3% MEL +0.1% BNE +6.4% ADE +5.7% PER +1.9% HBA +2.7% DRW +1.7% ACT +3.1% REG-NSW +5.1% REG-VIC +3.7% REG-QLD +6.1% REG-SA +7.4% REG-WA +2.3% REG-TAS +4.6% REG-NT + NA COM-CAP -1.5% COM-REG +5.1% NAT +2.4%

RETURN

SYD +20.2%

MEL +12.7%

BNE +33.7%

ADE +30.7%

PER +11.6%

HRB +27.3%

DWR +17.7%

ACT +26.3%

REG-NSW +31.8%

REG-VIC +24.5%

REG-QLD +31.5%

REG-SA +26.6%

REG-WA +16.0%

REG-TAS +32.7%

REG-NT NA

COM-CAP +19.2%

COM-REG +29.3%

NAT +21.3%

RETURN SYD +20.2% MEL +12.7% BNE +33.7% ADE +30.7% PER +11.6% HRB +27.3% DWR +17.7% ACT +26.3% REG-NSW +31.8% REG-VIC +24.5% REG-QLD +31.5% REG-SA +26.6% REG-WA +16.0% REG-TAS +32.7% REG-NT NA COM-CAP +19.2% COM-REG +29.3% NAT +21.3%

“The first quarter of the year has seen Australian dwelling values rise by 2.4%, adding approximately $17,000 to the value of an Australian dwelling. A year ago, values were rising at more than double the current pace, up 5.8% over the three months to March 2021 before the quarterly rate of growth peaked at 7.0% over the three months ending May 2021

Sydney’s growth rate is showing the most significant slowdown, falling from a peak of 9.3% in the three months to May 2021, to 0.3% in the first quarter of 2022. Melbourne’s housing market has seen the quarterly rate of growth slow from 5.8% in April last year to just 0.1% over the past three months”

Tim Lawless - Corelogic Australia

Last week, CoreLogic also gave us the biggest heads up when it came to purchasing a property in a High-Risk Coastal Erosion Area and named some key locations where properties were at Risk.

James Englebrecht from St James’s Place Asia and Summit Financial Hong Kong for sharing Jamie Towers from Mazars Australia for this fantastic recap of the 2022 Budget for you.

Keep an eye out for more from CoreLogic Reporting Tomorrow.

Happy Election/Easter - THE EXPATRIATE Team.