Webinar Invite 2023-24 Federal Budget Tax Update for Australian Expats, Send Payments Update, Depreciation Webinar, TE in Dubai Seminar Slides.

Lauren Staley, Dean Crossingham, Adam Kingston and Shona Stephenson

THE EXPATRIATE Team has been busy putting together some information packages for you, plus we’d love to hear your thoughts about THE EXPATRIATE in Dubai Seminar. In this newsletter, we will cover the following;

THE EXPATRIATE in Dubai, Slides and Event Survey

Deans Webinar Invitation 2023-24 Federal Budget Tax Update for Australian Expatriates

Bradley Beer’s Webinar invite for Tax Depreciation Commercial and Residential Investment Properties

Ian Craggs Send Currency Update

What a trip! THE EXPATRIATE were blown away by the support from the Australian Expat community when we hosted our first seminar at Publique Dubai.

Topics:

Tax - Dean Crossingham, Head of Accounting Stanford Brown

Property - Lauren Staley, Director, Infolio Property Advisors

Debt - Adam Kingston, Director, Australian Expatriate Finance.

We want to say a warm thank you to Australian Business Council Dubai (ABC Dubai) and UAE for your support and help with hosting our event. The presence has been fantastic, and we look forward to connecting with the Australian Expat Community Dubai in the Future. If you missed the seminar, no stress; we have the slide deck available for you with the contact details of the presenters.

We'd love to hear from you if you attended THE EXPATRIATE in Dubai seminar. Please take the time to fill out our attendee survey; here is the link below. Your feedback will help us plan and improve our next event.

Adam Kingston, Shona Stephenson, Lauren Staley and Dean Crossingham at the ANZAC Day Ball.

Our United Arab Emirates trip did not stop in Dubai, we drove to the stunning city of Abu Dhabi, where we invited key, THE EXPATRIATE Club Members to the Australian Business Group Abu Dhabi Anzac Day Ball.

The ball was a fantastic opportunity to for our specialists, Lauren, Adam and Dean, to talk candidly about how to grow your wealth best and secure your future. We know they will probably want to repatriate home to Australia one day, but they seemed to be enjoying expat life in the UAE!

Webinar Invitation 2023-24 Federal Budget Tax Update for Australian Expatriates, Send Payments Currency Update, BMT Tax Depreciation Webinar. THE EXPATRIATE in Dubai Seminar Slides.

I am delighted to invite you to the Stanford Brown Webinar: 2023-24 Federal Budget Tax Update for Australian Expatriates.

Webinar Details:

Date: Thursday, 18 May 2023

Duration: 30 minutes

Time:

10:00 am - United Arab Emirates

2:00 pm - Singapore / Hong Kong

4:00 pm - Sydney, Melbourne, Brisbane, AEST

If you cannot attend the live webinar, make sure you register to receive a complimentary recording.

In this webinar, Dean Crossingham, head of accounting at Stanford Brown, will provide concise commentary on the tax changes affecting Australian expatriates from the recently announced Federal Budget. The webinar will focus on the important tax changes impacting you.

This webinar includes updates from the Federal Budget regarding Australia’s tax residency rules, revision of individual tax rates for non-residents and superannuation restrictions affecting Australian expatriates.

The webinar will address the following questions:

What are the proposed tax changes affecting Australian expatriates?

Are there new wealth strategies that expatriates should consider?

What actions should expatriates immediately take?

The BMT Tax Depreciation team would like to invite you to join their Webinar and learn how you can boost your cash flow and save yourself thousands of dollars in deductions that investors can claim through tax depreciation.

If you’d like to take advantage of this fantastic opportunity to connect with BMT Tax Depreciation CEO Bradley Beer to discover the depreciation you could claim on your residential or commercial investment property, click on the links below.

Topics covered in the residential webinar:

Residential depreciation basics

Case studies using real examples

How to claim now

Commercial

Topics covered in the commercial webinar:

How both owners and tenants can claim depreciation

Current business incentives on offer

Renovations and scrapping

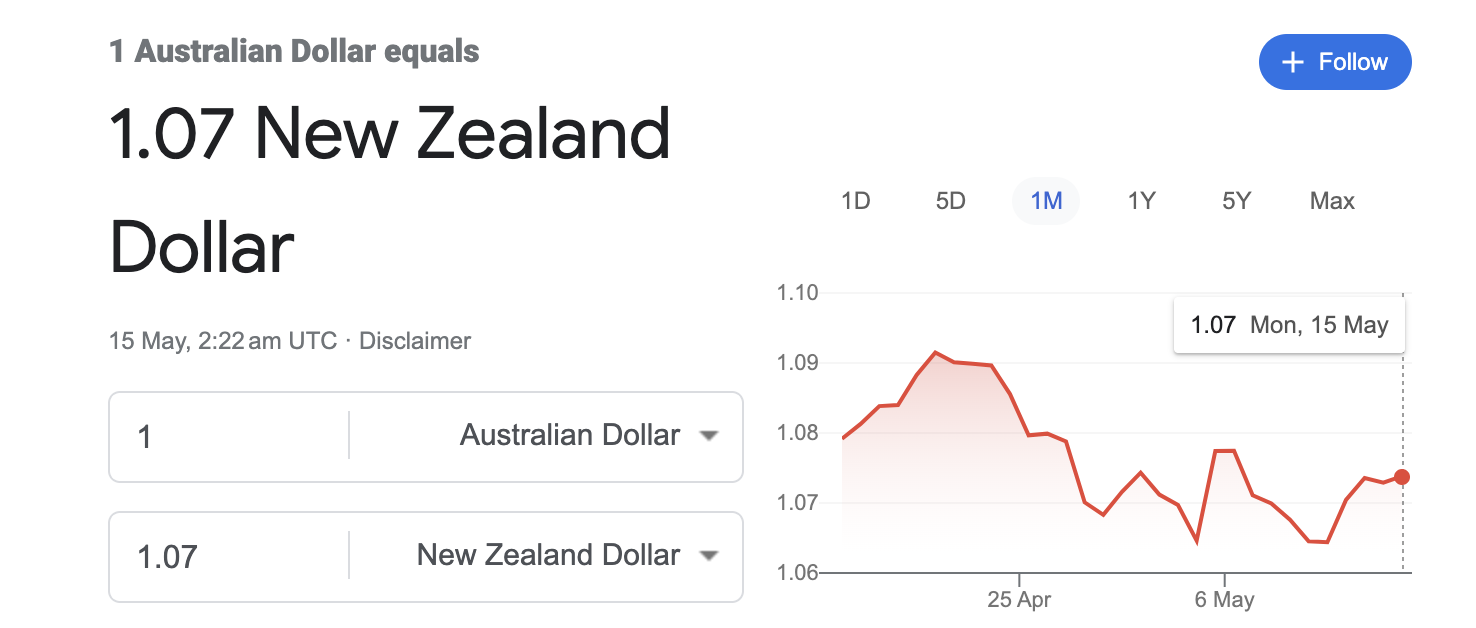

Now, let’s check in with Ian Cragg from Send Payments to see how the Australian Dollar is fairing against other currencies.

The AUD experienced a mixed performance this week, as central banks appear to be approaching the end of their hawkish phase. The coming months will be crucial in determining the direction of central bank policies. Market participants anticipate that interest rates will remain elevated for some time before banks adopt a dovish stance once more. This shift towards dovishness is expected to occur by the end of this year at the earliest, depending on various economic factors and indicators that will influence policy decisions in the interim. As these developments unfold, the AUD's trajectory will likely be influenced by global monetary policy shifts and the overall market sentiment.

Let’s dive in for more details.

AUD - USD

The USD experienced a decline against other major currencies on Wednesday, following the release of data indicating slower-than-expected U.S. inflation, which in turn increased the likelihood of the Federal Reserve pausing its interest rate hikes. According to the U.S. Labor Department, April inflation cooled to 4.9% YoY, marking the smallest increase in two years.

We hope you all have an amazing week, and we’d like to wish all the TE Mother ❤️ 🎁 💝 🤗 Happy Mother’s Day!

THE EXPATRIATE Team.