Send Payments International Currency Update 26th August 2024

In the news! 🌏 – Market conditions and what to look out for this week 🗓️

AUD/USD

Fed Chair Jerome Powell said the "time has come" for interest rate cuts.

The US Dollar (USD) will likely remain under pressure after US Federal Reserve Chairman Jerome Powell’s dovish Jackson Hole speech.

The US Durable Goods Orders for July are due later on Monday.

Fed Chair Powell spoke at the Kansas City Fed's annual economic symposium in Jackson Hole on Friday, stating, "The time has come for policy to adjust.” Powell did not specify when rate cuts would start or how large they might be, but the markets expect the Fed to announce a quarter-point rate cut in the September meeting.

The FOMC Minutes from the July meeting showed that a “vast majority” of Fed officials believe a September cut would be appropriate as long as there were no data surprises.

Following Powell’s speech, Philadelphia Fed President Patrick Harker said that the US central bank needs to lower rates methodically. Meanwhile, Chicago Fed President Austan Goolsbee noted that monetary policy is currently at its most restrictive level, and the Fed’s focus is shifting towards achieving its employment mandate.

The RBA’s hawkish comments might cap the AUD's downside soon.

The expectation of the Fed rate cut is likely to exert some selling pressure on the USD and create a tailwind for AUD/USD.

AUD/JPY

AUD/JPY loses gains as BoJ’s Ueda indicated no change in policy easing stance if the upcoming data aligns with forecasts.

BoJ Governor Ueda stated that he is not considering selling long-term Japanese government bonds as a tool for adjusting rates.

The Australian dollar received support from the improved risk sentiment before Fed Chair Powell’s speech.

Ueda stated, "the BoJ raised rates in July as the economy and inflation moved largely in line with forecasts."

He noted that recent BoJ policy decisions have been appropriate and warned that outlining the future policy path could lead to unnecessary speculation.

GBP/AUD

The GBP/AUD currency pair is currently in a corrective phase on the daily chart, as analysed through Elliott Wave theory. This analysis suggests that the market operates in a counter-trend mode, characterised by corrective patterns rather than impulsive movements.

Last Week 🗞️ Key Takeaways:

Jackson Hole and the Fed

Central bankers, academics, and journalists gathered at the mountainside resort of Jackson Hole on Friday, where Federal Reserve Chair Jerome Powell delivered a much-anticipated speech. This event has become known as the "Davos for central bankers" over the past four decades.”

Powell outlined a road map for US interest rates in an address loaded with economic and political significance.

While his immediate audience included central bankers and experts at the Jackson Lake Lodge, Wall Street closely analyzed the speech for clues on the Fed's future policy moves. Rivals in the US presidential race, Kamala Harris and Donald Trump, also watched, with the November election looming.

Financial markets were on edge, with every indicator of the health of the US economy being scrutinised. Earlier this month, concerns about a potential recession and Japanese interest rates triggered a brutal stock sell-off, but US markets later rebounded with their best day of trading in nearly two years.

Harris hoped the Fed hadn’t left it too late to cut rates as the US economy had cooled, and she wanted to avoid fighting the election with the country flirting with recession. Trump was likely to argue that the economy had performed poorly since his loss in 2020. Powell, a Republican, was nominated by Trump in 2017.

AUD/USD

The Australian Dollar rose against all major currencies on Wednesday after local labour market figures exceeded expectations for July.

Australia’s dollar was boosted after employment rose by 58.2k in July, far exceeding the consensus of a 20k increase. This marked a second consecutive increase, with gains concentrated in full-time employment.

Despite the unemployment rate increasing to 4.1%, some local economists suggested this should be the key indicator for markets and the central bank. Carol Kong, an economist and currency strategist at the Commonwealth Bank of Australia, noted that the unemployment rate was crucial for the monetary policy outlook.

AUD/USD traded on a more vital note near 0.6670 in Monday’s early Asian session. The RBA’s hawkish stance and a rise in the US University of Michigan sentiment boosted the Aussie against the USD.

The AUD/USD pair kicked off the week positively, with the Federal Reserve’s potential rate cut dragging the US Dollar lower. The RBA Board’s August meeting minutes and Powell's speech were in the spotlight that week.

AUD/JPY

AUD/JPY advanced further for the second consecutive day, trading around 98.90 during the early European session on Friday. The Australian Dollar gained ground against the Japanese Yen due to improved risk sentiment following a stronger-than-expected recovery in US Retail Sales, easing concerns about a potential US recession.

Hawkish comments from RBA Governor Michele Bullock boosted the Aussie Dollar and underpinned the AUD/JPY cross. Bullock emphasized that the Australian central bank was focused on potential upside risks to inflation and did not foresee any rate cuts shortly.

Australian Employment Data

The solid Australian July employment data proved challenging for the Reserve Bank of Australia. Gains in full-time employment could delay the RBA from moving into a full easing mode, as seen in New Zealand and potentially in the US in September.

Things to look out for this week;

Wednesday 28 August

🇺🇸 CB Consumer Confidence - USD

🇦🇺 CPI y/y - AUD

Thursday 29 August

🇩🇪 German Prelim CPI m/m - EUR

🇺🇸 Prelim GDP q/q - USD

🇺🇸 Unemployment Claims - USD

Friday 30 August

🇪🇺 CPI Flash Estimate y/y - EUR

🇨🇦 GDP m/m - CAD

🇺🇸 Core PCE Price Index m/m - USD

Saturday 31 August

🇨🇳 Manufacturing PMI - CNY

AUD-USD 🇺🇸

Rates are matching the year high at 0.6793

AUD-GBP 🇬🇧

Sitting 0.5138 the AUD - GBP has kept within its band over the last week

AUD-NZD 🇳🇿

Rates have been trending downwards at 1.0902

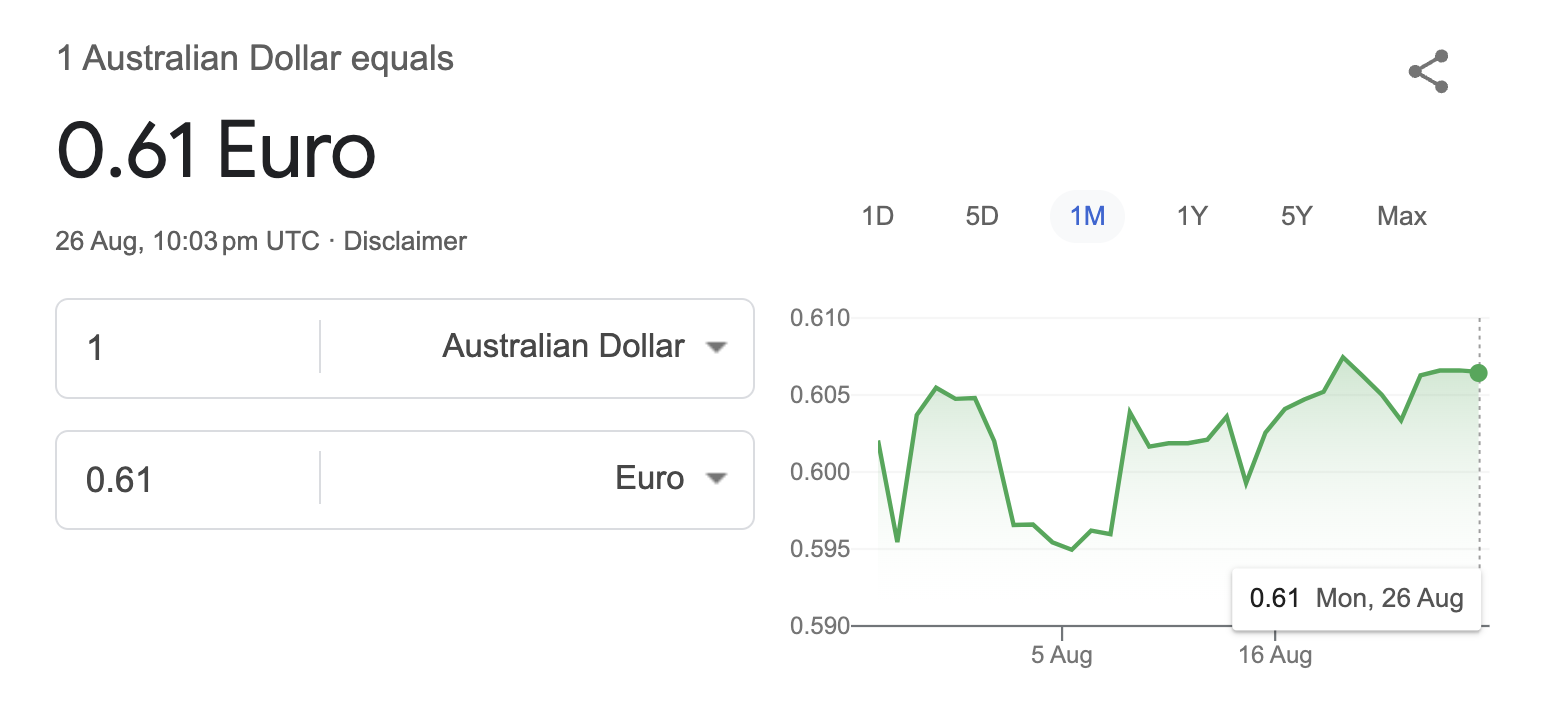

AUD-EUR 🇪🇺

AUR-EUR has kept within its band rates at 0.6064

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.