Send Payments Weekly Trading Update 6th January 2025

Send Payments Weekly Trading Update 6th January 2025

In The News🌏 – Market Conditions and what to look out for this week 🗓️

AUD/GBP Exchange Rate

AUD/GBP dropped to multi-year lows over the Christmas period, dropping into the low 0.49's before regaining the 0.5000 level on Thursday.

Throughout December, the rate dropped to 5.1%, starting at 0.5200 and ending the month at 0.4930.

The AUD has dropped rapidly against various currencies due to potential rate cuts in Australia and a broad risk-based sell-off in the currency.

Send Payments Market Update 28th October 2024.

Send Payments Market Update 28th October 2024 PLUS Competition.

Send Payments Competition

When you make an international transfer with Send from 13th October 2024 to 31st December 2024, you'll go into the draw for the chance to win 1 of 5 $500 Luxury Escapes vouchers when you transfer $AUD 10,000 or more. T&C’s apply*

Send Payments Weekly trading update.

Send Payments weekly trading update.

In The News 🌏 Market Conditions and what to look out for this week 🗓️

AUD

The Australian Dollar (AUD) is expected to strengthen against the Euro, Pound, and U.S. Dollar through 2025, according to Westpac, a major Australian lender.

Westpac predicts the AUD will rise due to improving global sentiment and the Reserve Bank of Australia (RBA) maintaining a firm stance on inflation.

Luci Ellis, Chief Economist at Westpac Group, believes that the RBA will not cut the cash rate until inflation is sustainably within the 2–3% target range.

Australia's Consumer Inflation Expectations eased to 4.4% in September, slightly down from the four-month high of 4.5% in August.

Send Payments International Currency Update 26th August 2024

Send Payments International Currency Update 26th August 2024

In the news! 🌏 – Market conditions and what to look out for this week 🗓️

AUD/USD

Fed Chair Jerome Powell said the "time has come" for interest rate cuts.

The US Dollar (USD) will likely remain under pressure after US Federal Reserve Chairman Jerome Powell’s dovish Jackson Hole speech.

The US Durable Goods Orders for July are due later on Monday.

Send Payments Weekly trading update.

Send Payments Weekly Trading Update. In The News 🌏 Market Conditions and What to look out for this Week 🗓️

AUD: Under Pressure – Commerzbank

The Australian Dollar (AUD) is under significant pressure, losing about 0.7% against the US Dollar (USD), according to Commerzbank’s FX analyst Volkmar Baur.

The AUD was affected by lower-than-expected inflation, which has reduced expectations for further rate hikes by the Reserve Bank of Australia (RBA). The RBA are due to announce Australia’s interest rate on Tuesday at 2:30pm, there is no expected change.

The AUD's strong reaction also seems tied to ongoing economic weakness in China, Australia’s largest trading partner. Weakness in China, especially in the housing market, could impact Australian exports and thus the currency.

Send Weekly Currency Update 22nd July 2024

In The News 🌏 – Market Conditions and what to look out for this week 🗓️.

AUD/USD

US President Joe Biden's exit from the presidential race increased the odds for former President Donald Trump and boosted investors' appetite for riskier assets.

Experts argued that Biden’s decision would increase market volatility, though the market reaction has been limited so far.

Peter Earle, senior economist at the American Institute for Economic Research, stated that investors may seek a safe haven until they can assess Biden’s replacement policies.

Dovish Fed expectations prompted fresh US Dollar selling.

Pairs where AUD is the weaker currency, such as EURAUD and GBPAUD, are now in focus.

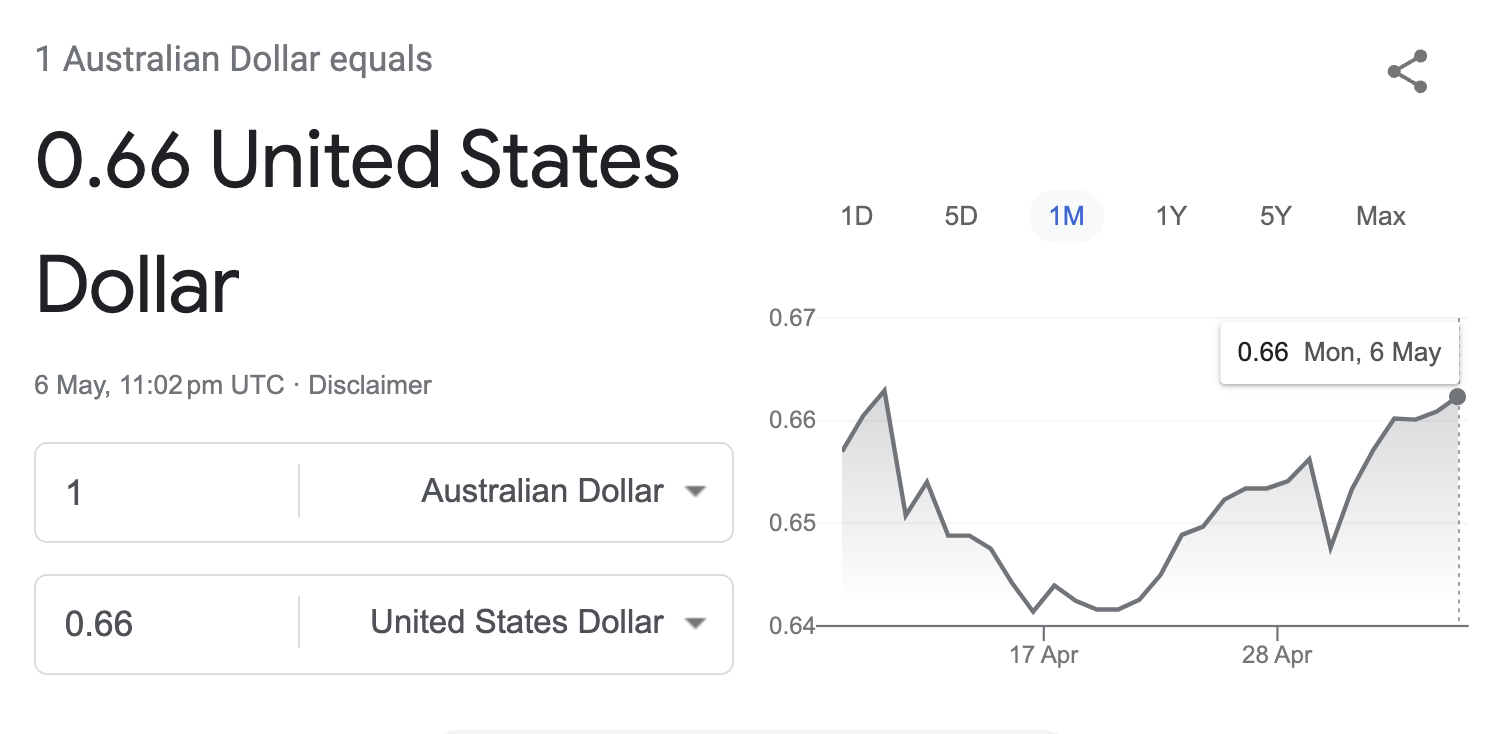

Send Currency Update Published on May 6th 2024

Send Currency Update Published on May 6th 2024

In The News 🌏 Market Conditions and What to look out for this week 🗓️

Speculation on RBA Rate Hike:

Capital Economics is forecasting a 25 basis points rate hike, citing stickier and stronger inflation than expected by the Reserve Bank of Australia (RBA).

The RBA has historically increased interest rates when the trimmed mean quarterly inflation has been at least 1 percent, which was the case in the March quarter.

Send Currency Update 29/01/2024

In The News Today! 🌏

– Market Conditions and what to look out for this week 🗓️

EUR/USD is trading below 1.0850 in Asian trading on Monday. The pair's downbeat tone is supported by further US Dollar demand amid rising geopolitical tension in the Middle East. Investors will be watching these developments closely prior to a busy end of the week.

Send Currency Market Update 4th September 2023

Send Currency Market Update 4th September 2023.

Last week saw some strength return to the AUD as the greenback lost some steam due to weak data and a possible rate halt. Positive signs from China also helped the Aussie recover some ground, but how long will this last? Moreover, August has ended, and the seasonal analysis of September tells us that the AUD tends to weaken towards the latter half of this month. This is something to take note of before making your trades.

Let`s dive in for more details.

Send 14th August 2023 Currency Update by Ian Cragg

The AUD has faced downward pressure against different currencies, impacted by factors such as safe-haven demand, economic data, risk aversion, and monetary policy outlook. This situation is not likely to improve anytime soon, which means that AUD is likely to remain weak for the time being.

Currency Market Update 7th August 2023

Currency Market Update 7th August 2023

Last week, the Australian dollar faced challenges against major currency pairs. The AUD/USD lost 2.11% due to a strong US dollar and positive economic data. The AUD/EUR declined 2.32% as the European Central Bank signaled a potential policy pause

AUD Currency Update over last 12 months V SGD, GBP, AED

AUD Currency Update over last 12 months V SGD, GBP, AED

AUD V SGD has fallen by -11% since April 2022 and has struggled to reach 0.94c over the past 6 months.

Typically the currency pairing has regularly enjoyed hovering around parity. However, the lows at the moment of 0.89c that we are currently experiencing are a far cry from the $1.05 we witnessed in August 2021.

Currency Update 9th August by Send Payments - Ian Cragg

Currency Update 9th August by Send Payments - Ian Cragg

THE EXPATRIATE International Currency Update by our Specialist Ian Cragg from Send Payments.

The AUD had a mixed week against major currencies. It started the week on a strong note with the RBA hiking rates by 50bps. However, market sentiment quickly shifted and the AUD fell after it was clear that the RBA was moving to a more dovish policy stance. This was compounded by a strong USD, which led to a flight to safety and away from risk currencies like the AUD.