St Jame’s Place Guide to Investing in Volatile Markets

Why investing for the long-term is the way to help you achieve your goals

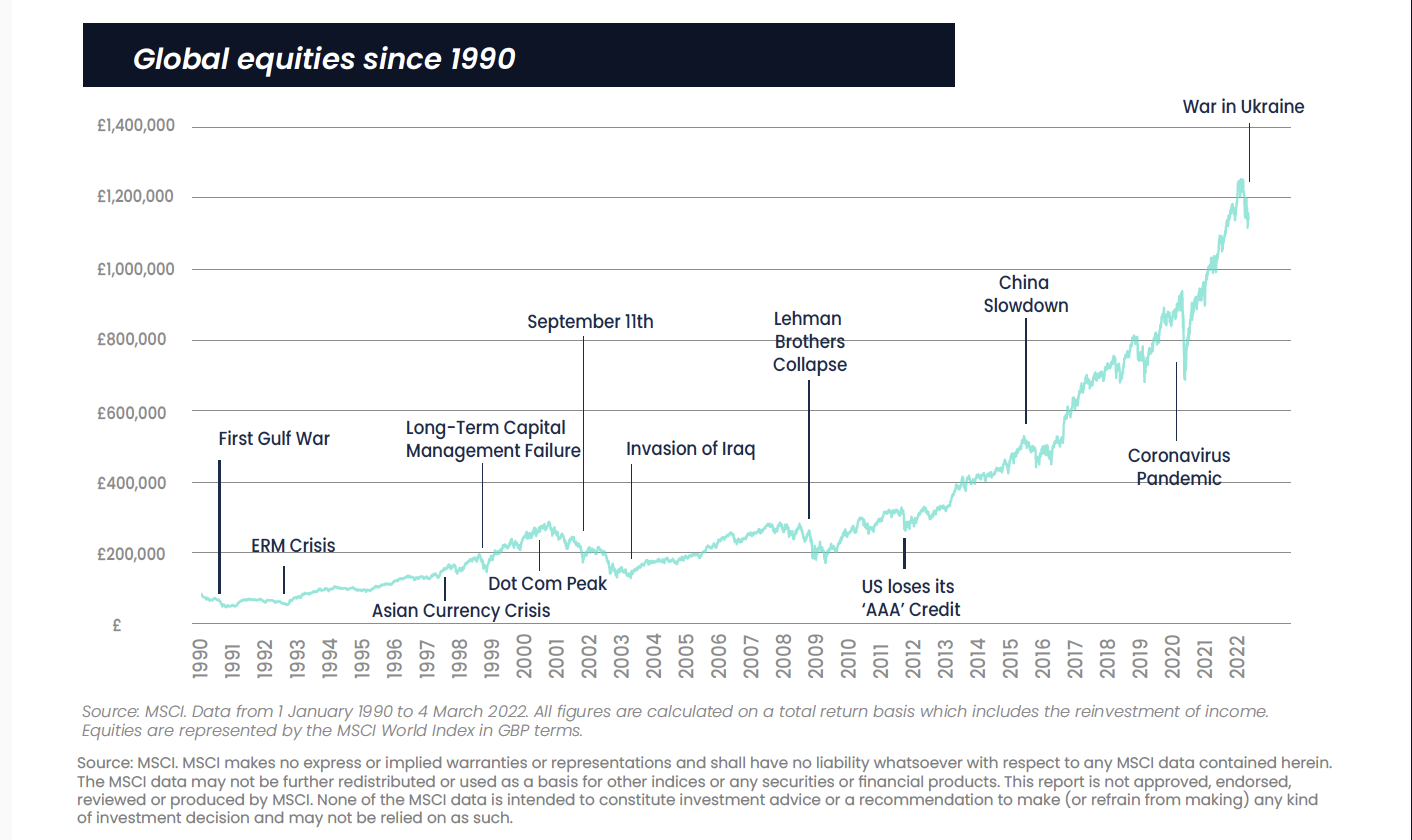

Investors always have a long list of things to worry about. The ongoing ramifications of the pandemic continue to play out even as the COVID-19 threat slowly recedes. The effects of the war in Ukraine, supply chain disruptions and the biggest cost-of-living crisis in decades are creating further distress. In this uncertain and volatile time, it can be very easy to make knee-jerk decisions that might not be the best course of action.

As markets battle this volatility and continue to fill headlines around the world, it is natural for investors to feel a sense of unease. The virus’s unpredictability and its economic impact are understandably unsettling. After all, watching the value of investments rise and fall can be challenging.

Although volatility can be scary, investors should be dispassionate and objective while focusing on the longer-term opportunities instead of the short-term fluctuations. One of the biggest mistakes investors can make is selling when the market falls because of an emotional reaction.

Therefore, it is crucial to take a step back and remind yourself of the investment objectives you want to achieve. In hindsight, you should not neglect your end goals, such as saving for your retirement or your children’s education.

Investors would do well to ignore the market volatility and uncertainty that will accompany any escalation - and think about the event in the context of their long-term investment strategy. Ignore this noise, and your likelihood for success increases.

One of the biggest mistakes investors can make is to sell when the markets fall because of an emotional reaction.

The value of an investment with St. James’s Place will be directly linked to the performance of the

funds selected and may fall as well as rise. You may get back less than the amount invested.

There are five ways to ride out market volatility.

Don’t time the markets

Investors cannot consistently and successfully time the markets. Nobody knows what the stock market will do next week, next month or next year. Taking a long-term view is what matters most.

Keep your emotions in check

We often become more optimistic and self-confident when markets rise, only to descend into fear and panic when they fall. But whether through exuberance or despair, learning not to overreact is key to long-term investment success.

Investing for the long term

Once you’ve invested your money, it is vital to ignore the short-term fluctuations of the stock markets. Over time, although there are no guarantees, a diversified portfolio of investments will tend to rise.

Have your financial goals in sight

Stay positive and take a step back to review your long-term objectives and coverage for yourself and your family. A financial adviser will help to ensure you stay the course in order to achieve your goals.

Tailoring an appropriate investment portfolio to match your plans

A good financial adviser will work to understand your long-term plans and help you to find the right balance between risk and reward. Your portfolio will be tailored to your current circumstances and be diverse enough to help even out the bumps along the way to achieving what you aim for the future.

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.