Stanford Brown July Monthly Market Report

Global financial markets snapshot This report refers to the month of June 2022, but we also include 5 July +0.50% RBA rate hike to 1.35%, which is consistent with the theme of accelerating rate hikes driving global sentiment and investment markets. June 2022, like May, was another month of two halves. In the first half, share prices rose and bond prices fell (ie yields rose) on hopes of continued economic growth, albeit with inflation. In the second half of June, share prices fell and bond prices rose (yields fell) as investors started to worry more that increasingly aggressive rate hikes would trigger economic recessions. The turning point was the US Fed’s 3rd rate hike on 15 June, raising US rates by 0.75%, following hikes of 0.25% in March and 0.50% in May. Slowdown fears in the second half of June also brought down prices of oil, gas, coal, industrial metals like copper and iron ore, and also the Australian dollar.

This month we cover:

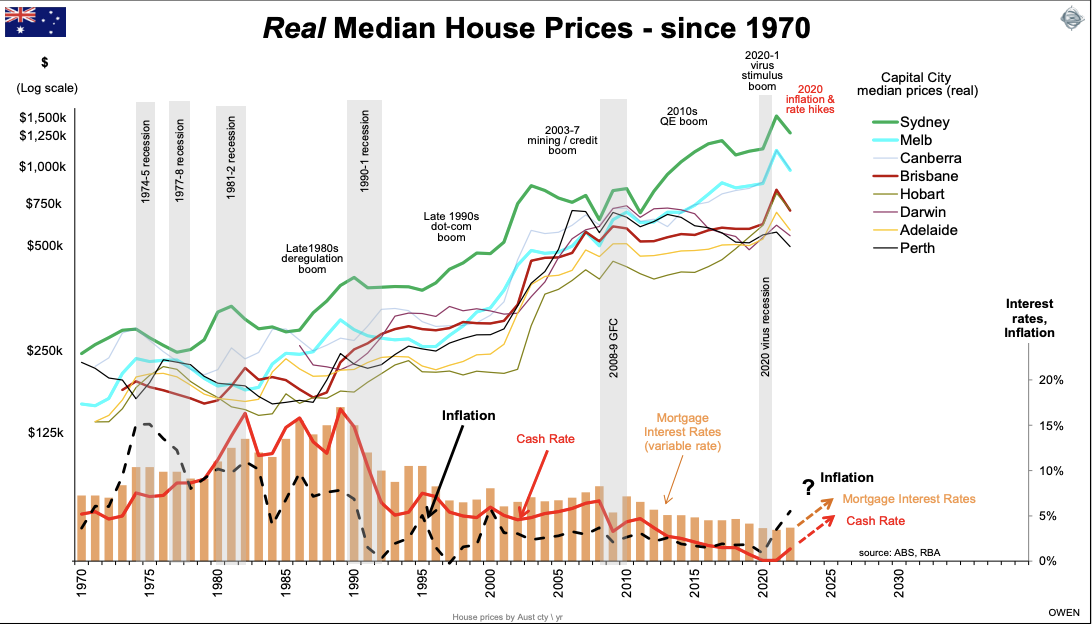

How will rising interest rates affect house prices?

Are we headed for recession?

Why do share markets always rebound in recessions?

Are share prices random or do they have a ‘memory’?

What were the winners over the past year?

Why is it dangerous to chase last year’s winners?

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.