Stanford Brown Monthly Investment Report - May

Stanford Brown Monthly Investment Report - May was released this week.

Stanford Brown Monthly Investment May Report will help you navigate through these uncertain times. Clarity and the most current information is essential to making clear and informed decisions. It is crucial to be informed about the movements in the local and international economy. Stanford Brown has your questions answered about Interest Rates, Australian Share Markets, Election Parties, and the positive outlook for the Australian Markets in the coming years. Here is the Stanford Brown May Market Report.

Stanford Brown May Monthly Market Report Topics;

How high will interest rates go?

Which side of politics has been better for Australian share markets?

Which side has been better on government deficits and debts?

What are the impacts and implications of rising inflation and interest rates on investments?

Why the Australian share market is set to shine in the coming years?

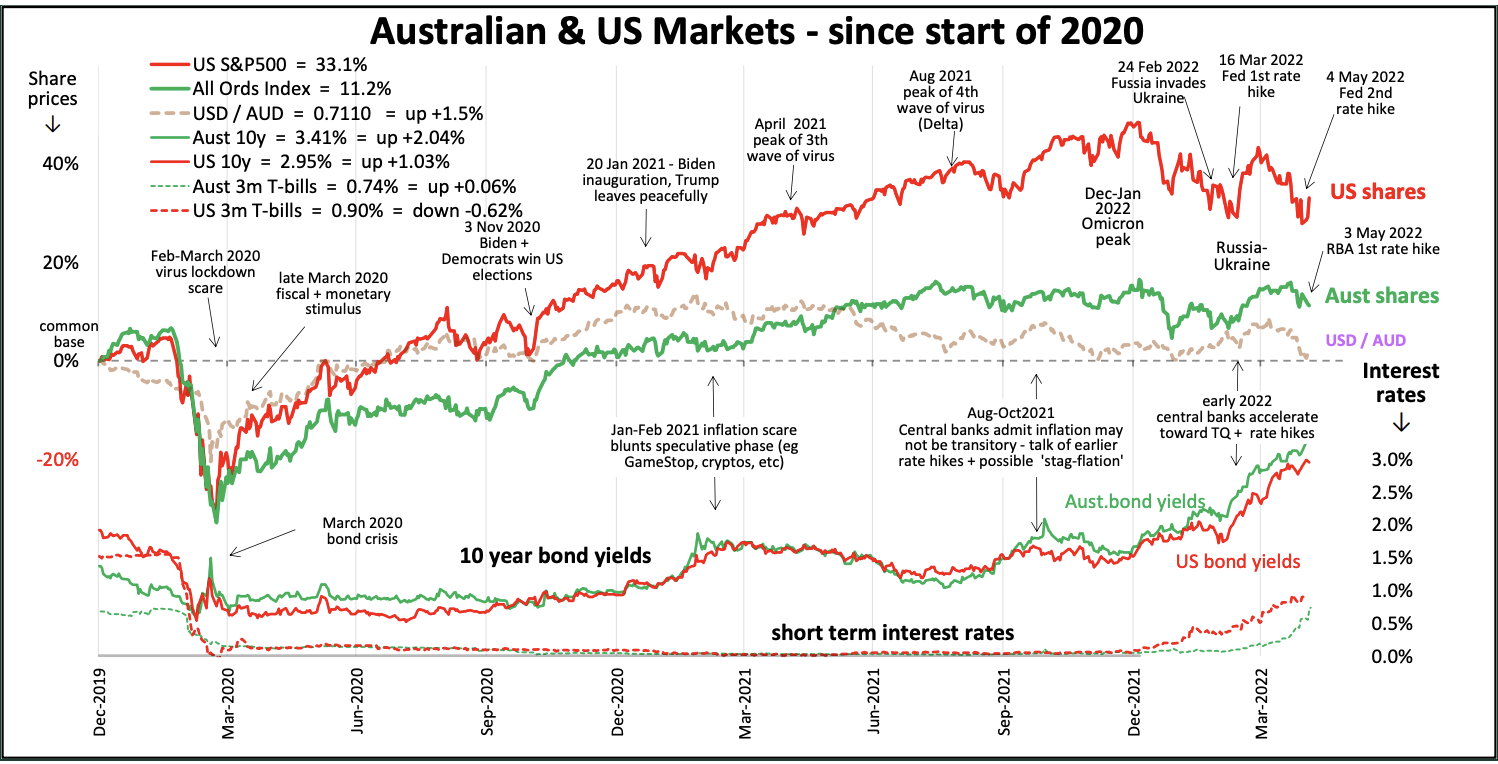

Australian and Global Markets finished April Flat; here are THE EXPATRIATE National Key Points Below;

Australian and Global Markets finished April Flat.

Big Banks were down a fraction.

Iron Ore -9% and Gold - 2% Also Down

Speculative Tech Stocks Down Heavily - Afterpay, Square, Block - most others are also in line with Global Tech Stock Pricing.

Most Gas and Oil were up a little, with Global Oil Prices up 4%

Coal was up 22%

Woolworths and Coles stocks were up, but retail discretional stocks were down.

AGL “Break Up” is one to watch as their shares are hotting up.

Winners in Transport, Qantas, Brambles, Transurban, Atlas Arteria as borders re-open.

International Key Points - Global Markets mainly were down, led by the US Market.

Netflix -49%, Nvidia -32%, Amazon -24%, Tesla -19%, Alphabet/Google -18%, Adobe -13%

While Apple, Microsoft, and Facebook were down 10% each

Year To Date, Netflix -68%, Nvidia -32%, Amazon -26%, Tesla -18%, Alphabet/Google -21 Adobe -30%, FaceBook -40%, Apple -11%, Microsoft -18%.

These figures pulled the NASDAQ down -13% in April and the broader market down 9%.

“As a result, US Pricing levels are back to more reasonable 21 times earnings, and dividend yields are up 1.6%. Back to reasonable territory but by no means cheap”.

-Ashley Owens - Chief Investment Officer Stanford Brown.

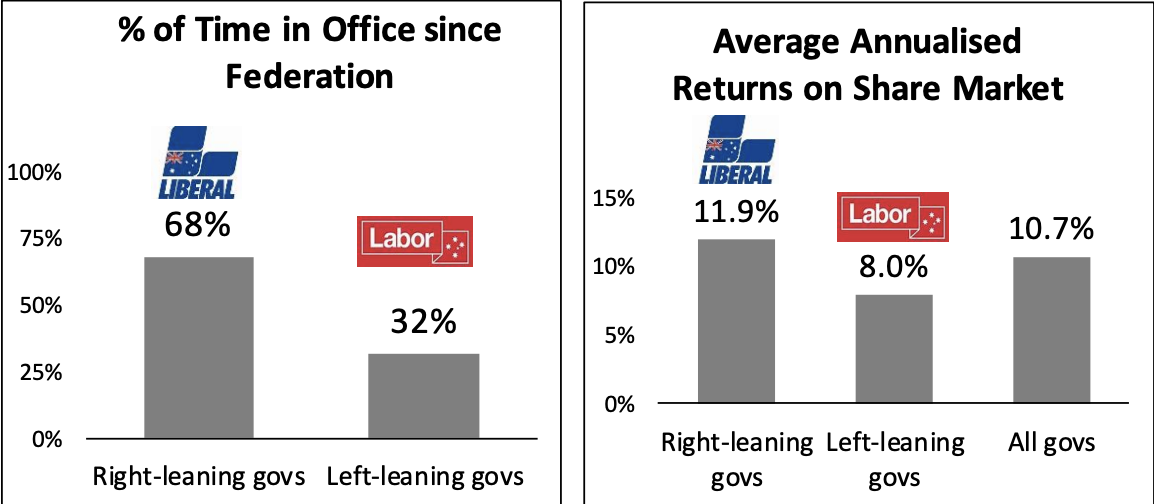

Which side of politics has been better for Australian share markets?

Since federation, the Liberal Coalition Government has been in office 68% of the time. The markets showed an average return of 11.9% when the Liberal Coalition Government was in power than the 8% return on the Share Market during a Labor Leadership.

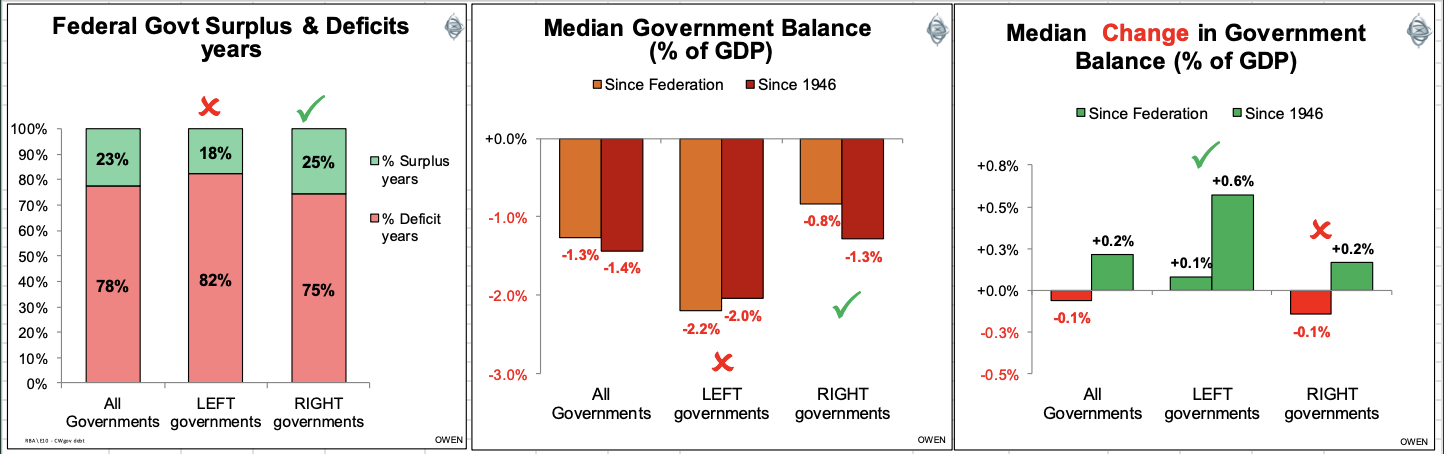

There are many factors to consider when it comes to returns on the sharemarkets and the relationship to share market returns, and this fantastic graph below shows. WW1, WW2, Vietnam War, Global Financial Crisis, and Covid19 Pandemic have all played a role in influencing the share market and governments ability to reduce the defecit.

“Clearly Left Governments have run up more deficits, more often (Left Chart) and have run up larger deficits (middle chart), however, the main reason is that Labor happened to be in power during the two big war-time build-ups, where deficits and debts were bypartsan. On the other hand, “left" governments also contributed to the largest increases (improvements) in budget balances - ie, reducing deficits, mainly after big wartime buildups. Equal points go to both sides. Top marks for voters for electing governments that maintain stable institutions”.

-Ashley Owens - Chief Investment Officer Stanford Brown.

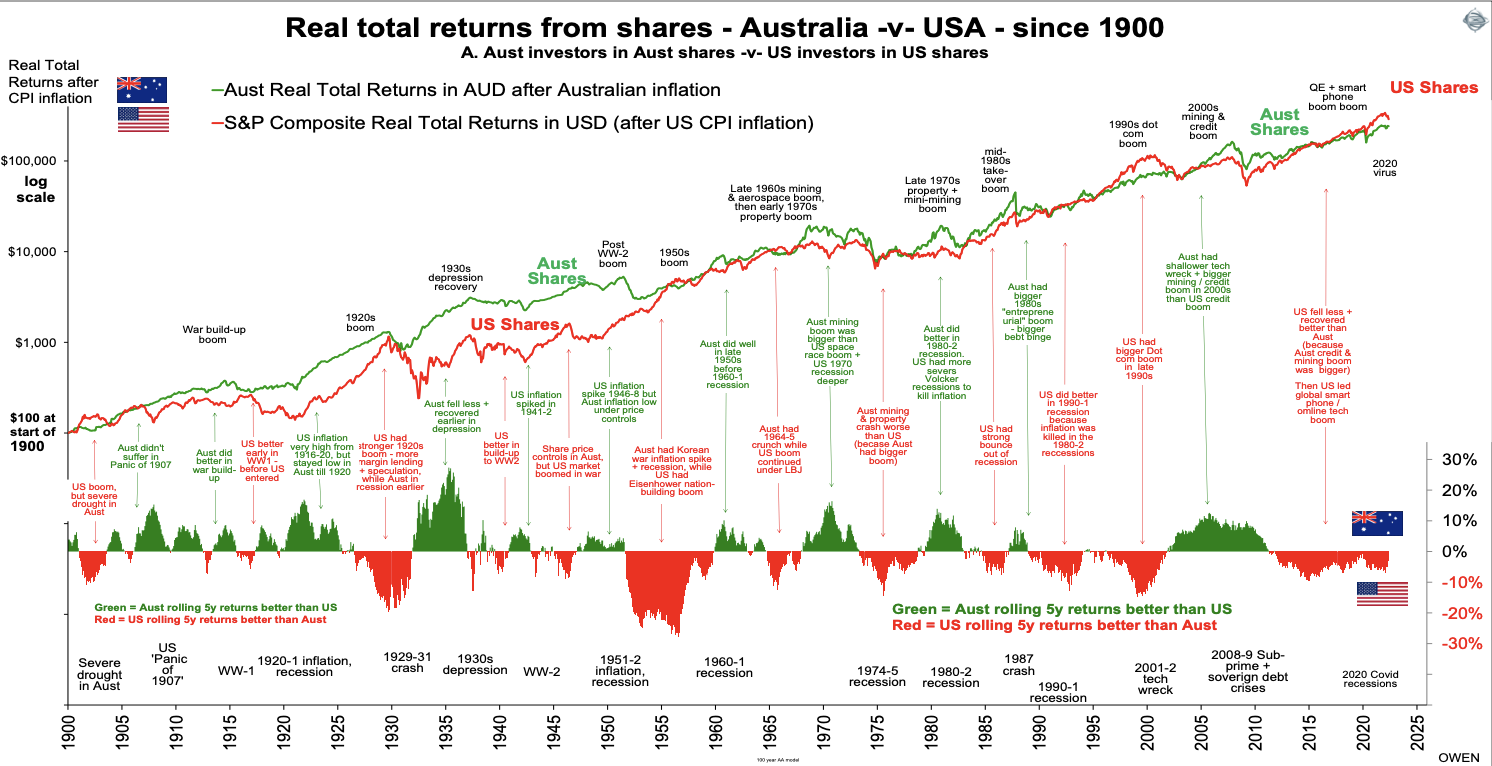

Ashley also covers “Australian Vs. US Shares” and believes it is now Australia’s time to outperform the US Share Market.

Australian and US shares have posted exactly the same returns for shareholders for over a century and average 6.5% above inflation since the turn of the century 1900. While the returns are the same, the components of the returns have been different, with Australian shares delivering higher normal price growth and higher dividend yields than US shares, but these benefits have been neutralised by Australia’s higher inflation.

Looking ahead to Australian and Global Markets in relation to “Russia, and China with its economic slow down from Covid Lockdowns and the unraveling of the property/construction lending bubble. This slow down is reducing the demand for raw materials. China has already cut off most of its imports from Australia, but iron ore is still holding up, gas is increasing, and there are signs of re-opening of a coal trade - all of which China has very few other options in the now or in the near future” -

-Ashley Owens - Chief Investment Officer Stanford Brown.

To delve deeper into the report full report click, on the link below;