SB Talks, RBA’s Decision, Inflation, US earning reports and more.

Stanford Brown (SB) Talks is an informative conversation with SB CEO Vincent O’Neill and Chief Investment Officer (CIO) Nick Ryder in which they explore the important elements of your financial world – from investments to strategy, from retirement planning to intergenerational wealth.

They discuss:

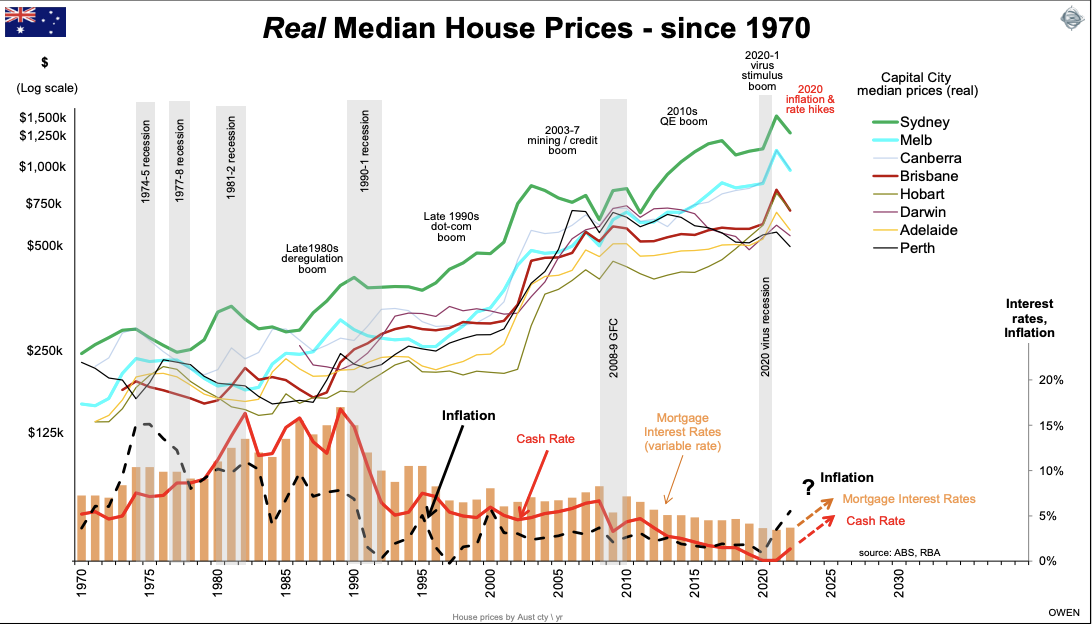

Why the RBA’s latest rate pause might give hope that inflation is waning

Services and rent are the biggest drivers of inflation

The divergence between cashed-up and stressed homeowners

Why Europe’s inflation remains sticky

Japan’s increased flexibility surrounding bond yield caps

US earnings reporting season

Stanford Brown July Monthly Market Report

Global financial markets snapshot This report refers to the month of June 2022, but we also include 5 July +0.50% RBA rate hike to 1.35%, which is consistent with the theme of accelerating rate hikes driving global sentiment and investment markets. June 2022, like May, was another month of two halves. In the first half, share prices rose and bond prices fell (ie yields rose) on hopes of continued economic growth, albeit with inflation. In the second half of June, share prices fell and bond prices rose (yields fell) as investors started to worry more that increasingly aggressive rate hikes would trigger economic recessions. The turning point was the US Fed’s 3rd rate hike on 15 June, raising US rates by 0.75%, following hikes of 0.25% in March and 0.50% in May. Slowdown fears in the second half of June also brought down prices of oil, gas, coal, industrial metals like copper and iron ore, and also the Australian dollar.