CoreLogic Home Value Index (HVI) December

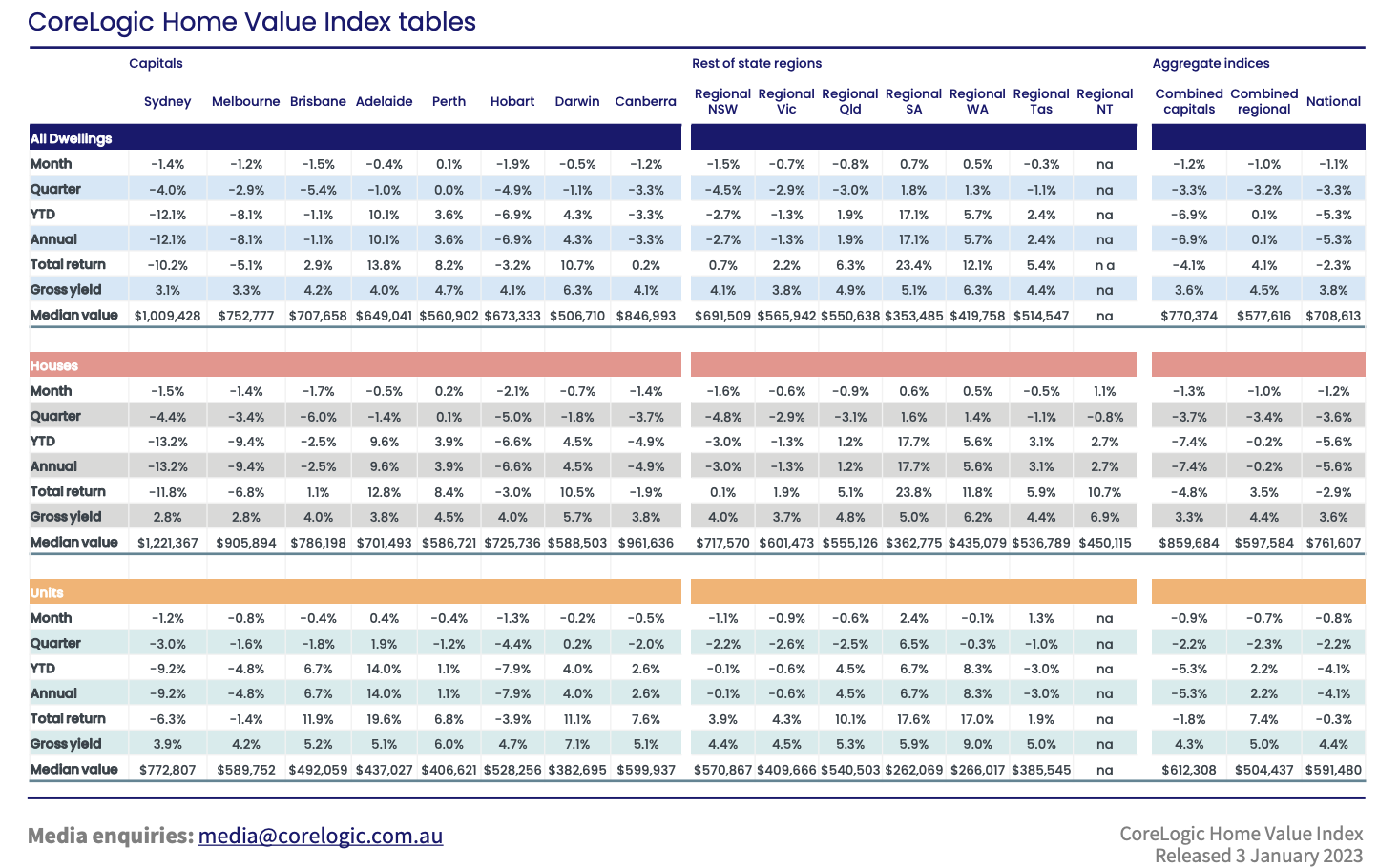

The Housing Value Index (HVI) weakened with CoreLogic’s national HVI falling -1.1% in December, taking values -5.3% lower over the 2022 calendar year.

Melbourne, Sydney, Adelaide and Darwin all re-acceleration their downward trend led by Sydney -1.4% and Melbourne with a decline of -1.2% fall for the month. The biggest downturn was still in Brisbane, however with a slowing of the dip from -2% in November to -1.5% in December.

Monthly HVI Capital Cities

Sydney -1.4% peak was 27.7% total decline -12.7%

Melbourne -1.2% peak was 17.3% total decline -8.3%

Brisbane -1.5% peak was 42.7% total decline -9.4%

Adelaide -0.4% peak was 44.7% total decline -1.3%

Perth +0.1% peak 25.9% total decline -0.6%

Hobart -1.9% peak 37.7% total decline 9.3%

Darwin -0.5% peak 31.1% total decline 1.2%

Canberra -1.2% peak 38.3% total decline 7.6%

Regional Areas

NSW -1.5% peak 47.6% total decline -8.8%

VIC -0.7% peak 35.0% total decline -6.0%

QLD -0.8% peak 42.7% total decline -6.3%

SA +0.7% peak 46.2% at peak

WA +0.5% peak 31.5% at peak

TAS -0.3% peak 51% total decline -5.1%

As noted above, the pace of falls eased in Brisbane, and Hobart joined the sunshine state in this trend, while value movements in Perth remained slightly positive for the second consecutive month.

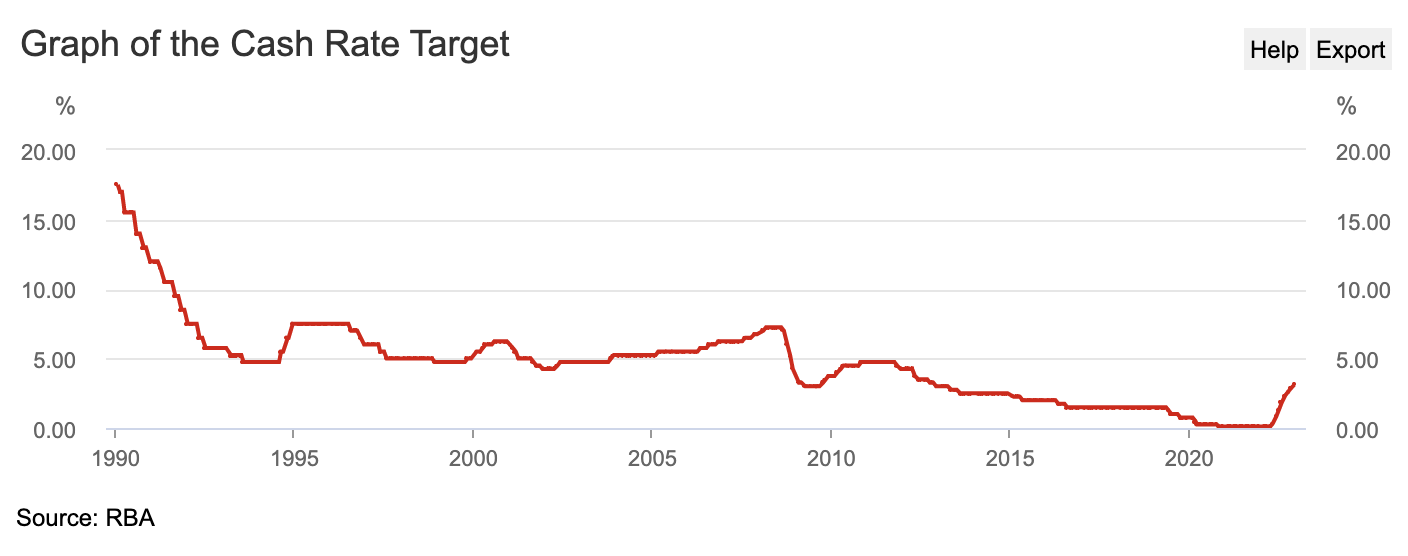

“The -5.3% drop in housing values through 2022 marks the first time since 2018 where national home values fell over the calendar year. The 12 months to December also mark the largest calendar year decline since 2008, when values were down -6.4% amid the Global Financial Crisis, and successive interest rate rises.

Annual value falls were the most significant in Sydney (-12.1%) and Melbourne (-8.1%) where conditions peaked early in the year. Hobart (-6.9%), the ACT (-3.3%), and Brisbane (-1.1%) also recorded an annual drop in housing values, while three capitals saw values rise over the year: Adelaide (10.1%), Darwin (4.3%), and Perth (3.6%).”

Says Tim Lawless, executive research director of CoreLogic’s Asia–Pacific research division.

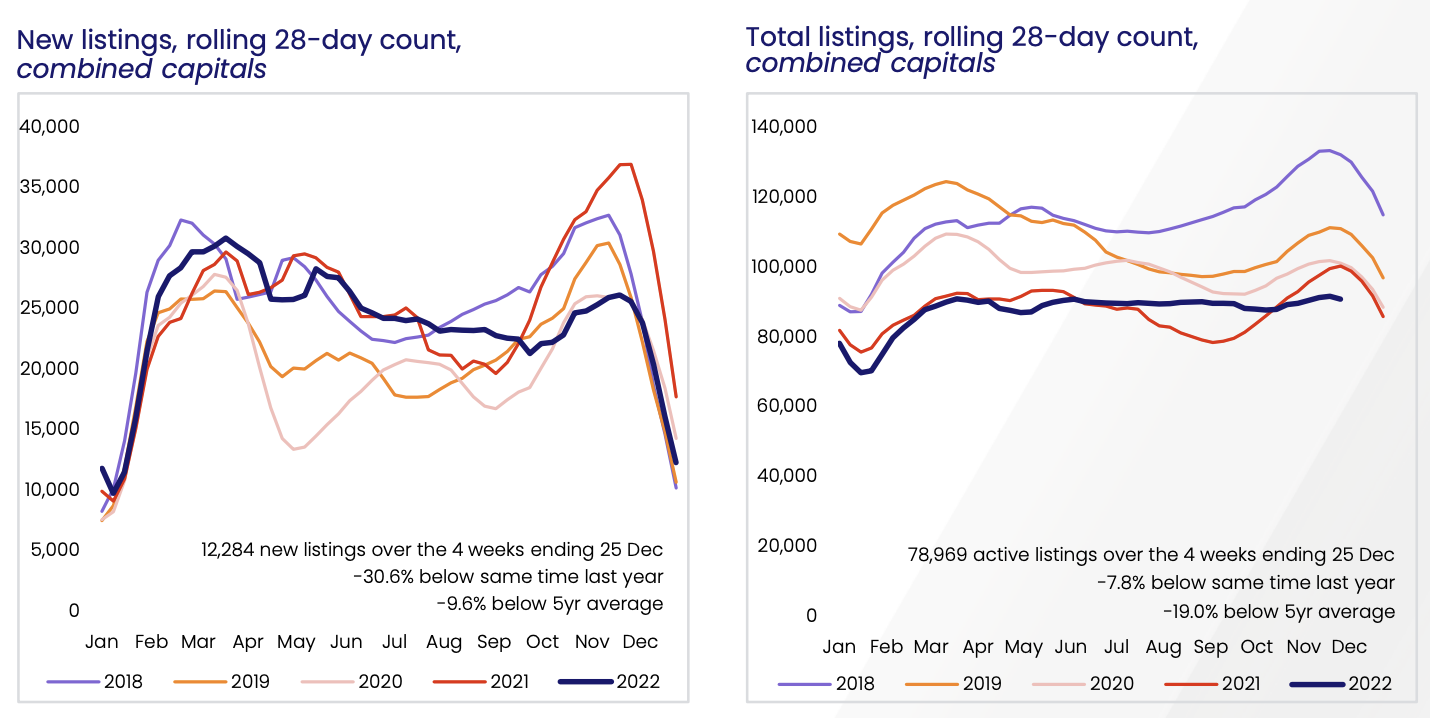

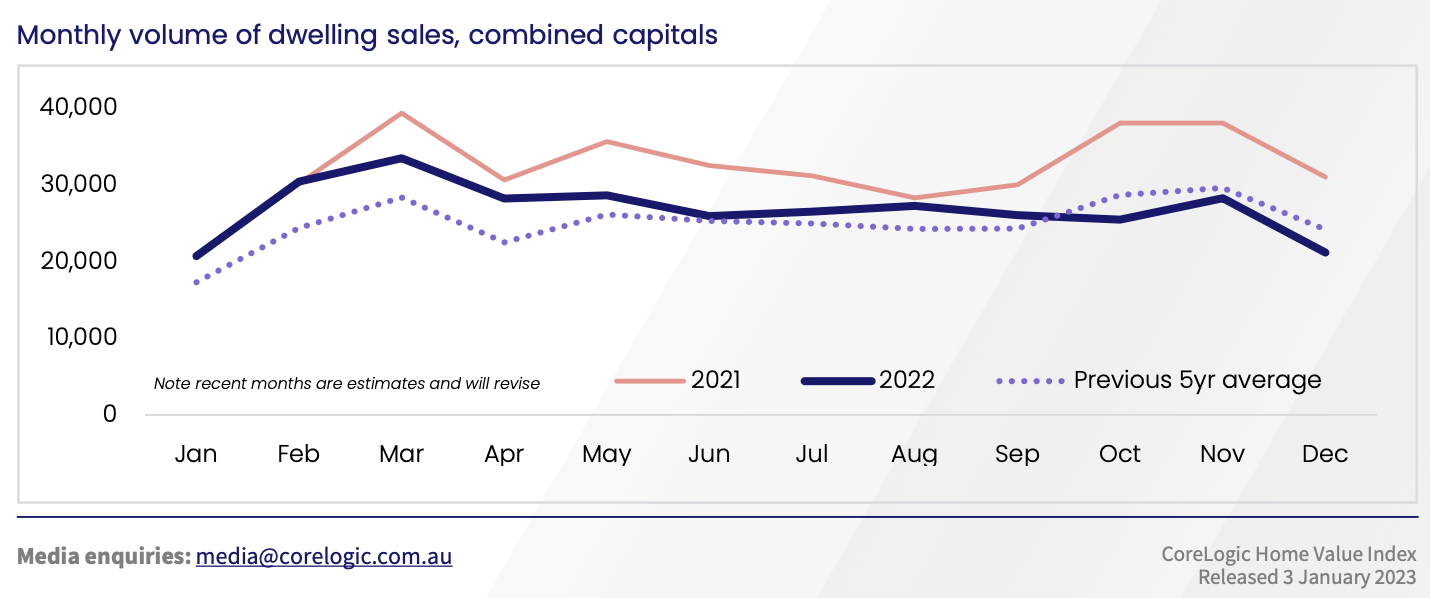

Traditionally the December month is not the month to list you house on the market, yet still there was -7.8% less capital cities dwellings listed on the market in December 2022 than one year ago and advertised stock was down -19.8% than the five year average. This meant there is limited stock available.

“The trend in housing inventory showed a conspicuous lack of seasonality through spring and the first month of summer, with advertised supply holding reasonably firm post-winter. Vendors have been reluctant to test the market through the downturn, with the number of new listings over the past four weeks almost -31% lower than a year ago when capital city homes were selling in around 20 days. Today, the median time on market has increased to 31 days, leading to a blow out in vendor discounting rates from just 3.1% a year ago to 4.2% at the end of 2022,” Mr Lawless said.

The volume of sales was also down an estimated -30.1% than a year ago and -9.2% on the previous five year average.

If you are an investor, the worries of covid are a distant memory, with the national dwelling rent values increasing a further 0.6% in December to be 2.0% higher through the December quarter and up 10.2% over the calendar year. Rents rose across every broad region and housing type across the country over the past year, ranging from a 4.0% rise in house rents across the ACT to a 15.5% increase in Sydney unit rents.

Interest rates heavily impact on housing values, compared to rental market conditions have been more closely linked to demographic trends through COVID. The pandemic has spread families and shared houses with fewer people per household. More recently, the strong return on overseas migration has added substantially to rental demand in 2022 and is predicted to remain strong into 2023. High rental demand is most likely to be concentrated in Sydney and Melbourne, where it is anticipated to absorb sixty per cent of the overseas migration. Such strong rental appreciation has occurred alongside record-low vacancy rates. The combined capital rental vacancy rates finished the year at 1.2%, ranging from 0.4% in Adelaide to 1.8% across Darwin.

CoreLogic Australia Key Points for Consideration for 2023 Outlook

Similar to 2022, the 2023 calendar year could be one of the contrasts; not all regions or capital cities are created equally. Housing affordability is the driving force behind the rapid growth.

Interest rates - CoreLogic is anticipating at least one more increase of +0.25 basis points to be added to the cash rate of now 3.10, this will peak around mid-year.

A surge in fixed-rate loan refinancing is around the corner. 35% of outstanding housing credit is on fixed terms, and 60% is to expire in 2023.

A rise in the number of newly listed properties as pent-up supply flows into the market. The flow of new listings has been abnormally low through the second half of 2022 as prospective vendors postponed or reconsidered their selling decisions in light of worsening housing market conditions. vendors are waiting to reach the top of the interest rate cycle.

As interest rates peak and inflation ease, housing values are likely to stabilise; however, a broad-based rise in housing values would depend on interest rates coming down or on other forms of stimulus. A potential easing credit policy could take the form of a reduction in APRA’s serviceability buffer (currently three percentage points, previously 2.5 percentage points), which could reflect an acknowledgement that mortgage rates aren't likely to rise much further following the recent adjustment from record lows.

Considering how important housing is to the household sector and the broader economy, it’s possible any combination of these outcomes could come to fruition later in the year. Australian housing is valued at approximately $9.4 trillion, almost three times the value of Australian superannuation funds and more than three times the value of Australian listed stocks. The housing comprises roughly 58% of household wealth and 62% of ADI balance sheets.

Rental markets are set to remain tight in 2023.

Resilient labour market conditions are expected to underpin borrower serviceability. Labour market outcomes will be critical in containing mortgage stress and empowering households to keep up with rising interest and rent costs through 2023. Overall, households are expected to be well-placed to deal with rising interest costs through 2023.

To Read the full report, click on the link below.

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.