The Time is Now: A Smart Move for Aussie Expats

The Time is Now: A Smart Move for Aussie Expats

Discover the latest insights and trends in the real estate market with the CoreLogic HVI (Home Value Index) report for April 2024.

The latest CoreLogic HVI April report highlights the remarkable resilience of the Australian property market; potential buyers are showing no signs of being deterred by interest rates as they continue to enter the market. The data from March (+0.6%) reveals an exceptional 14 months of continuous growth, bouncing back from the decline of -7.5% experienced between April 2022 and January 2023. Australia’s Property Home Value Index (HVI) has surged by 10.2%, which is equivalent to a substantial increase of around $71,832, setting new record highs consistently since November of the previous year. It is worth noting that all capital cities, except Darwin, experienced growth. Darwin experienced a slight decline of -0.2%.

Competitive auctions are back, but not for all Melbourne properties.

Competitive auctions are back, but not for all Melbourne properties.

We a property it at approximately $3.45 million, possibly even $3.5 million, amid competition. To our surprise, the bidding war concluded at a remarkable $4.3 million, leaving the vendor thrilled and neighbouring property owners reevaluating their price expectations.

CoreLogic AU - HVI +0.7 August 2023 Growth Easing in Regions, SYD - New Listings Rising

CoreLogic AU - HVI +0.7 August 2023 Growth Easing in Regions, SYD - New Listings Rising.

Finally, buyers have some stock returning to the market, with growth in Sydney’s stock level is up +18%. Regions are also experiencing an easing in HVI as new listings are rising. The nation experienced its 5th consecutive growth month in CoreLogic Australia Home Value Index HVI on August 1st, with dwelling prices increasing nationally by +0.7%, with Cities recording +0.8%, and regional growth slowing to+0.2%.

A dormant market with signs of a strong spring selling season.

A dormant market with signs of a strong spring selling season.

Lauren Staley, Managing Director of Infolio Property Advisors, shares her insights about the upcoming Spring Market.

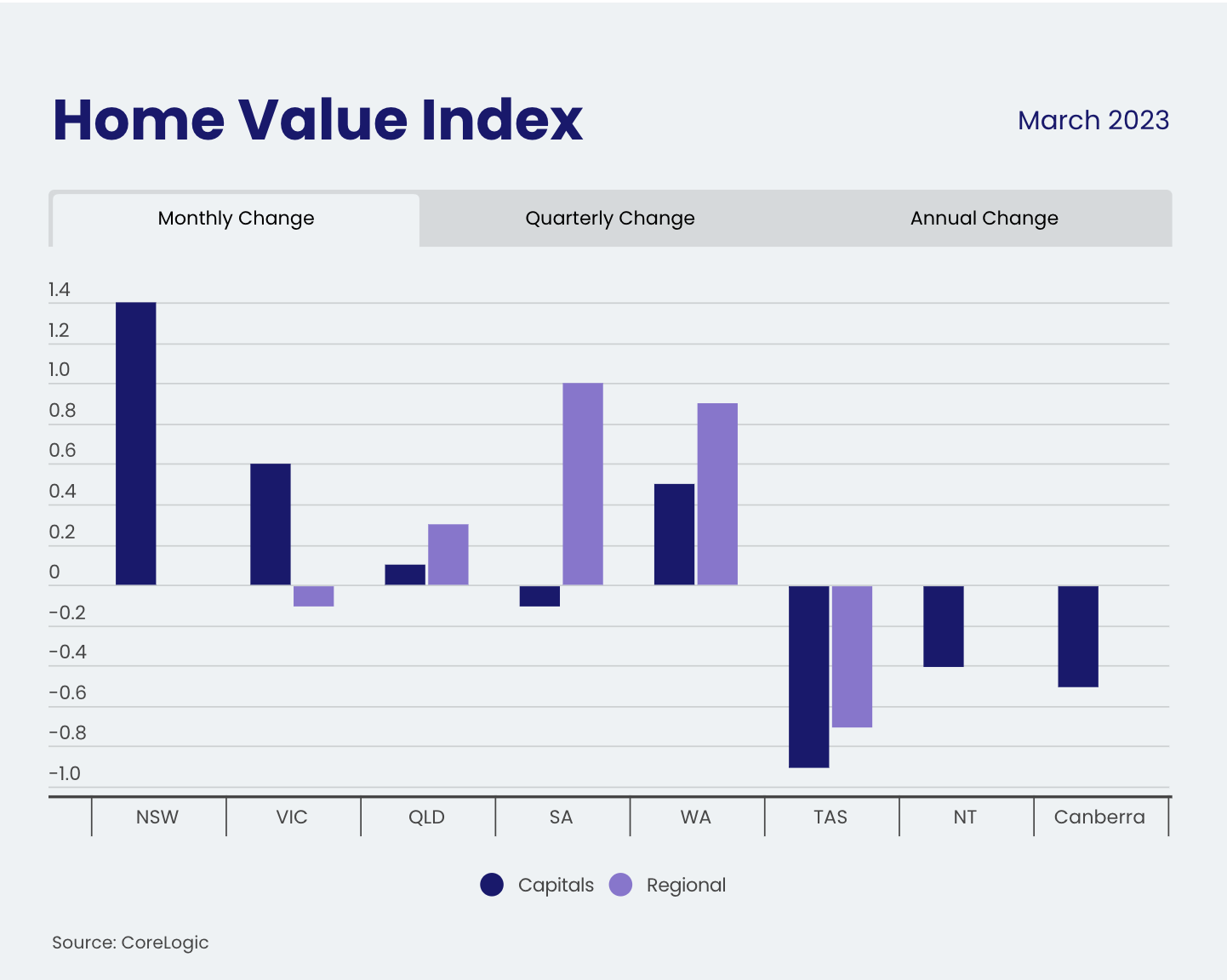

CoreLogic Home Value Index (HVI) posted the first month-on-month rise since April 2022, up 0.6% in March.

The lift in HVI, from the flat February -0.1% has been most evident across the blue-chip suburbs in the market, +2.0% in March, and the upper quartile of the Sydney unit market also followed this trend and was + 1.4% for the month.

Here are the HVI in order from best - lowest performers from the Capital Cities for Median Dwelling Value (MDV)

Sydney +1.4% MDV - $1,014,393

Melbourne +0.6 % MDV - $747,322

Perth +0.5% MDV - $567,111

Brisbane +0.1+ MDV - $698,071

Adelaide -0.1 MDV - $645,721

Darwin -0.4 MDV - $492,465

Canberra -0.5 MDV - $828,175

Hobart -0.9 MDV - $650,689

Your Empire Property Market Update March 2023

Your Empire Property Market Update March 2023.

THE EXPATRIATE Property Specialist, Lauren Staley Infolio Property Melbourne, Chris Gray Your Empire Sydney, Zoran Solano, and Hot Property Buyers Agency Brisbane share insider market updates and tips for buyers and vendors in their YouTube Video with us. Here are there key points below;

CoreLogic Home Value Index (HVI) February 2023 - Have we hit the bottom?

CoreLogic Home Value Index (HVI) February 2023 - Have we hit the bottom?

CoreLogic’s Home Value Index (HVI) for February recorded a sharp reduction in the rate of decline through February.

Your Empire Property Market Report February 2023

Chris Gray from Your Empire Sydney, Lauren Staley from Infolio Melbourne, and Zoran Solano from Hot Property Buyers Agency Brisbane shared their February 2023 Property Market Report.

What does the market feel like in Melbourne?

Lauren said in the Melbourne Bayside area, “It was a slow start to the year with low lock levels, only the leftover stock still on the market that will probably need a price adjustment. An auctioneer says they were only two Auctions in their area booked for February.” However, there if hope for buyers, many potential sellers in Melbourne are obtaining property appraisals and predicting the quality stock will return to the market from March onwards.

CoreLogic Home Value Index (HVI) Report January 2023

CoreLogic Australia Home Value Index (HVI) recorded its lowest fall in property prices since June 2022. The national HVI average recorded was -1.0% for January 2023.

“The quarterly trend in housing values is clearly pointing to a reduction

in the pace of decline across most regions, however at -1.0% over the

month and -3.2% over the rolling quarter, national housing values are

still falling quite rapidly compared to previous downturns”

CoreLogic Home Value Index (HVI) December

The Housing Value Index (HVI) weakened with CoreLogic’s national Home Value Index falling -1.1% in December, taking values -5.3% lower over the 2022 calendar year.

Melbourne, Sydney, Adelaide and Darwin all re-acceleration their downward trend led by Sydney -1.4% and Melbourne with a decline of -1.2% fall for the month. The biggest downturn was still in Brisbane, however with a slowing of the dip from -2% in November to -1.5% in December.

CoreLogic December Property Report - Annual Changes - Tim Lawless

Thank You, Tim Lawless, Executive Research Director from CoreLogic Australia, for the December Market Report.

Tim shares his expert data research of the market and the potentially positive outlook for 2023. The stats show the seven consecutive month decline has slowed. However, there is a chance of a double dip in the market, but with employment at record lows and interest rates looking to peak in early-mid 2023, one might be able to predict a bright outlook for the Third Quarter of 2023.

CoreLogic Home Value Index Report - October - Key Points

CoreLogic Home Value Index (HVI) Report is out, and it has recorded six months of falls for Australia’s residential property market. Here are our six key points below;

National Decline in HVI Has Slowed.

South Australia and Adelaide are showing resilience to the recent interest rate rises as housing affordability becomes the main driver of growth in the current market.

CoreLogic - Tim Lawless, Executive, Research Director, Asia-Pacific, shares his insight on the housing market and what stage of the cycle we are currently in.

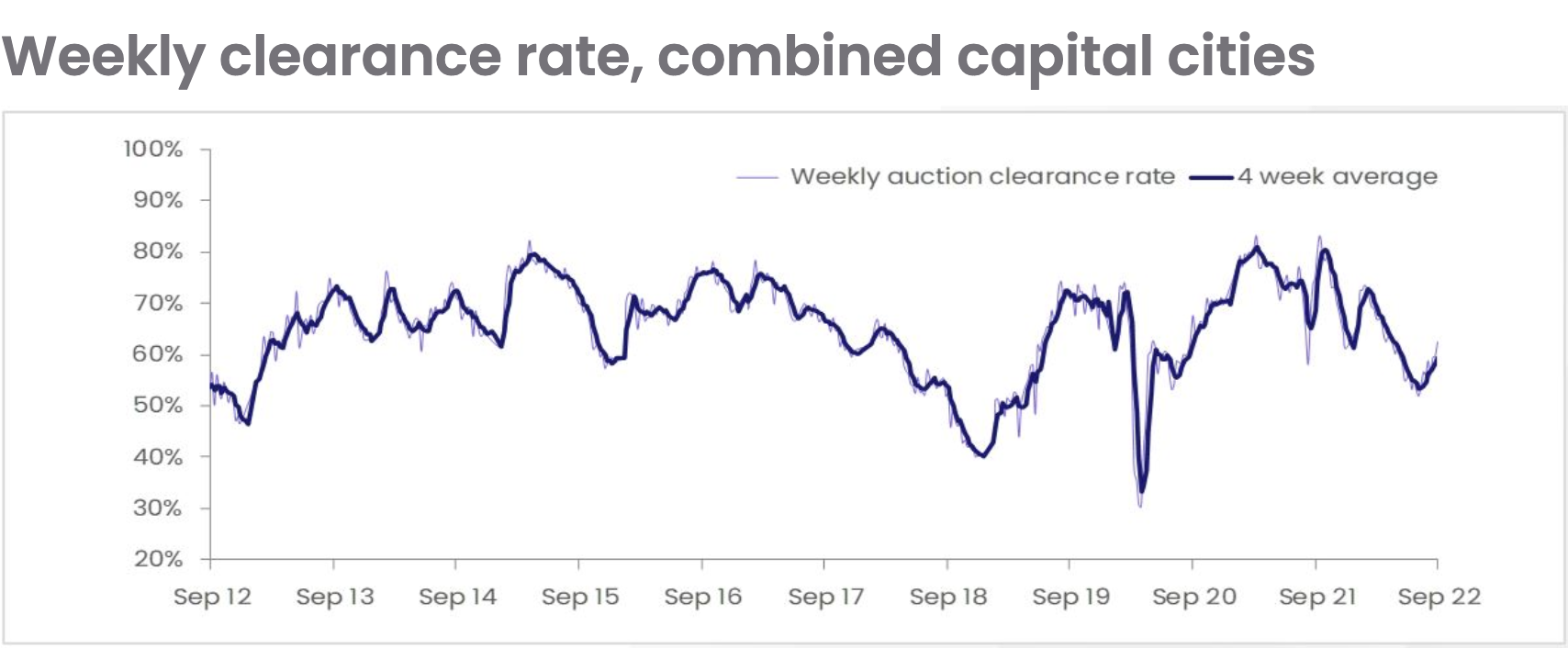

Corelogic Auction Clearance Rates

Corelogic Auction Clearance Rates

We have the CoreLogic Australia Auction Clearance rates for this week in September. There were 2,190 auctions held across the combined capital cities this week, up from 1,918 over the previous week and 1,672 this time last year making it the busiest auction week since late June. Overall auctions were up from 1672 in 2021 to 2190 in 2022.

Corelogic July Index Report

“Australian dwelling values fell by -1.3% in July, marking the third consecutive month CoreLogic’s national Home Value Index has fallen. After national dwelling values surged 28.6% through the pandemic growth phase, values are now -2.0% below April’s peak.”

Tim Lawless - CoreLogic Australia

Why the property market will not collapse because of rate hikes.

Why the property market will not collapse because of rate hikes.

We chatted to Michael Cleary our Property Growth Specialist from Milk Chocolate Property to share his thoughts on the recent interest rate hikes and their impact on the property market.

What is a Blue-Chip Property?

What is a Blue Chip Property?

What is the most important thing to think about when buying a property? If you think Blue-Chip property is going to continually rise in the LONG TERM (like it has in the past), it doesn't matter nearly as much as what you pay today, the most important thing you should be asking yourself is how much it will be worth in 10-20 years time? Why is this so?

Small Cites, Regional Areas Drive Growth in Housing - March Corelogic Report

Corelogic Australia March Home Value Index (HVI) is out, and we have some interesting findings to share with you. Here are our key points from Executive Research Director, Asia Pacific Tim Lawless's March Report.

What are the benefits of investing in Australian Property?

What are the benefits of investing in Australian Property?

The Australian property market has boomed through the global pandemic with record financial gains over the past few years. Australia has seen a safe place to invest in property. Australians desire property like no other nation; here are some key points to why it is beneficial to purchase property in Australia.