CoreLogic Home Value Index (HVI) February 2023 - Have we hit the bottom?

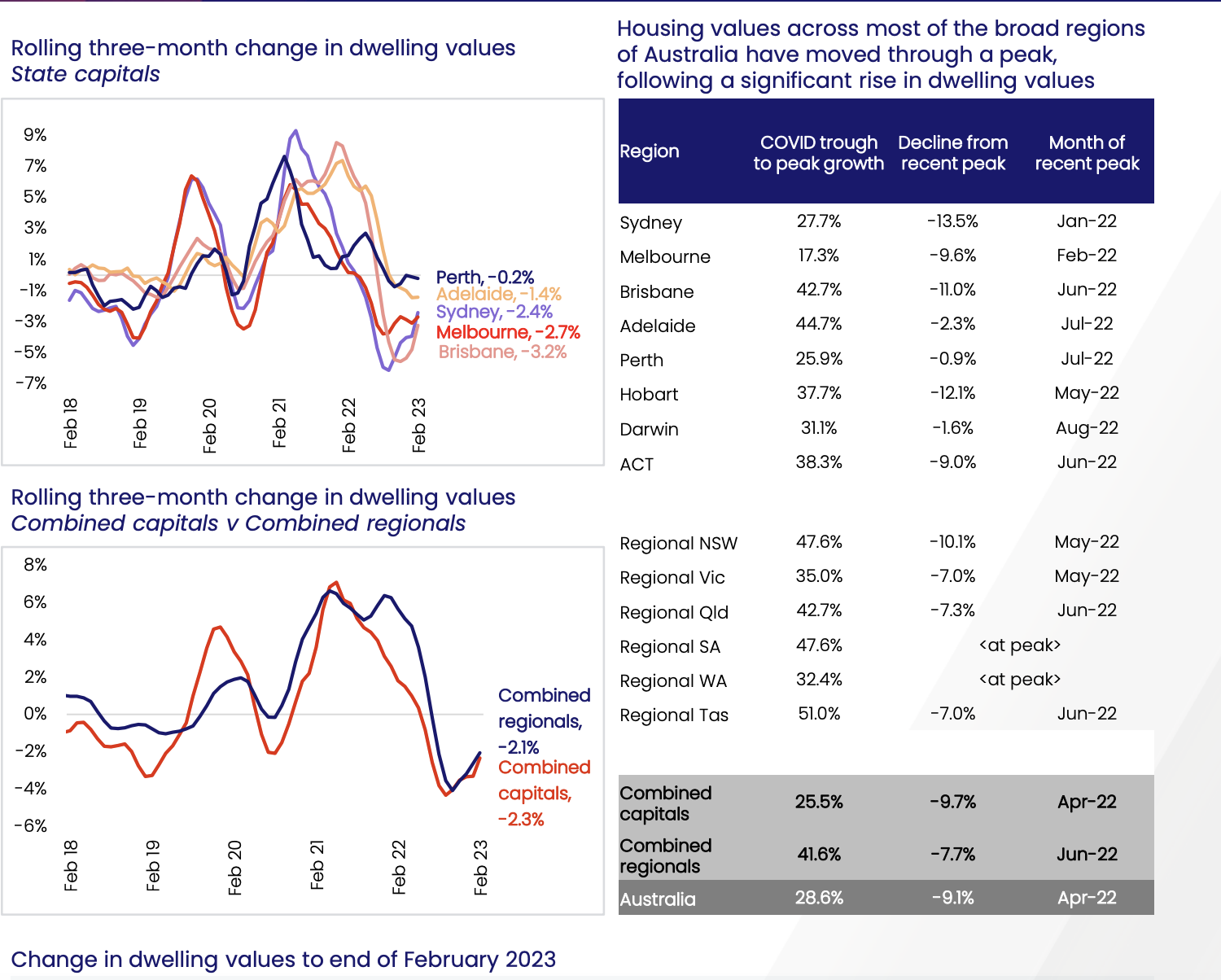

CoreLogic’s Home Value Index (HVI) for February recorded a sharp reduction in the rate of decline through February.

“The national index declined - 0.14% over the month, the smallest monthly fall since May 2022 (- 0.13%), when rate hikes commenced. A 0.3% rise in Sydney dwelling values was the most significant driver of the national deceleration, however, the loss of downwards momentum was broad-based. Darwin (-0.3%) was the only capital city to record a steeper monthly fall in February, albeit from relatively flat conditions previously. Every other capital city except Hobart (-1.4%) saw housing values fall by less than half a per cent over the month.”

Tim Lawless Corelogic Australia

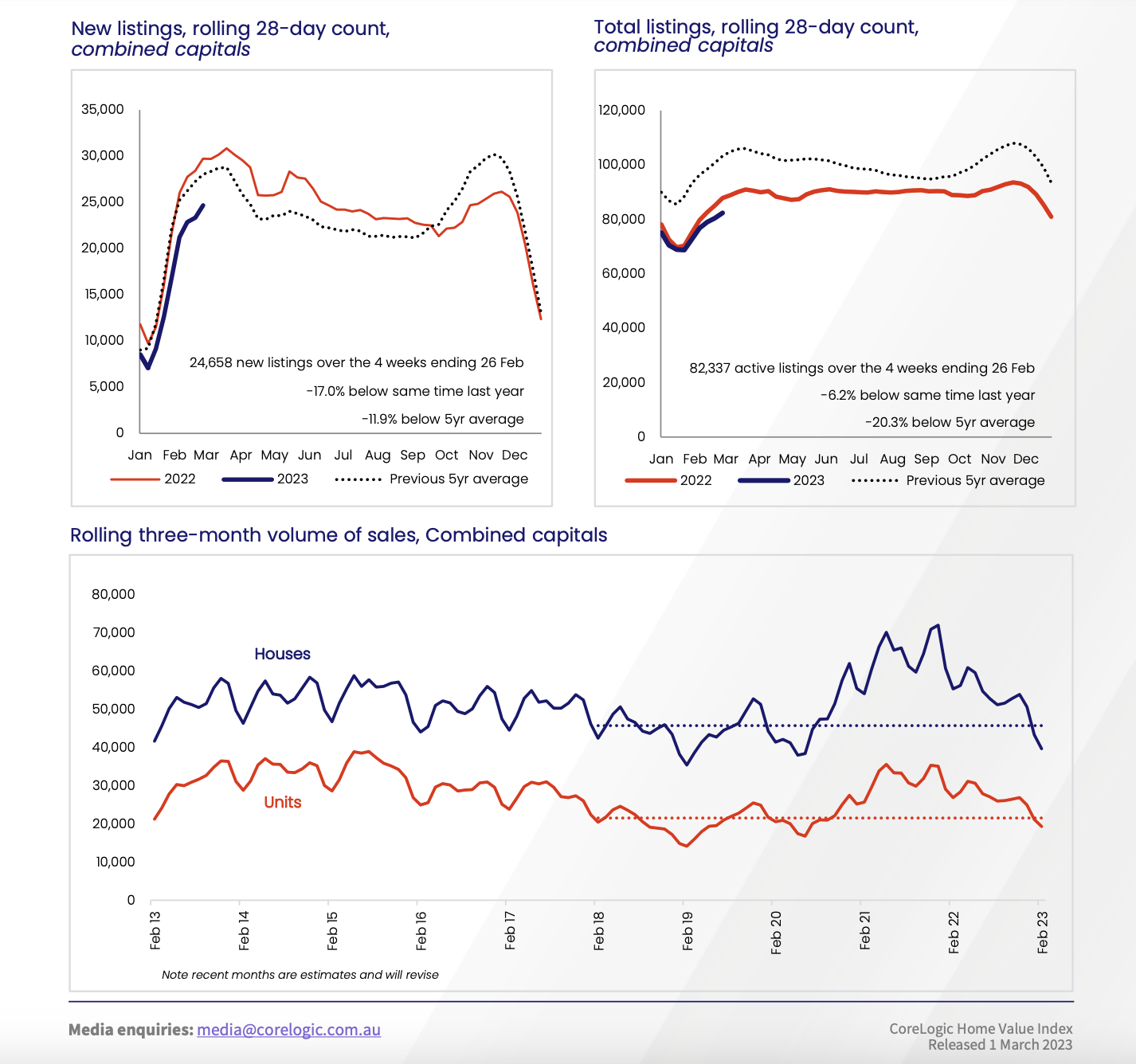

Currently, the market is experiencing historic lows in new listings and overall stock levels. With only 24,658 new listings over the four weeks ending 26 February, that’s -17.0% below the same time last year -11.9% below 5yr average. Overall stock levels are also tight with 82,337 active listings over the four weeks ending 26 February -6.2% below the same time last year and a whopping -20.3% below 5yr average, which is behind the stabilisation of the market.

“The past four weeks have seen the flow of new capital city listings tracking -17.0% lower than a year ago and -11.9% below the previous five-year average,” Mr Lawless said. “This trend towards a below average flow of new listings has been evident since September last year, coinciding with a loss of momentum in the rate of value decline.”

CoreLogic recorded Auction clearance rates also bouncing back through February, with the capital city weighted average reaching the high 60% range through the second half of the month, with Sydney leading the way with clearance rates rising to above 70% in the week ending 19 February, for the first time since February 2022.

Units have seen the largest increase in rentals increases in the capital cities, led by a 16.7% jump in Sydney unit rents over the past year.

“Although unit rents in the largest cities showed a period of weakness through the early phase of the pandemic, weekly rental values for units are now 19.0% higher than at the onset of COVID in Sydney, 10.4% higher across Melbourne and 23.6% up in Brisbane,” Mr Lawless said. “Several factors are likely to be contributing to the surge in unit rents. Rental affordability pressures may be forcing a transition of demand towards higher-density rental options (where costs tend to be lower). Additionally, the strong rebound in foreign student and international migrant arrivals would be adding to rental demand, particularly in inner city precincts as well as areas within close proximity to universities and transport hubs.”

Tims Key Takeaways

Looking forward, despite the recent trend towards stabilisation, housing risks remain skewed to the downside.

The past few weeks have seen a more ‘hawkish’ shift in messaging from the RBA. Three of the Big Four banks are now expecting the cash rate to peak at 4.1% between May and June. At this level, the average variable mortgage rate for a new owner-occupier loan would be in the vicinity of 6.0% and, based on a three percentage point serviceability buffer, prospective borrowers would be assessed to service their loan repayments at a mortgage rate of around 9%. APRA recently released a statement reinforcing that a three percentage point serviceability buffer remained prudent in the currently uncertain economic environment.

Serviceability of existing home loans may be challenged this year.

Longer term, the market is poised for recovery.

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.