Corelogic Auction Clearance Rates

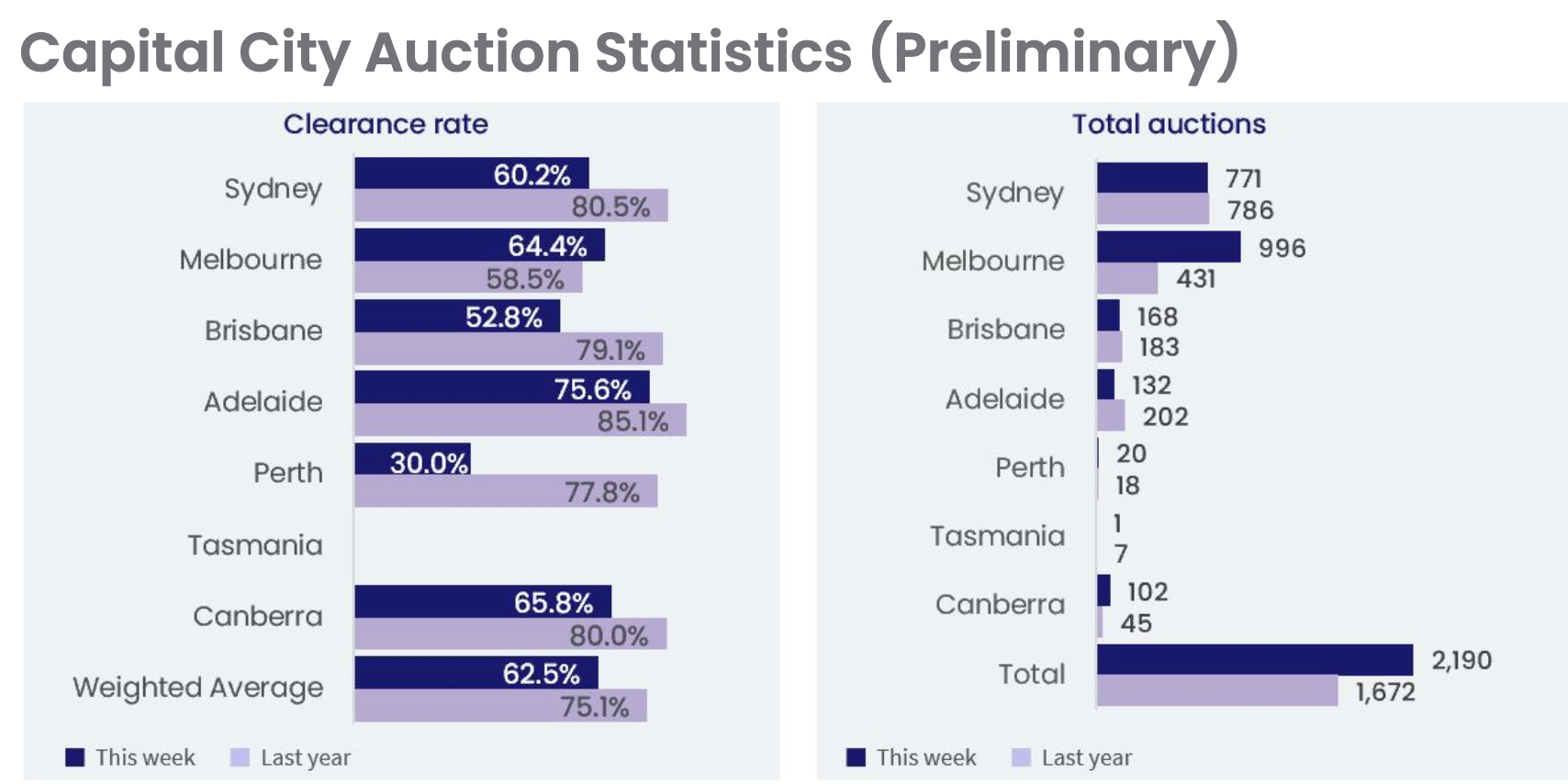

We have the CoreLogic Australia Auction Clearance rates for this week in September. There were 2,190 auctions held across the combined capital cities this week, up from 1,918 over the previous week and 1,672 this time last year making it the busiest auction week since late June. Overall auctions were up from 1672 in 2021 to 2190 in 2022.

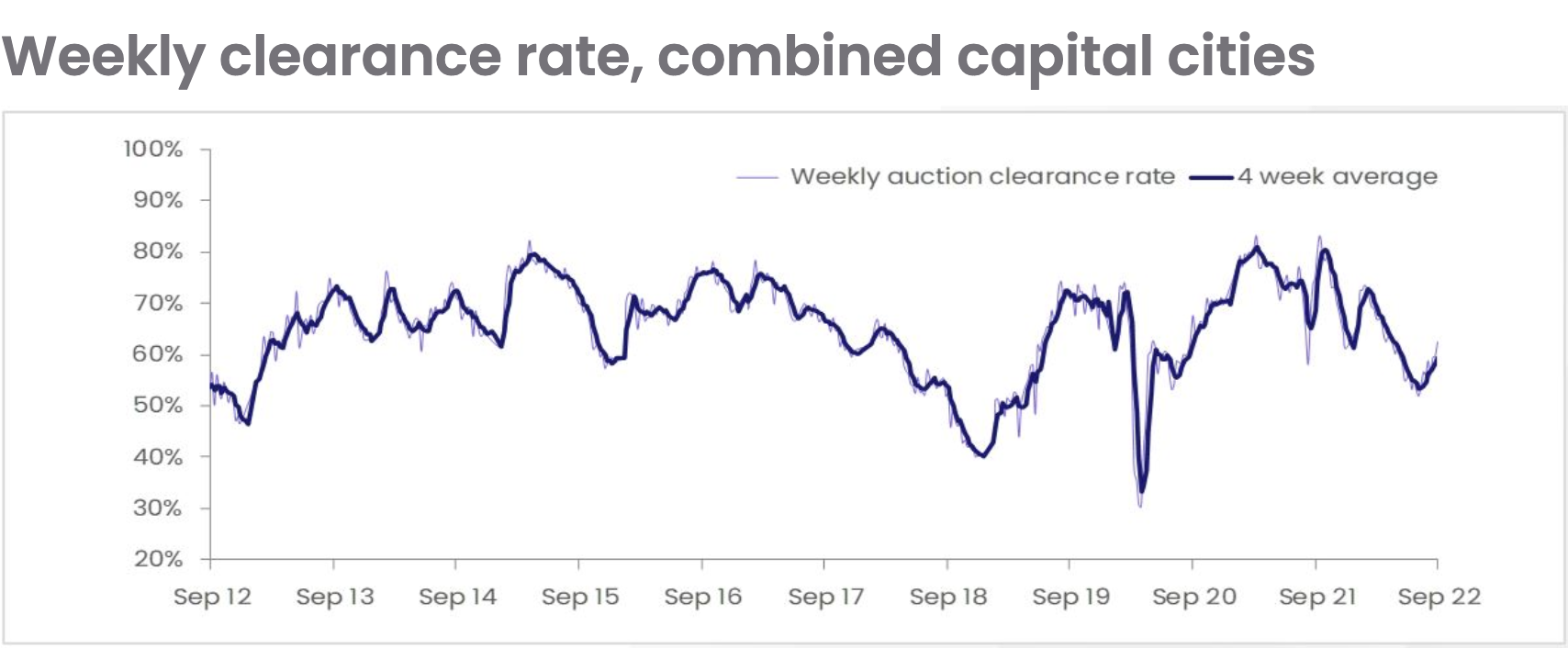

62.5% Auctions were successful and aligned with what is usually anticipated for clearance rates across the ten-year trend.

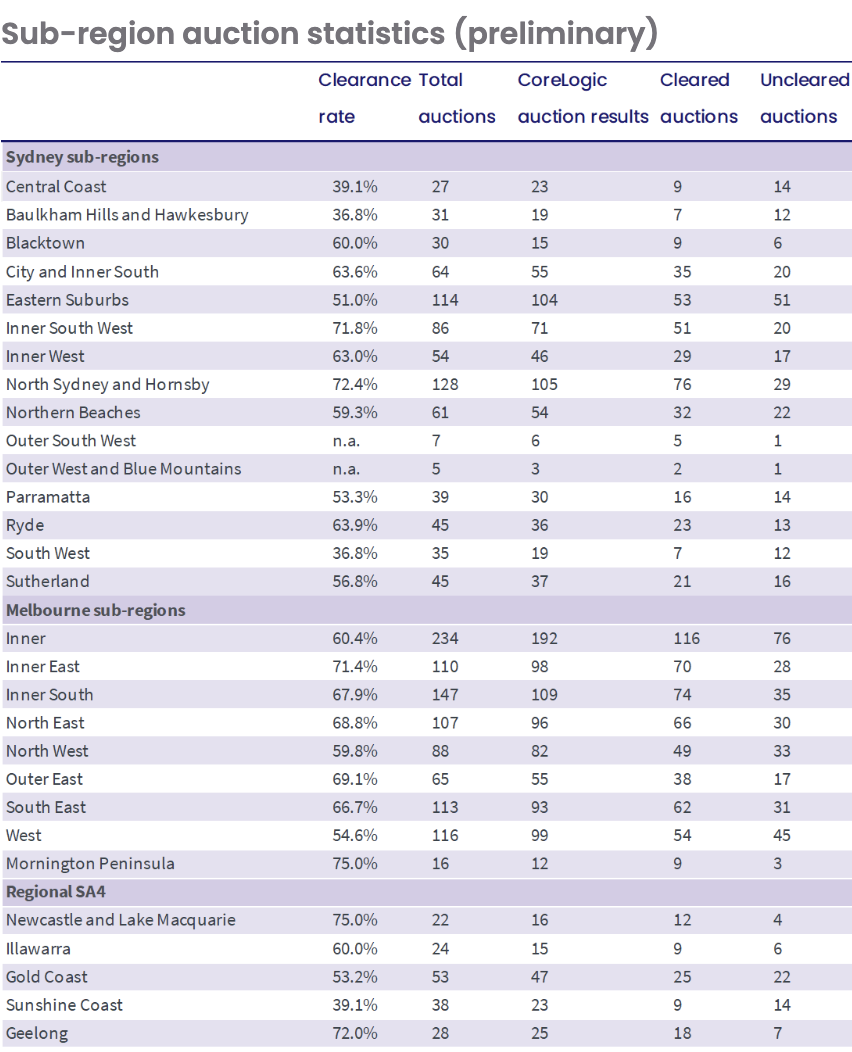

The clearance rates were up slightly from the previous week’s preliminary clearance rate of 61.7%, which was revised down to 59.7%, the highest final clearance rate seen since the week ending 22 May 2022 (61.3%). Melbourne and Victoria lead the way and remained strong amidst interest rate rises. The Mornington Peninsula recorded 75% compared to 54.6% in the West Melbourne Area.

In Sydney, not all areas are equal with the clearance rates. Blue Chip Properties in the North Sydney and Hornsby area recorded 72.4%, compared to South West of Sydney 36.8%.

What about Regional Areas?

NSW remained strong with Newcastle and Lake Macquarie 75%, Geelong 72%, Illawarra 60%, however in Queensland, we’ve seen a clear drop with Gold Coast recording 53.2% and more surprisingly Sunshine Coast with 39.1%

This time last year, 75.1% of auctions were successful.

The AFL Grand Final, School Holidays, and public holidays mean that there will be a considerable less volume in Auctions next week with around 1,400 auctions currently scheduled across the combined capitals.

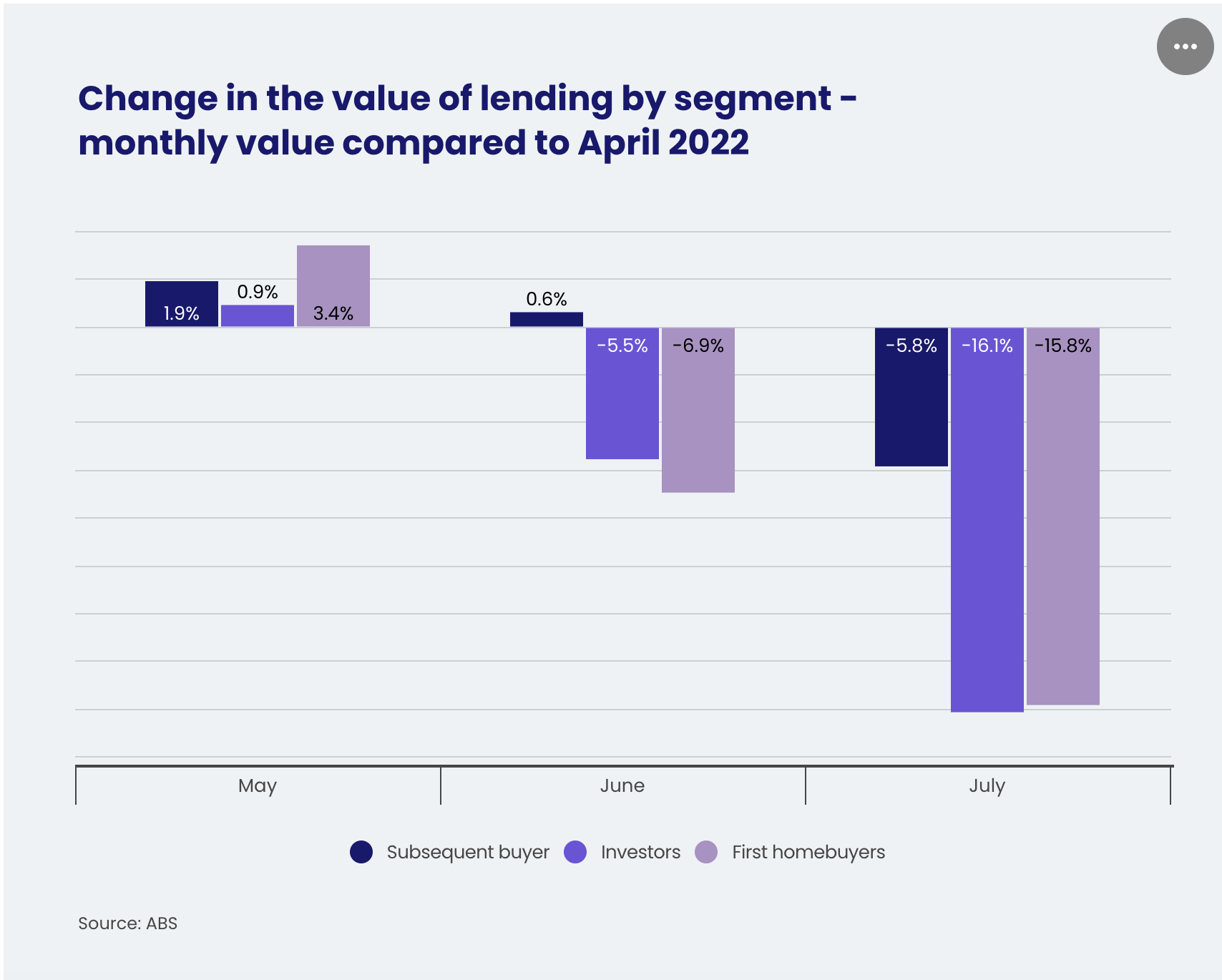

Who’s still buying Australian property?

We look at the mortgage approvals for each cohort. The demand for housing finance across owner occupiers that are not first home buyers (i.e., subsequent buyers defined as upgraders, movers, and downsizers) appears to be fairly resilient in the rising rate environment. As said above, previous property owners may recently be benefited from large gains in property value growth and making a move now to change property in a downturned market, using the equity in their property, and are now taking advantage of the recent drop in home values.

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.