Corelogic July Index Report

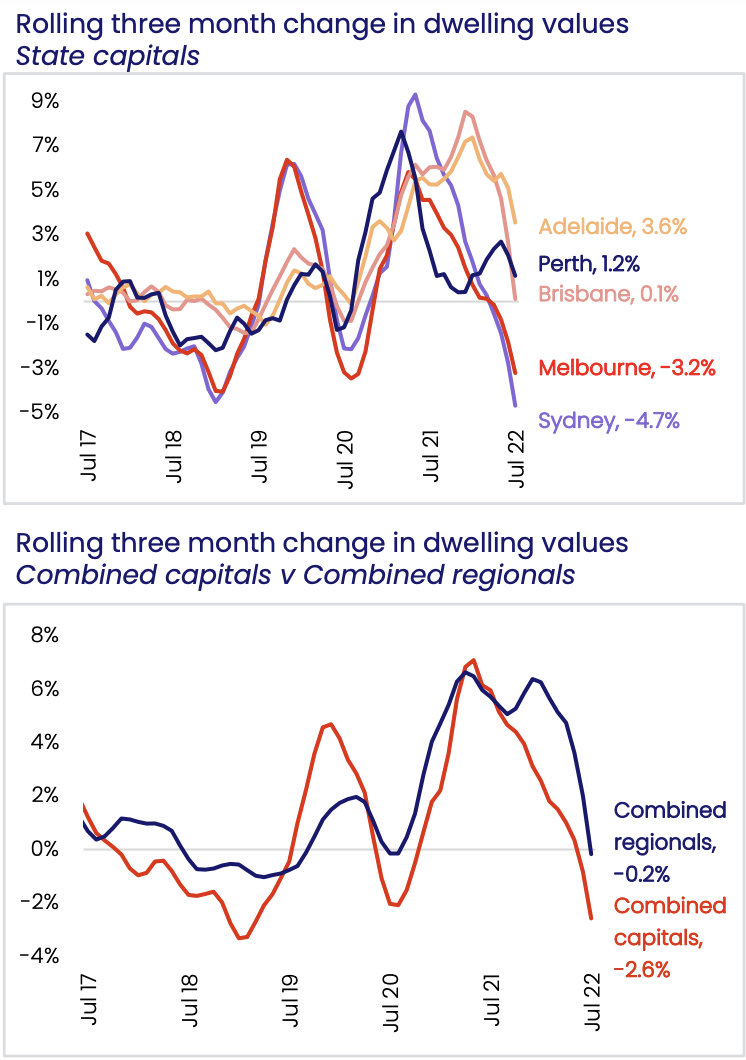

“Australian dwelling values fell by -1.3% in July, marking the third consecutive month CoreLogic’s national Home Value Index has fallen. After national dwelling values surged 28.6% through the pandemic growth phase, values are now -2.0% below April’s peak.”

Tim Lawless - CoreLogic Australia

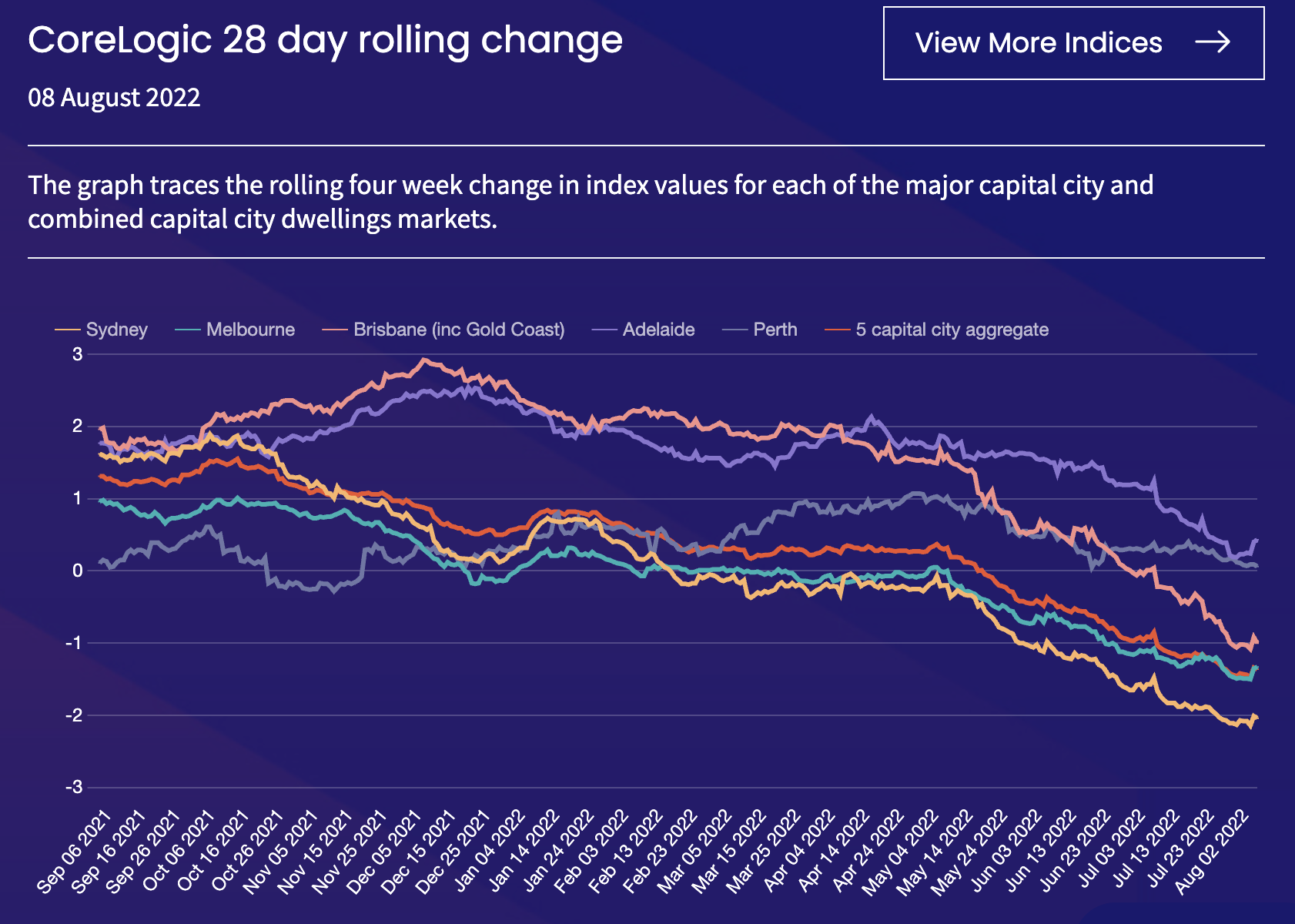

We are seeing a correction in the markets as the rate of growth slows with the recent interest rate rises. We may see a further downward swing in growth after last week’s interest rate rise announcement of the Reserve Bank of Australia’s cash rate to be increased to 1.85%. The experts are divided on exactly how high the cash rate will climb. CBA and NAB have provided an opinion that they can not see the Cash Rate climbing above 3% and believe it will stabilise at the neutral to 2.5% cash rate.

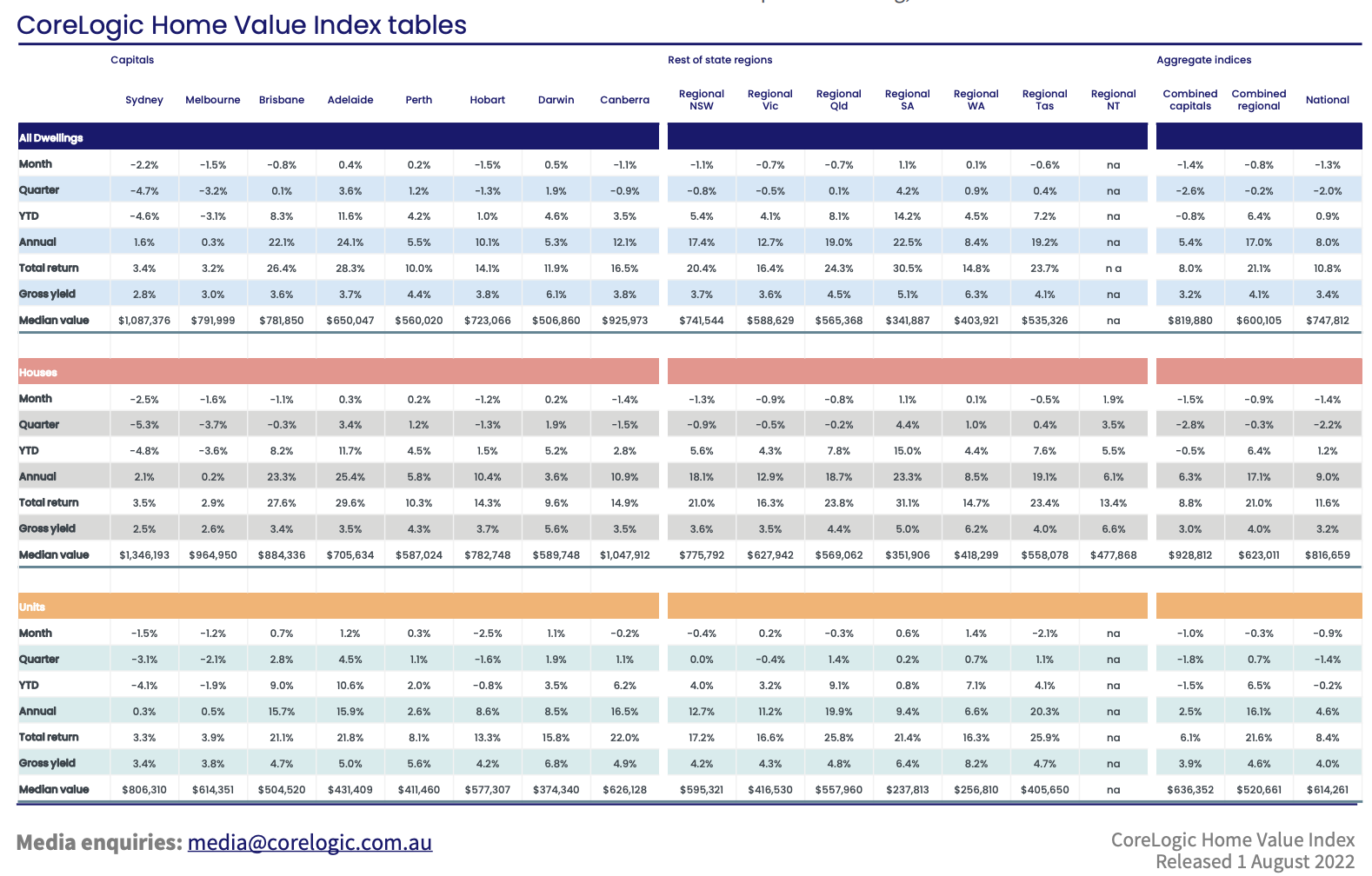

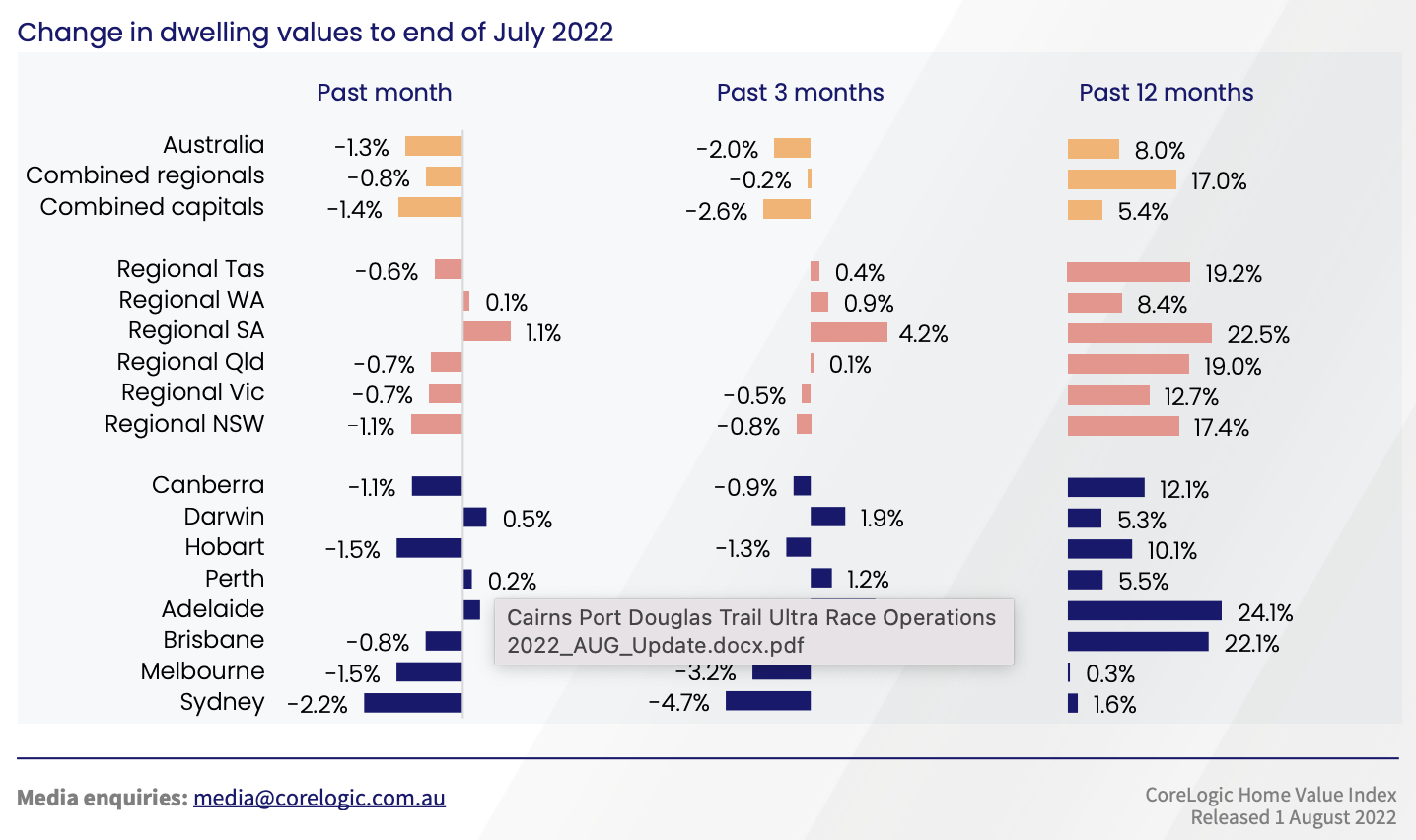

Sydney and Melbourne lead the month-on-month decline in Home Values falling -2.2% and -1.5% respectively. For the first time since August 2020, Brisbane also edged into negative growth recording -0.8%, while Canberra (-1.1%) and Hobart (-1.5%) were also down over the month.

Remaining strong but well off their peaks, Perth (+0.2%), Adelaide (+0.4%) and Darwin (+0.5%) remained in positive growth through July. The regional areas have also reached their peaks in QLD, -0.7%, VIC -0.7%, and NSW -1.1% with TAS following the downward trend as well with -0.6%.

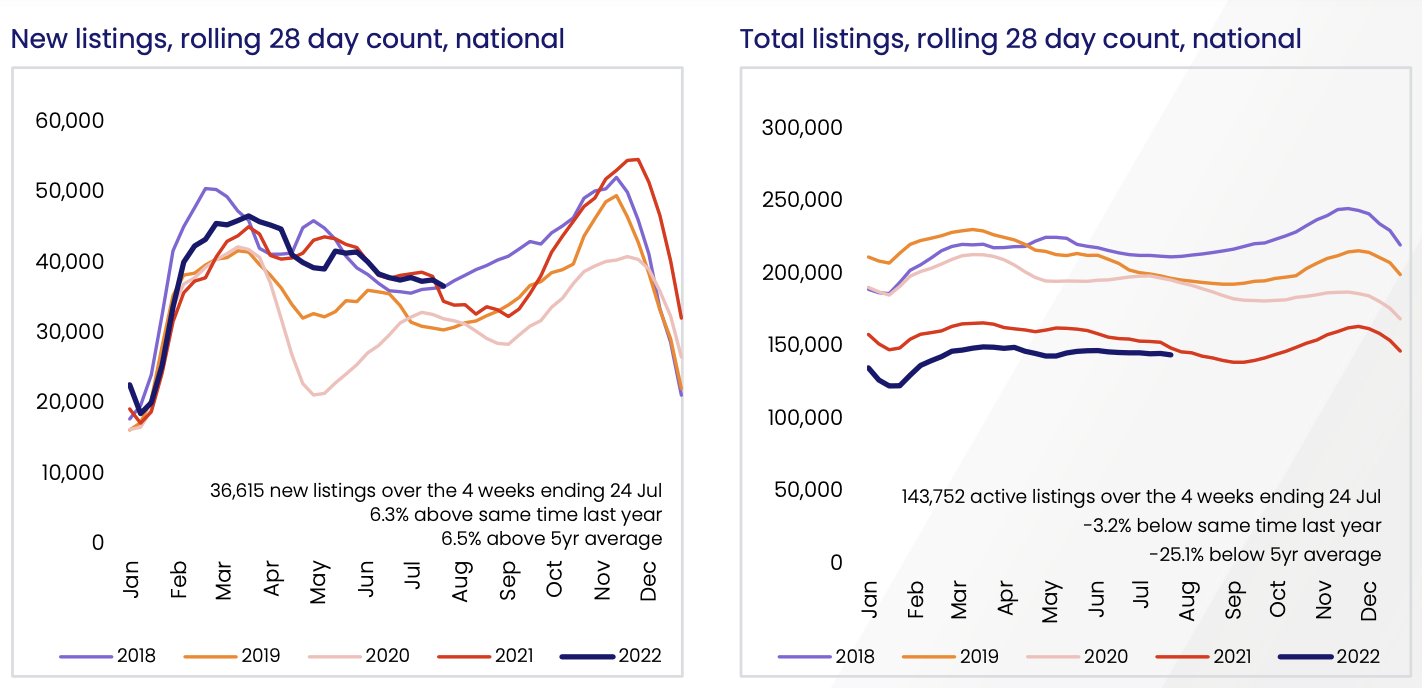

What is keeping the market buoyant is the lack of supply in the market. Total listings are still -25.1% below the last five-year National 28-Day Count. There is some hope for buyers, there were 36,615 new listings over 4 weeks ending July which is 6.3% above the same time last year and 6.5% above the five-year average. Supply is returning but there still is a -25% lack of supply on the market dwellings are still moving at a speedy rate.

The question is has Sydney and Melbourne reached the bottom? IN historically more changeable markets, HVI has dropped down to Mid 2018 levels. The previously stable Brisbane is edging close to its 2019 low and Adelaide and Perth markets have a way to go before they drop to their lows in 2019 and 2018 respectively.

Will we see an upturn? Time will tell. There may still be a bit to go, especially in the regional areas in the market before we see the market rebound into positive growth.

Is it becoming a good time to buy? With supply returning to the market, corrections in the market now sustained the buyer has the power to negotiate. However there is still limited Blue Chip Stock, homes are not staying on the market for long, good homes are being snapped up fast which is keeping the supply stocks below the five-year average.

“Although new listings are higher than at the same time last year and previous five-year average, the flow of freshly advertised stock has fallen -21.4% from the mid-March peak, helping to keep overall inventory levels low.”

Tim Lawless - CoreLogic

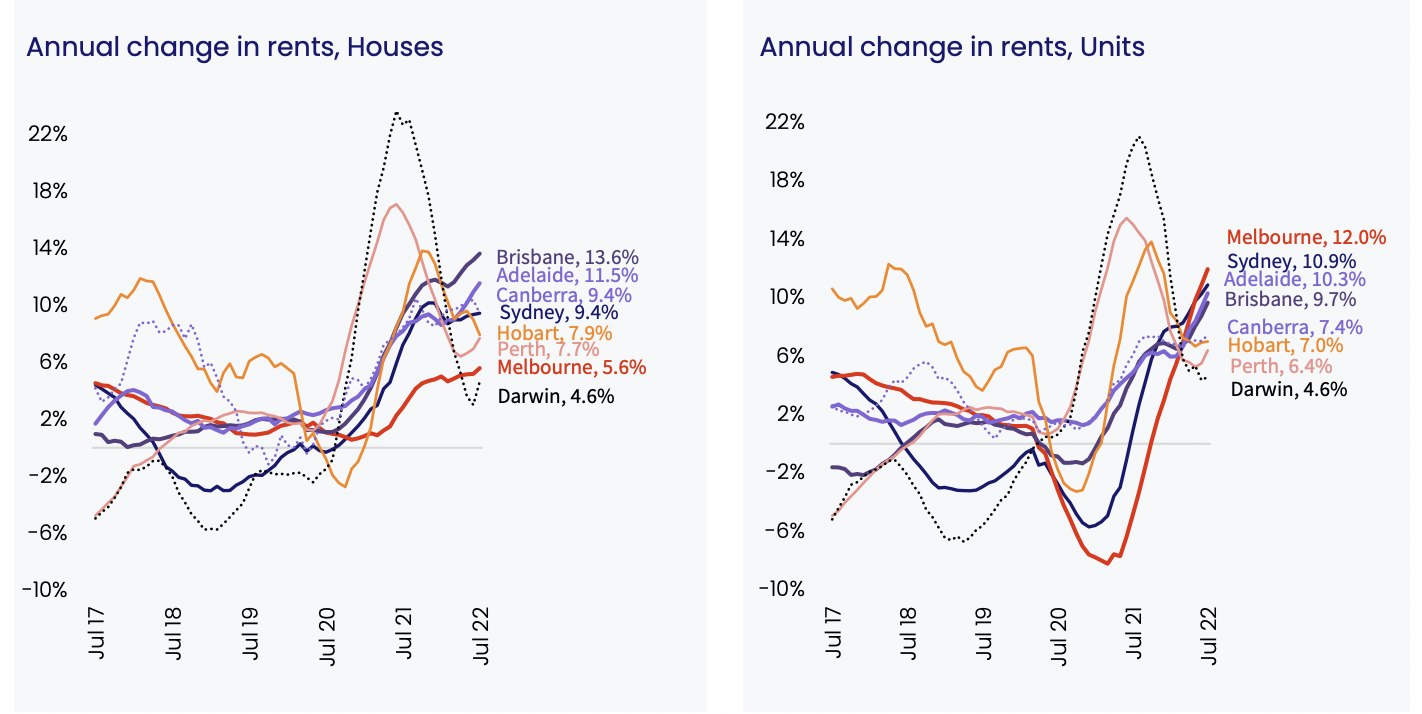

Rental Markets remains strong, rising 0.9% nationally over the month to be 2.8% higher over the rolling quarter and 9.8% higher over the past 12 months.

Brisbane still leads the market with annual growth with + 13.6%, followed by Adelaide +11.5%, Canberra +9.4%, Sydney +9.4% Hobart +7.9%, Perth + 7.7%, Melbourne +5.6% and Darwin +4.6%.

“Rental markets are extremely tight, with vacancy rates around 1% or lower across many parts of Australia. The number of rental listings available nationally has dropped by a third compared to the five-year average, with no signs of a lift in rental supply. On top of already tight rental supply, it’s likely demand will continue to increase as overseas arrival numbers climb,” Mr Lawless said.

The tight rental market and low supply of new stock on the markets with supply chains in construction being disrupted by the pandemic means that investment properties are in a solid position with international borders opening up and migration increasing it is anticipated that the rental market will remain tight in 2022 - 2023.

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.