Why the property market will not collapse because of rate hikes.

We chatted to Michael Cleary our Property Growth Specialist from Milk Chocolate Property to share his thoughts on the recent interest rate hikes and their impact on the property market.

The cash rate

At the monthly meeting on the 5th of July, 2022, the RBA board increased the cash rate target by 50 basis points to 1.35 percent, following a 50-basis-point increase on 7 June 2022 and a 25-basis-point increase on 3 May 2022.

Despite the recent hikes, the current cash rate remains low in comparison to the historical level, therefore, the RBA signaled to the market that further moves are on the way to curb the rising inflation due to COVID-related disruptions to supply chains, the eastern euro war, and strong domestic demand.

The rate hikes have happened on the back of a strong economy and the historically low unemployment rate at 3.9%, solid household spending, and more importantly, housing prices have declined in some large cities.

When considering the impact of cash rate hike episodes on housing prices from a long-term perspective, we find that there is no clear correlation between the two indicators. That means there are other important fundamentals that drive the housing prices rather than the cash rate alone.

Interestingly, the cash rate fluctuates from time to time and property prices keep going up.

We will have a closer look at other market fundamentals that will counteract the impact of cash rate hikes as follows:

Population growth

Despite a developed economy, Australia's population growth is 3 times higher than the OECD average. Australia's population growth in the long-term is 1.7%/year, while the OECD average is 0.5%; the USA is 0.7%, and New Zealand is 0.7%.

High population growth has been the major driving force behind consistent property price growth in the long term.

Overseas migration dropped to virtually zero since March 2020, from 250,000 per year in 2019. As the border opens (February 2022), we expect that overseas migration will return gradually back to the pre-pandemic level in 2 years, which will significantly counteract the negative effect of cash rate hikes.

Building costs

Building costs have increased astronomically since March 2020, due to supply chain disruptions: it is more expensive to manufacture and ship goods around. For example, steel prices have increased by 40%, timber has increased by 300% and crude oil has increased by 80% over the last two years. In addition, the cost of construction has increased by 60% since March 2020. As a result, the cost to build new houses has increased substantially, which will likely constrain the supply of new houses and overall housing supply.

Building approvals

The number of building approvals is one of the leading indicators of the property market. According to the latest data release from ABS, due to the effects of covid, the number of approvals has been substantially below the long-term average, down by 27% in Sydney and 46% in Melbourne.

This will translate to a shortage of properties in the next 1-2 years, coupled with the anticipated increase of overseas migrants, tourists, and students that will put upward pressure on housing prices.

Post-election housing policy

Labour proposed the co-ownership scheme where Australians on low and middle incomes buy houses by giving eligible applicants a commonwealth equity contribution of up to 40% of the purchase price of a new home, and up to 30% for an existing home.

Basically, there is no discussion or concrete plans about boosting housing supply such as changing zones in high-demand areas or fast-tracking the release of land and new developments. Therefore, ultimately, housing stock will remain in short supply for the foreseeable future.

Prices forecasting

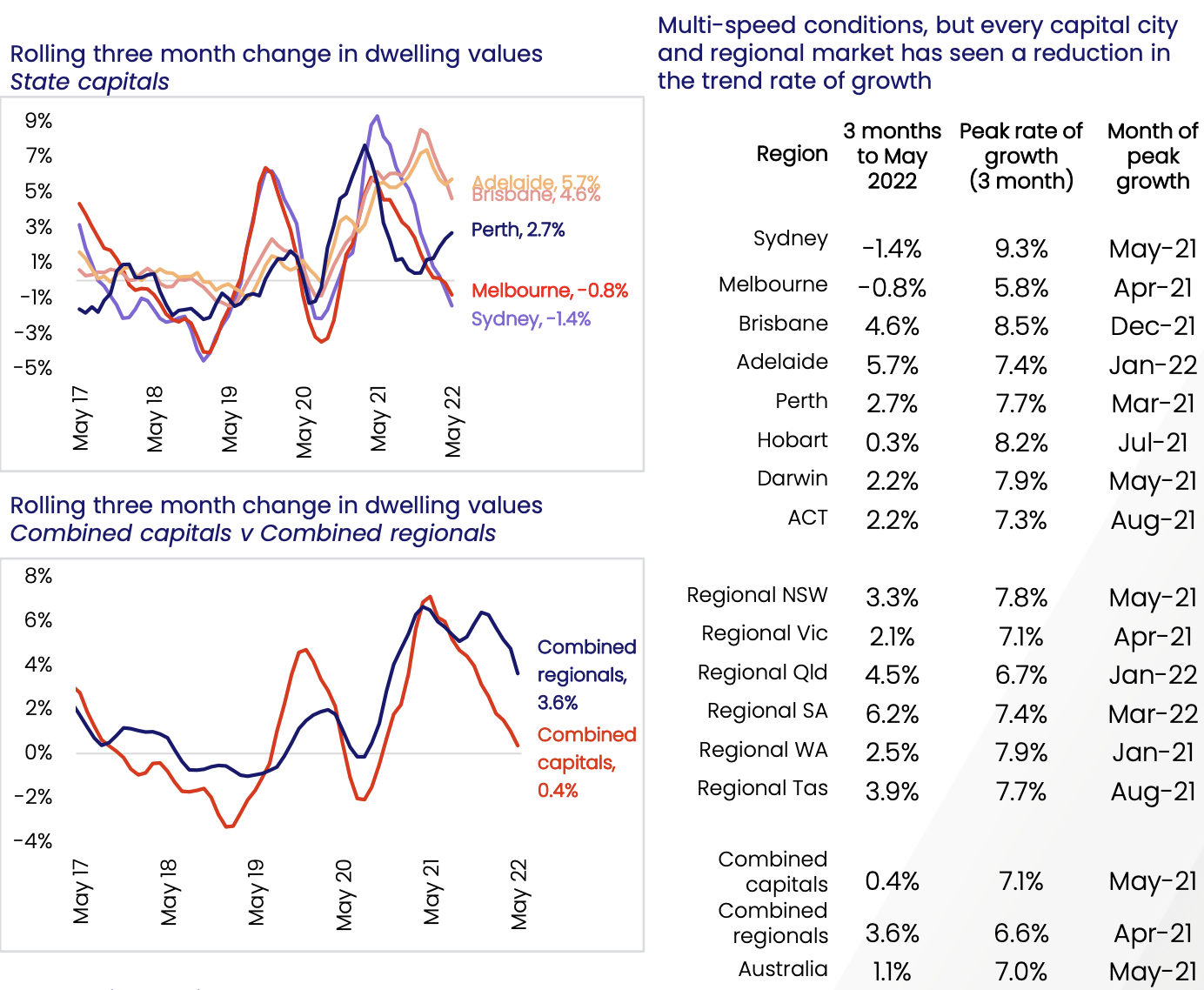

It is obvious that the housing market has transitioned from an upswing generally characterised by a strong and broad-based rise across capital cities and regions to a more diverse growth environment.

We have observed market activities easing in Sydney and Melbourne: the auction clearance rate has dropped and vendors are more realistic with their asking prices.

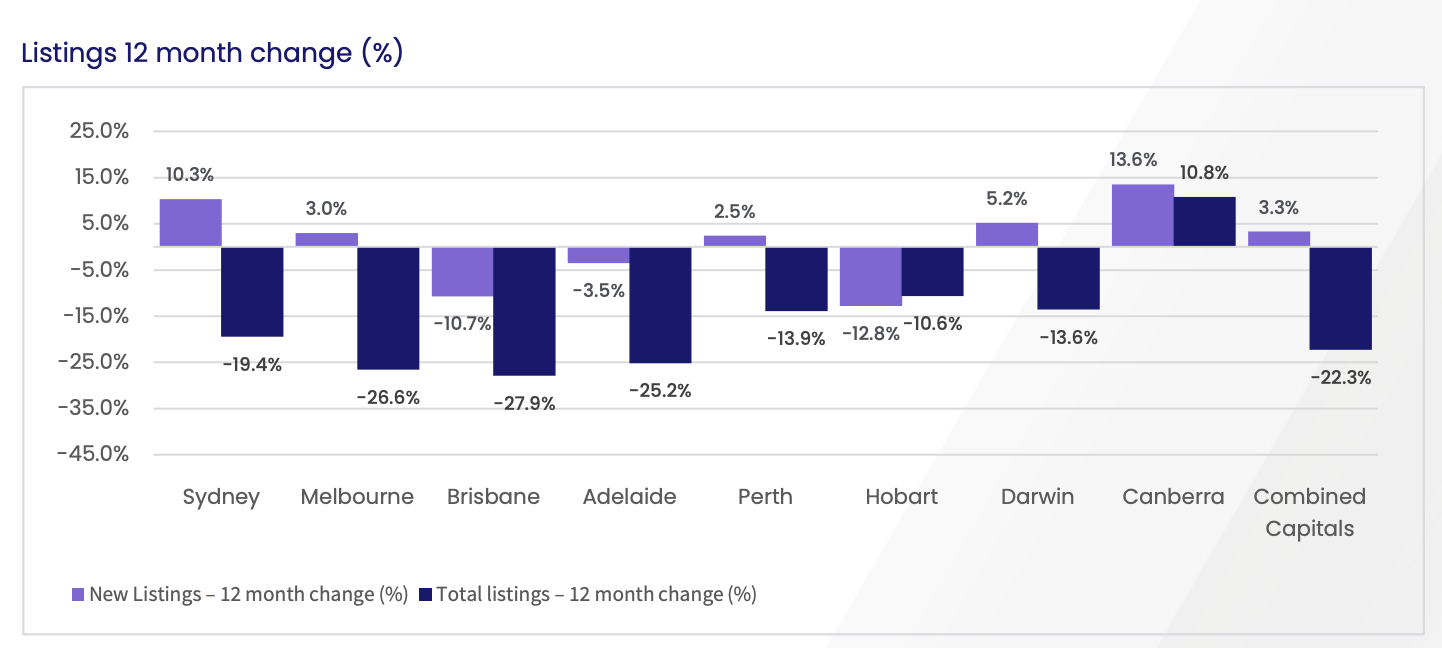

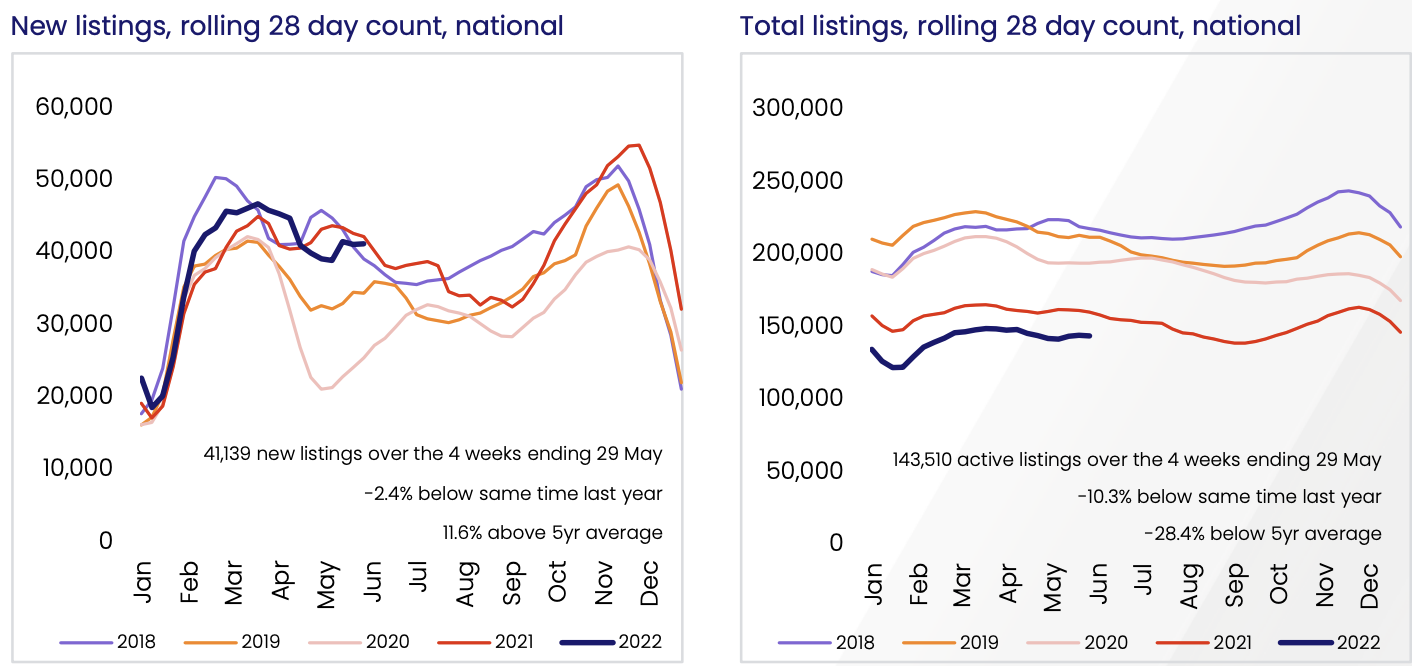

Total Listing Supply is still below the five year average. However new listing supply is 11.5% above the five-year average, but 2.4% below last years listings.

Corelogic New Listing and Total Listing Supply Graph

The Adelaide, Brisbane, and Hobart markets remain buoyant due to a large pool of buyers chasing the limited stock. The chance of large corrections in these cities is small.

Despite being the second most expensive city in Australia, Canberra will likely not have a large correction because it has the highest average household income in the country, as well as being a small city where the housing demand has outstripped supply for many years.

All Capital Cities have corrected their growth from their three-month peak in 2021, with Sydney and Melbourne recording a negative -1.4% and -0.8% respectively. Adelaide +5.7% and Brisbsne +4.6% are still the strongest Captial Cities, and Regional Areas in those states South Australia +6.2% and Queensland +4.5% showing growth in dwelling values for the three month period but have come off their highs of Border Opening Home Rush 2021.

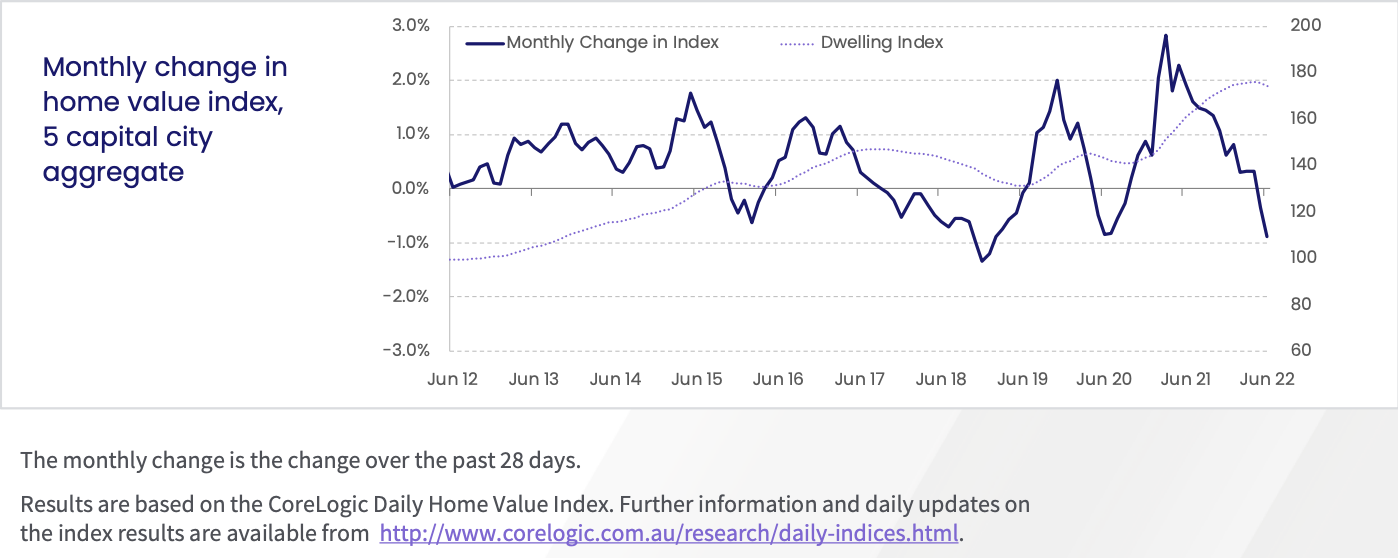

Above we have a graph showing the trend of a % of movement in house prices for the past twenty years. Each time we have an interest rate rise we then have a small correction in the property market. The largest drop was post-GFC mid-2009 a drop of around 7.5%.

Has the market already corrected itself? Or Is it just about to run again? Keeping in mind the economy is in a different place than post-GFC 2009.

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.