Small Cites, Regional Areas Drive Growth in Housing - March Corelogic Report

Corelogic Australia March Home Value Index (HVI) is out, and we have some interesting findings to share with you. Here are our key points from Executive Research Director, Asia Pacific Tim Lawless's March Report.

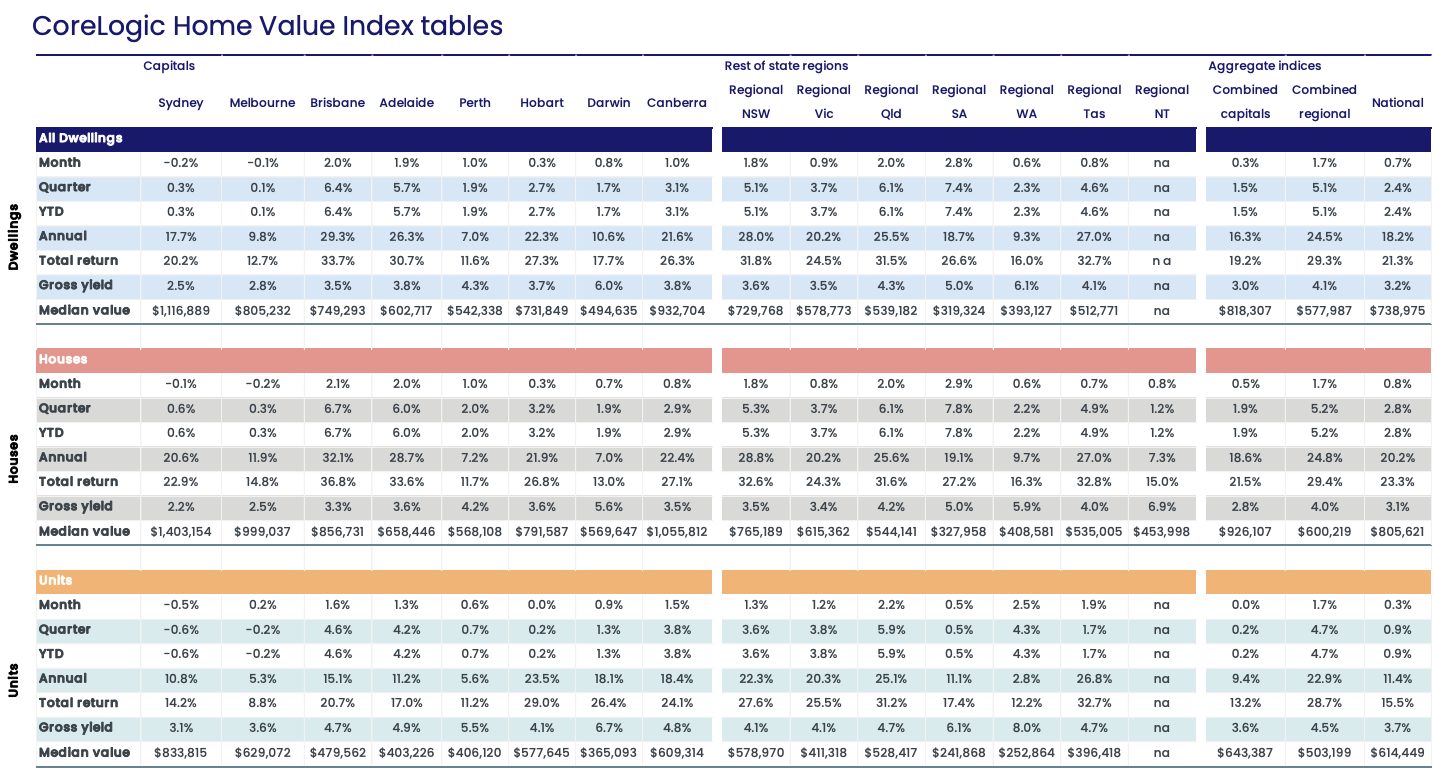

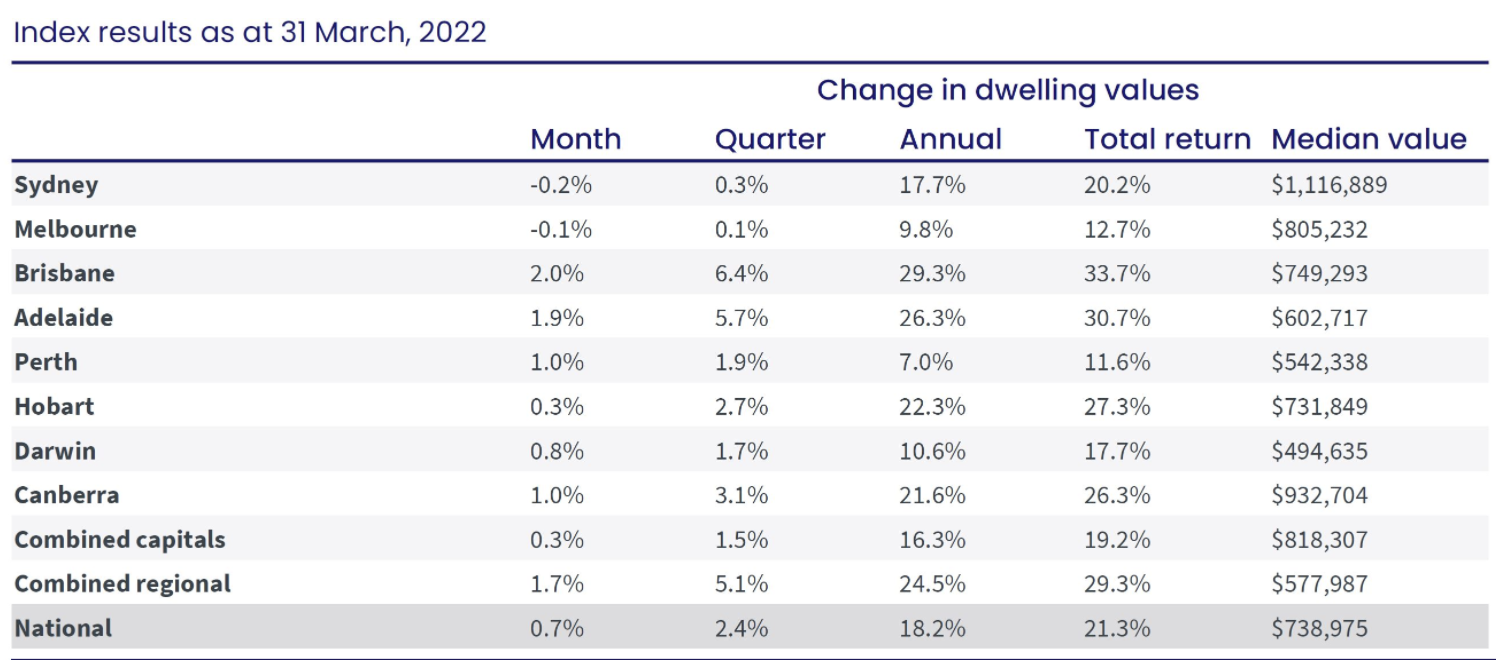

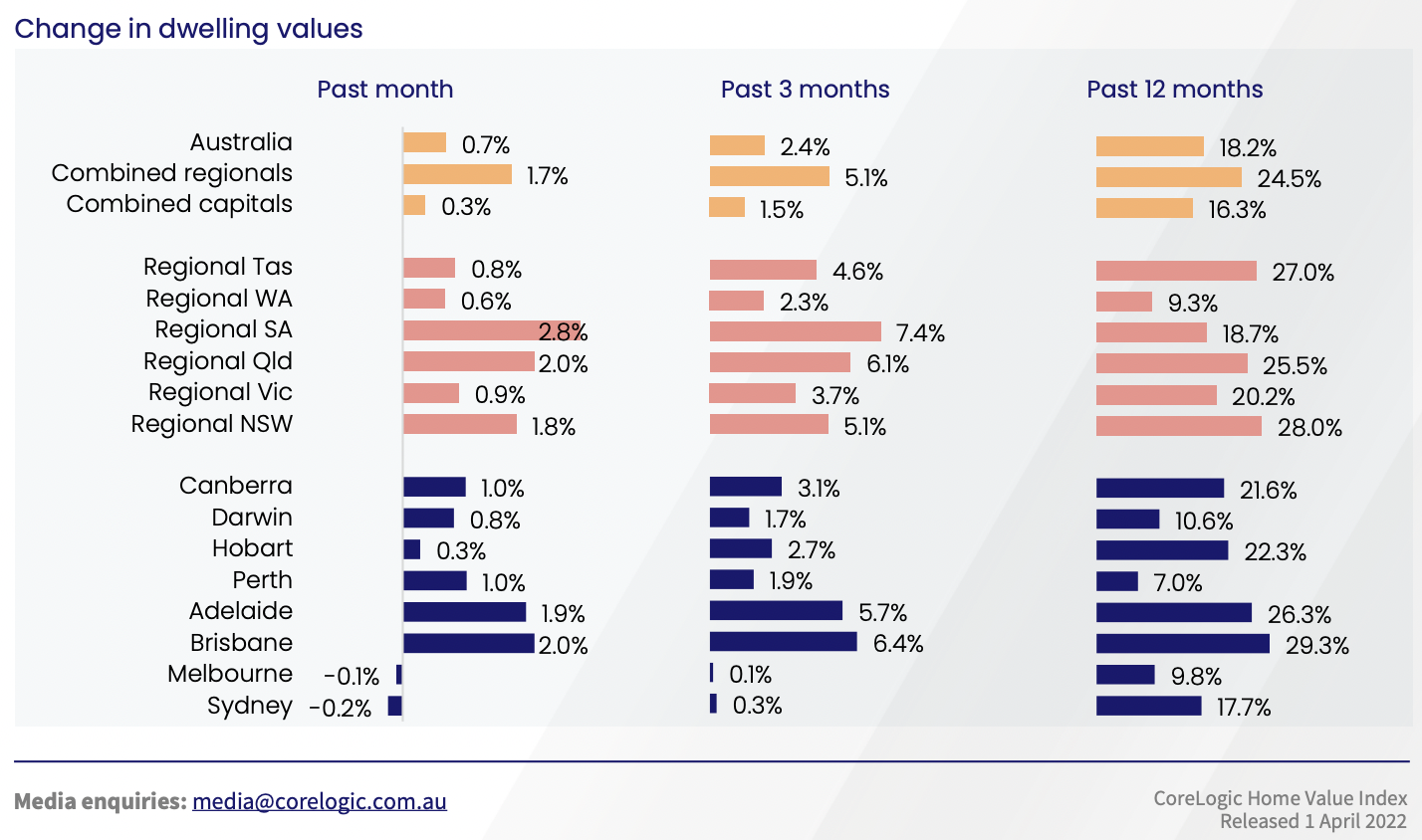

Corelogic HVI for March is up 0.1%, up from 0.6% to 0.7%, driven by Brisbane, Adelaide, Perth, and the ACT. Regional areas had impressive growth, which offset the drop in housing values in Sydney and Melbourne.

“The first quarter of the year has seen Australian dwelling values rise by 2.4%, adding approximately $17,000 to the value of an Australian dwelling. A year ago, values were rising at more than double the current pace, up 5.8% over the three months to March 2021 before the quarterly rate of growth peaked at 7.0% over the three months ending May 2021

Sydney’s growth rate is showing the most significant slowdown, falling from a peak of 9.3% in the three months to May 2021, to 0.3% in the first quarter of 2022. Melbourne’s housing market has seen the quarterly rate of growth slow from 5.8% in April last year to just 0.1% over the past three months”

Tim Lawless - Corelogic Australia

What will the trend be for next month?

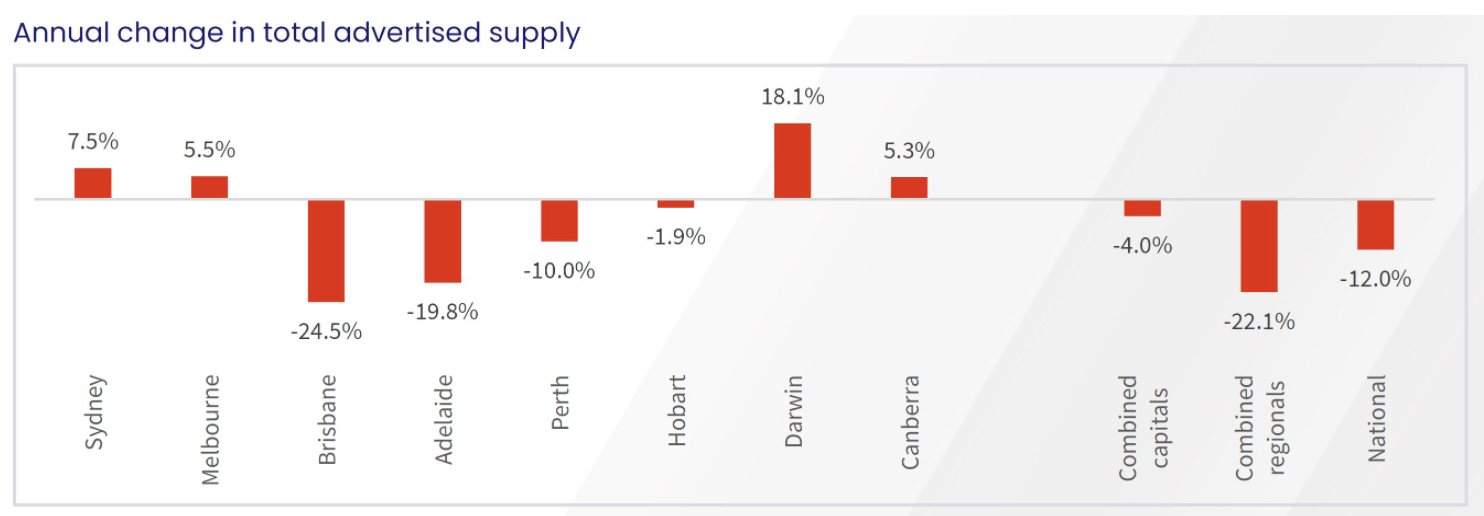

The best way to understand where the growth will be next is from the supply of listed properties on the housing market.

Nationally, we are still 8% below the five-year trend; however, advertising was up 8% in Melbourne in the previous five years. Melbourne buyers will have an advantage with more stock returning to the market.

Sydney is now only 2.6% below the five-year trend in stock available for sale, which will see an easing in demand in Sydney and more choices for buyers.

“In contrast, advertised stock levels in Brisbane and Adelaide remain more than 40% below the previous five-year average levels and around 20% to 25% down on a year ago. It’s a similar scenario across regional Australia, where the total advertised housing stock was 22% below last year’s level and 43% below the previous five-year average. Such low inventory levels along with persistently high buyer demand continue to create strong selling conditions in these areas, supporting the upwards pressure on prices.”

From the above graph, you can see the markets will remain split. There are Type 1 - Flat and Type 2 - Strong markets in Australia. Flat because there is now enough stock for purchasers, and then the strong as there is little stock on the market. Nationally, Australian stock remains in high demand compared to the five-year average.

Type 1 - Sydney - Melbourne - Darwin - Canberra- Hobart

It is predicted to remain flat.

Type 2 - Brisbane - Adelaide - Perth - Regional

Demand Remains Strong

Will these trends change with the new influx of international students and migrants? The rental data may give us some insight into how the borders opening and the return of international students affect the rental market.

Rental Yield Growth

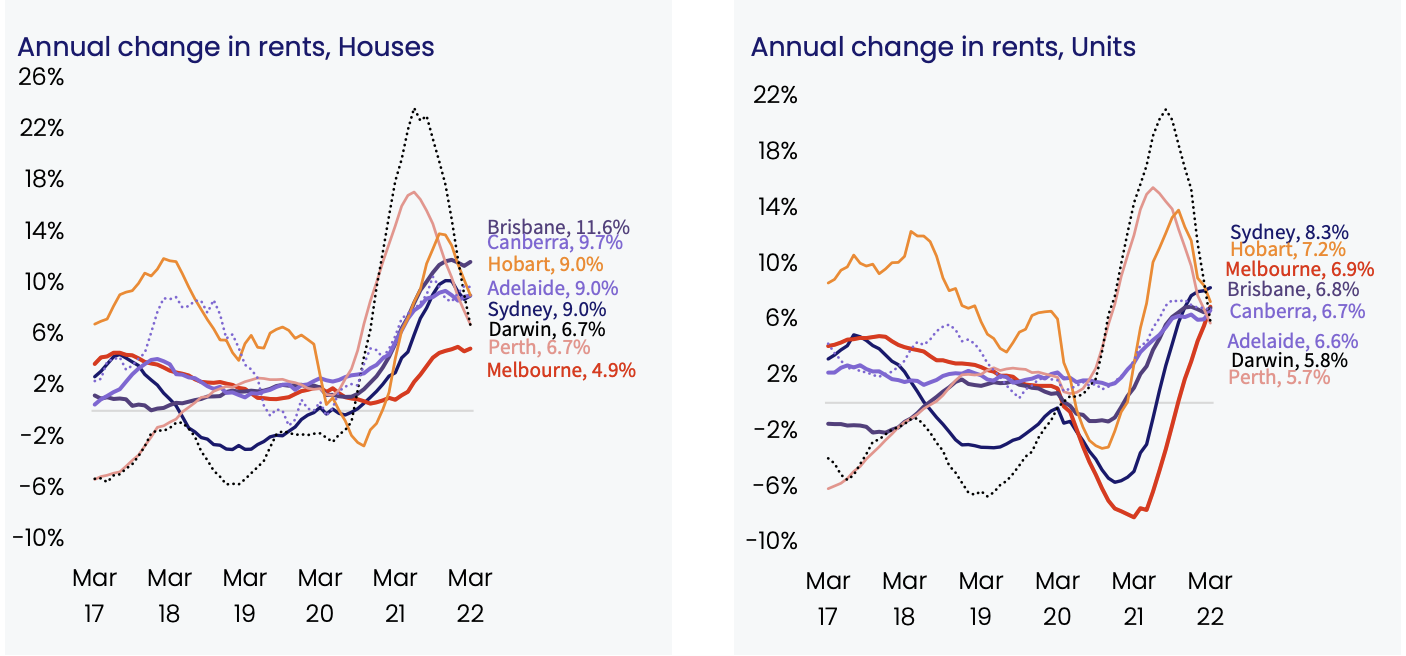

Annual Rental Growth has eased across Australia from its peak of 9.4% in November to 8.7% in March. However, we have seen the return of Overseas Migration and International Students to keep this sector strong for the quarter and has rebounded on an upwards trend from 1.9% in Dec 2021 to 2.6% in March 2022. There has been a return to units with a 3% growth for the March Quarter, this is a higher growth rate compared to houses with a 2.4% growth.

“Through the pandemic to date, capital city house rents have risen by 13.8% compared with a 3.4% rise in unit values,” Mr Lawless said.

“The net result is that renting a unit is substantially more affordable than renting a house. This affordability advantage, along with a gradual return of overseas migration, employees progressively returning to offices and inner-city precincts regaining some vibrancy, are likely key factors pushing unit rents higher,” Mr Lawless said.

What is the outlook for the Australian Property Market?

Headwinds to consider

* Rising fixed-term mortgage rates and the prospect of higher variable mortgage rates later this year. Note, the Reserve Bank of Australia kept its cash rate on hold today at .10%

* Affordability - With housing values rising so much more than incomes over the past two years.

* Inflation - Higher costs of living are also likely to weigh on housing demand.

* Higher supply - Both newly constructed dwellings and a rise in advertised listings

* Sentiment - Consumer confidence has taken a turn for the worse over recent months.

Tailwinds to offset the Downturn Risk

* A strengthening economy, low jobless rate, and rising income growth.

* A new round of incentives for first home buyers in Budget

* A return of migration - Allocated 200,000 Places for Migration

The latest the Australian Federal Election can be is on the 21st of May 2022. It will be a few interesting months ahead as we decide who will lead our country for the next four years. Massive challenges await the government, and many questions arise. How will they manage Australia's way through rising inflation, with the drawbacks of supply chain distribution locally with the recent floods, internationally with the Ukraine war, and global supply chain disruptions?