How am I Taxed in Australia?

A tax guide for departing and arriving Australians

There is no doubt that Australia’s tax system can be confusing to navigate, even I can admit!

This is especially the case for Australians who are leaving Australia for another country or returning home from their overseas tenure. Having to deal with the upheaval of your relocation, while also needing to address the complex changes to your Australian tax residency status. What does ‘residency’ even mean anyway?

Arrival for new Australians is no easy feat either. Although you may have already landed on Australian soil with a one-way ticket, the transition to your Australian tax residency can be a slower journey. Often, its years in the making with many important decisions along the way.

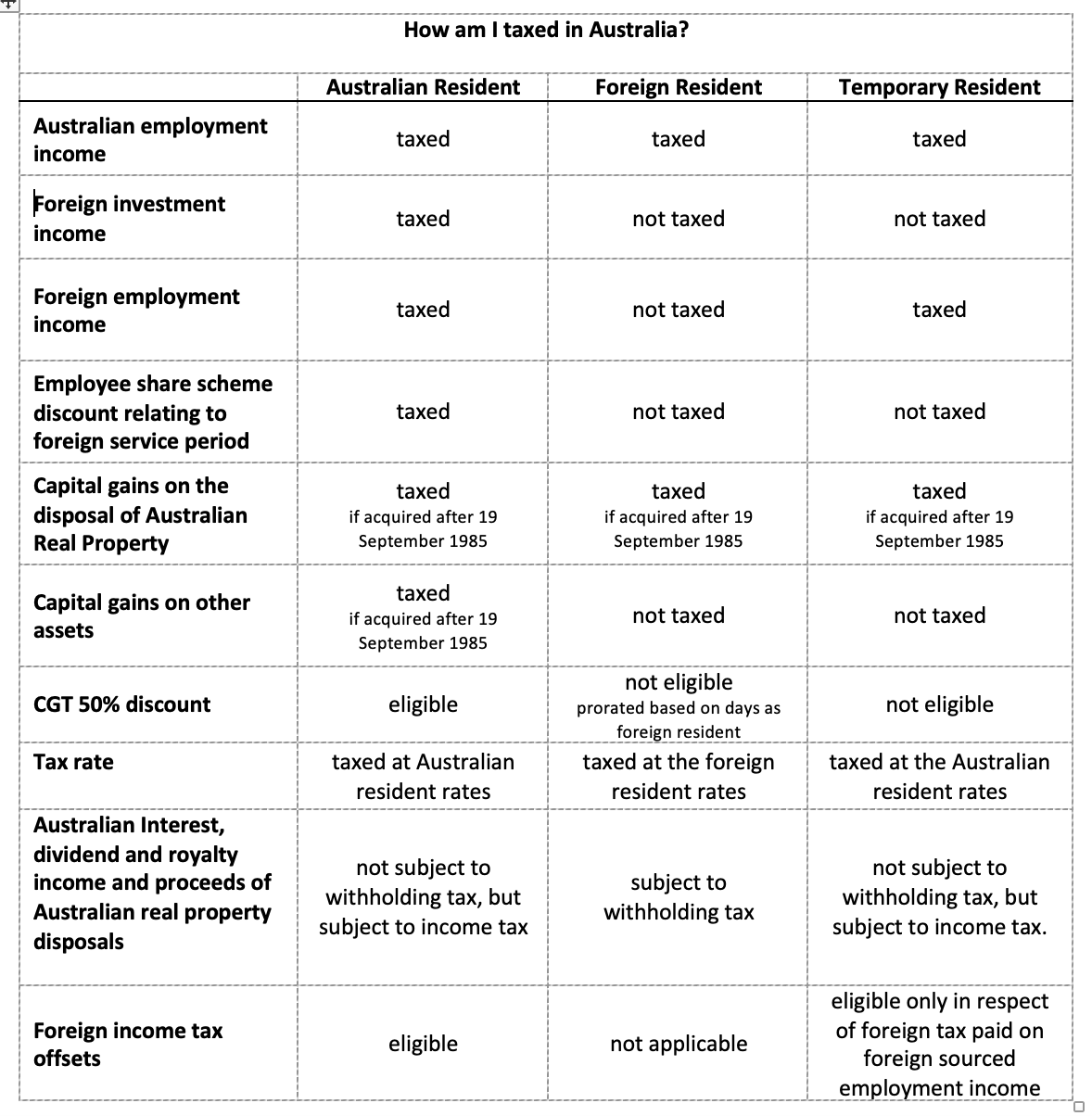

Whether you are an Australian expatriate changing between Australian and foreign residency status or vice-versa, or a new Australian graduating through foreign, temporary to (finally) Australian residency status it’s important to understand how Australia’s tax laws apply to you.

The Expatriate has put together a short-cut guide to help you quickly understand the tax consequences of each change to your Australian residency status.

The Expatriate always tries to make sure all information is accurate. However, when reading our website please always consider our Disclaimer policy.