Australian Budget 2022-2023 Highlights

The Federal Treasurer, the Hon. Josh Frydenberg MP, delivered the 2022 Federal Budget on 29 March 2022.

Macquarie Bank Budget Highlights

Individuals and trusts:

Cost of living tax offset

Digitalising trust income reporting and processing

Extension of ATO Tax Avoidance Taskforce on multinationals, large corporates and high wealth individuals

Paid parental leave

Business:

Small Business – skills and training boost

Small Business – technology investment boost

Superannuation:

Extension of the temporary reduction in superannuation minimum drawdown rates

Social security:

Cost of Living Payment

Other:

Affordable Housing and Home Ownership

Addressing Cost of Living Pressures – temporary reduction in fuel excise

What does the 2022-2023 Australian Budget mean for the Markets? This is what Macquarie Bank has to say

Federal Budget 2022/23

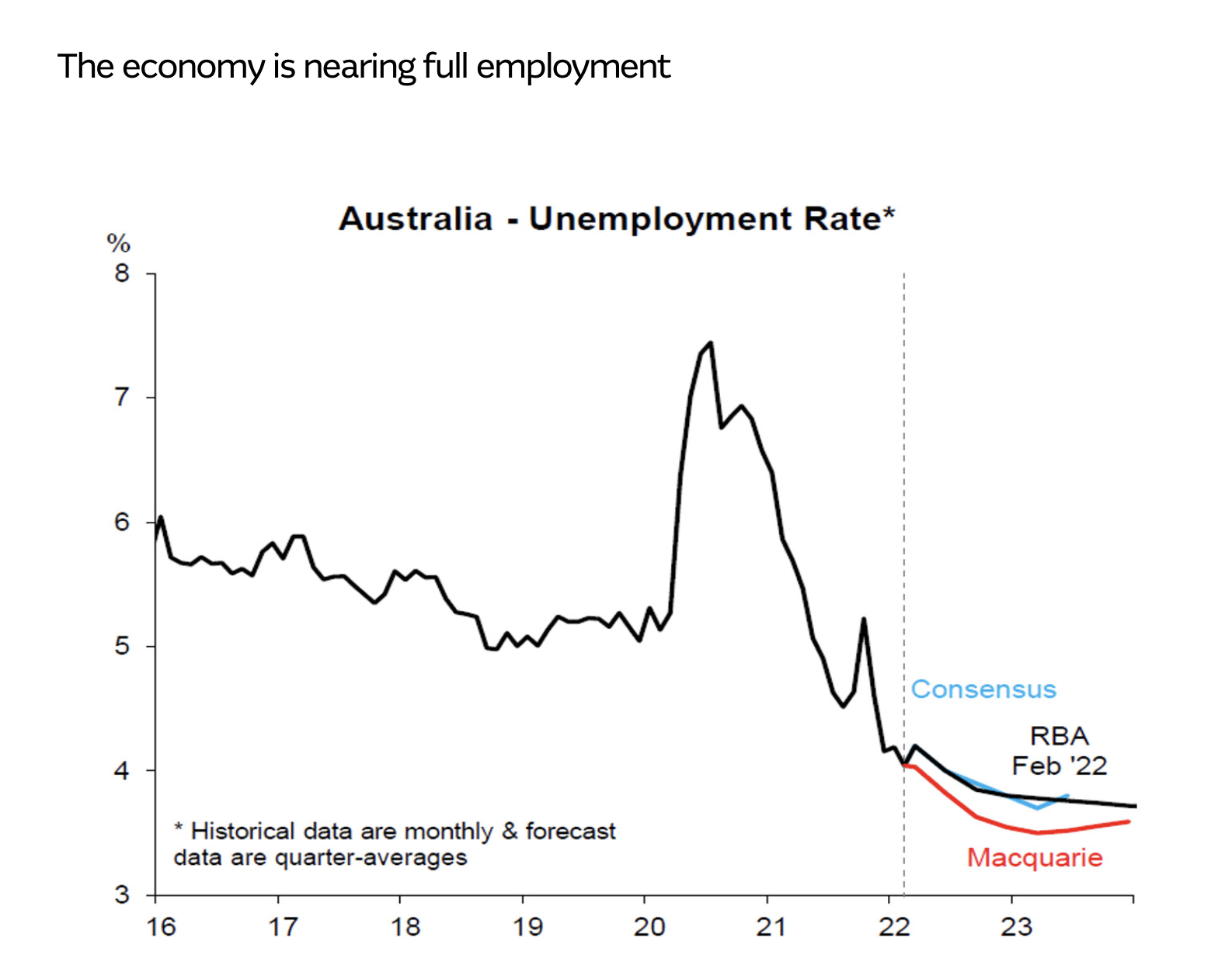

This budget was a notable shift from 12 months ago. Last year the recovery was fragile, the economy was transitioning away from JobKeeper, unemployment was >6% and the vaccination effort was yet to start in earnest. Now, the economy has strong momentum (despite Omicron), full employment is in sight, wages are growing, inflation is widespread, and commodity prices continue to surprise to the upside. Given this much more favourable backdrop the focus has shifted from stimulating a nascent recovery to near-term cost-of-living support for consumers and budget repair.

The budget position was strongly ahead of Treasury’s December forecasts in the Mid-Year Economic and Fiscal Outlook (MYEFO). The budget is expected to remain in deficit over the forecast period, supporting the economy’s rebound, but with smaller deficits than previously expected.

Recent budgets have prioritised supporting businesses and consumers through COVID-19, jobs growth and business investment to stimulate a domestic recovery. This has largely gone to plan with the economy in rude health and unemployment likely to hit the lowest levels in 50 years. Strong jobs growth boosts the budget’s bottom line via a higher tax intake while reducing welfare payments. The jobs recovery has been well ahead of forecasts. The unemployment rate is already at 4% with Macquarie expecting ~3.5% later this year. Similarly, wage growth is to increase to +3.25%pa, the strongest levels in a decade.

Key initiatives include:

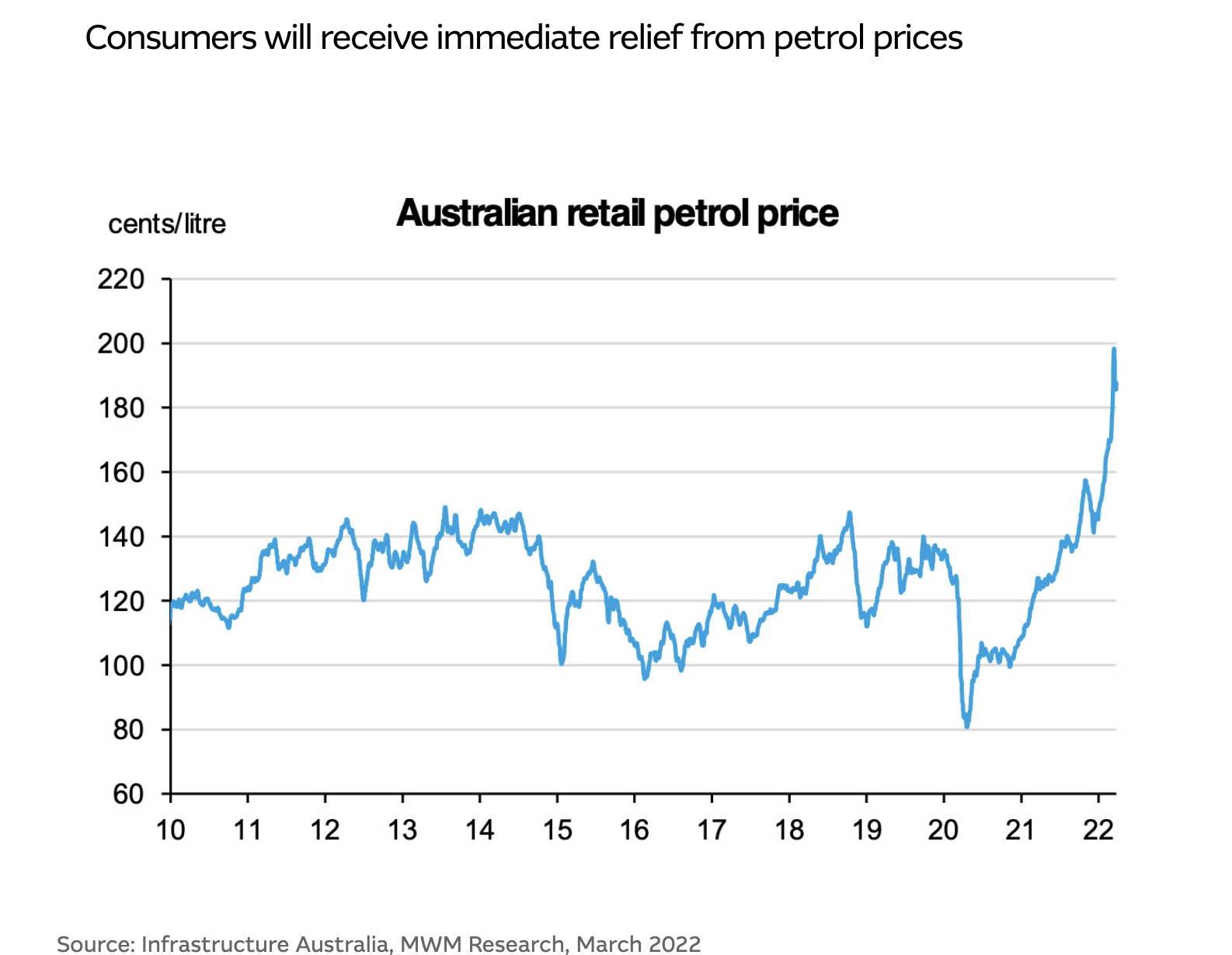

Fuel excise cut – Fuel excise will be cut by 50 per cent (from 44.2 to 22.1 cents per litre) for 6 months commencing 30th March at a cost of $5.6 billion.

LMITO – the low-and middle-income tax offset (LMITO), which was expected to not feature in this budget, will instead be bumped up from $1080 to $1500 to assist with cost-of-living pressures, at a cost of $4.1 billion.

Cash handouts – The Government will provide a one‑off, income tax-exempt payment of $250. This payment will help 6 million people (more than half of whom will be pensioners) at a cost of $1.5 billion.

Home guarantee scheme – the scheme, which supports first home buyers into the housing market with only a 5% deposit, will be expanded to 50k places annually and has also been made permanent.

1. Cost of living pressures

This budget was squarely focused on easing the burden of recent prices across the economy.

Key initiatives include:

Fuel excise cut – Fuel excise will be cut by 50 per cent (from 44.2 to 22.1 cents per litre) for 6 months commencing 30th March at a cost of $5.6 billion.

LMITO – the low-and middle-income tax offset (LMITO), which was expected to not feature in this budget, will instead be bumped up from $1080 to $1500 to assist with cost-of-living pressures, at a cost of $4.1 billion.

Cash handouts – The Government will provide a one‑off, income tax-exempt payment of $250. This payment will help 6 million people (more than half of whom will be pensioners) at a cost of $1.5 billion.

Home guarantee scheme – the scheme, which supports first home buyers into the housing market with only a 5% deposit, will be expanded to 50k places annually and has also been made permanent.

2. Infrastructure

Infrastructure spending features heavily again with $17.9b committed to high priority projects including:

Hells Gate Dam - $5.4b to build the far-north QLD project

Melbourne intermodal terminal at a cost of $3.1b

Outback way - $0.7b to seal a further 1000km on roads

NBN upgrades - $0.5b to upgrade the NBN’s fixed wireless network providing much faster speeds in rural and remote areas.

3. Health, education and environment

Key initiatives include:

Domestic vaccine facility – the government will co-fund the development of a domestic vaccine manufacturing and R&D hub with Moderna at a cost of $2 billion. Expected to be operational by 2024 and ensure vaccine supply.

NDIS users: Spending on the National Disability Insurance Scheme has increased by $40 billion (to $158 billion) over the forward estimates.

4. Defence spending

The Ukraine war has necessitated a strategic uplift in defence spending. Major initiatives announced included:

Boost the defence force with $38b to increase personnel by 18,500 by 2040

Future naval infrastructure funding of at least $10b including an east coast submarine base

Armoured vehicles to receive funding of $3.5b

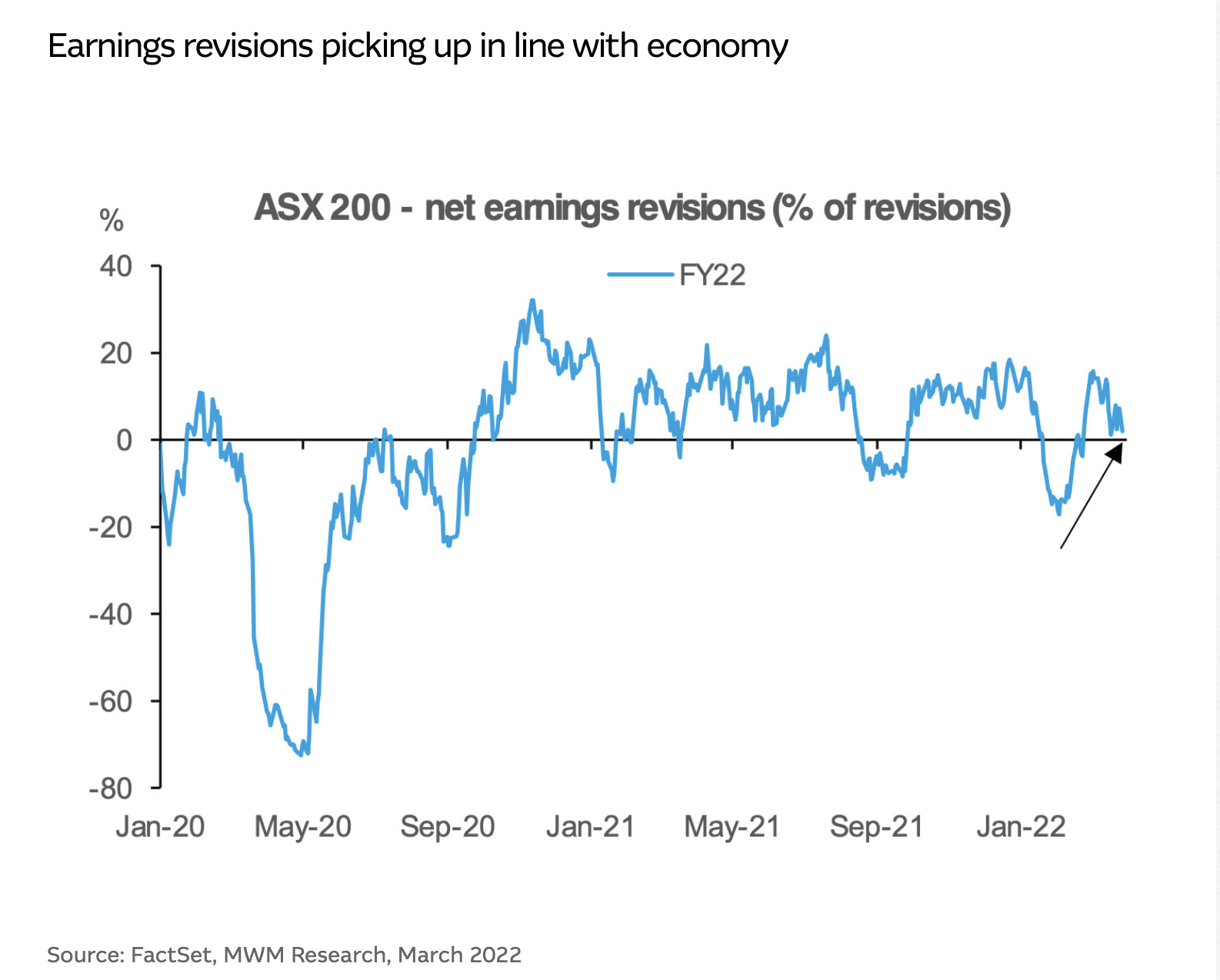

Equity market takeaways

This was a mildly pro-growth budget, but nothing compared to those announced through the pandemic. But, for the equity market, the reopening of the economy alongside further upward momentum in global growth, was likely to be the key tailwinds rather than additional policy support from the federal government.

Traditionally, budgets don’t have a major or a prolonged impact on the equity market and we don’t see the current combination of policies as anything different. There will be a boost to consumer spending and those areas leveraged into infrastructure may also see a small tailwind, But we don’t see either as being long dated positive drivers given the one-off nature of the cash payments and because the infrastructure sector is also facing structural constraints that are limiting new project starts.

It is hard to gauge how the additional cash payments will flow through. This is because excess savings already stood at around $240bn and was also there as a backstop for spending. In addition, if consumers feel that cost of living concerns will linger, then they may not be so willing to spend their handouts as they arrive.

At the end of the day, the equity market is being held up by a reasonable earnings outlook alongside still very favourable monetary conditions. We might see some evidence of earnings upside but given the momentum in commodity stocks (energy and materials), it’s unlikely that this is broad enough to drive a significant improvement. On the negative side, there is some risk that additional spending will force the RBA to move more quickly in raising rates. This would clearly be a headwind for the market, but we think market pricing was already factoring in a much earlier than expected start to the rate hike cycle than the RBA was forecasting.

Relative to previous years we see only a small set of sector beneficiaries. The cash handouts were the biggest surprise in the budget, as it was uncertain whether the LMITO would feature. This should be welcome news as the retail sector looks to pass through price hikes. Other areas that received significant spending, such as defence, are not well represented on the ASX.

Consumer – Premier Investment (PMV), JB Hi-Fi (JBH), Harvey Norman (HVN), Coles (COL)

Infrastructure – Boral (BLD), ADBRI (ABC), BlueScope Steel (BSL), Ventia Services (VNT), Downer (DOW)

Macquarie WM Investment Strategy Team

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.