Banks pass on the Interest rate drop, SJP’s insights on Trump Tariffs, CoreLogic HVI and Stanford Brown Monthly.

📢 This Month in Finance: Rate Cuts, Market Insights & Economic Trends

Big shifts are happening in the financial world! Banks are passing on the latest interest rate drop, offering new opportunities for borrowers. Meanwhile, SJP shares key insights on Trump's proposed tariffs, shedding light on potential economic impacts. We'll also break down the latest CoreLogic Home Value Index (HVI) trends and highlight key takeaways from the Stanford Brown Monthly update.

Stay ahead of the curve with expert insights and data-driven analysis—let’s dive in!

Interest Rates have finally dropped to 5.75 Variable and 5.49% Fixed 2 yrs, for Aussie Owner Occupiers.

As of March 10, 2025, several Australian lenders offer competitive home loan interest rates that might appeal to potential borrowers.

Here's a comparison of some of the lowest rates currently available on the market: A two-year fixed rate is attractive at 5.49%, the cheapest rate we've seen thus far, while a variable interest rate starts at 5.74-5.75%, with no additional fees, depending on your Loan to Value Ratio (LVR) and the total amount of funds you are considering borrowing. This is for onshore Australian Residence; if you’re an expat and purchasing an investment property, it will be slightly higher.

When making the critical decision regarding a home loan, it is essential to compare both the interest rates and the comparison rates, as the latter reflects the actual overall cost of the loan, including most fees and additional charges that may apply.

However, not all lenders will treat you equally; they target a particular niche or have a risk appetite they are comfortable lending to. If you don’t meet that criteria, or if your goal doesn’t fit their risk appetite, the banks won’t lend you the funds you require, and you might find yourself coming up a bit short with one lender, where another lender can facilitate your loan.

So how do you know which lender is right for your unique situation?

Technology is amazing. In 2025, your mortgage broker should be able to compare loans from 40+ lenders on a calculator, giving you more choice than if you went directly to a bank. Click on the link below to learn more.

SJP Tariff Update: Unforeseen consequences: How far reaching will US tariffs be?

Thank you to St. James’s Place Asia and Middle East for sharing an important update regarding the ongoing situation with the US Tariffs.

At a glance:

The recent tariff news wasn’t wholly unexpected, but the scale and initial countries targeted caught markets by surprise.

Tariffs will see costs passed on to consumers and impact interest rate decisions.

In times of uncertainty, it’s important not to make short-term decisions.

Global supply chains may be a casualty of the US tariff actions, extending their impact beyond the directly affected countries. Experts at SJP explore the potential long-term ramifications of the latest protectionist measures.

According to investment experts at SJP, the US's move to implement tariffs on key trading partners is likely to have many unforeseen impacts.

Canada and Mexico import 30% of US goods and are highly integrated in supply chains. For example, more than 50% of auto parts come from Canada and Mexico, and goods cross the border several times during the production process.

Hetal Mehta, head of economic research at SJP, says that while it was well known President Trump may turn to tariffs, the scale and the initial targets caught many off guard. While the US has large trade deficits with both countries (meaning the US imports more than it exports), they are also its closest neighbours. They have also all been part of “free” trade agreements with the US for decades.

Trump is reneging on deals he signed (when he was first president in 2016), Hetal explains. While the Canadian and Mexican tariffs are grabbing the biggest headlines, other countries are being targeted – such as China. Where next? Consequently, how will this affect trade relationships – and supply chains - worldwide?

While Hetal points out it is unlikely to be as disruptive to supply chains as the pandemic, it will likely change relationships between countries. But it isn’t just a matter of switching suppliers to other countries or emphasising buying domestically, Hetal notes. For one, building supply capacity from different regions and areas takes time to fill current demand. For another, there are also non-tariff barriers with other countries – such as regulation. “You can’t just jump to another supplier that easily. So, will these non-tariff barriers get watered down? Where will the trade get rerouted to?”

She highlights that the US consumer already buys more than the country can supply, which is why it imports more goods than it exports.

Hetal comments:

“One way or another the US consumer will pay for tariffs – they are on the hook. The impact could be

1. Higher inflation.

2. Higher interest rates to combat that inflation and

3. Higher taxes for households. The latter is because the intention is to funnel the profits of the imposed tariffs to lower US corporate taxes.

If the US were to reverse this action in the future, they may find it difficult and have to turn to consumers to pay that bill.”

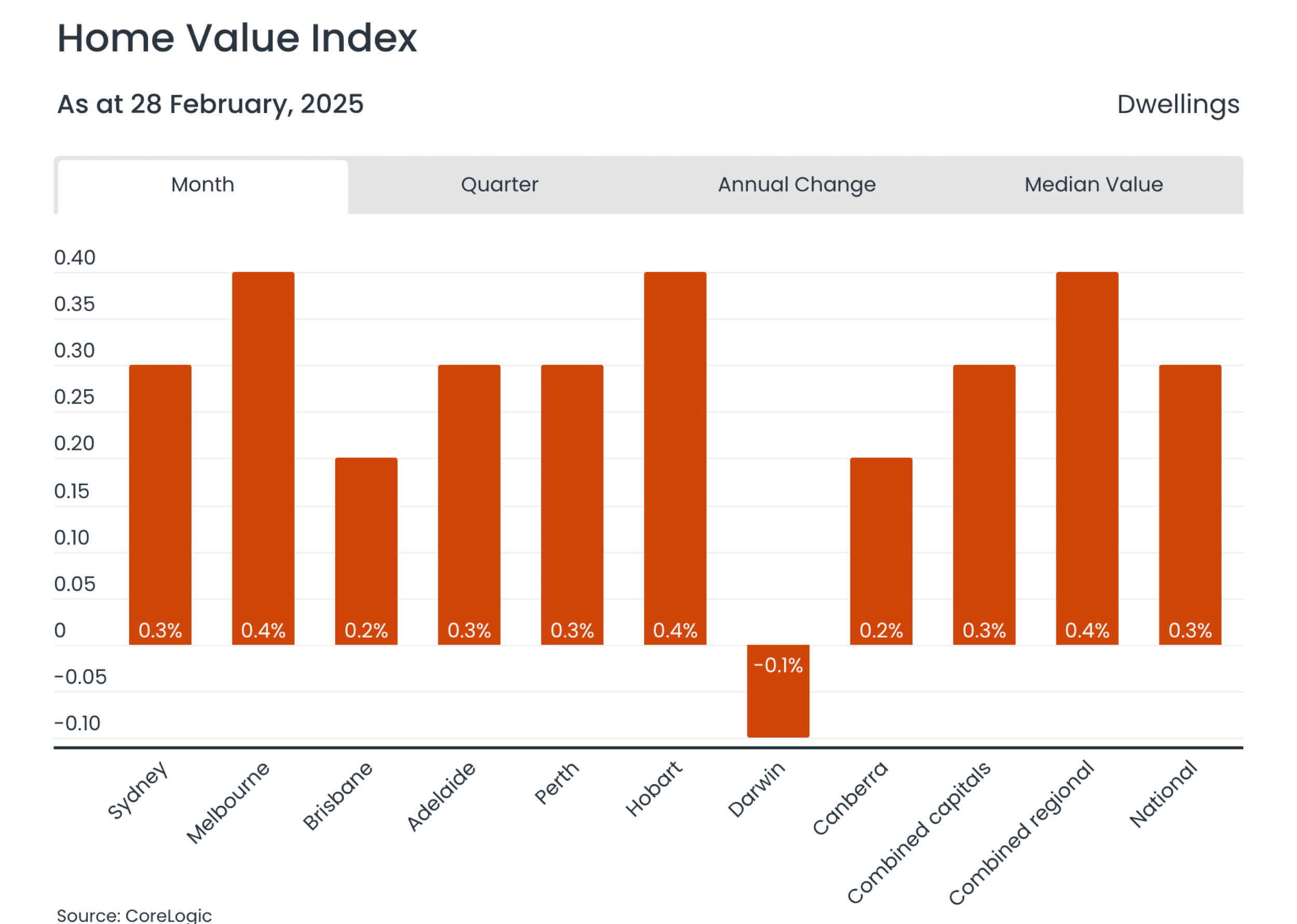

CoreLogic Home Value Index: HVI Report March 2025: Housing downturn reverses in February, with Melbourne & Hobart leading the way.

The latest CoreLogic Home Value Index (HVI) for March 2025 reveals a subtle yet broad-based re-acceleration in housing values across Australia. Following a brief three-month downturn, national home values rose by 0.3% in February, signaling improved market sentiment and optimism among buyers.

Melbourne and Hobart Lead the Recovery

While most markets saw an uplift, Melbourne and Hobart experienced the highest month-on-month growth at +0.4%, marking a notable shift for these cities, which had been among the weakest performers in recent months. For Melbourne, this marks the end of a ten-month streak of falling values.

Shifts in Market Strength

Interestingly, the mid-sized capitals—Brisbane, Perth, and Adelaide—have lost their momentum as the strongest growth markets. While these cities still recorded positive monthly gains (ranging from 0.2% to 0.3%), their pace has slowed compared to previous months. Adelaide and Brisbane continue to lead quarterly growth trends, with increases of 1.2% and 0.9%, respectively. However, Perth has seen a sharper deceleration, with its quarterly change slipping to just 0.3%.

Premium Markets Driving Growth

A key trend emerging from the data is the outperformance of high-value properties. The upper quartile of house values in Sydney and Melbourne led the gains, reversing some of the steep declines seen in previous months. This aligns with historical patterns, where premium markets tend to react more swiftly to changes in interest rate expectations.

Thanks, Nick Ryder, Stanford Brown (SB) CIO for sharing the latest “Stanford Brown's Monthly Investment Markets Report for March 2025,’” with our community.

The report aims to help investors cut through all the media noise and hype and understand what drives investment markets and portfolio returns.

This month the SB Team tackle some of the most pressing questions for longer term investors:

Key developments over the month

Performance of major financial markets

Current investment outlook and portfolio positioning

Views on major asset classes

To read the report, click on the link below;

The information contained is general information only and does not consider your personal objectives, financial situation and needs. We strongly recommend that you do not act on any information provided in this website without individual advice from your trusted advisor. You should also obtain a copy of and consider the Product Disclosure Statement for all financial products before making any decision.

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.