Join us at the next SJP webinar: The Seven Behavioural Sins of Investing. Cameron Porter from Porter’s House Joins the team, CoreLogic HVI and more.

The past weeks in THE EXPATRIATE Community have been busy. Send Payments updated us on the international currency market. CoreLogic Australia released a YouTube video discussing the September 2024 HVI based on August data and noted that Melbourne fell to 6th in median dwelling values in the Australian Property Market. Congratulations to Stanford Brown for being #1 in the Best Places to Work competition 2024 by WRK+, but first, we’d like to invite you to the upcoming St James’s Place Webinar.

St James’s Place Webinar: The Seven Behavioural Sins of Investing

Which biases are hiding in your investment decisions?

Join us to hear from Joe Wiggins, Investment Research Director at St. James's Place, as he explores the psychological pitfalls that can undermine an investor's success, such as overconfidence, action bias, and short-term loss aversion. Learn practical strategies to overcome these challenges and embrace a disciplined investing approach. Joe will guide us in understanding and conquering biases, empowering us to make smarter, less emotional investment choices.

The value of an investment with St. James’s Place will be directly linked to the performance of the funds selected and may fall as well as rise. You may get back less than the amount invested.

Date: Thursday 12th September, 2024

Time: 12.30-1.15pm (UAE time)

Register here: https://us02web.zoom.us/webinar/register/WN_e6dPDSfKRA6YJOpLUS1J0g

About our speaker:

Joe Wiggins, Investment Research Director, St. James’s Place

Joe is Director of Research at St James’s Place. Across his career he has worked at some of the largest asset and wealth managers in Europe. Most notably, spending seven years with ABRDN, where he was a fund manager with responsibility for Strategic Asset Allocation for MyFolio, one of the most successful multi-asset fund ranges in the UK.

Joe, who holds a Master’s degree in Behavioural Science from the London School of Economics and is a CFA Charterholder, is widely known across the industry as a behavioural finance expert. His first book ‘The Intelligent Fund Investor’ was published in November 2022 and focuses on how investors can make better decisions.

Cameron Porter, from Porters House Buyers Agency, joins the TE Team.

We proudly announce that Cameron Porter, Principal Buyer’s Agent at Porter's House, has joined THE EXPATRIATE as our Sydney - Northern Beaches Property Specialist.

Cameron brings a wealth of knowledge and expertise, spanning over 20 years of experience in the Northern Beaches property market. He is an industry leader, enabling him to navigate the complexities of buying and selling properties with a focus on securing the best possible deal for his clients. Cameron deeply understands property investment and the intricacies of purchasing for Australian expats. He has helped countless Aussie expat clients build generational wealth by strategically building impressive property portfolios. Cameron’s diversified awareness of the Northern Beaches property market spans Palm Beach to Manly, Fresh Water to Belrose and all the price points. Whether his clients purchase their dream home or are interested in interstate high-yield-investment properties. He is passionate about sharing his knowledge and empowering his clients and our Australian Expat community. If you’d like to get to know Cameron a little bit more, you can read his Bio and catch the Porters House Team on the following socials;

Instagram: @PortersHouseBuyersAgency

Facebook:@Porters House Buyers Agency

LinkedIn: @Porters House

YouTube: @buyersadvocatesydney

Or you can watch the latest CoreLogic Australia hosted by Tim Lawless, as he delves into the latest data on Housing Market Updates across Australia. The housing and economic data is derived from the CoreLogic Hedonic Home Value Index for the month of August, released in September 2024.

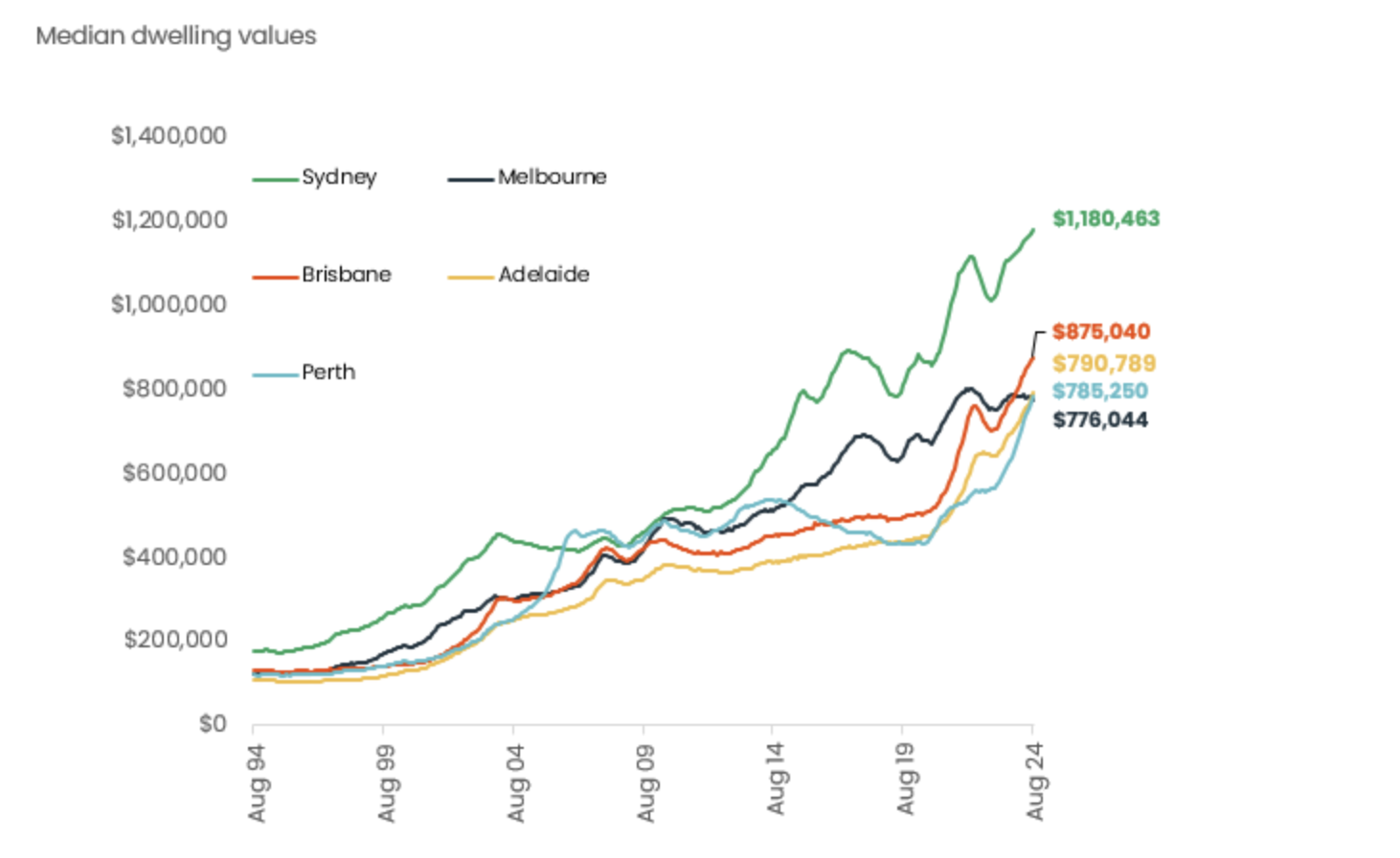

CoreLogic also shared their latest Property Pulse and unpacked how Melbourne’s median dwelling value became the sixth lowest across the Australian capitals.

In today’s insightful Pulse article, Research Director Tim Lawless thoroughly examines the various driving forces that have contributed to Melbourne falling behind Adelaide and Perth in terms of median dwelling value. This trend emerges as housing values across Australia’s capital cities experience a significant changing of the guards, reflecting shifting market dynamics and economic influences.

In Short

The difference comes back to the composition of dwellings and the fact that Melbourne has densified more substantially and rapidly than the mid-sized capitals. In August, CoreLogic estimates a third (33%) of housing stock in Melbourne falls within the multi-unit sector, compared with 25% in Brisbane and 16% of housing stock in Adelaide and Perth.

Tim Lawless, Research Director CoreLogic Australia.

To read the Property Pulse Report, click on the link below.

Congratulations Stanford Brown! #1 Great Places to WRK+

WRK+ asked over 43,047 employees from 101 organisations dedicated to building great workplaces why their organisation is the best. Stanford Brown came in at NUMBER 1 for workplaces under 100 employees. Well done, SB!

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.