SJP US Election Special Update. SBTalks, Prestigious Properties 2024. Adam is in HK and More.

Australia and the world are experiencing rapidly changing times: the upcoming US election and the conflict in Gaza. Yet the Australian Property Market seems to be protected by it all, with its value reaching over $11 Trillion. In this newsletter, we will be covering the following.

SB Talks: Middle Eastern conflict, US employment and Chinese stimulus, with CEO Vincent O’Neill and CIO Nick Ryder.

SB Quarterly Investment Market Report October 2024, by CIO Nick Ryder.

October 2024 Property update. “Australian property market reaches $11 trillion as national price growth slows.” CoreLogic Australia, and Cameron Porter our Northern Beaches Property Specialist, Founding Director of Porters House Buyers Agency

Prestige Property Market Update 2024 by Sunshine Coast Property Specialist, Christine Mount, Founding Director of Luxe Coastal Property Buyers.

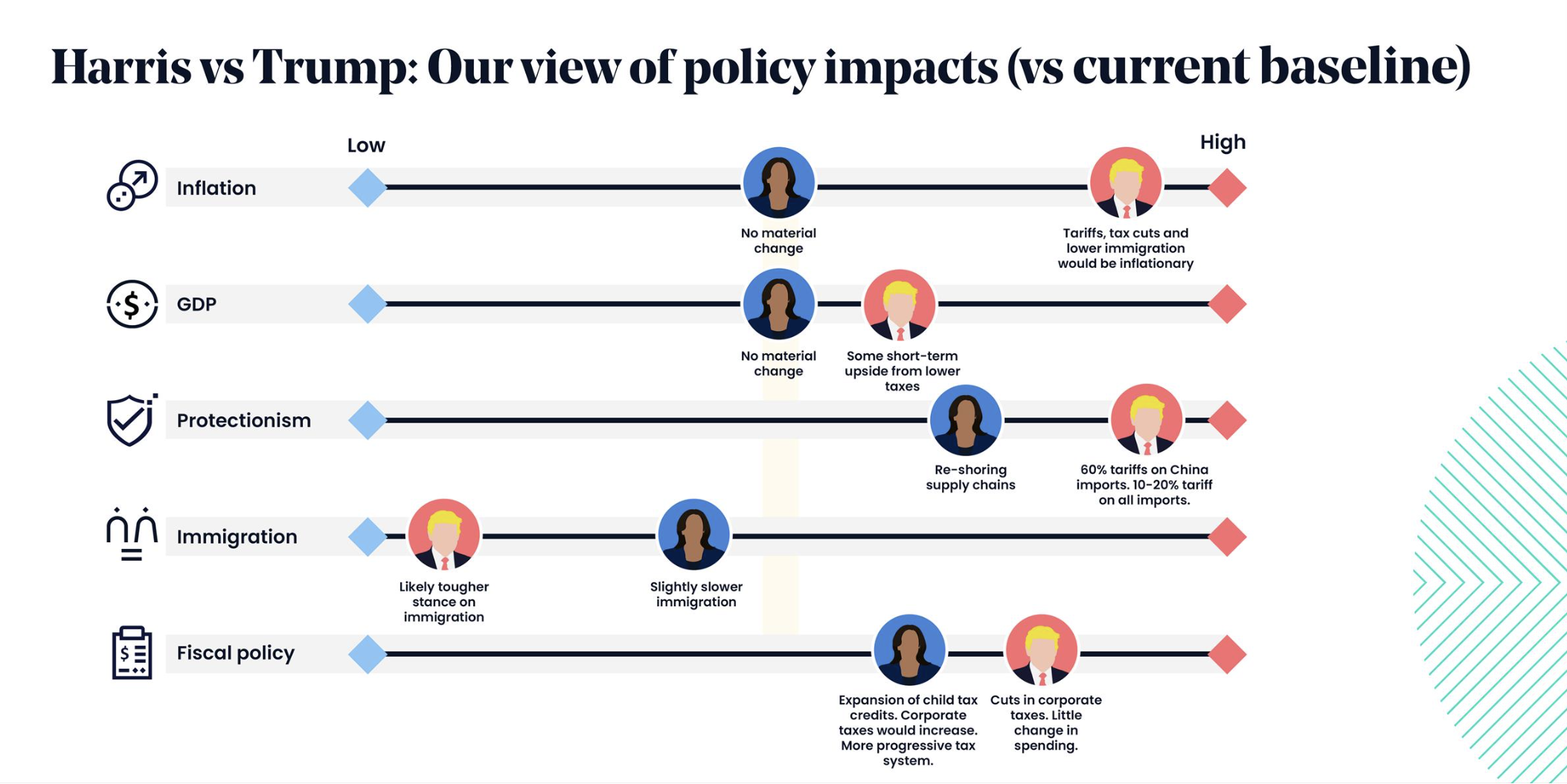

Beyond the Ballot: the US Election 2024 - St. James’s Place.

Firstly, Stanford Brown experts CEO Vincent O’Neill and CIO Nick Ryder have analyzed the market impacts in their latest SB Talks on YouTube and audio platforms. In this episode, Vincent O’Neill talks with Nick Ryder about:

Implications of the Israel-Iran conflict for financial markets

US Fed meeting minutes and the latest US jobs report

China’s ‘Whatever it takes’ Stimulus Announcements

Reflection on the last quarter and outlook for the rest of the year

The SB Team have also put together their quartley report. Here is a the link below to the PDF.

This week, SJP have taken the time to put together the key points of the update; the focus is on the US Election 2024 after a short recap of the global financial markets quarter.

📈The last quarter saw significant market swings due to the Japanese yen carry trade, a larger-than-expected Fed rate cut, and a new China stimulus.

📈Expect short-term market fluctuations due to emotional election reactions but focus on long-term policy changes that will impact global markets.

📈Focus on the basics, not distractions. History shows missing the ten best market days can significantly lower your returns.

US 🇺🇸Election 2024.

As the campaigning ploughs ahead, three things are becoming increasingly clear:

1)This is likely to be a close election.

2) Harris and Trump's potentially large borrowing requirement is not of significant concern to the financial markets. However, it could store potential future volatility for US government bonds.

3)The results could have far-reaching implications for industries sensitive to regulation.

To read the update, click on the link below.

Our Sydney and Northern Beaches Property Specialist Cameron Porter, from Porter House Buyers Agency, has unpacked the latest data from CoreLogic Australia in a YouTube Video for THE EXPATRIATE Community. Here are the key takeaways;

The Australian residential property market reached a record $11 Trillion in September.

The annual pace of growth has slowed to 6.7% for the past 12 months, down from the high of 9.7% in the 12 months to March.

Sydney, Brisbane, Adelaide, and Perth dwelling values are currently high. Perth had the highest monthly, quarterly, and annual dwelling value increase, while Adelaide has overtaken Brisbane as the second-strongest capital city market nationally.

In September, Sydney increased by 0.2%, Brisbane by 0.9%, and Perth by 1.6%. Melbourne is continuing to fall.

We are also seeing an increase in listings coming to market in spring, but they are also higher than in the same period last year, with the national number up 2.1%.

Annual growth in rent values slowed to 6.8% nationally, down from a recent high of 8.5% over the year to April. This compressed yields further, with the gross rental yield at 3.68% nationally.

Dwelling approvals are down further, which will strain the property market.

The Reserve Bank of Australia (RBA) has held interest rates. While many predicted interest rates would fall in late 2024, the consensus among economists is that interest rates will not fall until 2025 or even 2026 due to underlying inflation still above the RBA’s target range.

Lending is increasing, with Investor lending up 1.4% month over month and owner-occupier lending rising by 0.7%; however, I see more first-time buyers purchasing an investment property rather than an owner-occupier property due to affordability issues where they desire to live.

To watch the YouTube Video, click on the link below.

PRESTIGE PROPERTY MARKET UPDATE 2024

Our Sunshine Coast Property Specialist, Christine Mount, Founding Director of Luxe Coastal Property Buyers, has put together the Prestige Property Market Update 2024 for pour community.

The Sunshine Coast stands out prominently among Australia's top 20 premium regional suburbs, as highlighted in the Prestige Market Report by CoreLogic and Westpac Private Bank. Common traits of the sought-after Top 20 Regional Prestige Suburbs include:

Desirable coastal or hinterland lifestyle

Affluent communities

World-class beaches and scenic surroundings

Positioned within a two-hour commute from major capital cities, providing convenience and accessibility (Brisbane CBD)

Accessible airports and a wealth of quality dining and recreational facilities (Sunshine Coast Regional Airport & Brisbane Airport)

The Sunshine Coast delivers these attributes in spades... To read the full report, download here:

Stay tuned for our following newsletter, when we will share Chistine’s much-anticipated podcast with Tim Lawless, Research Director from CoreLogic Australia, for her next podcast on Living Your Luxe Life.

Finally, Adam Kingston, the EXPATRIATE founder and Founding Director of Australian Expatriate Finance, will jet to Hong Kong and Singapore again in November. If you’d like to arrange a face-to-face meeting with your helpful Mortgage Broker to discuss your options for the end of 2024 and be organized for the 2025 selling season, please feel free to contact Adam directly via email.

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.