St. James’s Place Week Watch 30th September 2024

St. James’s Place Week Watch 30th September 2024

In this week’s WeekWatch, the SJP Team tackles the Stock Take, Wealth Check and In the Picture. In particular, the SJP team focuses on the Chinese, US, EU, and UK economic updates and more. We’ve taken the time to put together the takeaways from the update.

Stock Take

China

Since it was opened up and reformed in the late 1970s, China’s economy has grown at an average rate of 9% annually.

China risks missing its annual growth target of around 5%. Therefore, markets reacted enthusiastically to the People’s Bank of China unveiling a major package of aggressive measures designed to stimulate the economy.

Plans to cut the amount of cash banks must hold in reserve are estimated to free up around one trillion yuan ($142 billion) for new lending.

Efforts to boost the property market by cutting borrowing costs for existing mortgages and lowering the minimum down payments on all homes to 15%.

Global stocks rose to a record high on Tuesday, while major US indices also hit closing highs as investors cheered the news.

SB Talks: US Fed’s 50bp rate cut. Will RBA Follow? Australia’s Millennial Recession and more.

SB Talks: US Fed’s 50bp rate cut. Will RBA Follow? Australia’s Millennial Recession and more.

In this episode of SB Talks, Stanford Brown CEO Vincent O’Neill speaks with Chief Investment Officer Nick Ryder to discuss the following:

The implications of the US Fed’s supersized 50bp rate cut

Whether the RBA will follow the Fed and cut rates this year

Australia’s Millennial Recession

The impact of lower cash rates on bond and equity valuations

Australian Bureau of Statistics reported that the monthly CPI indicator rose by 2.7% from the 12 months to August.

Australian Bureau of Statistics reported that the monthly CPI indicator rose by 2.7% from the 12 months to August.

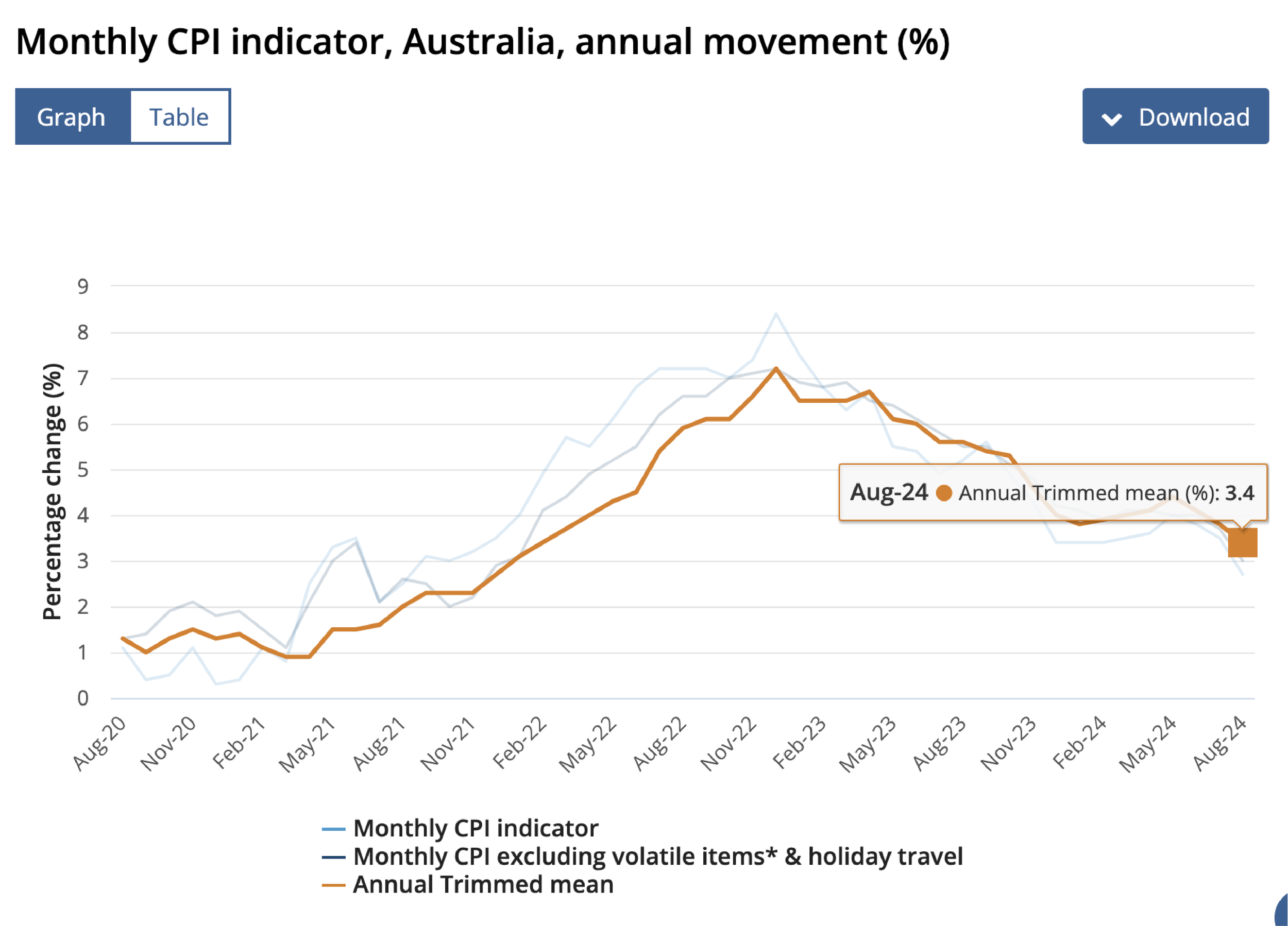

On September 25th, the Australian Bureau of Statistics (ABS) reported that the monthly CPI indicator rose by 2.7% from the previous 12 months to August, down from 3.5% in July. The Trimmed mean inflation, excluding fluctuations in automotive fuel and electricity, was 3.4% in August, down from 3.8% in July.

SB Talks - Meet the investor: Andrew Lockhart, Managing Partner at Metrics Credit Partners

SB Talks - Meet the investor: Andrew Lockhart, Managing Partner at Metrics Credit Partners

In this episode of Meet the Investor, SB Talks host Joey Mouracadeh, Principal, Senior Investment Director, and Private Office Adviser, is joined by Andrew Lockhart, Managing Partner at Metrics Credit Partners, one of Australia's largest lenders outside of the major Australian banks. Andrew takes us through his career, sharing the origins and evolution of Metrics Credit Partners and the firm's role in shaping the private credit landscape in Australia.

US Federal Reserve Central Bank cuts interest rates by 0.5%

The US Federal Reserve cut interest rates by 0.5%, reducing the target range to 4.75-5%.

This significant move aims to effectively reduce interest rates, returning the target range to the previous levels in March 2023, reflecting the bank's ongoing efforts to respond to current economic conditions. They will review new data and risks before making further changes. The Committee will keep reducing its Treasury and agency mortgage-backed securities holdings as part of its commitment to achieving maximum employment and bringing inflation back to 2%.

SJP WeekWatch 16th September 2024

WeekWatch

Thank you, David Gardner and St James’s Place Asia and Middle East, for sharing your valuable market insights with our community in the SJP 16th September Weekwatch.

In this week’s WeekWatch, the SJP Team tackles the Stock Take, Wealth Check, In the Picture and the Last Word. In particular, the fallout from US Job Data, US, UK and European rate cuts, the Chinese slowdown, the Trump/Harris Debate, Nivida talks with Saudi Arabia, and which stocks performed well. Here are our key takeaways below;

St James’s Place Weekwatch 9th September 2024

Thank you, David Gardner and St James’s Place Asia and Middle East, for sharing your valuable market insights with our community in the SJP 9th September Weekwatch.

This week, SJP will delve into the intricacies of the global financial markets, including Nvidia’s recent annual results, September's historic poor performance, the upcoming election and its effect on the markets, and interest rates, UK and Europe Markets and share practical tips to enhance your wealth management strategies and a perspective on interpreting the media reports and narratives. This week’s blog covers the following points;

Stock Take

Has the ‘The Magnificent Seven,’ dream run finished?

Nvidia's recent annual results highlight its challenges with the S&P 500 and NASDAQ.

Peter McLoughlin, Head of Research at Rowan Dartington, notes that September is typically a tough month for tech.

The Russell 2000 (Trump Trade) shows strong growth.

SB Talks: Stanford Brown CEO Vincent O’Neill is again speaking with Stanford Brown Investment Committee member and former RBA Governor Ian Macfarlane AC.

SB Talks: Stanford Brown CEO Vincent O’Neill is again speaking with Stanford Brown Investment Committee member and former RBA Governor Ian Macfarlane AC. In this video, SB Talks discusses:

A resilient economy and elevated inflation

No rate cuts until late 2025

The implications for asset prices

The transition in RBA Governor to Michele Bullock

The far-reaching implications of the RBA Review

St James’s Place Week Watch 27th August 2024

Thank you, David Gardener and St James’s Place Asia and Middle East, for sharing your valuable market insights with our community in the SJP 27th August Week Watch.

This week, SJP will delve into the intricacies of the global financial markets, including the US, UK and Japan, and share practical tips to enhance your wealth management strategies and a perspective on interpreting the media reports and narratives. This week’s blog covers the following points;

Stock Watch

Jackson Hole Economic Symposium

the US Fed will meet to decide on interest rates in September, where markets will be expecting either a 0.25% or a 0.50% cut.

BoE will feel comfortable making further cuts to the UK Bank Rate, albeit at a measured pace, but cautioned that it is too early to declare victory over inflation.

Australian Bureau of Statistics Monthly Consumer Price Indicators (CPI) Indicators for July

Australian Bureau of Statistics (ABS) Monthly Consumer Price Indicators (CPI) Indicators for July on the 27th of August 2024.

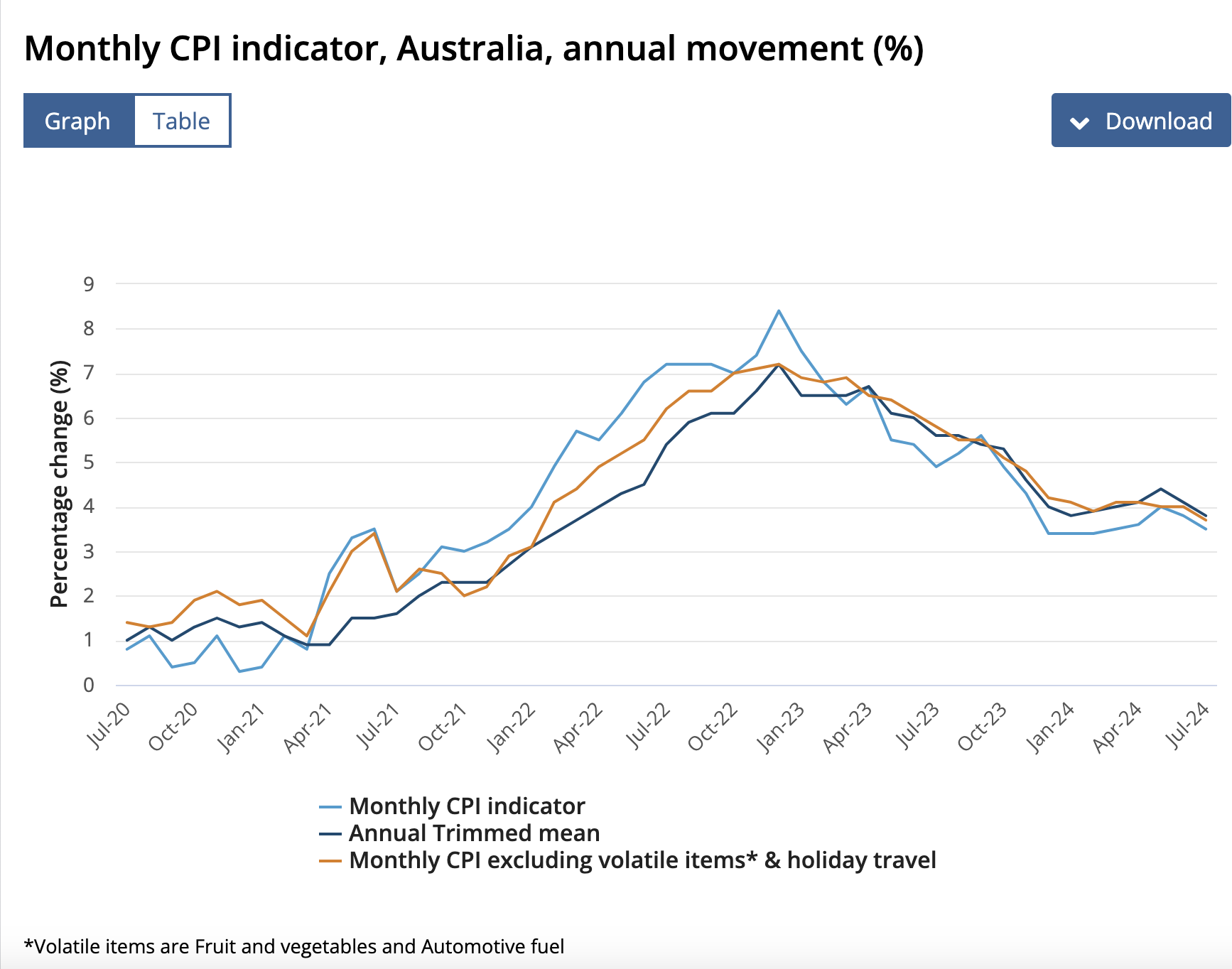

The Australian Bureau of Statistics officially released the most recent Consumer Price Index (CPI) data on August 27, 2024. In this latest report, the monthly CPI indicator rose 3.5% over the 12 months leading up to July, reflecting a slight decrease from the 3.8% increase recorded in June. Since the release, the Reserve Bank of Australia has updated the website's monthly inflation indicator rate.

Stanford Brown Talks.

SB Talks aims to help investors cut through all the media noise and hype and understand what drives investment markets and portfolio returns. In this episode of SB Talks, Stanford Brown CEO Vincent O’Neill speaks with Chief Investment Officer Nick Ryder to discuss the following:

The Australian earnings reporting season, including BHP’s profit results

The US rate outlook following the Jackson Hole Economic Symposium

Recent global Purchasing Manager business surveys

Upcoming data to watch, including Nvidia’s quarterly results

St James’s Place Week Watch

Thank you, St James’s Place, for sharing your valuable market insights with our community in the SJP 19th August Week Watch. This week, SJP will delve into the intricacies of the global financial markets, share practical tips to enhance your wealth management strategies and present the week's informative graph, which offers crucial data for consideration. This week’s blog covers the following points;

Potential US recession, recovery and inflation.

UK GDP growth, inflation and interest rate cuts.

Japanese Equities.

Wealth Check: Why do start-ups fail?

Limited companies: separate your personal and business finances

Graph of the week: Past performance is not indicative of future performance

Stanford Brown Talks: Volatile equities, the Japanese carry trade, and the RBA rate cut off the agenda

Stanford Brown Talks: Volatile equities, the Japanese carry trade, and the RBA rate cut off the agenda.

SB Talks aims to help investors cut through all the media noise and hype and understand what drives investment markets and portfolio returns. In this episode of SB Talks, Stanford Brown CEO Vincent O’Neill speaks with Chief Investment Officer Nick Ryder to discuss the following:

What drove the volatile ride for global equity markets over the past week

The Sahm rule recession indicator flashes red

Unwind of the Japanese currency carry trade

The outlook for local interest rates following the RBA’s latest decision

To listen to the update on Spotify or Apple Podcast, click on the links below.

SB Talks, July 2024

Thank you, Stanford Brown, for sharing your insightful SB Talks with our community.

In this episode of SB Talks, Stanford Brown CEO Vincent O’Neill speaks with Author and Philanthropic Adviser Peter Winneke to discuss:

The Role of a Philanthropic Adviser

Peter’s Book ‘Give While You Live’

The Difficult Question of ‘How Much is Enough?’

The Tax Incentives of Philanthropy

Reflecting on ‘Have We Done Our Best Work Yet?’

You can watch the interview on YouTube or listen to it on a podcast or your favourite audio app. The links are below.

Stanford Brown Quarterly Market Report 12th July 2024

We are lucky to have Stanford Brown's Quarterly Investment Markets Report for the second quarter 2024.

The report aims to help investors cut through all the media noise and hype and understand what drives investment markets and portfolio returns.

In the report, Stanford Brown Cheif Financial Officer Nick Ryder tackles some of the most pressing questions for longer-term investors:

What happened over the quarter

Performance of major financial markets

Current investment outlook and portfolio positioning

Views on major asset classes

Current portfolios allocations

SB April 2024 Market Report by CIO Nick Ryder

Thank you, Nick Ryder, Stanford Brown's Chief Investment Officer, for generously sharing Stanford Brown's insights in the Monthly Investment Markets Report for April 2024. We appreciate the valuable information you provided to our community.

The SB Monthly Report aims to help investors cut through the media noise and hype and understand what is really driving investment markets and portfolio returns.

This month, Nick tackles some of the most pressing questions for longer-term investors:

What happened over the month

Performance of major financial markets

Current investment outlook and portfolio positioning

Views on major asset classes

Current portfolios allocations

SB Talks April 17th 2024

Thank you, Stanford Brown, for sharing their episode of SB Talks with host CEO Vincent O’Neill, who speaks with Chief Investment Officer Nick Ryder to delve into the latest economic developments shaping global markets.

The pair examine the following;

The recent pullback in equity markets and the outlook for equities in the future.

March’s CPI numbers exceed market expectations, prompting speculation about the inflation and monetary policy trajectory.

They discuss the IMF's upgraded World Economic Outlook, highlighting growth projections and regional disparities, focusing on US and European economies.

Lastly, they analyse China's Q1 GDP data, examining the role of government investment versus consumer sentiment in driving economic performance.

SJP Financial Education Workshops” in your workplace.

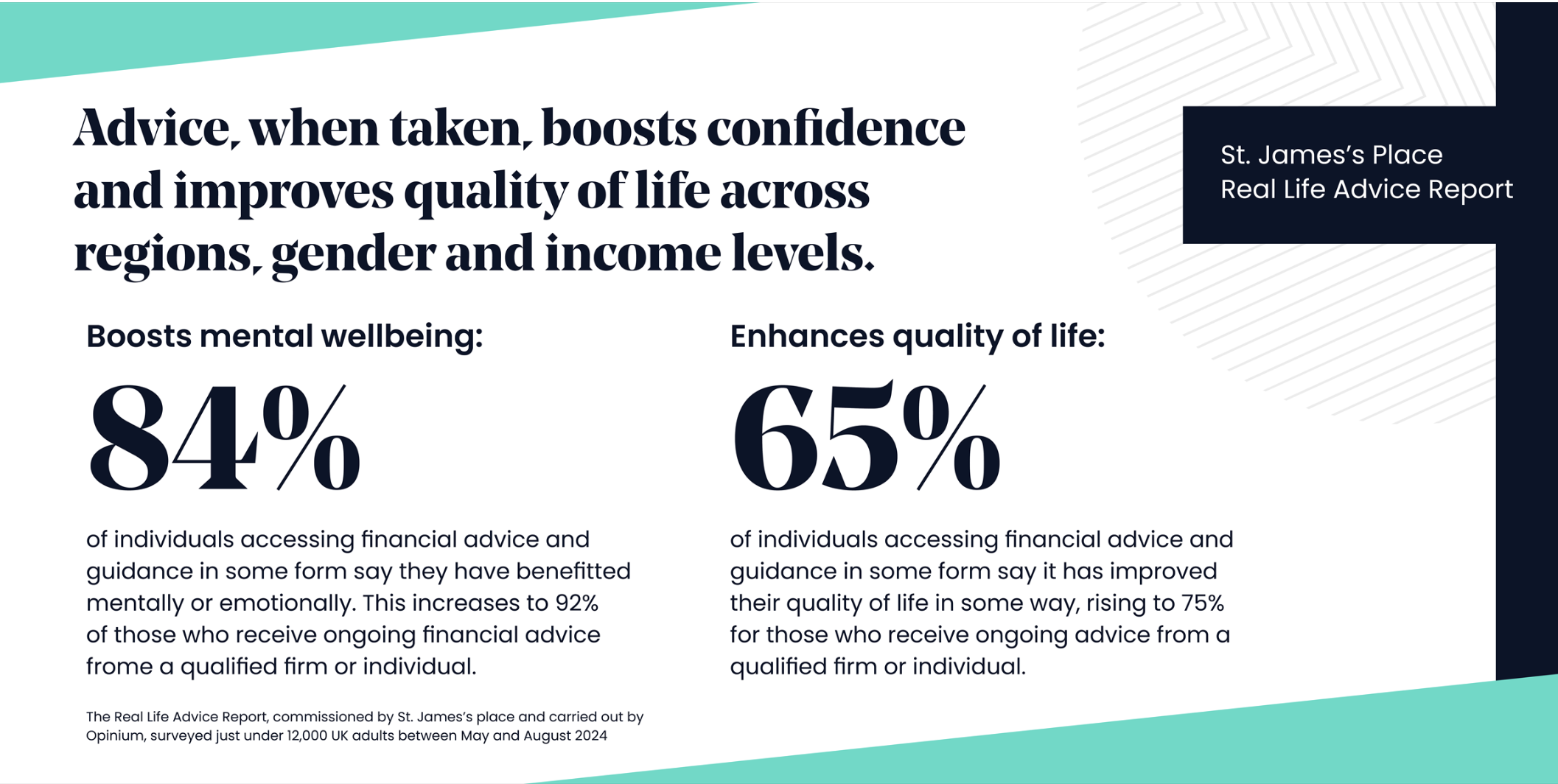

SJP Financial Education Workshops” in your workplace.The St. James’s Place team has created Financial Education “Workshops”, a fantastic platform to increase financial literacy within your workplace community. This holistic approach supports your employees through financial well-being and recognizes the significant correlation between financial well-being and mental health.

Stanford Brown Quarterly Report Q1 2024

Stanford Brown Quarterly Report Q1 2024

We hope you like Stanford Brown's (SB) Quarterly Investment Markets Report for the first quarter of 2024. The primary objective is to provide investors with clear insights to navigate the complexities of investment markets, enabling a deeper understanding of the factors influencing portfolio performance amidst the constant media chatter and sensationalism.

This month, Nick Ryder, Chief Investment Officer from SB, tackles some of the most pressing questions for longer-term investors:

What happened over the quarter

Performance of major financial markets

Current investment outlook and portfolio positioning

Views on major asset classes

Current portfolios allocations

SB Talks

Thank you, Stanford Brown, for sharing your insights with THE EXPATRIATE community.

In this episode of the SB Talks podcast, CEO Vincent O’Neill sits down with CIO Nick Ryder to discuss the latest in global economics.

This week they examine the recent RBA rate pause decision and the nuanced shifts in central bank language. They delve into the Bank of Japan’s departure from its negative interest rate policy (NIRP) and the outcome of the recent Shunto wage negotiations. Lastly, they discuss Stanford Brown’s comprehensive Fixed Income Sector Review and the intricacies of investing in cash, investment grade and high-yield credit as well as government bonds, all with an eye toward improving portfolio diversification, capital stability, liquidity and income generation.