CoreLogic Australian Property Market Report: March HVI 2025

CoreLogic Australian Property Market Report: March HVI 2025

The latest CoreLogic Home Value Index (HVI) for March 2025 reveals a subtle yet broad-based re-acceleration in housing values across Australia. Following a brief three-month downturn, national home values rose by 0.3% in February, signaling improved market sentiment and optimism among buyers.

CoreLogic Monthly Housing Chart Pack February 2025

We are thrilled to share the CoreLogic Housing Chart Pack February 2025 with our esteemed community. This informative PDF document unpacks the following essential insights and data:

Each Capital city and Regional Area property sale Home Value Index

Rental cycles and rental yields

Auction Clearance Rates

Available stock

Vendor discounting

New Listings

Building approvals

Mortgage rates and investor lending

CoreLogic February Home Value Index (HVI) Report.

CoreLogic February Home Value Index (HVI) Report.

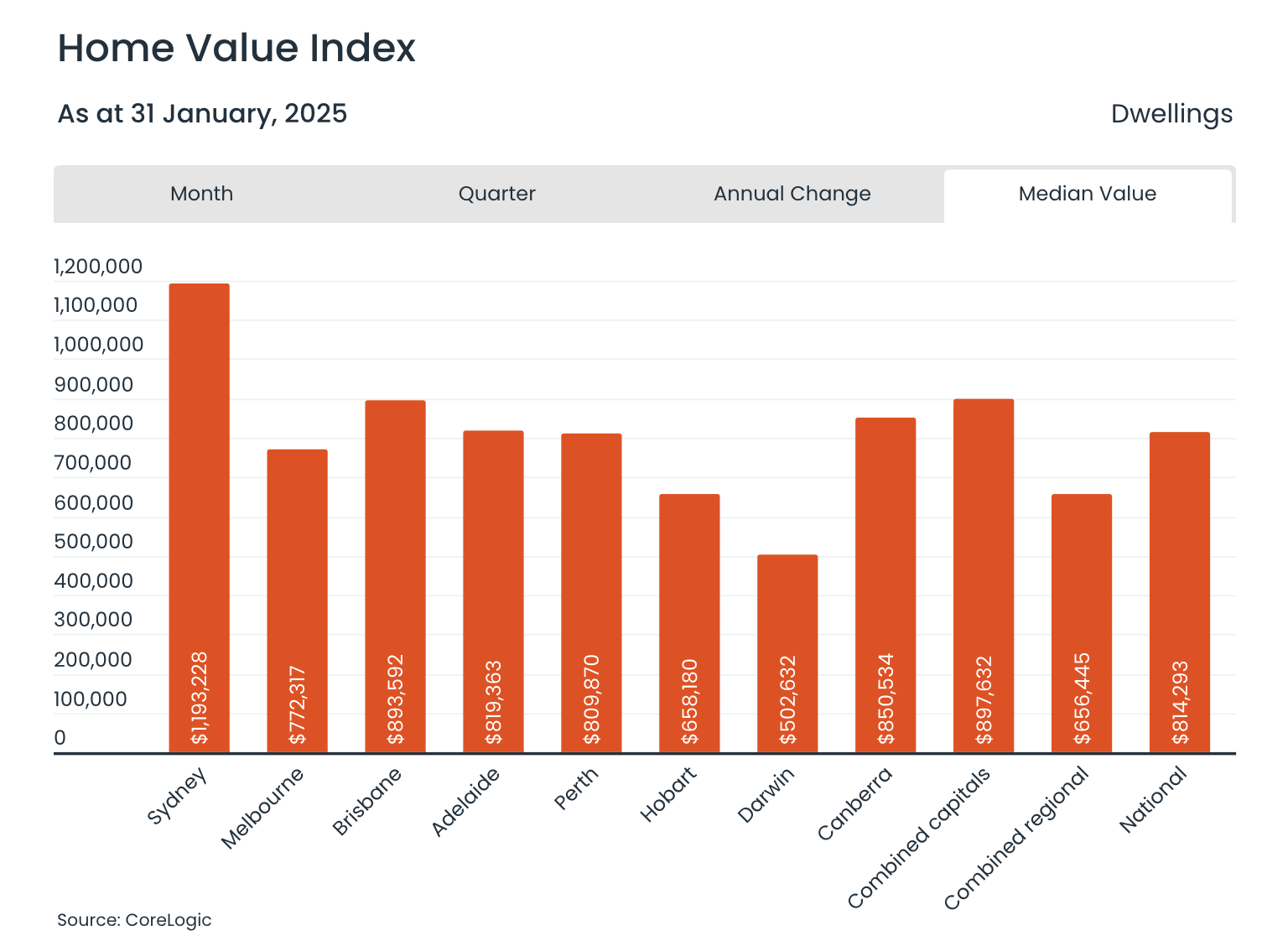

CoreLogic’s February Home Value Index (HVI) and reporting Australian home values held firm, with a 0.0% change in January and Regional Area’s rising 0.4%.

Not all markets are equal; here are our key takeaways below;

Melbourne(-0.6%)

Canberra (-0.5%)

Sydney (-0.4%)

Recorded a decline in home values in January, while Hobart remained stable.

Adelaide(0.7%)

Perth (0.4%),

Brisbane (0.3%)

Home values have continued to rise, but there has been a clear and steady loss of momentum in these markets, showing they are still at the peak of their cycle.

Australia's regional markets hit new heights;

REG QLD+0.7

REG WA +1.2

REG SA +1.3

They are still at the cycle's peak, with dwelling values across the combined regional areas rising a further 0.4% in January, driven by renewed internal migration and healthier affordability in some regions.

S02:E16: The profile of property investors on the Sunshine Coast, with Carolyn Jansen, Luxe Property Management.

S02:E16: The profile of property investors on the Sunshine Coast, with Carolyn Jansen, Luxe Property Management.

In this episode of Living Your Luxe Life, Christine Mount, Founder & Principal of Luxe Coastal Property Buyers, interviews Carolyn Jensen, Principal of Luxe Property Management. With nearly three decades of experience in real estate and property management, Carolyn shares her expertise in managing rental properties. She shares insights into the profile of Investors in the vibrant Sunshine Coast property market, including holiday rentals, short-term lets and short (3 months) to medium (9 months) term furnished rentals.

Why are Victorians shifting their investment focus to South East Queensland?

Christine Mount and Tim Lawless from CoreLogic examine why Victorians are shifting their investment focus to Queensland and why the Sunshine Coast and South East Queensland are emerging as hotspots for property investment.

Infolio’s Melbourne's 2025 Property Market Outlook

Infolio’s Melbourne's 2025 Property Market Outlook

The start of 2025 is expected to reflect the subdued market seen in late 2024, with the potential for a slight decline in property values during the year's first half.

Reducing the cash rate could serve as a turning point, driving increased demand in the latter half of 2025. However, this is not guaranteed, as economists remain divided on Melbourne’s recovery prospects.

CoreLogic Best of the Best 2024

In late 2024, CoreLogic Australia dropped the best of the best Report for the Australian Housing Market. Sydney, Melbourne, and Noosa Heads feature in the Top 10 Sales Nationally. Sydney and Melbourne still lead the way with the most expensive sales. However, Queensland's Sunshine Coast and Gold Coast outperform Brisbane for the most expensive houses sold in 2024. Perth also sells houses well into the 20+ million dollar bracket! Unsurprisingly, Regional Queensland has outperformed regional NSW and VIC, mainly due to the prestige market developing on the Gold and Sunshine Coast; both locations have a domestic airport with easy access and an international airport in the GC or Brisbane less than 2 hours away.

CoreLogic Home Value Index (HVI) 2nd January 2025 report.

CoreLogic’s Home Value Index (HVI), published on 2 January 2025, dropped over the New Year’s Holidays with flat results for the overall Australian Housing Market. Still, the growth differed considerably, depending on which capital city or regional area you’ve invested in. However, the data shows that the nation has moved through its peaks, and a national slowdown has arrived as potential buyers await an interest rate cut. The key takeaways from the report are below.

CoreLogic December Property Update, HVI and Chart Pack.

CoreLogic December Property Update, HVI and Chart Pack.

Thank you, CoreLogic Australia’s Executive Research Director of Asia Pacific, Tim Lawless, for sharing CoreLogic's National Home Value Index (HVI) with our community. Over the past month, the HVI rose only 0.1% in the last month of spring, the slowest increase since January 2023. This is the 22nd month of growth, but it may end soon. CoreLogic Australia’s Executive Research Director of Asia Pacific, Tim Lawless, CoreLogic's research director, noted that Melbourne and Sydney are seeing a downturn, and mid-sized capitals are also slowing down. In Melbourne, housing values fell 0.4% last month and are down 2.3% over the past year. For Sydney, the peak likely occurred in August, with values levelling off in September and dropping 0.2% in October and November.

Porters House December Australian Property Market Update

Porters House December Australian Property Market Update.

As 2024 draws close, National prices have risen by 5.5% over the past 12 months. This is the 22nd straight month of growth, however growth is further slowing, increasing in Sydney by 3.3%, Brisbane by 12.1%, Adelaide by 14% and Perth by 21%. Melbourne fell by 2.3% over the past year.

There are opportunities for savvy buyers in Melbourne’s subdued market.

There are opportunities for savvy buyers in Melbourne’s subdued market.

The Melbourne property market remains sluggish, with no interest rate cut on Cup Day, high listing numbers, and subdued property values. However, this creates a window of opportunity, especially for premium home buyers and strategic investors.

Luxury home market in Melbourne: A window of opportunity.

The Prestige Property Market with Tim Lawless, Head of Research of CoreLogic Asia Pacific.

In this episode, I had the privilege of engaging in a robust property discussion with Tim Lawless, Executive Research Director, CoreLogic Asia–Pacific.

Together, we explore the landscape of investing in South East Queensland, diving into key drivers for investment and a broader view of the Australian property market. Tim shares insights on the best suburbs to invest in on the Sunshine Coast and highlights affordable options for those taking their first steps on the property ladder, as well as suburbs with strong investment fundamentals for capital growth and higher yields.

November Property Update with Cameron Porter.

November 2024 Property update with Cameron Porter from Porters House Buyers Agency.

In the update, Cameron discusses the following topics;

International stock market response to the US Election.

Australian Property Market overview, and key movements in the capital cities.

Is the market becoming a buyer’s market?

Rental Growth Slowing

Potential Capital Gains Tax (CGT) and Negative Gearing Changes.

Government progress regarding to the five-year plan to build 1.2 million homes

Recent Reserve Bank of Australia’s (RBA) decision.

CoreLogic Home Value Index report HVI November 2024 and Property Pulse Update.

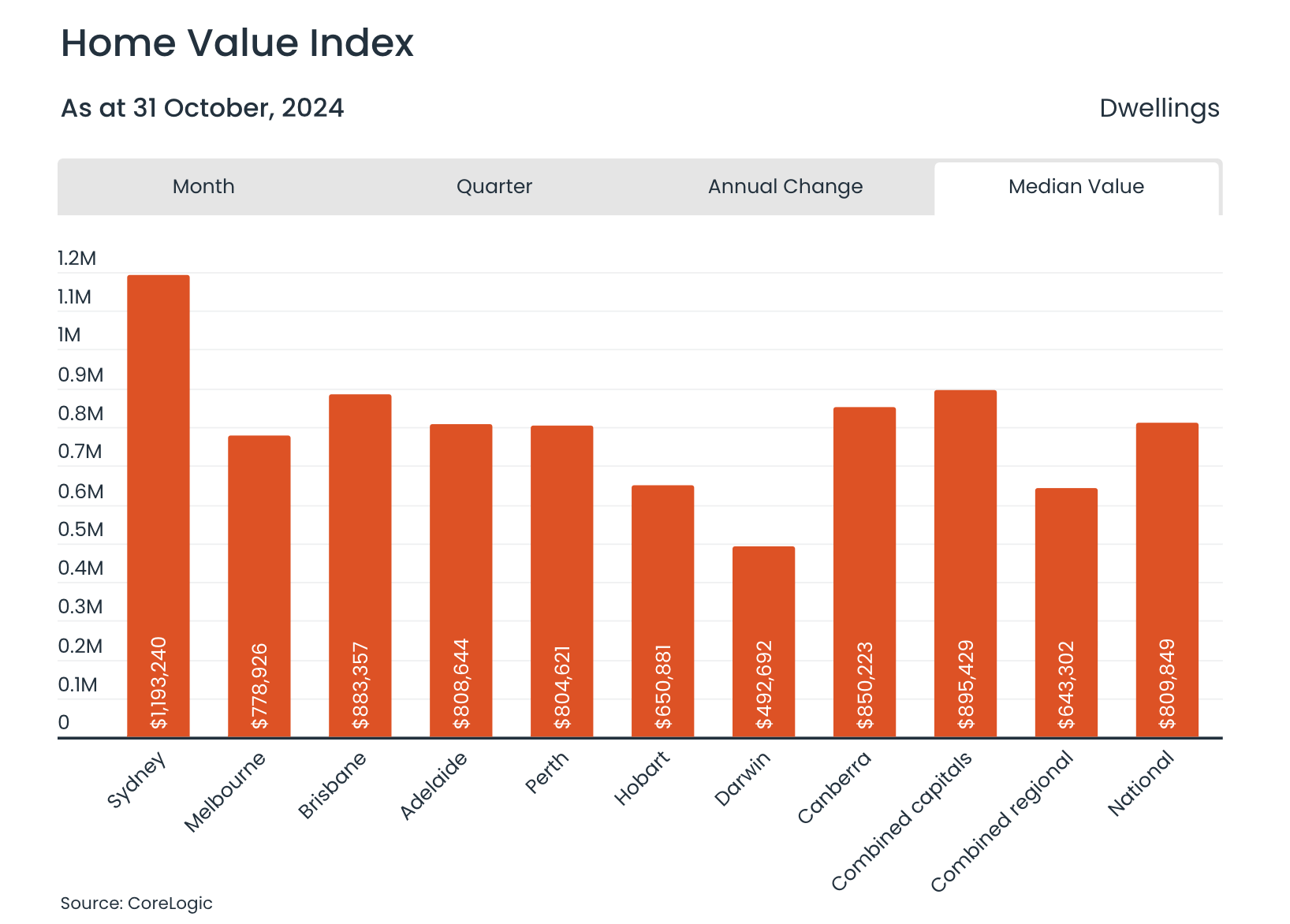

CoreLogic Home Value Index Report November 2024: Sydney home values slip in October as the national market cooldown continues.

Monthly Home Value Index Changes are as follows:

Sydney -0.1% REG NSW +0.5

Melbourne -0.2%, REG VIC -0.2%

Brisbane +0.7%, REG QLD +0.8%

Adelaide +1.1%, REG SA +1.3%

Perth +1.4%, REG WA +1.4%

Hobart +0.8%, REG TAS +0.7%

Darwin -0.1%,

Canberra -0.3%

Combines Capitals +0.2%, Combines REG +0.6%, National +0.3%

PRESTIGE PROPERTY MARKET UPDATE 2024

PRESTIGE PROPERTY MARKET UPDATE 2024

The Sunshine Coast stands out prominently among Australia's top 20 premium regional suburbs, as highlighted in the Prestige Market Report by CoreLogic and Westpac Private Bank. Common traits of the sought-after Top 20 Regional Prestige Suburbs include:

Desirable coastal or hinterland lifestyle

Affluent communities

World-class beaches and scenic surroundings

Positioned within a two-hour commute from major capital cities, providing convenience and accessibility (Brisbane CBD)

Accessible airports and a wealth of quality dining and recreational facilities (Sunshine Coast Regional Airport & Brisbane Airport)

The Sunshine Coast delivers these attributes in spades... To read the full report, download here:

October 2024 Property update. “Australian property market reaches $11 trillion as national price growth slows.” CoreLogic Australia

October 2024 Property update. “Australian property market reaches $11 trillion as national price growth slows.” CoreLogic Australia.

Our Sydney and Northern Beaches Property Specialist Cameron Porter, from Porter House Buyers Agency, has unpacked the latest data from CoreLogic Australia in a YouTube Video for THE EXPATRIATE Community. Here are the key takeaways;

The Australian residential property market reached a record $11 Trillion in September.

The annual pace of growth has slowed to 6.7% for the past 12 months, down from the high of 9.7% in the 12 months to March.

Sydney, Brisbane, Adelaide, and Perth dwelling values are currently high. Perth had the highest monthly, quarterly, and annual dwelling value increase, while Adelaide has overtaken Brisbane as the second-strongest capital city market nationally.

In September, Sydney increased by 0.2%, Brisbane by 0.9%, and Perth by 1.6%. Melbourne is continuing to fall.

CoreLogic Australia has discovered 65 Unit Markets in Sydney and Melbourne, with values below the 2010 peaks.

Thank you, Eliza Owen, Head of Research Australia at CoreLogic, for sharing the latest Property Pulse Report. It explores the unit markets in Melbourne and Sydney, revealing 65 areas where 2024 values are lower than their peaks in 2010, indicating "The buyer’s markets where no one wants to buy.”

CoreLogic Home Value Index (HVI) released October 1st 2024.

CoreLogic Home Value Index (HVI) released October 1st 2024.

Thank you, CoreLogic Australia, for sharing the Home Value Index September housing market results with the expatriate community. The HVI reported that Australian home values increased by 0.4% in the first month of spring, similar to the changes of 0.3% in July and August as the market slows down.

Perth +1.6% Regional WA +1.8%

Adelaide +1.3% Regional SA +1.1%

Brisbane +0.9% Regional QLD +0.7%

Sydney + 0.2% and Regional NSW +0.2%

Melbourne -0.1% Regional VIC -0.2%

Darwin -0.1%

Canberra -0.3%

Hobart -0.4% Regional TAS -0.2