Newsletter 8, Budget Overview, St Jame’s Place Recap, Core Logic Coastal Risk Scores and More

It’s been one busy week at

THE EXPATRIATE.

Firstly, it was Australian Budget 22-23 Night on Tuesday night, which meant a flurry of activity with our specialists as they all analysed how this would affect THE EXPATRIATE Community.

Julia Qian wrote an amazing overview of the

Australian Federal Budget 2022-23:

Immigration Overview

In considering means to aid Australia’s economic recovery and post-pandemic growth, the Australian Chamber of Commerce and Industry (ACCI) has proposed skilled permanent migration numbers to nearly double to 200,000 per year. In New South Wales, senior bureaucrats have advised that Australia needs an explosive surge of 2 million migrants in the next 5 years. The federal Treasurer has indicated that the Government is “thinking through” the migrant numbers and composition.

So what Government commitments are in the Federal Budget 2022-23?

To read Julia’s Blog, click on the Button Link Below;

We want to thank James Englebrecht from St James’s Place Asia and Summit Financial Hong Kong for sharing Jamie Towers from Mazars Australia for this fantastic recap of the 2022 Budget for you. Here is a snippet of his full report.

The Australian Federal Treasurer, Mr Josh Frydenberg, handed down the 2022–23 Federal Budget at 7:30pm (AEDT) on 29 March 2022.

After two years of budgets with overwhelming stimulus designed to encourage businesses to spend their way out of a covid fueled recession, the 2022-23 Budget is in comparison underwhelming.

In an economy emerging from the pandemic, the Treasurer has confirmed an unemployment rate of 4% and an expected budget deficit of $78 billion for 2022–23. As international uncertainties add pressure on the cost of living, key measures in the Budget provide cost of living relief in the form of an increased Low and Middle Income Tax Offset, a one off $250 payment for welfare recipients and pensioners and a 6-month fuel excise relief.

Other measures for business seek to promote innovation, with expanded “patent box” tax concessions proposed, and provide tax incentives for small business to invest in the skills of their employees.

The Australian Taxation Office (ATO) will receive a significant funding boost to extend its anti-avoidance taskforce, with Trusts being a key target.

Click on the Button Below to see the full PDF Report or Scan the above QR Code to listen to the podcast,

THE EXPATRIATE Team has been busy making sure we provide the best possible information to our community, part of this is to connect with industry specialist. Our latest connection is with the Australia’s Premier Independent Property Data and Analysis Leader Core Logic.

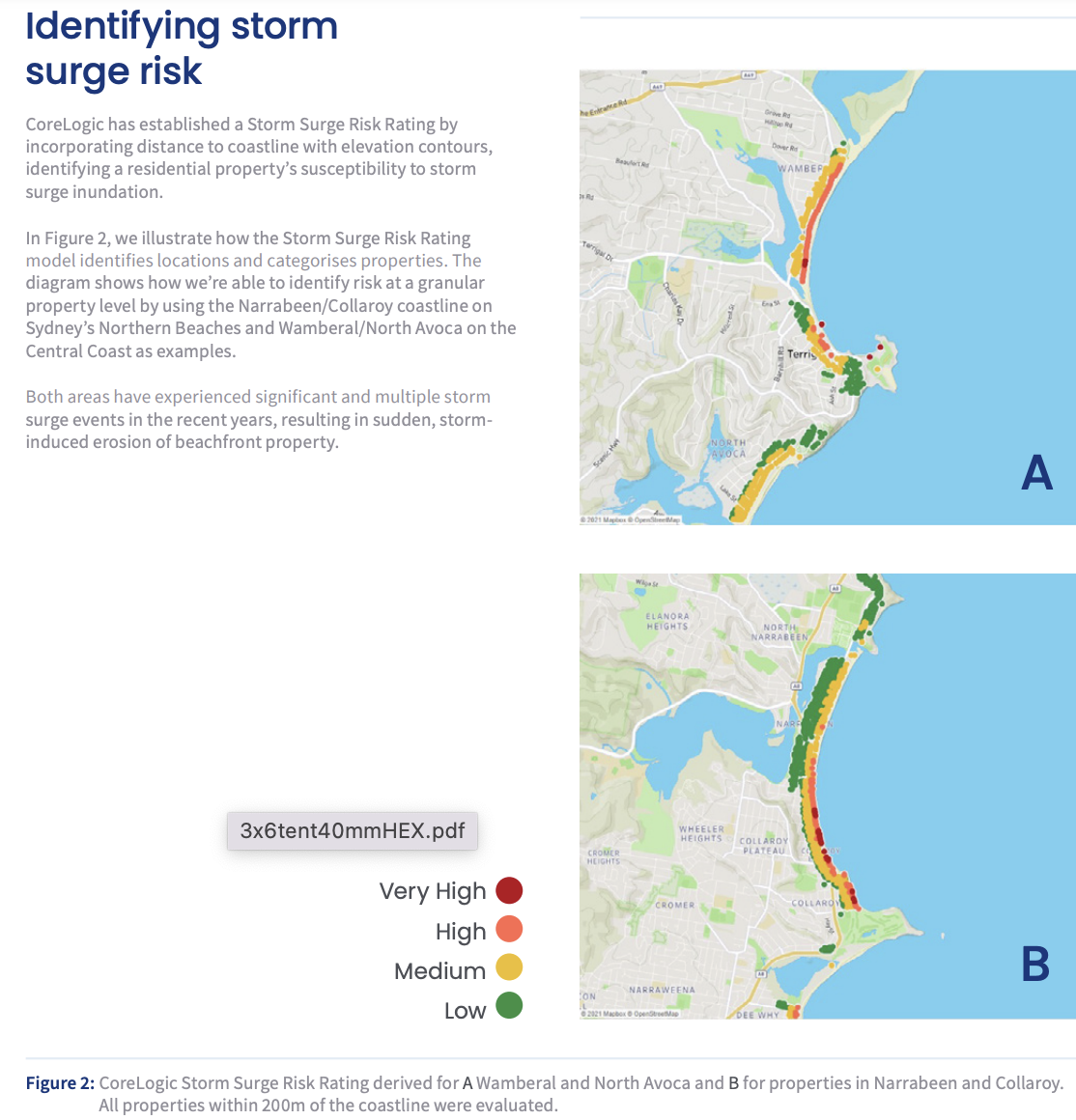

Core Logic have shared with us an insightful report on Global Warming and the potential Properties that may be at risk. The report is called Coastal Risk Scores for Financial Risk Assessment, it is written by Dr Pierre Wiart Head of Consulting and Risk Management CoreLogic Asia Pacific. We’ve pulled out some key points from the report that we believe will be helpful.

“In the next three decades it’s expected that coastal risk will crystallise, with the tangible effects of climate change already being felt in most parts of Australia. This is leading to direct physical and financial consequences. Coastal risk has far-reaching implications for the country’s property market and its supporting financial sector, including property valuations, bank loan viability and insurance premiums.

In August 2021, the United Nations Intergovernmental Panel on Climate Change (IPCC) released its latest report, the Sixth Assessment Report (AR6).

It is unequivocal that human influence has warmed the atmosphere, ocean and land.

Human-induced climate change is affecting many weather and climate extremes such as heatwaves, heavy precipitation, droughts and tropical cyclones.

The impact of the change appears to be faster and more pronounced than previously anticipated.

Key Risks Are;

Storm Surges

Long Term Erosion

Rising Sea Levels

Our Coastal Risk Score = A combination of storm surge + erosion potential

How is the Coastal Erosion risk my property scored?

Very High Risk of gradual coastal erosion reaching dwelling within 30 years and/or very high risk of significant storm surge impact.

High Risk Risk of gradual coastal erosion reaching dwelling within 60 years and/or high risk of significant storm surge impact.

Medium Risk Risk of gradual coastal erosion reaching dwelling within 120 years and/or medium risk of significant storm surge impact.

Low Risk Risk of gradual coastal erosion reaching dwelling within 240 years and/or low risk of significant storm surge impact.

No Risk Gradual coastal erosion likely to reach dwelling in more than 240 years OR no rate of retreat (stable coastline) and distance from coast and/or elevation above maximum expected storm surge height.

The Australian population is unevenly distributed, with 46% – almost half of all Australians – living within 10km of the coastline. At a more granular level, one in 10 residential dwellings (houses, units and farms) are located within 1km of the coastline, corresponding to more than $1 trillion of residential property wealth. These figures are broken down by state and territory in Table 1. The distribution of wealth has accelerated significantly in the past five years, with growth rates increasing 100% or more in some local government areas (LGAs).

While coastal risk concerns a relatively narrow distance from the coast, it is an area where a lot of residential wealth and high-density living are concentrated. Spectacular views and limited supply attract a premium for Australia’s best coastal properties. In the past two years there has been a broad demographic shift where more Australians are prepared to consider housing options outside of the capital cities.

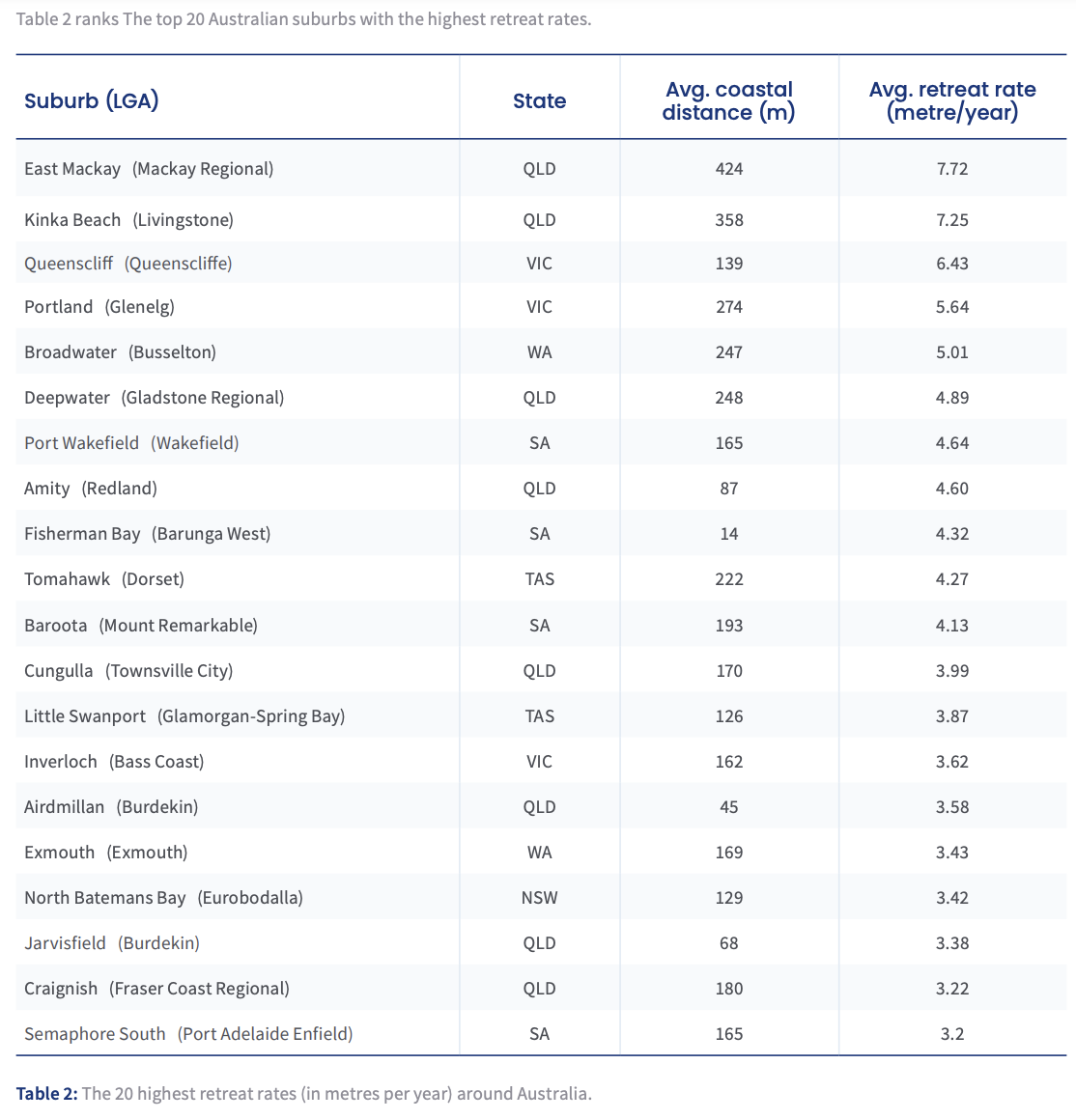

Identifying gradual coastal erosion risk

While storm surges present an immediate risk to coastal properties, the effects of gradual coastal erosion over time can also be significant. As with storm surges, CoreLogic has developed a proprietary methodology for ascribing gradual coastal erosion risk at property level.

By analysing shoreline movements from 1988 to 2019, we’ve calculated a retreat rate for each individual property where the shoreline retreat has been continuous over the last 30 years. The methodology is based on a perpendicular coastline retreat rate over time, assuming a constant future retreat rate based on the past 30 years. We’ve also integrated any trends in sea level rise observed in the last 30 years.

To read the full report here is the link below.

Finally, look out for the Currency Market Report for the week thanks to Send Payments, and a fantastic relocation blog from Claymore Thistle, Leona Lees, on whether it is more cost-effective to Ship or Shop!

We wish you all the best! Stay safe these school holidays.

- THE EXPATRIATE TEAM

The Expatriate always tries to make sure all information is accurate. However, when reading our website please always consider our Disclaimer policy.