THE EXPATRIATE in Hong Kong, Staunton's Gastropub.

We're excited to invite you to a relaxed and informative evening at Staunton’s Gastropub in SoHo

When: Tuesday, 29th of April

Time: 6 pm to 9 pm

Where: Level 1 /F 10-12 Staunton Street, Central, Central & Western District, Hong Kong

With significant shifts in exchange rates, interest rates, the Australian property market, and lender rules, now is a golden moment to act. Whether you're thinking of buying back home, refinancing, or want to make smarter financial decisions while living abroad, this night is packed with valuable insights.

So join us for this fantastic opportunity to connect with your Aussie Expat Community, enjoy cold drinks, great food, and insightful conversation and connect with our Industry Specialist, Michael Purvis, Financial Advisor, Eight Wealth International: Partner at St. James’s Place Hong Kong, Erika Humb-Freiman, Property Strategist & Buyers Agent MCA Buyers Agency and Adam Kingston Expat Mortgage Specialist, Australian Expatriate Finance, Co-Founder of THE EXPATRIATE

Save the Date, TE in HK, and SJP Weekwatch unpacks the Trump Tariffs.

Save the Date, TE in HK, and SJP Weekwatch unpacks the Trump Tariffs.

With the financial world teetering under the weight of Trump-led turmoil, markets are bracing for a turbulent 2025. Leading economists are forecasting three additional rate cuts in the US and Australia this year — a move that could ripple across global markets.

But what does this mean for Australian property and the debt landscape?

Join us for an exclusive in-person update as we unpack:

The implications of a potential Trump-induced global recession

Where Australian house prices could be headed in a falling rate environment

The outlook for debt markets and borrowing conditions for expats

Key risks and opportunities for investors in 2025

TE in SINGAPORE Recap, Next Event Hong Kong Wednesday 19th February.

TE in SINGAPORE Recap, Next Event Hong Kong Wednesday 19th February.

We are excited to have successfully hosted two info TE sessions in Singapore aimed at the Australian 🇦🇺 expat Community 🫶🏽. One event occurred at the iconic 1 Raffles Place, while the other was at the bustling Dallas Bar at Boat Quay. Both nights were a tremendous success, featuring abundant valuable information shared by our knowledgeable presenters and many thoughtful questions answered throughout the evenings. Most importantly, these events gave the Aussie expat community a fantastic opportunity to connect, share their experiences, and meet new friends. Attendees could relax, connect with their fellow expat community and indulge in a delightful selection of nibbles and refreshing drinks🥂🍺 thanks to our Venue hosts, SJP Singapore and Dallas Bar, Boat Quay.

Last Chance to RSVP for TE in Singapore on February 11th and 13th. 1st event is on tonight.

Last Chance to RSVP for TE in Singapore on February 11th and 13th. 1st event is on tonight.

TE in Singapore on 11th & 13th Feb; Expat Tax Specialist Tristan Perry joins the team. Podcast: Why are investors purchasing on the Sunshine Coast?

Newsletter

TE in Singapore on 11th & 13th Feb

Expat Tax Specialist Tristan Perry joins the team

Podcast: Why are investors purchasing on the Sunshine Coast?

Adam in HK and Singapore, CoreLogic HVI, SB Meet the Investor, and SJP Unpacks the UK Budget.

Adam in HK and Singapore, CoreLogic HVI, SB Meet the Investor, and SJP Unpacks the UK Budget.

Introducing Christine Mount from Luxe Coastal Property Buyers Noosa and SSC. Last chance to catch Adam from Australian Expatriate Finance in HK and Singapore, SJP, Send updates +more

Introducing Christine Mount from Luxe Coastal Property Buyers Noosa and SSC. Last chance to catch Adam from Australian Expatriate Finance in HK and Singapore, SJP, Send updates; Lauren Staley from Infolio Property Advisors answers, "Why is it so hard to value a property?" and more.

CoreLogic Monthly Media pack, Adam unpacks Bridging Finance, SB talks about the recent market volatility and more.

It’s been one interesting week filled with various developments. The RBA's recent cash rate decision has certainly captured attention, especially amid the ongoing market volatility that has affected many sectors. In addition, we are excited to share our Send Currency Weekly Update, which provides insights into the latest trends. Furthermore, we have an informative blog from our Mortgage Specialist that offers valuable advice and tips. Additionally, we have gathered some engaging data regarding property trends from CoreLogic Australia. We will also delve into some intriguing intra-state migration patterns that have emerged recently. Therefore, in this week’s newsletter, we cover the following topics:

Stanford Brown Talks: CEO Vincent O’Neill and CFO Nick Ryder discuss - Volatile equities, the Japanese carry trade, and the RBA rate cut off the agenda.

Send Currency International Currency Update.

Adam Kingston unpacks Bridging Finance and whether it is the right option for you.

CoreLogic has released its industry media pack, which includes more graphs, including stock on the market, and data to help you navigate the Australian Property Market as an owner-occupier or an investor.

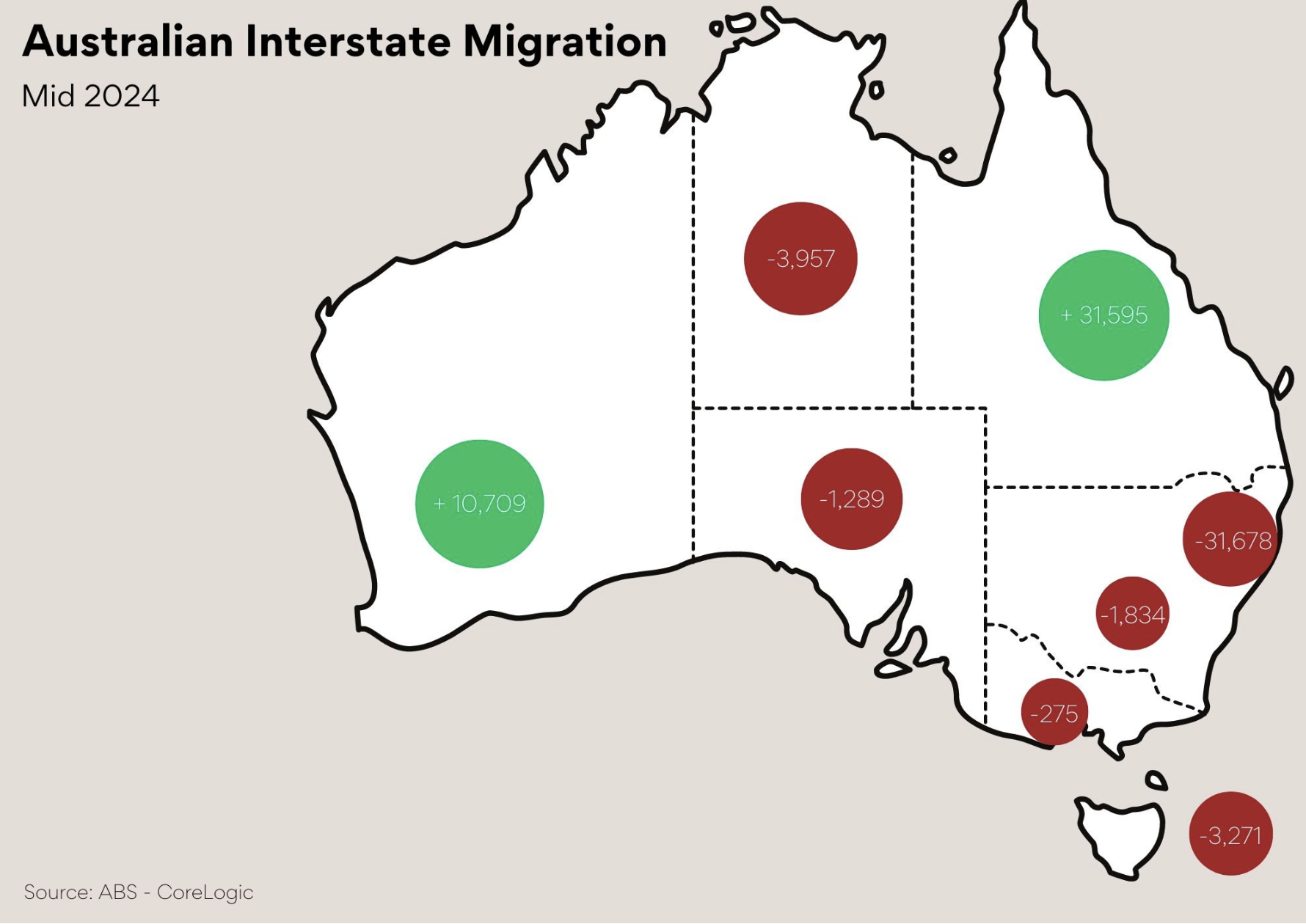

Zoran Solano, our Brisbane-based Property Specialist, shares the intra-state migration patterns for 2024.

Happy New Year! Check out our Favourite information blogs for 2023.

Happy New Year! Wow, what an exciting 2023 it was! The Expatriate Team took to the skies and connected face-to-face with THE EXPATIATE Community in Dubai, Abu Dhabi, London, Singapore and Hong Kong.

We saw the launch of St James’s Place in the Middle East, celebrated the achievements of our specialists from Send Payments and Australian Expatriate Finance and hosted wealth optimisation seminars on Tax, Property, Mortgages, and investments.

To help you start 2023 with a boost and get useful tips for managing your wealth, we want to share our favourite blogs from the year with you.

Dean’s Expat Tax Guide

Interview with Chi Longevity Andrea Maier

How do I use the equity in my property to purchase a second property?

Insights to the success of “The Block” and why its properties are attractive for investors.

Closing the retirement gap. Solving a 30-50 year problem.

Australian Repatriation checklist

New ATO Ruling Affecting Australian Expats

Pros and Cons of using a buyer agent.

Should we get short-term accommodation when relocating?

How much can I borrow?

Newsletter 22 THE EXPATRIATE BOOKED OUT IN Singapore, Dubai, Abu Dhabi - Next Stop Hong Kong

Newsletter 22 TE - Singapore, Dubai, Abu Dhabi - Next Stop Hong Kong

THE EXPATRIATE (TE) Taxation Specialist Dean Crossingham, Head of Accounting at Stanford Brown and TE Mortgage Specialist Adam Kingston, Director of Australian Expatriate Finance, finished a sold-out tour of the financial hubs in Singapore, Dubai and Abu Dhabi.